Insurance constitutes a vital component of our lives, offering protection and financial security in the face of unexpected circumstances. Acquiring a comprehensive understanding of the diverse insurance options is imperative for making well-informed choices that shield our well-being, possessions, and future. Within this article, we shall examine the core principles of insurance and scrutinize the various policy types, equipping readers with the knowledge to select the optimal coverage for their requirements.

Toc

- 1. What is Insurance?

- 2. Exploring each types of Insurance

- 3. Related articles 01:

- 3.1. Navigating Auto Insurance

- 3.2. Protecting Your Business with Commercial Insurance

- 3.3. Travel Insurance for Worry-Free Trips

- 3.4. Understanding Disability Insurance

- 3.5. The Significance of Liability Insurance

- 3.6. Securing Your Future with Long-Term Care Insurance

- 3.7. The Emergence of Cyber Insurance

- 4. Navigating the Claims Process

- 5. Related articles 02:

- 6. Tips for Choosing the Right Insurance Policy

- 7. Insurance and Financial Planning

- 8. Conclusion

What is Insurance?

Definition of Insurance

Insurance is a mechanism designed to manage risks and offer protection against potential financial losses. It functions through a contractual relationship between the policyholder and an insurer, where the insured agrees to pay regular premiums, and in return, the insurer promises to compensate for covered losses that may arise from unforeseen events or circumstances. The essence of insurance lies in its capacity to spread the economic impact of risks over many individuals, making large, unexpected expenses more manageable for each policyholder.

Primarily, insurance serves to afford individuals and entities a sense of security and peace of mind. It allows for financial stability by shielded individuals and businesses from the full weight of losses, whether from calamities like fires, theft, or health-related issues. The protective layer that insurance creates enables people to recover more quickly from setbacks and minimizes the disruption to their lives or operations.

Key elements of Insurance

- Policy: A legal contract between you (the insured) and the insurance company (the insurer). It specifies the event covered, the amount of coverage (payout), and the premium you pay.

- Premium: The regular payment you make to the insurance company to maintain your coverage.

- Coverage: The specific event or situation the insurance policy protects you from.

- Payout (Claim): The financial compensation you receive from the insurance company if a covered event occurs. You typically file a claim to initiate the payout process.

Types of Insurance

There are many insurance types, each catering to different risks. Here are some common examples:

