As life expectancy continues to increase, so does the need for long-term care. Long-term care insurance is a crucial tool that provides financial security and peace of mind for individuals and families facing the challenges of aging and potential health issues. In this comprehensive guide, we will explore the importance of long-term care insurance, its coverage, benefits, and factors to consider when making this significant investment.

Toc

What is Long-Term Care Insurance?

Long-term care insurance is a specialized form of insurance that covers the costs associated with long-term care services. Unlike traditional health insurance, long-term care insurance focuses on custodial care and assistance with daily living activities, which are not covered by regular health insurance plans.

The Cost of Long-Term Care insurance

Long-term care services, which encompass a range of options like nursing home care, assisted living facilities, in-home care services, and adult day care programs, tend to come with considerable costs. These expenses can accumulate rapidly, posing a substantial financial strain on individuals and their families who seek to ensure the well-being and comfort of their loved ones in need of such care. With the average cost of a private room in a nursing home reaching $100,000 or more per year, and the cost of in-home care services averaging around $50,000 annually, it is clear that long-term care expenses can quickly deplete one’s savings.

This is where long-term care insurance comes into play. By purchasing this form of coverage, individuals can protect themselves from having to shoulder the full burden of these high costs on their own. Long-term care insurance policies vary in terms of what they cover and how much they pay out per day or month depending on the specific plan chosen. However, most plans will typically cover expenses related to skilled nursing facility stays, home health care services, hospice care, and personal assistance with activities like bathing and dressing.

One of the major benefits of long-term care insurance is that it allows individuals to maintain their financial independence and avoid burdening their loved ones with these costly expenses. With this coverage in place, individuals can have peace of mind knowing that they will have financial assistance should they need it in the future. This is especially important since most people underestimate how much long-term care can cost and overestimate what Medicare will cover.

It’s also worth noting that there are different types of long-term care insurance policies available on the market. Traditional policies require individuals to pay premiums throughout their lifetime, while hybrid policies combine life insurance or annuity plans with long-term care coverage. There are also policies specifically designed for couples, which offer discounts and other benefits when both partners are covered.

1. https://viralblogspost.com/mmoga-progressive-insurance-customer-service-number

2. https://viralblogspost.com/mmoga-car-insurance-quotes-houston

4. https://viralblogspost.com/commercial-property-insurance-guild-to-protecting-your-investment

5. https://viralblogspost.com/the-3-car-insurance-companies-that-give-you-the-option-of-no-down-payment

But why should someone consider getting long-term care insurance in the first place? The answer is simple: it provides financial security. As individuals age, they may not be able to rely on their own income or savings for the high costs of long-term care. Long-term care insurance ensures that individuals can afford quality care without depleting their assets or burdening their loved ones with expensive expenses.

In addition, having long-term care insurance allows individuals to have options when it comes to where and how they receive care. They can choose from a variety of services such as home health aides, nursing homes, assisted living facilities, and adult day care centers. This flexibility can provide peace of mind for both the individual and their family members.

Coverage and Benefits of Long Term Care Insurance

Long-term care insurance covers a wide range of services, including assistance with activities of daily living (ADLs) such as bathing, dressing, eating, and mobility. It may also cover skilled nursing care, physical therapy, and other medical services required during long-term care. This coverage ensures that individuals receive the necessary support and care to maintain their quality of life as they age or face health challenges.

Who Needs Long-Term Care Insurance?

Long-term care insurance is particularly essential for individuals who want to protect their assets and avoid exhausting their savings on long-term care expenses. It is also beneficial for those who do not want to burden their family members with the responsibility of caregiving. By securing long-term care insurance, individuals can ensure that they have access to quality care without compromising their financial stability or placing undue strain on their loved ones.

The Ideal Time to Purchase Long-Term Care Insurance

Purchasing long-term care insurance at a younger age when you are healthier can lead to lower premiums and more comprehensive coverage. Delaying the purchase can result in limited coverage options and higher costs. Therefore, it is advisable to consider long-term care insurance early on as part of your financial planning to secure affordable coverage that meets your future care needs.

Factors Affecting Long-Term Care Insurance Premiums

Several factors influence the cost of long-term care insurance, including age, health status, coverage options, and the waiting or elimination period. Understanding these factors can help manage insurance premiums effectively and make informed decisions about the type of coverage that best suits your individual circumstances. By assessing these variables, individuals can tailor their long-term care insurance to align with their budget and care requirements.

Understanding Elimination Periods and Benefit Periods

Elimination periods in long-term care insurance refer to the waiting period before the policy starts paying benefits. Benefit periods determine the length of time the policy will pay for long-term care services. By understanding these periods, policyholders can plan for the timing of benefit payouts and ensure that their care needs are met according to the terms of their insurance coverage.

