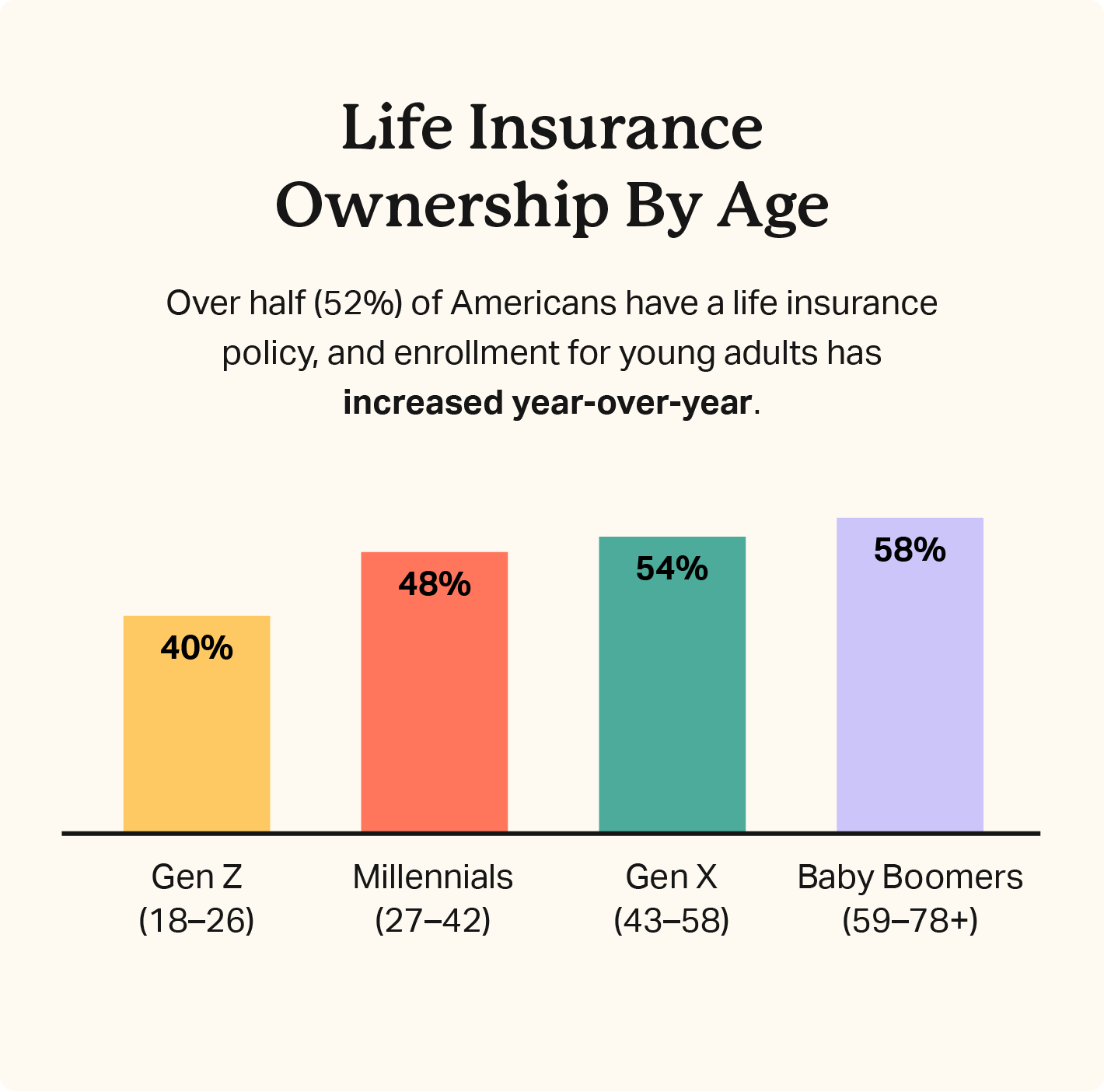

If you’ve recently married or welcomed a new addition to the family, it’s a good time to consider life insurance. Review your current coverage to ensure it meets your needs. Life insurance is a key aspect of financial security that requires attention. While it may seem complex or dull, it plays a vital role in safeguarding your loved ones’ future. Once someone depends on you financially, especially a child or spouse, having life insurance is crucial. Acting sooner rather than later is advisable, as coverage is more affordable for young and healthy individuals.

