Credit card debt can be a significant financial burden, especially when high-interest rates are involved. For many, using a personal loan to pay off credit card debt is an effective strategy to regain control of their finances. In this article, we will explore the benefits of this approach, provide real-life examples, and offer guidance on how to apply for a personal loan. Our goal is to help you make an informed decision about whether this strategy is right for you.

Toc

Understanding the Benefits of Using a Personal Loan to Pay Off Credit Card Debt

There are several advantages to using a personal loan to pay off credit card debt. Some of the most significant benefits include:

Lower Interest Rates

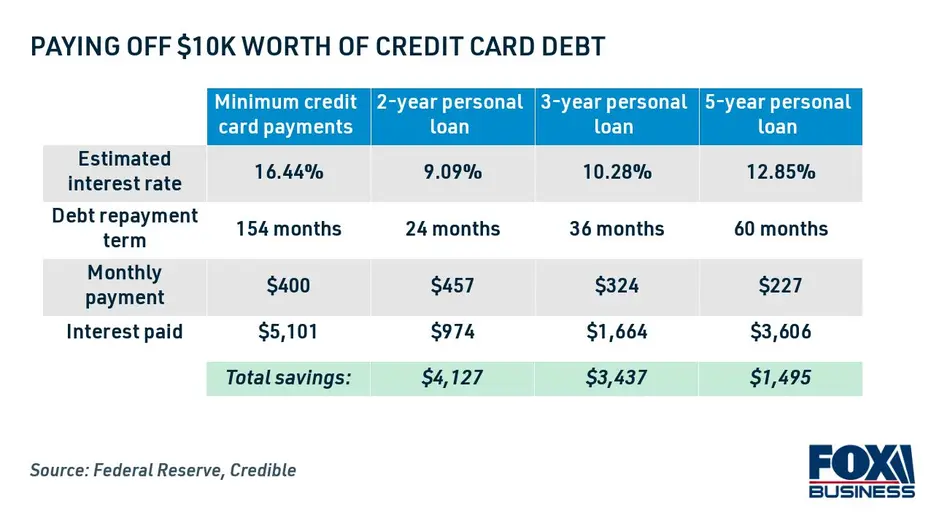

One of the most compelling reasons to use a personal loan to pay off credit card debt is the potential savings on interest payments. Credit cards often carry high interest rates, typically ranging from 15% to 25%, depending on your credit score and the card issuer. In contrast, personal loans generally offer lower interest rates, especially for borrowers with good credit. According to NerdWallet, the average interest rate for a personal loan is around 9% to 12%. By securing a personal loan at a lower rate, you can significantly reduce the amount of interest you pay over time, making it easier to pay off your debt.

Fixed Repayment Terms

Unlike credit cards, which require minimum monthly payments that can fluctuate based on your balance, personal loans come with fixed repayment terms. This means you’ll have a consistent monthly payment amount and a clear timeline for when your debt will be paid off. Fixed repayment terms make it easier to budget and manage your finances, providing a sense of stability and predictability.

Improving Credit Scores

Credit utilization, or the amount of available credit you’re using, is a significant factor in your credit score. High credit card balances can negatively impact your credit score by increasing your credit utilization ratio. By using a personal loan to pay off your credit card debt, you can lower your credit utilization and potentially improve your credit score. Additionally, having a mix of credit types (revolving credit like credit cards and installment loans like personal loans) can positively impact your credit score.

Debt Consolidation

If you have multiple credit card balances, managing multiple due dates and payment amounts can be stressful. A personal loan allows you to consolidate all your credit card debts into a single, more manageable payment. Debt consolidation simplifies your financial life, reducing the risk of missed payments and late fees.

Access to Larger Sums of Money

Personal loans often provide access to larger sums of money compared to credit cards. This can be particularly beneficial if you have high credit card balances that you want to pay off quickly. By securing a personal loan, you can tackle your debt head-on and start working towards financial freedom.

Consider a Personal Loan to Pay Off Credit Card Debt

Who Should Consider a Personal Loan

A personal loan can be a suitable option for individuals who are looking to simplify their financial management while reducing the cost of their debt. However, not everyone will benefit equally from this strategy. To determine if a personal loan is right for you, consider the following factors:

- Your Credit Score: If you have a good credit score, you are more likely to qualify for a personal loan with favorable terms, including lower interest rates. This will maximize your savings compared to continuing to pay high-interest rates on your credit cards. On the other hand, if your credit score is low, you might not qualify for a lower interest rate, which could negate the benefits of taking out a personal loan.

