Property insurance is a crucial aspect of financial planning, offering protection and peace of mind to property owners. Whether you own a home, a condo, or rental properties, property insurance serves as a safety net against unexpected damages and losses. In this article, we will delve into the world of property insurance, understanding its importance, coverage options, and key factors to consider when selecting a policy.

Toc

- 1. Understanding Property Insurance

- 2. Types of Property Insurance Policies

- 3. Additional Coverage Options

- 4. Key Coverage Areas

- 5. Related articles 01:

- 6. Factors Affecting Property Insurance Premiums

- 7. Making Informed Decisions

- 8. The Claims Process

- 9. Property Insurance for Renters

- 10. Property Insurance for Condominium Owners

- 11. Protecting Your Home Business

- 12. Renovations and Property Insurance

- 13. Property Insurance for Vacation Homes

- 14. Related articles 02:

- 15. Insuring Rental Properties

- 16. Rental Property vs. Vacation Rental

- 17. Insurance Coverage for Rental Properties

- 18. Ensuring Adequate Coverage

- 19. Conclusion

Understanding Property Insurance

Property insurance is a type of insurance that provides coverage for properties, such as residential homes, condos, and rental properties. It protects against financial losses resulting from perils like fire, theft, vandalism, and natural disasters. Property insurance not only covers the physical structure but also extends to personal belongings and provides liability protection for the property owner.

Types of Property Insurance Policies

Homeowners Insurance

Homeowners insurance is designed for individuals who own residential homes. It offers a comprehensive package of coverage, including dwelling coverage for the physical structure, personal property coverage for belongings, and liability coverage for legal protection. Homeowners insurance provides financial security in case of property damage or injuries that occur on the premises.

Renters Insurance

Renters insurance is tailored for tenants who rent a property rather than own it. While the landlord’s insurance covers the building structure, renters insurance protects the tenant’s personal belongings and provides liability coverage. It ensures that tenants are financially protected in the event of theft, fire, or other covered perils.

Condo Insurance

Condo insurance is designed for condominium unit owners. It typically includes coverage for personal belongings and interior structures within the unit. Condo insurance also offers liability protection in case of accidents or injuries that occur inside the unit.

Additional Coverage Options

Flood Insurance

Flood insurance is a separate policy that provides coverage for property damage caused by floods. Standard property insurance policies do not typically cover flood-related losses, making flood insurance crucial for properties located in flood-prone areas.

Earthquake Insurance

Earthquake insurance provides coverage for damages resulting from earthquakes. This type of insurance is essential for properties in regions susceptible to seismic activity, as earthquakes are not covered under standard property insurance.

Umbrella Insurance

Umbrella insurance offers additional liability protection beyond the limits of standard property insurance policies. It can provide coverage for situations where the liability limits of other policies are exceeded, offering a higher level of financial security.

Key Coverage Areas

Dwelling Coverage

Dwelling coverage is the core component of property insurance, providing protection for the physical structure of the property, including the walls, roof, floors, and built-in appliances. In the event of covered perils like fire or windstorm damage, dwelling coverage helps cover the cost of repairs or rebuilding.

Personal Property Coverage

Personal property coverage protects the policyholder’s belongings inside the property, such as furniture, electronics, clothing, and valuables. If these belongings are damaged or stolen due to covered perils, personal property coverage provides compensation for their replacement or repair.

1. https://viralblogspost.com/errors-and-omissions-insurance-quote

2. https://viralblogspost.com/mmoga-car-insurance-quotes-pa

3. https://viralblogspost.com/securing-your-future-with-long-term-care-insurance

Liability Coverage

Liability coverage is a critical aspect of property insurance that protects the policyholder from lawsuits and legal claims. If someone is injured on the property, liability coverage can help cover the medical expenses and legal costs associated with the incident.

Factors Affecting Property Insurance Premiums

Several factors influence the cost of property insurance premiums:

Location and Proximity to Risk Factors

Properties located in high-crime areas or regions prone to natural disasters may have higher insurance premiums. Insurance companies assess the risks associated with the property’s location when determining the premium.

