The thrill of getting my driver’s license was quickly followed by the daunting task of finding car insurance. As a young driver in Virginia, navigating the world of car insurance quotes VA can feel overwhelming. This guide aims to simplify the process, helping you secure the best rates and coverage options available. We’ll break down essential information, explore discounts specifically for young drivers, and provide practical tips to save money on your first car insurance policy.

Toc

Understanding Car Insurance Quotes VA Requirements

Before you dive into comparing car insurance quotes Virginia, it’s crucial to understand the legal requirements for car insurance in the state. Knowing these requirements not only keeps you compliant but also helps you make informed decisions about your coverage.

Minimum Liability Coverage

In Virginia, every driver is required to have minimum liability coverage of 30/60/20. This means your policy should cover $30,000 for bodily injury per person, $60,000 per accident, and $20,000 for property damage. This coverage acts as a financial safety net if you cause an accident that injures someone or damages their property.

Imagine you’re involved in a fender bender that results in two people needing medical attention. Your liability coverage will handle their medical expenses up to the limits of your policy. However, if their bills exceed your coverage, you could be left to pay the difference out of pocket. For young drivers, who may not have significant savings, understanding this aspect of car insurance is vital.

Uninsured/Underinsured Motorist Coverage

Virginia also mandates that drivers maintain uninsured and underinsured motorist coverage. This is particularly important for young drivers, as you may frequently encounter inexperienced or uninsured motorists. The minimum requirements for this coverage are the same as those for liability coverage: $30,000 per person and $60,000 per accident.

If you find yourself in an accident with a driver who doesn’t have sufficient insurance, this coverage steps in to help pay for your medical bills and vehicle repairs. Without it, you could face substantial out-of-pocket expenses due to someone else’s negligence, leaving you financially vulnerable.

Full Coverage

While meeting minimum liability coverage is essential, many young drivers choose to invest in full coverage, which includes liability, collision, and comprehensive insurance. This option is often recommended for new drivers as it offers broader protection against various risks, such as theft, vandalism, and accidents.

Collision insurance covers the cost of repairs to your vehicle after an accident, no matter who is at fault. Comprehensive coverage protects against non-collision incidents like theft or natural disasters. When deciding whether full coverage is right for you, consider the value of your vehicle and your financial situation. If your car is worth a significant amount, full coverage can provide peace of mind.