- Your Debt Amount: Evaluate the total amount of credit card debt you need to pay off. If your debt is relatively small, you might manage to pay it down faster through aggressive payments on your existing credit cards. But if you have a substantial amount of debt, a personal loan can provide the financial breathing room you need to pay it off more efficiently.

- Your Spending Habits: It’s crucial that you address any underlying spending habits that contributed to high credit card debt. Consolidating your debt with a personal loan won’t be beneficial if you continue to use your credit cards irresponsibly. Make sure you have a solid plan for budgeting and managing your expenses moving forward.

- Financial Discipline: Taking out a personal loan to pay off credit card debt requires a commitment to financial discipline. Fixed monthly payments can help you build a repayment schedule, but you must stick to it. Ensure you are ready to meet these obligations consistently to make the most of the personal loan.

When to Consider a Personal Loan

Before deciding to use a personal loan to pay off credit card debt, it’s essential to assess your financial situation and consider the following factors:

1. https://viralblogspost.com/mmoga-finance-and-accounting-outsourcing-companies

2. https://viralblogspost.com/bill-consolidation-debt-your-path-to-financial-freedom

3. https://viralblogspost.com/mmoga-newtek-small-business-finance

4. https://viralblogspost.com/stock-futures-yahoo-finance

5. https://viralblogspost.com/cash-flow-from-financing-activities

- Interest Rates: Compare the interest rates of personal loans with those of your credit cards. Ensure that the personal loan offers a lower rate to maximize your savings.

- Credit Score: Your credit score will impact the interest rate you qualify for on a personal loan. Check your credit score and ensure it’s in good standing before applying.

- Repayment Terms: Evaluate the repayment terms of the personal loan and ensure they fit within your budget. Consider the monthly payment amount and the loan term.

- Loan Fees: Some personal loans come with origination fees or prepayment penalties. Be sure to read the fine print and understand any additional costs associated with the loan.

- Debt-to-Income Ratio: Lenders will also consider your debt-to-income ratio, which is the amount of debt you have compared to your income. A lower debt-to-income ratio can increase your chances of approval and potentially qualify you for a better interest rate.

How to Apply for a Personal Loan

Applying for a personal loan involves several steps, and being prepared can streamline the process and improve your chances of approval.

Steps to Secure a Personal Loan

- Check Your Credit Score: Before applying for a personal loan, check your credit score to understand what interest rate you may qualify for.

- Shop Around: Compare offers from multiple lenders, including banks, credit unions, and online lenders, to find the best interest rate and terms.

- Gather Documentation: Lenders typically require proof of income, employment history, and other financial information. Gather the necessary documentation to streamline the application process.

- Apply for the Loan: Submit your loan application with the chosen lender. Be prepared for a credit check and provide all requested information accurately.

- Review the Terms: Once approved, carefully review the loan terms, including the interest rate, repayment schedule, and any fees. Ensure you understand the commitment before accepting the loan.

Tips for a Smooth Application Process

- Improve Your Credit Score: If your credit score is less than ideal, take steps to improve it before applying for a loan. Paying down existing debt and correcting any errors on your credit report can help.

- Consider a Co-Signer: If you have a low credit score, a co-signer with good credit can help you secure a better interest rate.

- Stay Organized: Keep all your financial documents organized and readily available to expedite the application process.

Potential Risks and Drawbacks

While using a personal loan to pay off credit card debt can offer numerous benefits, it’s also important to be aware of the potential risks and drawbacks associated with this approach.

Accumulating More Debt

One of the primary risks is the possibility of accumulating more debt. After paying off your credit cards with a personal loan, you may be tempted to use your newly available credit. If you start accumulating new balances on your credit cards while still repaying the personal loan, you could end up in a worse financial situation with even more debt to manage.

Higher Interest Costs

While personal loans often have lower interest rates than credit cards, this is not always guaranteed. If you have a low credit score or limited borrowing history, you may not qualify for the most competitive personal loan rates. In some cases, the interest rate on the personal loan might be higher than the interest rate on your credit cards, potentially increasing your overall cost of borrowing.