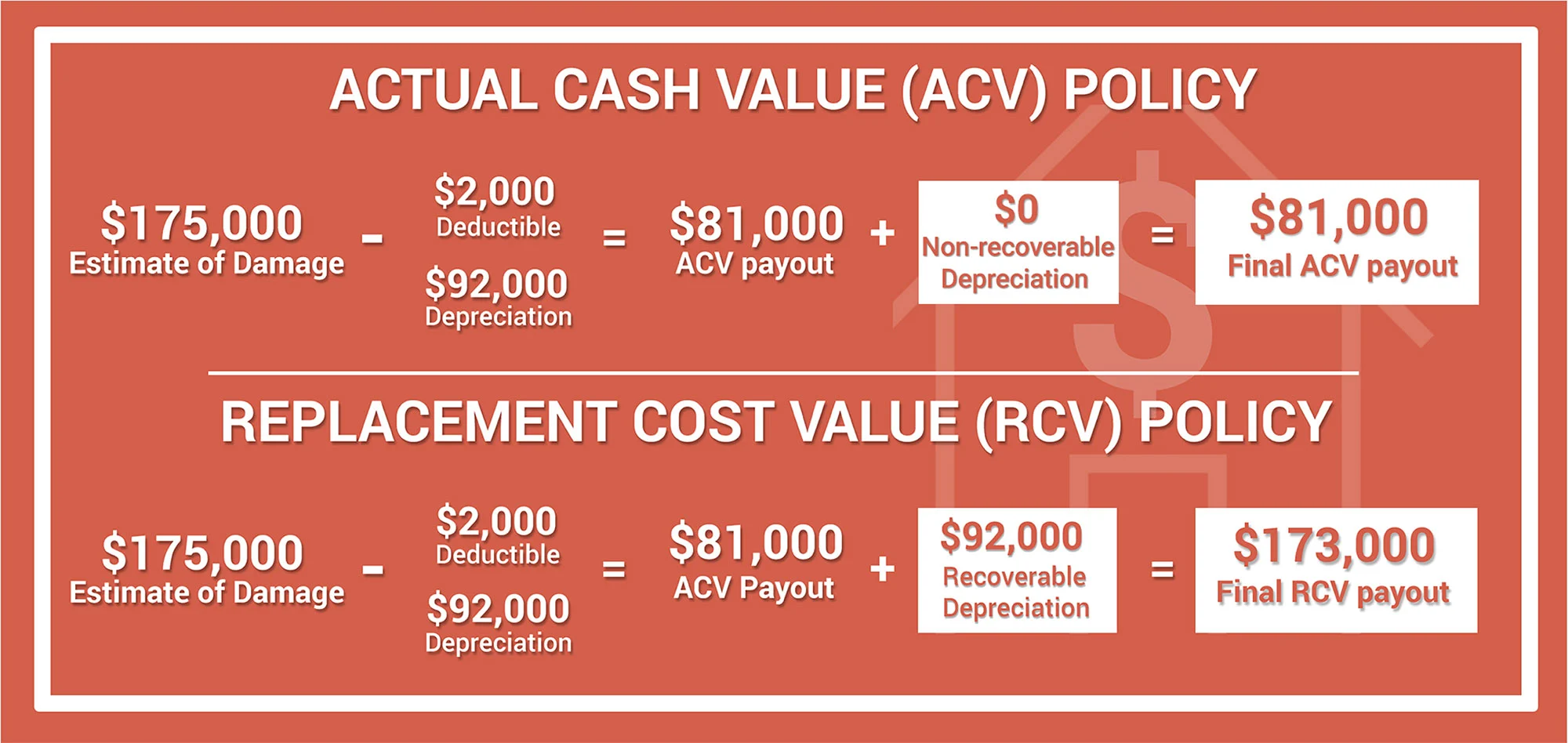

Property Value and Replacement Cost

The value of a property and the cost associated with rebuilding or repairing it play crucial roles in determining the insurance premium. Properties with higher values or those constructed with expensive building materials are likely to attract higher premiums due to the increased financial risk involved for the insurance provider. This is because the replacement cost of the property and materials directly influences the insurer’s potential liability in the event of a claim, impacting the overall premium amount charged to the policyholder.