Toc

- 1. How to buy life insurance

- 2. What kind of life insurance to buy

- 3. Where to get online life insurance quotes

- 4. Related articles 01:

- 5. Information you need to get your quote

- 5.1. You’ll complete a brief form about you

- 5.2. Select how much insurance you need (and for how long)

- 5.3. You may be surprised to see a wide range of prices from different insurers

- 5.4. Learn your class: preferred, super-preferred, standard, or substandard

- 5.5. Compare quotes from over a dozen insurance carriers

- 6. How to apply for a life insurance policy

- 7. Related articles 02:

- 8. What to expect after you apply

- 9. Conclusion

How to buy life insurance

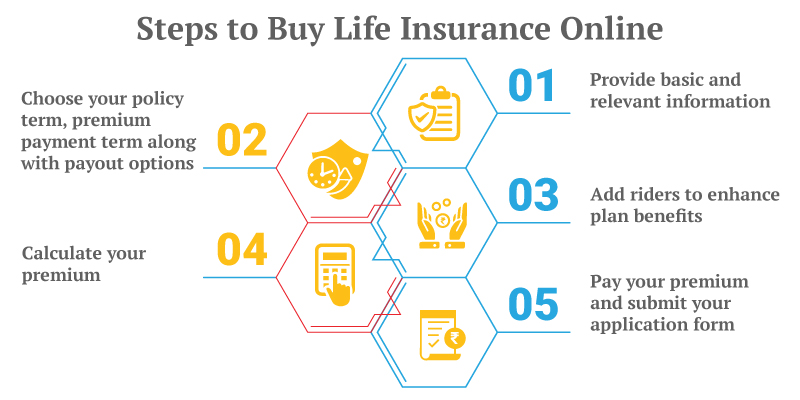

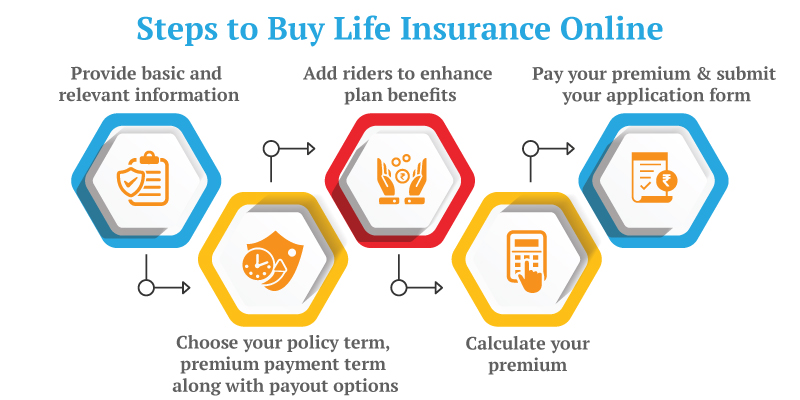

There are three fundamental approaches to purchasing life insurance. One option is to directly purchase it from an insurance company. Alternatively, you can opt for an independent local insurance agent or choose to go through an independent online broker.

It is crucial to emphasize the significance of obtaining life insurance through an independent broker, regardless of whether they are local or online. Agents who exclusively represent a single insurance carrier, like MetLife or John Hancock, may be focused on selling you a policy. While both companies are well-established and reputable insurers, navigating life insurance pricing can be exceptionally intricate. Failure to compare options could result in paying more than necessary.