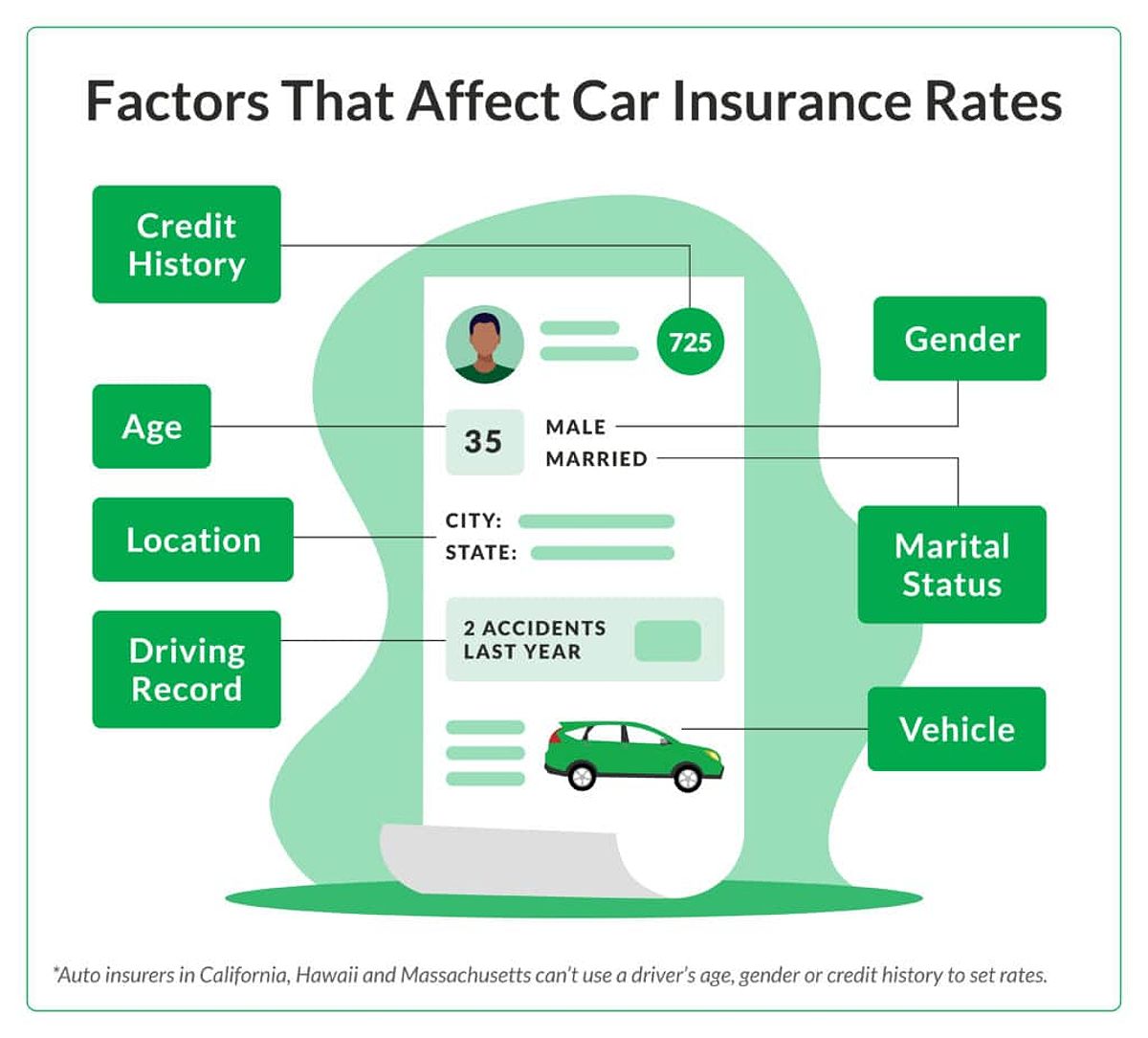

Factors That Impact Your Car Insurance Quotes in VA

Understanding the factors that influence your auto insurance quotes Virginia can empower you to find the best deals tailored to your circumstances.

Your Age

It’s a well-known fact that young drivers often face higher premiums. Insurance companies typically view this demographic as higher risk due to their lack of experience behind the wheel. However, maintaining a clean driving record and taking part in safe driving programs can help ease these costs over time.

As you gain experience and avoid accidents, your rates may decrease. Many insurers offer discounts for completing defensive driving courses, which not only enhance your skills but also signal to insurers that you are committed to safe driving.

Driving Record

Your driving history has a significant impact on your insurance rates. A clean driving record—free from accidents and traffic violations—can lead to lower premiums. Conversely, incidents like speeding tickets or accidents can cause your rates to rise.

For young drivers, it’s crucial to prioritize safe driving habits. If you do receive a ticket or are involved in an accident, consider enrolling in traffic school. This may help mitigate the impact on your insurance rates and show insurers that you are taking steps to improve your driving skills.

Vehicle Type

The make and model of your vehicle also play a critical role in determining your insurance rates. Typically, newer and more expensive cars with advanced safety features may come with higher premiums due to repair costs and theft risk. On the flip side, older, less valuable cars usually have lower insurance costs.

1. https://viralblogspost.com/the-basics-of-insurance-understanding-the-different-types

2. https://viralblogspost.com/what-does-renters-insurance-cover-and-why-do-you-need-it

3. https://viralblogspost.com/mmoga-auto-insurance-quotes-texas

4. https://viralblogspost.com/amica-life-insurance-company

5. https://viralblogspost.com/mmoga-car-insurance-quotes-houston

When choosing a vehicle, consider its safety ratings and repair costs to find one that won’t strain your budget on insurance. Some vehicles are more prone to theft than others, which can also influence your rates. Researching the insurance costs associated with specific makes and models before making a purchase can save you money in the long run.

Location

Where you live in Virginia can significantly affect your car insurance quotes. Urban areas tend to have higher rates because of increased traffic and accident rates. In contrast, rural areas may offer lower premiums.

Factors such as local crime rates, population density, and accident statistics all contribute to how much you will pay for insurance. If you reside in a high-traffic area, consider adding safety features to your vehicle, such as an alarm system or GPS tracking, which could help lower your premiums.

Finding the Cheapest Car Insurance Quotes for Young Drivers in VA

Now that you have a solid understanding of Virginia’s requirements and the factors influencing your rates, let’s focus on finding the best deals.