Home Security Measures and Risk Prevention

Homes that are equipped with advanced security systems, including motion sensors, CCTV cameras, smart locks, and monitored alarm systems, along with smoke detectors and other risk prevention measures, are generally viewed as less risky by insurance providers. By proactively implementing these protective measures, homeowners can significantly reduce the likelihood of incidents and in turn, potentially qualify for reduced insurance premiums on their policies.

Making Informed Decisions

Choosing the right property insurance requires careful evaluation of coverage needs and comparison of insurance policies and quotes. Property owners should assess the specific risks they face and tailor their coverage accordingly. Seeking professional guidance from an insurance agent can help navigate the complexities of property insurance and ensure adequate protection.

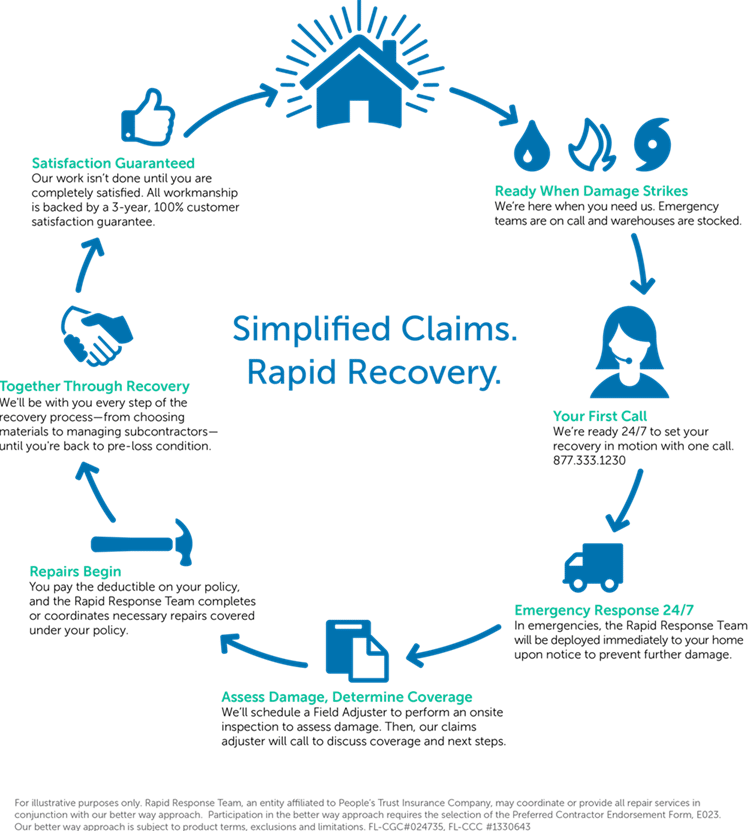

The Claims Process

Property Insurance for Renters

Renters insurance holds significant importance for tenants, safeguarding their personal belongings and extending liability coverage in case of unforeseen events. It is crucial for renters to carefully assess the value of their possessions, considering factors like electronics, furniture, and other items of value, to accurately determine the appropriate coverage amount that aligns with their needs and potential risks they may encounter. By customizing their renters insurance policy to suit their unique circumstances, tenants can ensure comprehensive protection and peace of mind.

Property Insurance for Condominium Owners

Condo owners should take the time to thoroughly comprehend the coverage offered by their condo association’s master policy. Additionally, they should contemplate obtaining additional condo insurance to safeguard their personal belongings and any interior improvements they have made. It is crucial for condo owners to meticulously review the condo association’s insurance policy to pinpoint any potential coverage gaps that may exist. By being proactive and diligent in this process, condo owners can ensure comprehensive protection for their investments and peace of mind in the long run.

Protecting Your Home Business

When operating a business from home, it’s important to note that standard property insurance might not offer comprehensive coverage for losses related to your business activities. Home-based entrepreneurs should delve into various additional coverage options available, like a business owner’s policy (BOP). This type of policy can provide a broader range of protection for business assets and liability, ensuring a more robust safeguard for your home-based business.