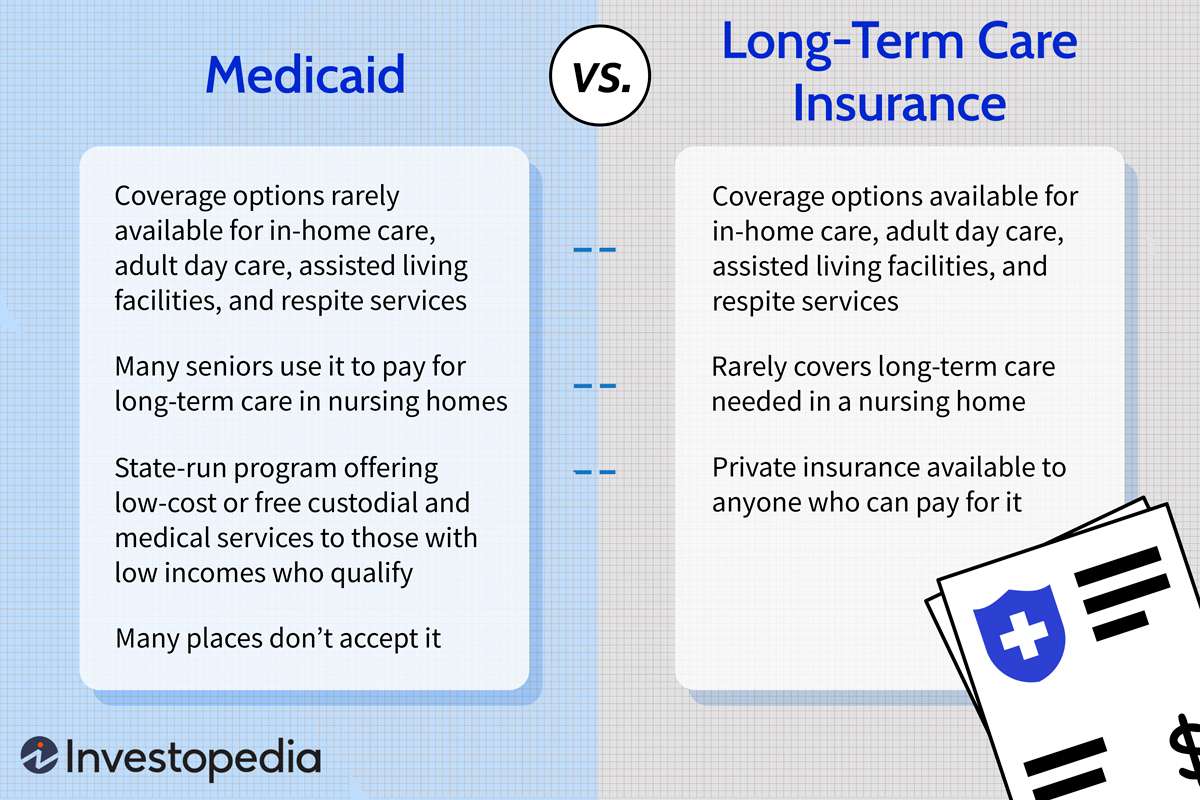

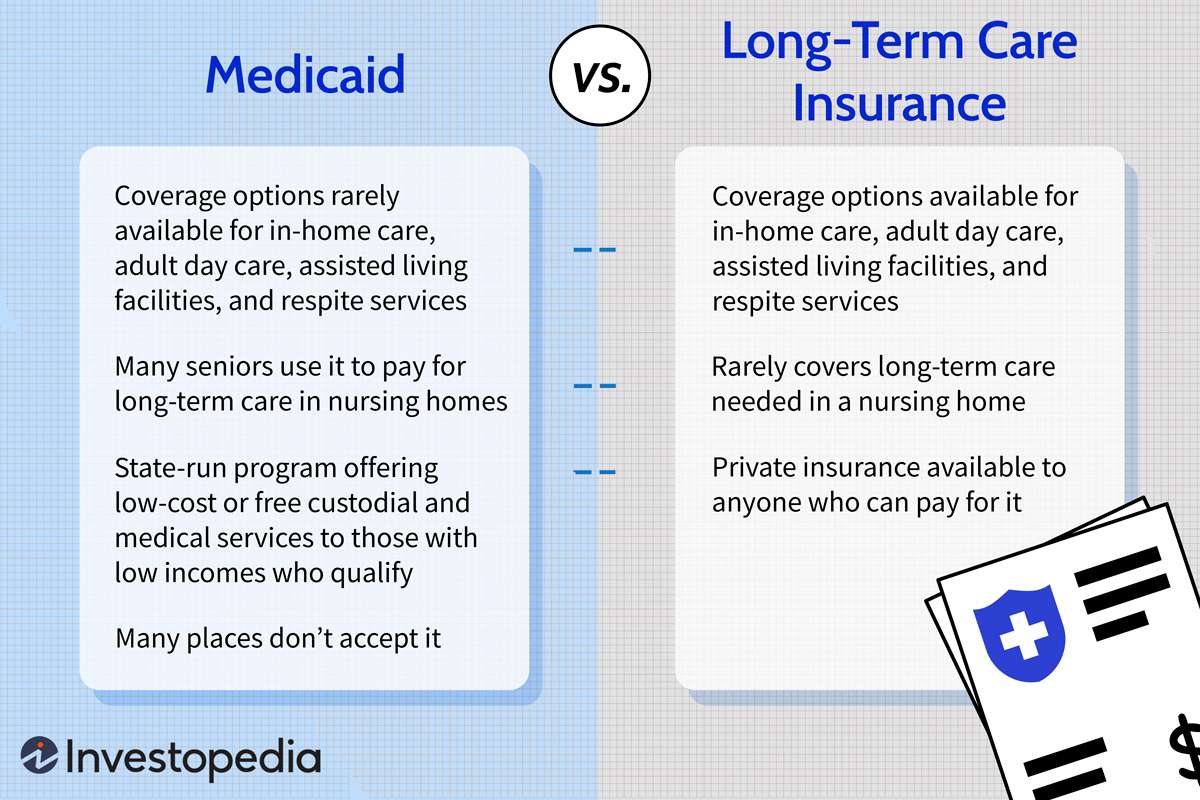

Long-Term Care Insurance and Medicaid

Long-term care insurance can complement Medicaid coverage, providing additional options and flexibility in long-term care services. Long-term care partnership programs also offer a way to protect assets while qualifying for Medicaid, offering individuals a comprehensive approach to managing their long-term care needs. By understanding the relationship between long-term care insurance and Medicaid, individuals can make informed decisions about their care funding options and asset protection strategies.

2. https://viralblogspost.com/mmoga-auto-insurance-quotes-texas

3. https://viralblogspost.com/workers-compensation-insurance-quote

4. https://viralblogspost.com/mmoga-seven-corners-travel-insurance

5. https://viralblogspost.com/small-business-insurance-online

Exclusions and Limitations in Long-Term Care Policies

As with any insurance policy, long-term care insurance may have exclusions and limitations. Understanding these limitations and reading the policy terms and conditions thoroughly is essential to ensure that individuals are aware of any restrictions on their coverage. By reviewing these details carefully, policyholders can clarify the scope of their insurance benefits and make informed choices about their long-term care planning.

Customizing Long-Term Care Coverage

Long-term care insurance policies can be customized to meet individual preferences and needs. Additional riders or options can be added to tailor coverage based on personal circumstances, allowing policyholders to enhance their protection and address specific care requirements. By customizing their long-term care coverage, individuals can create a comprehensive insurance plan that aligns with their unique care preferences and financial goals.

Filing a Long-Term Care Insurance Claim

Filing a long-term care insurance claim requires proper documentation and adherence to specific steps. Understanding the claims process can ensure a smooth and efficient resolution, enabling policyholders to access their benefits promptly when they need care services. By familiarizing themselves with the claim procedures, individuals can navigate the insurance process effectively and receive the support they require for their long-term care needs.

Long-Term Care Insurance for Couples

