Obtaining car insurance with no down payment can pose challenges. Several insurance companies may not openly provide this choice, favoring low-risk drivers. The absence of a down payment could be perceived as high-risk behavior.

Toc

- 1. Why do Insurance Companies Require a Down Payment?

- 2. Related articles 01:

- 3. Compare No Down Payment Auto Insurance Quotes

- 4. Summary of the Best Insurance Companies with no Down Payment

- 5. Related articles 02:

- 6. Can I Get Auto Insurance with No Down Payment?

- 7. Why You Should Consider Making a Down Payment

- 8. Summary

Making a down payment is a prudent choice to consider. Your down payment is factored into your rate, alleviating the need for monthly premium payments towards it. Opting for a substantial down payment is an effective strategy for securing lower rates.

When contemplating this decision, various factors come into play. Some individuals prioritize swift acquisition of car insurance without upfront costs, while others aim to fulfill dealership requirements promptly. The latter group seeks no down payment policies, as perceived by car insurance providers.

Alternatively, uncertainty regarding the chosen car insurance company may influence your decision. As the down payment affects future monthly payments, selecting a provider entails an element of risk. Hence, it is advisable to obtain quotes from multiple car insurance companies and assess feedback from other customers.

Regardless of your rationale, I have identified reputable car insurance companies offering a no down payment alternative, should this align with your preferences.

Why do Insurance Companies Require a Down Payment?

All car insurance companies prefer, and in most cases require, a down payment to be made. This is to offset their upfront costs of running a background check and setting up a new policy.

These two things cost them money and they like to recoup it on the front end, as opposed to over the life of a six-month policy.

Additionally, a down payment serves as a form of commitment from the customer. By paying upfront, the insurance company can be assured that the customer is serious about maintaining their coverage and will make regular payments in the future.

It’s also important to note that some states have laws requiring car insurance companies to collect a down payment before providing coverage. This is to ensure that drivers are financially responsible and able to cover any potential damages or accidents they may cause while on the road.

Understanding No Down Payment Car Insurance

While most insurance companies require a down payment, there are some that offer a no down payment option. This means that customers do not have to pay anything upfront to secure their coverage.

No down payment car insurance may seem like an attractive option for those who are struggling financially or have a tight budget. However, it’s important to understand how this type of insurance works and the potential risks involved.

How No Down Payment Insurance Works

With no down payment car insurance, customers do not have to pay anything upfront in order to get coverage. Instead, they will be required to make regular monthly payments towards their policy. These payments may be higher than traditional car insurance policies, as the entire cost of the policy is spread out over smaller increments.

2. https://viralblogspost.com/car-insurance-quotes-va

3. https://viralblogspost.com/selective-insurance-agent-login

4. https://viralblogspost.com/is-life-insurance-worth-it-and-when-do-you-need-it

5. https://viralblogspost.com/mmoga-car-insurance-quotes-houston

Benefits of No Down Payment Car Insurance

The main benefit of no down payment car insurance is that it allows individuals with limited funds to obtain auto insurance coverage. This can provide peace of mind for those who may not have enough money saved up for a down payment but still need to drive.

Another advantage is the convenience factor. By not having to pay a lump sum upfront, individuals can spread out the cost of their insurance over time and better manage their finances. This can be especially helpful for those on a tight budget or living paycheck to paycheck.

Risks Involved

While no down payment car insurance may seem like an attractive option, there are some risks involved. The monthly payments for this type of policy may end up being higher than traditional policies, which could strain someone’s budget in the long run.

Additionally, if a customer misses a monthly payment or fails to renew their policy before it expires, they could lose coverage and potentially face legal consequences if caught driving without insurance. It also may be more difficult to switch insurance providers or negotiate for better rates in the future if a customer has a history of missed payments.

Furthermore, some insurance companies may charge higher interest rates or fees for no down payment policies, which could end up costing more in the long term. It’s important to carefully compare and consider all options before committing to this type of policy.

Other Considerations

When considering no down payment car insurance, it’s important to also think about the potential consequences if you are unable to make a payment in the future. Many policies have strict cancellation policies and late fees that could end up costing even more money in the long run.

It’s also important to keep in mind that choosing a no down payment policy may limit your options for switching insurance providers in the future. Some companies may require a down payment when starting a new policy with them, which could leave you without coverage until you are able to make the payment.

Ultimately, the decision to opt for no down payment car insurance should be carefully considered. It may offer some short-term relief in terms of affordability, but it’s important to weigh the potential long-term consequences and consider all your options before making a decision.

