Are you frustrated by the high premiums you’re paying for your car and home insurance? This comprehensive guide will show homeowners like you how to find the most affordable car and house insurance quotes by leveraging the power of bundling.

Toc

We’ll explore the impressive advantages of bundling your auto and homeowners insurance, including substantial cost savings, enhanced convenience, and improved customer service. Then, we’ll dive into a step-by-step approach to comparing quotes from multiple insurers, helping you identify the best deals on the market.

Finally, we’ll highlight some of the top insurance companies known for their competitive bundled rates and exceptional customer satisfaction. By the end, you’ll be armed with the knowledge and tools to make an informed decision and start enjoying the benefits of bundling your car and house insurance policies.

The Perks of Bundling Car and House Insurance

Combining your car and house insurance with the same provider can unlock an array of valuable benefits that go beyond just saving money. Let’s explore the key advantages in detail.

Significant Cost Savings

One of the primary reasons homeowners choose to bundle their auto and home insurance is the potential for significant cost savings. Many insurers offer bundling discounts ranging from 5% all the way up to 20% or more on your combined premiums.

Just imagine the impact those savings can have – you could pocket hundreds of dollars per year or even splurge on a much-needed vacation. Of course, it’s essential to do your homework and compare both bundled and unbundled quotes to ensure you’re truly getting the best deal. Sometimes, a mix-and-match approach across different insurers can yield even greater savings.

Unparalleled Convenience

In our fast-paced, technology-driven world, convenience has become a highly sought-after commodity. Bundling your car and home insurance with a single provider streamlines the entire process, making policy management a breeze.

Imagine having just one bill to pay, one customer service number to call, and one online platform to manage all your insurance needs. No more juggling multiple accounts, due dates, and login credentials. With a bundled policy, you can enjoy the peace of mind that comes with seamless, centralized insurance management.

Many leading insurers also offer user-friendly digital tools, such as mobile apps and intuitive websites, allowing you to access your policy details, file claims, and make payments on the go. This level of accessibility and simplicity can be a game-changer, freeing up your time and mental energy for the things that matter most.

Enhanced Customer Service

When you bundle your car and house insurance, you often gain access to a more personalized customer service experience. By consolidating your policies with a single provider, you’ll typically be assigned a dedicated agent who intimately understands the nuances of your coverage.

This level of familiarity can translate into faster claims processing, more tailored recommendations, and overall better support when you need it most. Instead of feeling like just another number, you’ll enjoy the benefits of a one-on-one relationship with a knowledgeable professional who has your best interests at heart.

Of course, not all insurers are created equal when it comes to customer service. Be sure to research the company’s reputation, reading online reviews and assessing their ratings from reputable sources. The best providers invest in training their agents to deliver exceptional, empathetic service, ensuring you feel valued as a policyholder.

Strategies for Comparing Car and House Insurance Quotes

Finding the most competitive car and house insurance quotes requires a methodical, multi-faceted approach. Let’s explore the key steps you can take to compare options and uncover the best deals.