For couples, joint long-term care insurance policies are available, offering advantages in terms of cost and coverage. Couples can plan together to secure their financial future and well-being, ensuring that both partners have access to quality care and financial protection. By considering joint insurance options, couples can simplify their long-term care planning and enhance their overall coverage for potential care needs.

Planning for the Future with Long-Term Care Insurance

Long-term care insurance plays a crucial role in comprehensive financial planning. It offers peace of mind, knowing that you and your loved ones are protected from the financial strains of long-term care. By incorporating long-term care insurance into your financial strategy, you can create a secure foundation for your future care needs and safeguard your assets for a comfortable and worry-free retirement.

Conclusion

Securing your future with long-term care insurance is a prudent decision that offers financial security and peace of mind. As life expectancy continues to rise, the need for long-term care is becoming increasingly common. By investing in long-term care insurance, you can safeguard your assets, protect your family, and ensure that you receive the care you need in the later stages of life. Don’t wait to plan for the future; take proactive steps today to secure your financial well-being and enjoy the peace of mind that comes with comprehensive long-term care coverage.

FAQs

- When is the right time to purchase long-term care insurance? The ideal time to purchase long-term care insurance is when you are younger and healthier, as it leads to lower premiums and more comprehensive coverage.

- Who needs long-term care insurance? Long-term care insurance is essential for individuals who want to protect their assets and avoid the financial burden of long-term care expenses.

- What does long-term care insurance cover? Long-term care insurance covers a range of services, including assistance with activities of daily living (ADLs) and skilled nursing care.

- Can long-term care insurance be customized? Yes, long-term care insurance policies can be customized to suit individual preferences and needs by adding additional riders or options.

- What is the role of long-term care insurance in comprehensive financial planning? Long-term care insurance plays a crucial role in financial planning, providing peace of mind and ensuring that individuals and their families are financially protected during the later stages of life.