Compare No Down Payment Auto Insurance Quotes

Car Insurance with no Down Payment Overview

| Company | Best for | Average premium (Monthly rate for 25-year old female driving ‘17 Jetta with no prior accidents) |

|---|---|---|

| State Farm | Low rates | $284.95 |

| USAA | Military members | Varies (but highly competitive) |

| Allstate | Lower credit borrowers | $392 |

Finding a car insurance company that is willing to give you insurance without a down payment or deposit is a pretty difficult feat. However, there are a few that will allow it, in certain states, and if you ask nicely.

About average premiums

Average premiums were determined based on the following hypothetical profile:

- Jennifer, a 25-year-old single individual who is employed and has a clean accident record.

- She leases a 2017 Volkswagen Jetta 1.4 SE and resides in an apartment in zip code 30324 (North Atlanta).

- Jennifer avails all relevant discounts and participates in telematics programs such as Progressive Snapshot.

While the provided chart gives a general estimate of costs with Allstate and State Farm, it’s important to note that individual circumstances vary. Unfortunately, a sample quote from USAA couldn’t be generated without a military ID. Your profile is likely different from Jenny’s, which will affect the quotes you receive.

To determine which provider offers the best rates, it is essential to obtain accurate, personalized quotes from each. Utilizing aggregators can streamline this process.

Summary of the Best Insurance Companies with no Down Payment

| Car insurance company | How rates compare | Can get a policy with no down payment automatically? |

|---|---|---|

| Allstate | Highest in general, but lower for subpar credit | No, you’ll have to speak to an agent |

| State Farm | Lower for excellent credit, but higher for subpar credit | No, you’ll have to speak to an agent |

| USAA | Lowest | Yes |

Allstate

Allstate is a well-known company in the US. Their insurance products are accessible to eligible individuals, typically contingent on credit score and accident history. Despite a low credit score, they may still provide coverage at a higher premium. Given Allstate’s relatively higher rates, the cost may be considerable. For those seeking insurance without a down payment, Allstate offers this option, although it is not extensively promoted. To determine eligibility for this feature, direct consultation with a representative is necessary.

State Farm

State Farm is a widely recognized company, known to many. When comparing State Farm to Allstate in terms of their application processes, the key distinction lies in their rates.

1. https://viralblogspost.com/small-business-insurance-online

2. https://viralblogspost.com/securing-your-future-with-long-term-care-insurance

4. https://viralblogspost.com/car-insurance-quotes-va

5. https://viralblogspost.com/mmoga-seven-corners-travel-insurance

In general, State Farm tends to provide more favorable rates for individuals with credit scores of 800 or higher. Conversely, if your credit score is significantly lower, below 600, Allstate may prove to be the preferable choice.

Both companies offer the unique benefit of initiating a policy without a down payment. However, similar to Allstate, you will need to engage with an agent to access this option, as it is not available through online applications for either company.

USAA

USAA is exclusively accessible to specific segments of the population. Eligibility is granted to individuals who have served in any branch of the military, as well as those with a parent or child who has served. If these criteria are not met, this option may not be available to you.

The advantage lies in their competitive rates, tailored to the military and their families. Additionally, they provide a no down payment option to alleviate the initial financial burden.

Certain restrictions, primarily based on geographical location, apply. An exception is that the down payment must be under $50, with no history of non-payment cancellations in the past three years.

If you fulfill the stipulated requirements, you may qualify for a no down payment car insurance alternative through USAA.

Can I Get Auto Insurance with No Down Payment?

Obtaining car insurance without an initial down payment can be challenging for many. This option is not universally available, with specific states like Arizona, California, Florida, Georgia, New York, Oklahoma, and Washington currently offering it. If you reside outside these states, you may not have access to this option. It’s crucial to note that within states providing no down payment car insurance, there is a limited pool of insurance providers offering this service. These companies may not offer the most competitive rates, potentially leading to higher costs in the long run.