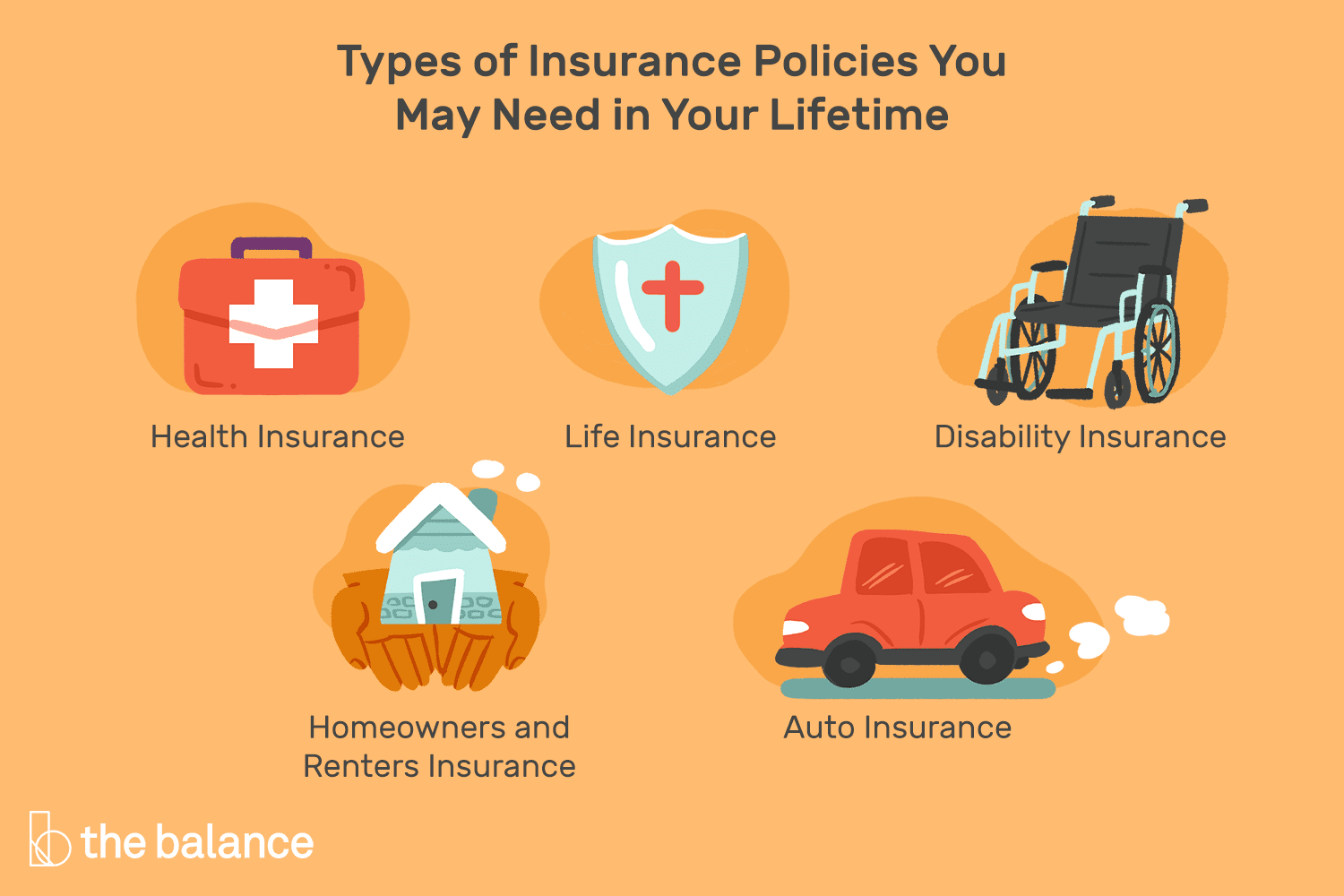

- Life Insurance: Provides a death benefit to your beneficiaries if you pass away.

- Health Insurance: Helps cover medical expenses in case of illness or injury.

- Auto Insurance: Protects you financially in case of car accidents.

- Homeowners Insurance: Covers your home and belongings against damage from fire, theft, and other perils.

- Pet Insurance: Helps pay for veterinary care for your pet.

Exploring each types of Insurance

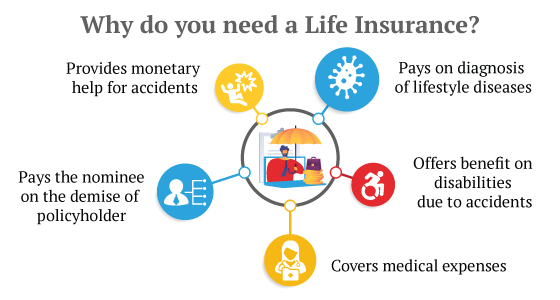

Understanding Life Insurance

Life insurance is a fundamental form of insurance designed to protect the financial well-being of loved ones after the policyholder’s death. There are several types of life insurance policies, each catering to different needs and objectives. Term life insurance offers coverage for a specific period, while whole life and universal life policies provide lifetime coverage with investment components. Choosing the right life insurance policy depends on factors such as age, health condition, and financial goals.

Exploring Health Insurance

Health insurance is a vital form of insurance that covers medical expenses, providing access to quality healthcare without incurring significant out-of-pocket costs. Health insurance plans come in various types, including Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Exclusive Provider Organization (EPO), and Point of Service (POS) plans. Understanding the differences between these plans and their cost-sharing mechanisms, such as premiums, deductibles, and copayments, is essential for maximizing the benefits of health insurance.

Unraveling Property Insurance

Property insurance protects valuable assets, including homes, rental properties, and condominiums, from potential damages and losses due to perils like fire, theft, or natural disasters. Homeowners, renters, and condo insurance are common types of property insurance, each offering specific coverage for different types of properties. Additionally, property insurance policyholders can opt for additional coverage options, such as flood insurance and earthquake insurance, to address region-specific risks.

1. https://viralblogspost.com/the-3-car-insurance-companies-that-give-you-the-option-of-no-down-payment

2. https://viralblogspost.com/cheap-insurance-for-business

3. https://viralblogspost.com/how-to-buy-life-insurance-the-easy-way

5. https://viralblogspost.com/mmoga-seven-corners-travel-insurance

Auto insurance is a mandatory requirement for vehicle owners, providing financial protection in case of accidents or damage to the insured vehicle. Understanding the different coverage options, such as liability, collision, and comprehensive coverage, is essential for tailoring auto insurance policies to individual needs. Factors like the driver’s age, driving history, and the make and model of the vehicle can influence auto insurance premiums.