When seeking guidance on life insurance, turning to an independent insurance agent whom you trust can be a good starting point. However, be prepared for the possibility of being presented with various life insurance options, which can be overwhelming. Personally, I found it helpful to determine my preference for level term insurance before delving into the shopping process.

Once you have identified the type of life insurance that suits your needs, comparing policies becomes somewhat simpler, albeit with several variables to consider. This is where the internet proves to be a valuable resource, as we will explore shortly.

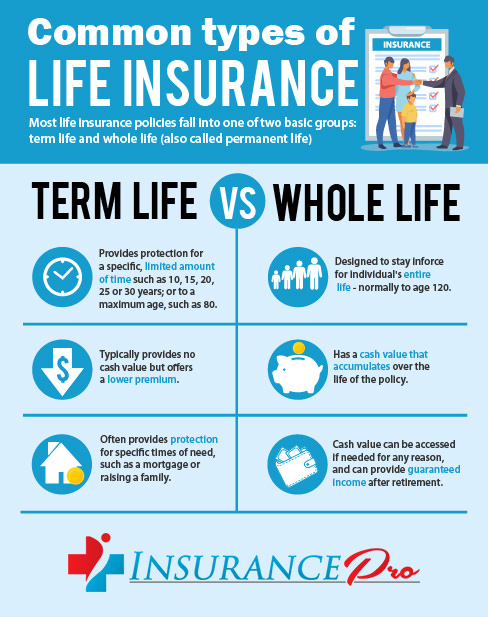

What kind of life insurance to buy

Term life insurance is the way to go! It’s not only cheaper, but for 99% of folks, it’s the smartest financial move when getting life insurance. Forget about whole life or universal life – stick with term life! It’s as simple as your car or home insurance. Pay your premium, stay covered. If the unexpected happens during the term, you’re protected. And the best part? It’s budget-friendly! Picture this: a healthy 20-something scoring a $1 million 20-year term policy for just $500 a year. Even a $250,000 policy could be as low as $15 a month!

Factors to consider when buy life insurance

When it comes to life insurance, there are several factors to consider. One of the most important decisions is what type of life insurance policy to purchase. With so many options available, it can be overwhelming to know which one is the right choice for you. Thankfully, the internet offers a wealth of information that can help you make an informed decision.

Among all the different types of life insurance, term life insurance stands out as a popular and practical choice for the majority of people. This type of policy provides coverage for a specified period or “term”, typically 10-30 years. It’s known for its affordability and simplicity – much like your car or home insurance.

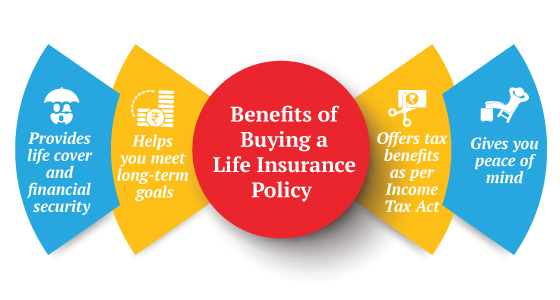

Why should buy life insurance

So why should you choose term life insurance over other options like whole life or universal life insurance? One of the main reasons is cost. Term life insurance policies have lower premiums compared to permanent life insurance policies, making it a more budget-friendly option. This is especially beneficial for young families or individuals who are just starting out in their careers and may not have a lot of extra income to spare.

Another advantage of term life insurance is its flexibility. Unlike permanent policies, term life insurance allows you to choose the length of coverage that best fits your needs, whether it’s 10 years, 20 years, or even up to 30 years. This gives you the freedom to tailor your policy according to your specific financial goals and obligations.

Additionally, term life insurance provides peace of mind knowing that your loved ones will be financially protected in case of your untimely death. It can help cover expenses such as mortgage payments, college tuition for your children, and other daily living costs that your family may struggle with without your income.