Leverage Online Comparison Tools

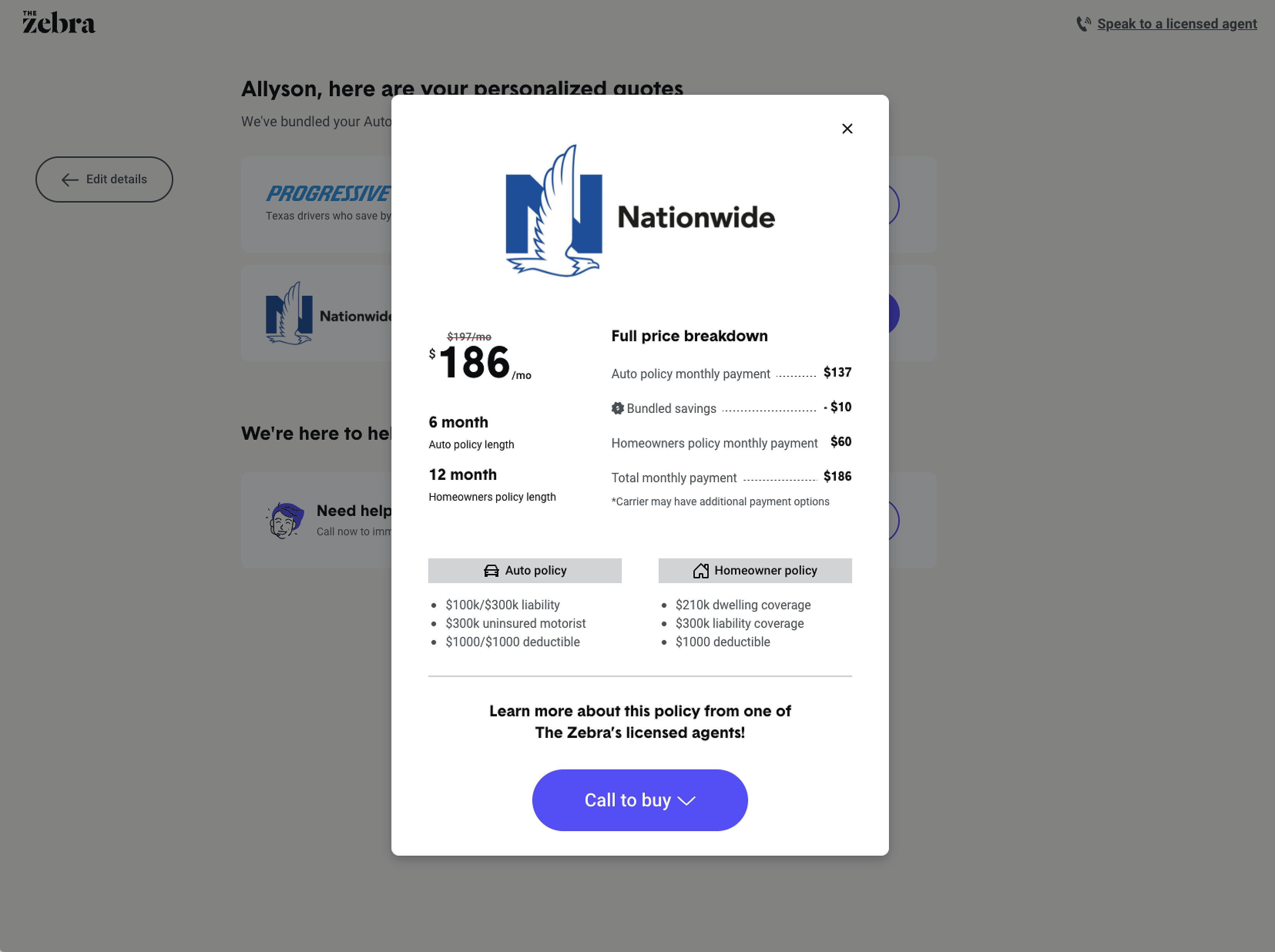

In today’s digital landscape, online comparison platforms have become invaluable resources for insurance shoppers. Websites like The Zebra allow you to input your information and instantly receive quotes from a wide array of insurers, providing a comprehensive side-by-side view of your options.

These comparison tools are particularly useful for quickly gathering and analyzing bundled policy quotes. Look for platforms that offer accurate, detailed information about coverage features, pricing, and customer satisfaction ratings. By using these unbiased resources, you can save time and pinpoint the most favorable offers in the market.

Engage with Insurance Agents Directly

While online tools are an excellent starting point, don’t overlook the value of human interaction. Speaking directly with licensed insurance agents can provide unique insights that automated systems may miss. These professionals can offer personalized quotes tailored to your specific needs and help you navigate the nuances of different coverage options.

2. https://viralblogspost.com/cheap-auto-insurance-utah

3. https://viralblogspost.com/cheap-insurance-for-business

4. https://viralblogspost.com/8-best-homeowners-insurance-companies-of-2023

Working with agents who represent multiple insurers ensures you have access to a broader range of possibilities. An experienced agent can clarify complicated policy terms, walk you through the decision-making process, and provide expert recommendations based on your unique circumstances. This personal touch can be particularly helpful in ensuring you don’t overlook any vital coverage.

Consider Your Unique Coverage Requirements

Before finalizing your insurance quotes, take the time to carefully assess your specific coverage needs for both your car and home. Think about factors such as deductibles, liability limits, and any optional add-ons that may be necessary to protect your assets adequately.

Understanding your unique requirements will empower you to make informed decisions about the policies you choose, ensuring you get the right coverage without paying for unnecessary extras. For instance, if you have a newer, more valuable vehicle, comprehensive coverage may be the way to go. Conversely, an older car might only require basic liability insurance.

By taking this thoughtful approach, you’ll be able to identify the policy combinations that provide the best value and the most comprehensive protection for your specific needs.

Top Insurers for Bundling Car and House Insurance

While many insurance providers offer bundling options, some companies consistently stand out for their competitive rates, customer satisfaction, and overall reputation. Let’s explore a few of the top contenders.

USAA

If you’re eligible, USAA is widely regarded as one of the premier choices for bundling car and house insurance. This insurer, which primarily serves military members and their families, is renowned for its exceptional customer service and impressive pricing.

Many USAA customers report significant savings when bundling their policies, making it an excellent option for those who qualify. The company’s commitment to customer satisfaction is evident in its consistently high ratings from independent surveys, showcasing its reliability in both service and claims processing.