Loan Fees

Personal loans can come with various fees, such as origination fees, processing fees, and prepayment penalties. These additional costs can add up, affecting the total amount you repay. It’s crucial to carefully read the terms of the loan agreement and consider all associated fees before committing to a personal loan.

Fixed Payment Schedule

While fixed repayment terms can be a benefit, they can also be a drawback if your financial situation changes. Unlike credit card payments, which offer flexibility with minimum payment options, personal loans require a fixed monthly payment. If you experience a loss of income or unexpected expenses, maintaining regular loan payments may become challenging.

Impact on Credit Score

Initially, applying for a personal loan can result in a hard inquiry on your credit report, which can temporarily lower your credit score. Additionally, if you miss payments or default on the personal loan, it can negatively affect your credit score, making it difficult to access future credit.

Limited Flexibility

Personal loans provide a lump sum of money that must be repaid over a set term. Unlike credit cards, which offer revolving credit, once you pay off your personal loan, you do not have access to those funds again unless you take out another loan. This lack of flexibility can be a limitation if you need additional funds in the future.

Before deciding to use a personal loan to pay off credit card debt, it’s crucial to weigh these risks and drawbacks against the potential benefits. Carefully assess your financial situation, budget, and ability to repay the loan to make an informed decision.

Real-Life Examples

1. https://viralblogspost.com/bachelor-of-science-in-finance

2. https://viralblogspost.com/mmoga-masters-degree-in-finance

3. https://viralblogspost.com/cash-flow-from-financing-activities

4. https://viralblogspost.com/mmoga-online-masters-in-finance

5. https://viralblogspost.com/mmoga-wells-fargo-financing-home

To better understand how using a personal loan to pay off credit card debt can be beneficial, let’s look at some real-life examples:

Sarah’s Story

Sarah had accumulated $10,000 in credit card debt over the years. With an average interest rate of 20%, her minimum monthly payments were barely making a dent in her balance, and she felt trapped in a cycle of debt. After researching her options, Sarah decided to take out a personal loan with a lower interest rate of 10%. By consolidating her credit card debt and paying off the balances in full, Sarah saved thousands of dollars in interest payments and was able to pay off her debt within three years.

John and Emily’s Story

John and Emily had multiple credit cards with varying interest rates. Their monthly payments were becoming overwhelming, making it challenging to keep up with all their bills. After consulting with a financial advisor, they decided to take out a personal loan to consolidate their credit card debts into one fixed payment. Not only did this simplify their finances, but it also allowed them to save money on interest payments and pay off their debt faster.

Alex’s Story

Alex, a 30-year-old marketing executive, found himself with $20,000 in credit card debt across five cards, with interest rates ranging from 18% to 25%. Struggling to make headway on his balances, Alex opted for a personal loan with a 10% interest rate to consolidate his debt. After 18 months of disciplined payments, Alex not only eliminated his credit card debt but also substantially improved his credit score.

Rachel’s Journey

Rachel, a 28-year-old freelancer, faced a similar situation with $15,000 spread across three credit cards. With fluctuating income, Rachel found it challenging to manage her payments, often paying only the minimum due. After securing a personal loan at a fixed rate, Rachel was able to set a clear repayment plan with consistent monthly payments. Within two years, she was debt-free and more in control of her finances.

Michael’s Case

Michael, a 35-year-old teacher, had experienced a period of unemployment that led to significant credit card debt. With the help of a personal loan, he was able to pay off his high-interest credit cards, significantly reducing the total interest paid over time. This not only saved him money but also improved his credit score, making it easier for him to access more favorable financial products in the future.

These case studies illustrate the effectiveness of using a personal loan to pay off credit card debt, showcasing its potential to save on interest, improve credit scores, and provide a clearer path to financial stability.

Conclusion

Using a personal loan to pay off credit card debt can be a smart financial move, offering benefits such as lower interest rates, fixed repayment terms, improved credit scores, and debt consolidation. By understanding these advantages and learning from real-life examples, you can make an informed decision about whether this strategy is right for you.

If you’re struggling with credit card debt, consider exploring the option of a personal loan. Assess your financial situation, compare offers, and take the necessary steps to secure a loan that will help you achieve your financial goals. With careful planning and disciplined repayment, you can regain control of your finances and work towards a debt-free future.

Leave a Reply