Protecting Your Business with Commercial Insurance

For businesses, commercial insurance is crucial for mitigating financial risks and protecting against liability claims. General liability insurance safeguards businesses from third-party claims, while commercial property insurance covers property damages and losses. Workers’ compensation insurance provides coverage for employee injuries and medical expenses. The type of commercial insurance required depends on the nature and size of the business.

Travel Insurance for Worry-Free Trips

Travel insurance is an indispensable aspect of travel planning, offering protection against potential trip disruptions and emergencies. Coverage areas may include trip cancellations, travel delays, medical emergencies abroad, and lost or delayed luggage. Frequent travelers can benefit significantly from travel insurance, providing peace of mind during their journeys.

Understanding Disability Insurance

Disability insurance provides financial support in case of a disability that prevents the policyholder from working and earning income. There are two primary types of disability insurance: short-term disability insurance, which covers temporary disabilities, and long-term disability insurance, which provides coverage for extended periods or permanent disabilities. Evaluating disability insurance coverage is essential for ensuring financial security during times of unexpected health challenges.

The Significance of Liability Insurance

Liability insurance protects individuals and businesses from legal claims and lawsuits filed by third parties for bodily injury or property damage. General liability insurance covers non-professional negligence claims, while professional liability insurance offers protection for professionals, such as doctors, lawyers, or consultants, against errors and omissions. Liability insurance is crucial for safeguarding personal and business assets from potential lawsuits.

Securing Your Future with Long-Term Care Insurance

Long-term care insurance offers coverage for the costs associated with long-term care services, such as assisted living, nursing home care, and in-home care. As the population ages, long-term care insurance becomes increasingly important for securing financial stability during retirement years. Understanding the scope of long-term care insurance coverage is essential for effective retirement planning.

The Emergence of Cyber Insurance

In the digital age, cyber insurance is an emerging type of insurance that protects individuals and businesses from cyber threats and data breaches. Cyber insurance coverage may include costs related to data breaches, cyber-attacks, ransomware incidents, and legal expenses. With the rise of cybercrimes, cyber insurance is becoming an indispensable form of protection against digital risks.

Filing insurance claims can be a daunting process, but it is essential for accessing coverage when needed. A step-by-step guide to filing insurance claims, along with tips for documenting damages and communicating with insurers, can help policyholders navigate the claims process smoothly. Maximizing claim settlements requires attention to detail and effective communication with the insurance company.

Tips for Choosing the Right Insurance Policy

Selecting the right insurance policy involves evaluating coverage terms, limits, and exclusions to ensure it aligns with individual needs and financial goals. Understanding policy details, seeking professional advice for complex insurance needs, and comparing different insurance options are vital steps in making an informed decision. Tailoring insurance coverage to specific requirements provides comprehensive protection and peace of mind.

Insurance and Financial Planning

Integrating insurance into a comprehensive financial plan is essential for managing risks and securing the future. Insurance plays a crucial role in risk management and wealth preservation, offering financial protection against unforeseen events. By aligning insurance policies with financial goals, individuals and businesses can create a robust financial safety net.

Conclusion

Insurance is a vital aspect of modern life, providing protection and financial security against various risks. Understanding the different types of insurance, from life and health insurance to property and auto insurance, empowers individuals and businesses to make informed decisions. By choosing the right insurance coverage, one can safeguard their assets, secure their future, and gain peace of mind knowing that they are financially protected in times of need.

FAQs – Frequently Asked Questions

1. Can I have multiple life insurance policies? Yes, it is possible to have multiple life insurance policies to suit different financial goals and needs. However, it’s essential to assess coverage requirements and affordability before obtaining multiple policies.

2. Does health insurance cover pre-existing conditions? Health insurance policies may or may not cover pre-existing conditions, depending on the terms and conditions of the policy. Some policies may have waiting periods or exclusions for pre-existing conditions.

3. Is homeowners’ insurance mandatory for all homeowners? Homeowners’ insurance is not legally required, but it is highly recommended to protect your home and belongings from potential damages and losses.

4. How does travel insurance work for international trips? Travel insurance for international trips provides coverage for emergencies, medical expenses, trip cancellations, and lost luggage during the travel period.

5. What factors affect auto insurance premiums? Auto insurance premiums are influenced by factors such as the driver’s age, driving history, type of vehicle, location, and coverage options selected.