State Farm

With an expansive network of agents and a strong reputation for customer service, State Farm is another top pick for bundled car and house insurance. The company offers highly competitive rates for bundled policies, making it an attractive choice for homeowners looking to maximize their savings.

State Farm’s user-friendly online tools also enhance the overall customer experience, allowing policyholders to conveniently manage their accounts. Moreover, the company’s well-trained agents are adept at providing valuable insights and recommendations to help you find the best coverage options.

GEICO

Known for its robust digital presence, GEICO has become a popular choice for consumers who prefer to handle their insurance needs online. The company’s bundling options often come with significant discounts, appealing to tech-savvy individuals who value simplicity and accessibility.

While some customers have reported mixed experiences with GEICO’s claims satisfaction, the insurer remains a top contender for its affordability and user-friendly digital platforms. With a comprehensive mobile app and intuitive website, GEICO makes managing your car and home insurance a breeze.

Nationwide

Rounding out our list of top insurers for bundling is Nationwide, a company known for its comprehensive coverage options, bundling discounts, and strong customer service reputation. Renowned for its financial stability, Nationwide is a reliable choice for those seeking to bundle their car and home insurance.

Nationwide’s commitment to customer satisfaction is evident in its positive reviews and ratings, making it a compelling option for homeowners who value personalized attention and efficient claims handling.

Tips for Choosing the Best Car and House Insurance Bundle

Selecting the right bundled car and house insurance policy requires careful consideration. Keep the following tips in mind to ensure you make the best decision for your unique needs.

Verify Coverage Isn’t Compromised

Before committing to a bundled policy, it’s crucial to thoroughly review the coverage details to confirm that your protection won’t be compromised. Different insurers may have varying underwriting criteria, which could lead to limitations or exclusions in your bundled policy.

Take the time to read through the policy documents and ask your agent any clarifying questions. It’s better to address any uncertainties upfront than to face unexpected issues when you need to file a claim.

Prioritize Claims Management Reputation

Research the insurer’s reputation for handling claims efficiently and fairly. A provider with a proven track record of responsive and empathetic claims processing can save you a great deal of stress and hassle when you need to file a claim.

1. https://viralblogspost.com/commercial-property-insurance-guild-to-protecting-your-investment

2. https://viralblogspost.com/car-insurance-quotes-tn

3. https://viralblogspost.com/small-business-insurance-online

4. https://viralblogspost.com/auto-insurance-quotes-arizona

5. https://viralblogspost.com/mmoga-auto-insurance-quotes-florida

Look for customer reviews and ratings that highlight the insurer’s claims management capabilities. A company that values its policyholders will invest in training its agents to deliver a seamless and positive claims experience.

Compare Bundled and Unbundled Quotes

Don’t assume that bundling is automatically the most cost-effective option. It’s wise to compare both bundled and unbundled quotes from various insurers to determine which approach offers the best value for your specific situation.

In some cases, a mix-and-match strategy where you choose different providers for your car and home insurance may yield greater savings than a bundled policy. Conducting a thorough comparison will ensure you make an informed decision.

Consider Long-Term Insurance Needs

When selecting your insurance provider, it’s important to consider your evolving needs over time. Life changes, such as buying a new home, adding a teen driver, or starting a business, can significantly impact your insurance requirements.

Choose an insurer that has the flexibility and resources to accommodate your changing needs, ensuring you maintain the appropriate coverage as your circumstances evolve. This foresight can save you time, money, and hassle in the long run.

FAQ

Q: Is it cheaper to have car and house insurance together?

A: Bundling often leads to discounts, but it’s crucial to compare bundled and unbundled quotes to ensure you’re getting the best deal.

Q: How much can I save by bundling insurance?

A: Discounts can vary, but you could save between 5% and 20% or more on your combined premiums.

Q: What are the best car and house insurance companies?

A: Some top contenders include USAA, State Farm, GEICO, and Nationwide. Research their offerings and compare quotes to find the best fit for your needs.

Q: Who has the cheapest car and house insurance bundles?

A: Average rates can vary, but USAA and State Farm are often cited as having competitive bundled pricing.

Conclusion

Bundling your car and house insurance can be a smart financial move, unlocking significant cost savings, enhanced convenience, and improved customer service. By leveraging online comparison tools, engaging with knowledgeable insurance agents, and carefully assessing your coverage needs, you can find the best bundled policies to protect your assets while keeping more money in your pocket.

Start comparing your options today and see how much you can save by bundling your car and house insurance. With the right provider and the right coverage, you’ll be well on your way to enjoying the benefits of a simplified, cost-effective insurance experience.

Leave a Reply