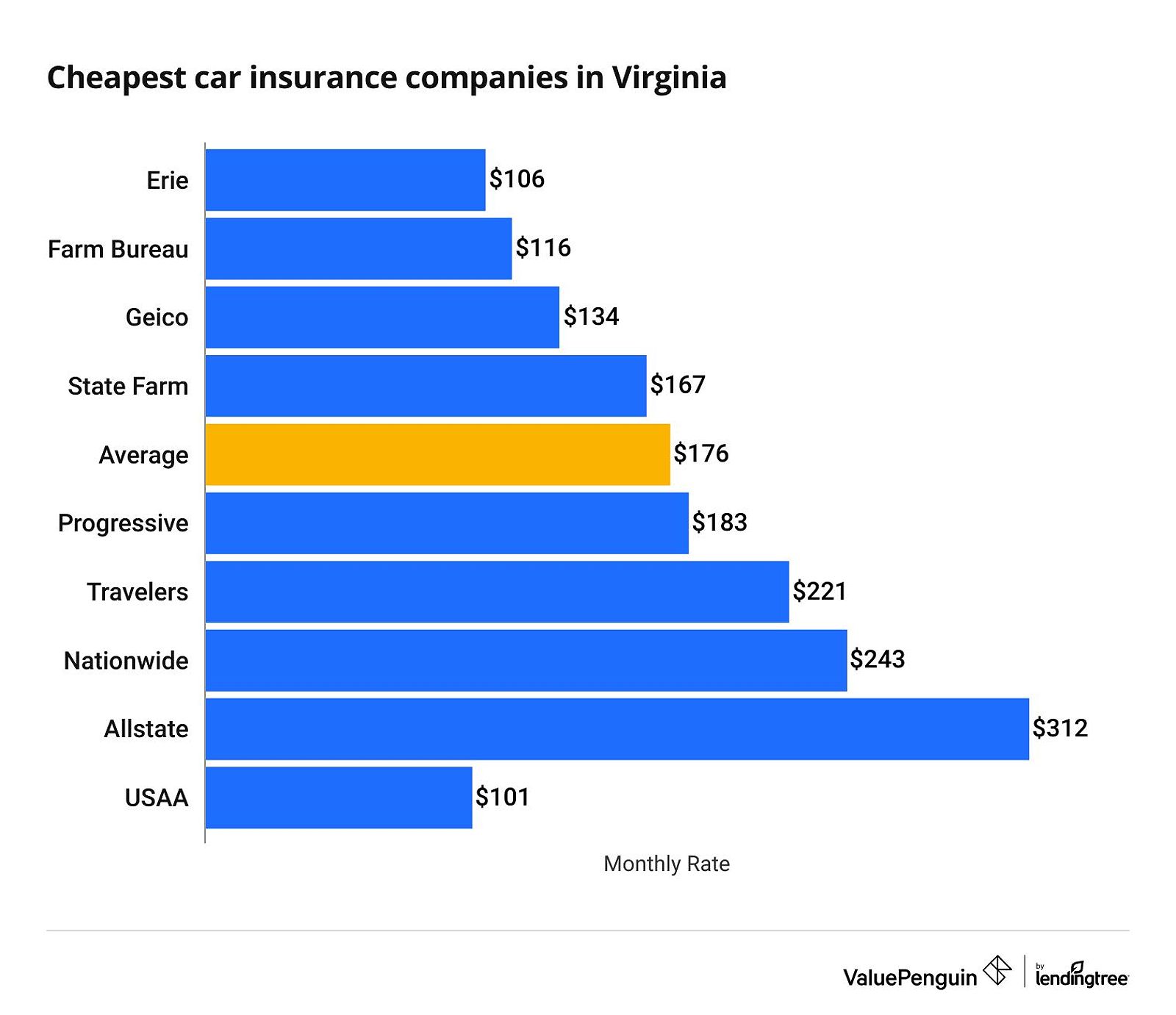

Top Car Insurance Companies for Young Drivers

Some insurance companies are known for offering competitive rates specifically for young drivers. Researching these providers can help you discover the best options tailored to your needs. Many companies provide online quotes, making it easier to compare rates quickly.

Look for insurers that advertise discounts for young drivers or have a solid reputation for customer service. Reading reviews and asking friends or family about their experiences can also provide valuable insights into which providers might be right for you.