Renovations and Property Insurance

During home renovations, it is crucial to communicate with your insurance company to guarantee that you have the appropriate coverage in place. It’s important to notify them about any changes, as certain renovations could potentially raise the value of your property. This increased value might require adjustments to your current insurance policy to ensure that you are adequately protected. Taking the time to review and update your insurance coverage during renovations can help prevent any unforeseen issues and provide you with peace of mind regarding the protection of your home.

Property Insurance for Vacation Homes

Owning a vacation property entails specific insurance considerations to safeguard your investment adequately. Depending on the property’s usage, you may need seasonal insurance to address varying occupancy levels and risks associated with different times of the year. Additionally, rental property insurance could be crucial if you plan to lease out the property to guests, providing coverage for any potential liabilities that may arise during their stay. By understanding these nuances and tailoring your insurance coverage accordingly, you can protect your vacation property comprehensively.

1. https://viralblogspost.com/amica-life-insurance-company

2. https://viralblogspost.com/shop-for-car-insurance

3. https://viralblogspost.com/car-insurance-quotes-maryland

5. https://viralblogspost.com/mmoga-auto-insurance-quotes-florida

Insuring Rental Properties

For landlords and rental property owners, having the right insurance coverage is crucial to safeguard their investment and rental income. Landlord insurance offers protection not only for property damage but also for potential liability risks that may arise from renting out the property. By securing comprehensive landlord insurance, property owners can mitigate financial risks and ensure peace of mind knowing that their assets are well-protected. However, for those who are considering renting out their vacation property, there are some key differences to be aware of when it comes to insurance coverage.

Rental Property vs. Vacation Rental

While rental properties and vacation rentals may seem similar, they actually have distinct differences that affect insurance coverage. A rental property typically refers to a long-term lease agreement where tenants reside in the property for an extended period of time, usually a year or more. On the other hand, a vacation rental is often rented out on a short-term basis, ranging from a few days to several weeks.

The main difference between these two types of rentals is the frequency of occupancy and the type of guests staying in the property. With long-term rentals, tenants typically sign a lease agreement and are responsible for the upkeep and maintenance of the property. They also have a more permanent residency, making them less likely to cause damage to the property.

Vacation rentals, on the other hand, often have a high turnover rate with guests coming and going frequently. This can increase the risk of potential damages or accidents occurring on the property. Guests may also be unfamiliar with the layout and features of the rental, increasing their chances of causing unintentional damage.

Insurance Coverage for Rental Properties

For long-term rental properties, landlords typically purchase landlord insurance to protect their investment. This type of insurance provides coverage for both liability and physical damages to the property caused by tenants or natural disasters. It may also include loss of rental income in case tenants are unable to pay rent or the property is temporarily uninhabitable.

However, for vacation rentals, traditional landlord insurance may not provide adequate coverage. This is because vacation rentals are considered high-risk properties due to their transient nature and frequent turnover of guests. In addition, many insurance companies have specific exclusions for short-term rental properties.

To address this gap in coverage, there are now specialized insurance policies designed specifically for vacation rentals. These policies often include additional protections such as coverage for theft or damage caused by guests, liability protection in case a guest is injured on the property, and coverage for lost rental income due to unforeseen circumstances.

Ensuring Adequate Coverage

As a landlord or homeowner considering renting out your property as a vacation rental, it is important to carefully review your insurance coverage and make any necessary adjustments. This may include purchasing a specialized vacation rental insurance policy or adding endorsements to your existing homeowner’s or landlord insurance.

It is also crucial to communicate with your guests and ensure that they are aware of their own responsibilities for obtaining travel insurance. Encouraging them to purchase a separate policy can help protect both parties in case of unforeseen events.

In addition, it is important to maintain thorough documentation of your property and its contents, as well as keep records of all rental agreements and transactions. These documents can be crucial in the event of a claim or dispute.

Conclusion

Property insurance is a fundamental aspect of protecting one’s assets and achieving peace of mind. Whether it’s a home, condo, or rental property, insurance serves as a safety net against unexpected events. By understanding the different types of property insurance, key coverage areas, and factors affecting premiums, property owners can make informed decisions to safeguard their most valuable assets. Choosing the right insurance coverage ensures financial security and offers a sense of confidence in the face of uncertainties.

Leave a Reply