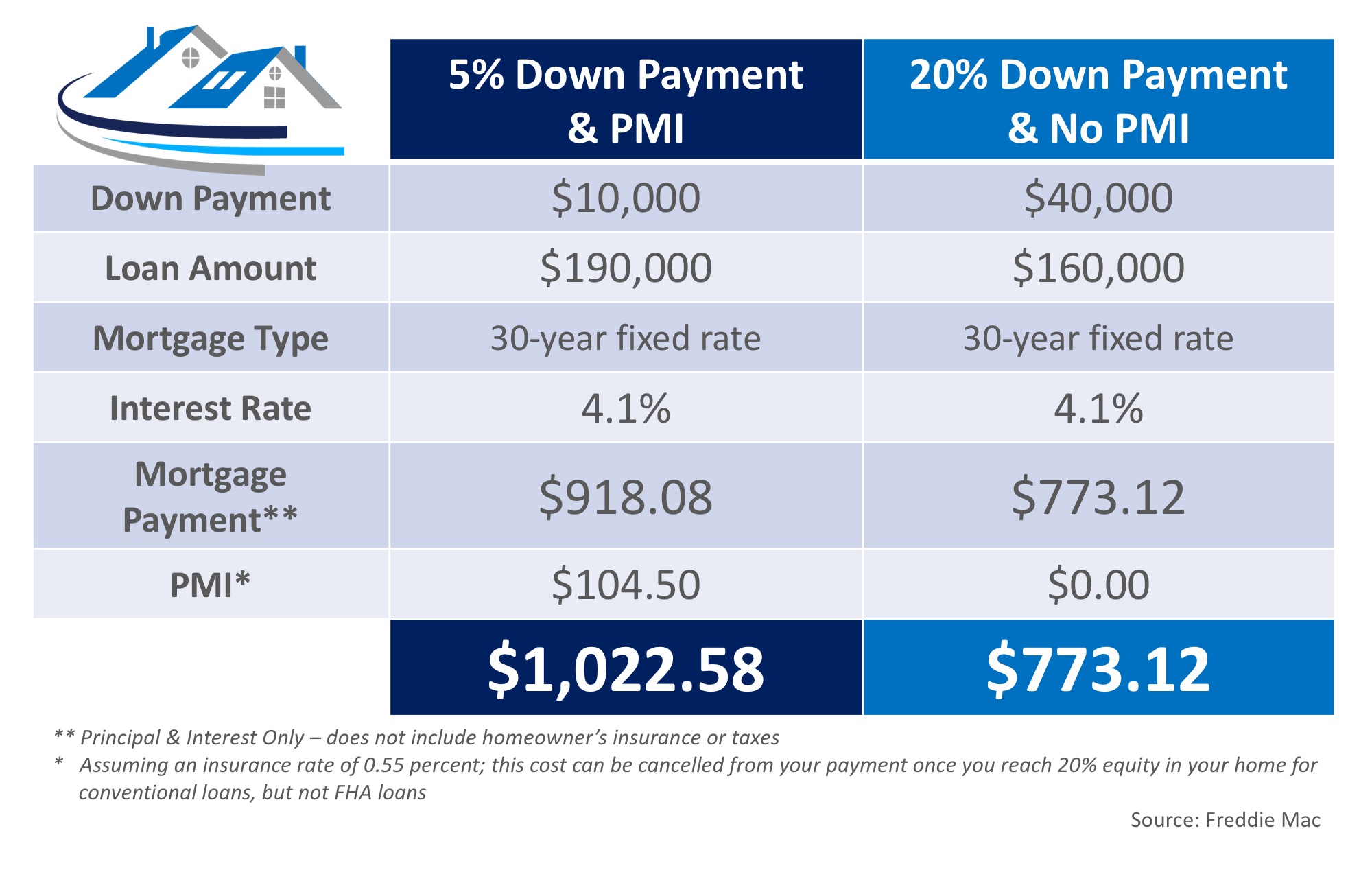

Why You Should Consider Making a Down Payment

Finding car insurance without a down payment can be challenging, but it’s crucial to consider certain factors for informed decisions. In most cases, making a down payment can actually save you money in the long run. Here’s why:

A Downpayment Reduces Your Monthly Payments

The initial point to consider is that your down payment is not simply an expenditure that vanishes into thin air. Rather, the down payment contributes to lowering your forthcoming monthly car insurance premiums. For instance, by providing a 30% down payment on a $100 monthly policy, you can decrease your payment to $70. Thus, making a down payment on your car insurance could assist you in managing your budget more effectively by providing an additional monthly buffer.

No Downpayment May Mean a Higher Rate

Most car insurance providers typically do not offer a no down payment option, leading to potentially higher initial rates due to the perceived risk. High-risk clients are often charged a higher premium. However, opting for direct deposit using your debit or credit card could increase your chances of avoiding the down payment requirement. This option may not be openly advertised, so consider reaching out to an agent by phone to explore this possibility further.

There are Other Factors to Consider

Another factor to consider is your credit score and the type of vehicle requiring insurance. A higher credit score paired with a slightly older vehicle increases the likelihood of securing car insurance without a down payment. Conversely, attempting to insure a high-end brand-new car decreases the probability due to the heightened risk associated with expensive new vehicles. Insurers often require upfront payment to mitigate this risk.

Summary

Looking for car insurance without a down payment can present a challenge, as this option is not commonly promoted by insurance providers. Nevertheless, some companies such as Allstate, State Farm, and USAA have started offering policies with no down payment required. USAA, in particular, stands out for its tailored services for military personnel, providing additional benefits and discounts. Whether you lean towards a down payment or seek alternatives, exploring the variety of options on the market can help you find a policy that aligns perfectly with your specific requirements and preferences.