Discounts for Young Drivers

As a young driver, you may qualify for various discounts that can significantly reduce your insurance costs. Common discounts include:

- Good Student Discounts: Maintaining a certain GPA can earn you a discount.

- Safe Driver Discounts: Completing defensive driving courses can lead to lower rates.

- Multi-Policy Discounts: Bundling your car insurance with other types of coverage can save you money.

Taking advantage of these discounts can lead to substantial savings on your premium. It’s essential to ask about all available discounts when obtaining quotes, as some companies may not readily advertise them.

Comparing Quotes

Obtaining and comparing multiple car insurance quotes is essential. Each insurance provider may assess your risk profile differently, resulting in varying rates. By gathering quotes from at least three different companies, you can make an informed decision.

Use online comparison tools to streamline the process and ensure you’re getting the best deal. When comparing quotes, pay attention not only to the premium but also to the coverage limits and deductibles. A lower premium may come with higher deductibles or less coverage, which could cost you more in the event of an accident.

Tips for Negotiating Lower Rates

Don’t hesitate to negotiate with insurance providers. If you find a better rate elsewhere, let your current insurer know. They may be willing to match or beat competitor rates to retain your business.

Consider adjusting your deductible as well. A higher deductible often results in lower premiums, but ensure you can comfortably cover that amount in the event of a claim. Additionally, inquire about payment plans. Some insurers offer discounts for paying your premium in full rather than in monthly installments. If you can manage it, this can be a simple way to save money.

How to Get Started with Car Insurance Quotes in VA

Ready to start your journey toward finding the best car insurance quotes VA? Here’s a step-by-step guide to help you get started.

1. https://viralblogspost.com/shop-for-car-insurance

2. https://viralblogspost.com/mmoga-auto-insurance-quotes-florida

3. https://viralblogspost.com/cheap-auto-insurance-utah

4. https://viralblogspost.com/what-does-renters-insurance-cover-and-why-do-you-need-it

Gather Your Information

Before requesting quotes, compile all relevant information, including your driver’s license, vehicle details, and driving history. This information will help insurers provide accurate quotes tailored to your situation.

Having your vehicle identification number (VIN), mileage, and any safety features handy can also be beneficial. If you have previously been insured, having your prior policy details ready can assist when discussing coverage options.

Contact Insurance Companies

Once you have your information prepared, reach out to reputable insurance companies. You can obtain quotes online, over the phone, or in person. Many insurers have user-friendly websites that allow you to fill out a form and receive quotes quickly.

Consider contacting local agents as well. They may provide insights into specific discounts or options available in your area that you might not find online.

Review Your Quotes

After receiving your quotes, take the time to analyze them carefully. Look beyond just the premium; consider coverage options, customer service ratings, and claims processes. This thorough evaluation will help you choose a policy that meets your needs.

Be sure to read the fine print and understand what is covered and what is not. Sometimes, policies may appear similar on the surface but differ significantly in the details, which could impact your coverage in the event of an accident.

Choose a Policy

Once you’ve compared quotes and assessed your options, select the policy that best aligns with your budget and coverage requirements. Finalize your policy by following the insurer’s instructions and making the necessary payments.

Take your time with this decision. Consider your options and ask questions if you’re unsure about any aspect of the policy. Understanding your coverage will provide peace of mind when you’re behind the wheel.

FAQ

Q: What are some common mistakes young drivers make when buying car insurance?

A: Common mistakes include not comparing quotes, overlooking available discounts, choosing too low of a deductible, and failing to understand their coverage needs.

Q: How often should I shop for new car insurance quotes?

A: It’s a good idea to shop for new quotes at least once a year, especially when your policy is up for renewal.

Q: What are some ways I can improve my driving record to lower my car insurance rates?

A: Drive safely, avoid traffic violations, and consider taking a defensive driving course.

Q: Can I get car insurance if I’m a new driver with no driving history?

A: Yes, but you may face higher premiums. Consider adding an experienced driver to your policy, such as a parent, to potentially lower your rates.

Conclusion

Finding the cheapest car insurance quotes in Virginia as a young driver can be challenging, but with the right information and strategies, you can secure the best coverage at a price that fits your budget. Start comparing quotes today and take control of your car insurance journey. Remember, safe driving habits and a clean driving record are the best ways to keep your rates low in the long run. By being informed and proactive, you can navigate the complexities of car insurance with confidence, ultimately finding a policy that offers the best value for your unique situation.

Leave a Reply