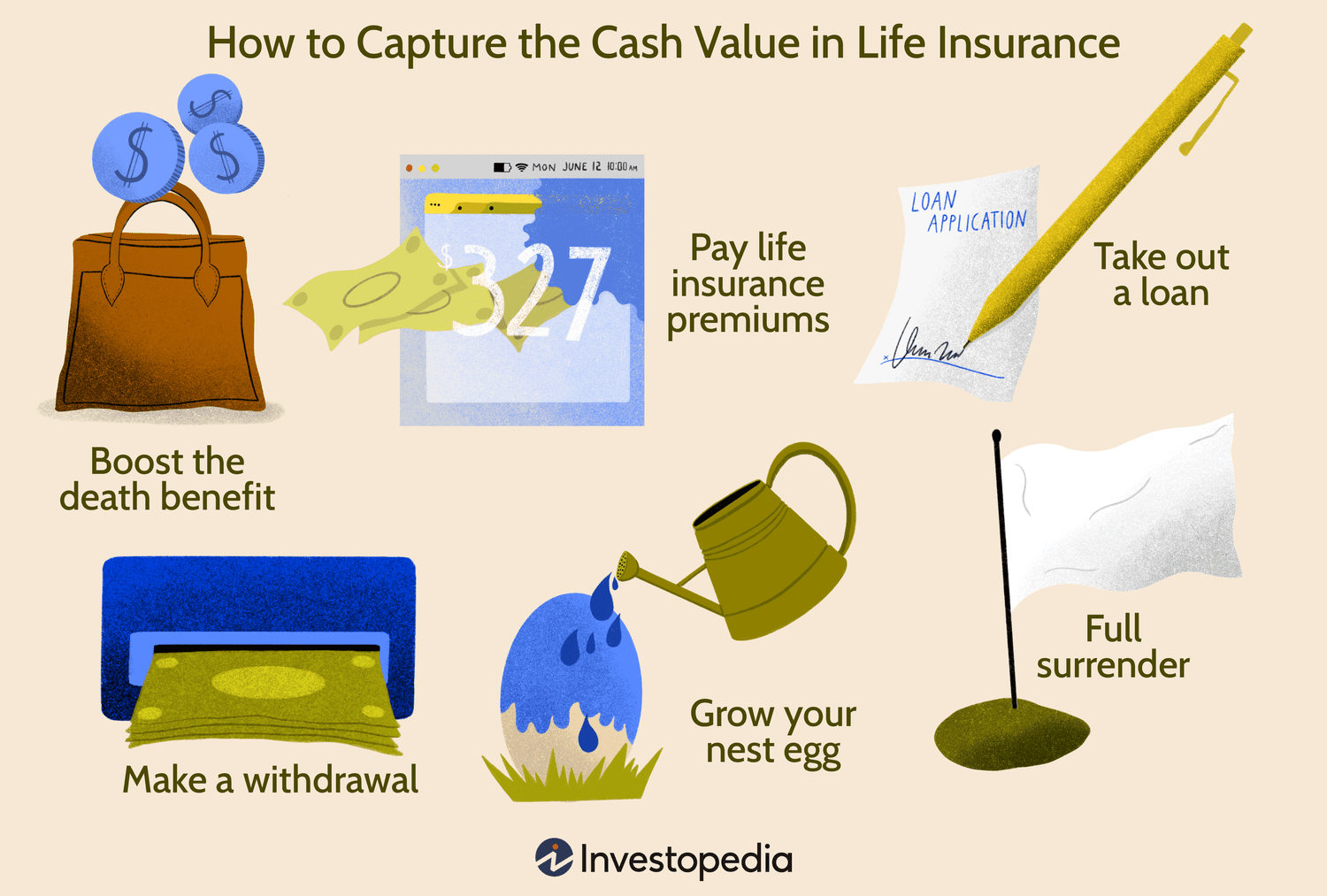

However, it’s important to note that term life insurance does not have any cash value accumulation like permanent policies do. This means that once the term expires, you will not receive any money back from the premiums you paid. But for many individuals, this trade-off is worth it in order to have affordable and flexible coverage during their working years.

It’s also important to regularly review and update your term life insurance policy as your circumstances change. For example, if you get married or have children, you may want to increase your coverage amount to provide more financial support for your loved ones in the event of your passing.

Additionally, some term life insurance policies offer the option to convert to a permanent policy at the end of the term. This can be beneficial if you decide that you want to continue having life insurance coverage after the initial term expires.

Overall, term life insurance is a valuable tool for providing financial protection for your family in case of your untimely death. It’s affordable and customizable, making it accessible for individuals at any stage of life. Consider exploring this type of coverage to ensure that your loved ones are taken care of no matter what happens.

Where to get online life insurance quotes

1. https://viralblogspost.com/mmoga-auto-insurance-quotes-florida

2. https://viralblogspost.com/cheap-insurance-for-business

We recommend Policygenius because they provide more accurate quotes, let you complete more of your application online, and won’t harass you with telemarketing calls.

As insurance industry veterans, Policygenius designed their site to address the most inefficient and inconvenient aspects of buying life insurance.

Policygenius provides a thorough, yet easy, online form that returns term life insurance quotes. The price quotes you got online from most sites, in seconds, are rough estimates at best. According to Policygenius, however, 92% of their estimates are within $10 of a user’s actual yearly payment!

Better yet, Policygenius will only call you if you want to be called. Life insurance salespeople have a reputation for being aggressive with a capital A. As a result, after you request a quote from some other websites, they will call you multiple times a day for weeks.

I know because I tried it! Trust me, Policygenius provides a more pleasant experience; you can read more about Policygenius in our full review.

Information you need to get your quote

You won’t need any specific documents to get a life insurance quote, but you should be familiar with your medical history and the results of your most recent physical exam.

Here are the rough steps involved in comparison shopping for life insurance:

You’ll complete a brief form about you

Gender, age, weight, and whether you smoke are all questions you should be prepared to answer. Smoking is the biggest factor in pricing life insurance. Prepare to pay double if you smoke.

Most sites will require an email address and phone number before spitting back some quotes. But, again, not Policygenius.

If you want to compare life insurance quotes, the broker will ask a lot of personal medical questions, which is unfortunately necessary to provide accurate estimates. Be honest, as much of this information will be verified with your medical record or during a medical exam when you apply for insurance.

Select how much insurance you need (and for how long)

You need life insurance to replace your income in the event of your death, in order to provide for your family. It’s common to buy enough life insurance to replace your after-tax income until your children turn 18, plus an additional amount to cover education expenses or debts.

Common terms are 10, 20, and 30 years. If you’re not sure, use our easy life insurance calculator to find out how much life insurance you should buy.

You may be surprised to see a wide range of prices from different insurers

But without a more detailed application, most of these numbers are just guesses. Insurance companies employ actuaries who do nothing but crunch numbers to determine how to price insurance. The more information you provide upfront, the more accurate your quotes will be.

Learn your class: preferred, super-preferred, standard, or substandard

The insurance industry uses these broad groups to classify customers by risk. For example, if you are perfectly healthy, have a low body mass index (BMI), and do not have other risk factors (like smoking, dangerous activities, or a lousy driving record), you may meet the super-preferred class. By contrast, somebody who is overweight and has high blood pressure may only classify for the standard class and will pay more for the same insurance.

Although life insurance classes can provide broad guidelines of what you can expect to pay, every insurer works differently. For example, let’s say you have a hobby that insurance companies consider high risk – like flying a plane or rock climbing. Some insurance companies may place you in a lower class and charge you more for these “high-risk” activities. Another insurance company may insure you in a higher class, but place exclusions on your policy meaning you won’t receive a benefit if you die as a result of those activities.