The High Cost of Car Insurance for Young Drivers

Toc

- 1. The High Cost of Car Insurance for Young Drivers

- 2. Finding Cheap Car Insurance in Utah

- 3. Tips for Young Drivers to Save on Car Insurance

- 4. Related articles 01:

- 5. Cheapest Car Insurance Companies for Young Drivers in Utah

- 6. Understanding Utah Car Insurance Requirements

- 7. Related articles 02:

- 8. FAQ

- 9. Conclusion

Let’s face it—insurance premiums for young drivers can be sky-high. Why is that? Well, there are a few reasons behind this financial headache.

Lack of Driving Experience

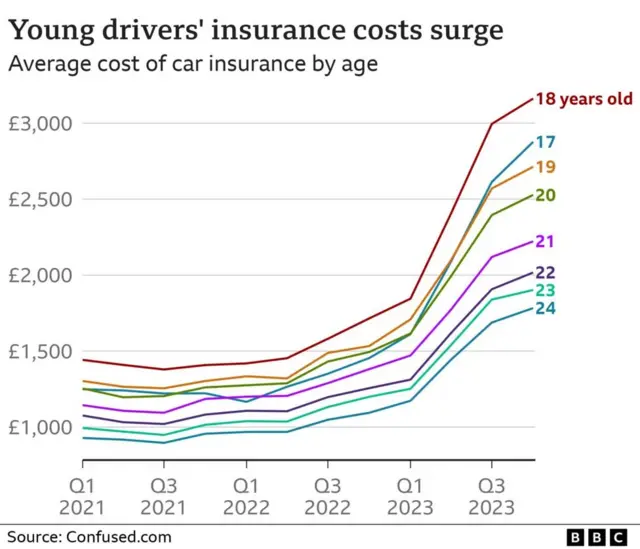

First off, there’s the issue of experience. Young drivers, especially those under 25, tend to have less behind-the-wheel time. Statistically, this means they’re more likely to get into accidents. In fact, research shows that drivers in this age group are involved in more than double the number of fatal crashes per mile driven compared to their older peers. This isn’t just a statistic; it’s a reality that insurance companies take very seriously. When you’re young and inexperienced, you’re seen as a higher risk, and that translates into higher premiums.

Higher Risk Perception

But it’s not just about statistics. Insurance companies use sophisticated algorithms to assess risk, and young drivers often fall into the “high-risk” category. Factors like lack of a clean driving record, age, and even geographical location come into play. For instance, if you’ve had a fender bender or two, that’s going to raise your rates. It can feel frustrating, but understanding this can help you take steps to improve your situation. The good news is that as you gain experience and maintain a clean driving record, your rates will likely decrease over time.

Finding Cheap Car Insurance in Utah

So, how do you find cheap car insurance in Utah? It’s all about being proactive and knowing your options.

Compare Quotes from Multiple Companies

One of the best ways to uncover affordable car insurance is to shop around. Seriously, don’t just settle for the first quote you get. Use online comparison tools or call local agents to gather quotes from different providers. You might be surprised at how much rates can vary! For example, you could save hundreds of dollars just by switching insurers. Check out reputable companies like Geico, Nationwide, and Auto-Owners Insurance, and see what they offer.

When you’re comparing quotes, make sure you’re looking at the same coverage levels. It can be tempting to just glance at the price, but if one policy offers significantly less coverage than another, you might end up with more financial risk in the event of an accident. Take your time to read the fine print and understand what each policy includes.

Explore Discounts and Bundling Options

Next up, don’t forget about discounts. Many insurance companies provide special deals specifically for young drivers. You could score savings for good grades, completing defensive driving courses, or even bundling your car insurance with other policies like renters or homeowners insurance. For example, maintaining a B average in school might qualify you for a good student discount, which can significantly cut down your premiums.

Additionally, consider bundling your insurance policies. If you already have renters or homeowners insurance, ask your provider if they offer discounts for combining policies. This can lead to substantial savings and simplify your insurance management. Many companies will give you a discount of 10-20% for bundling, which can add up quickly.

Consider Minimum Liability Coverage

While it’s tempting to go for the cheapest option available, you need to think about the implications of choosing minimum liability coverage. Utah requires drivers to carry a basic level of liability insurance, which covers damages to others in an accident. However, this minimal coverage might not protect you adequately in a serious accident, leading to hefty out-of-pocket expenses. Take a moment to weigh the cost savings against the potential risks. Sometimes, investing a little more in coverage can save you a lot of trouble down the road.

For instance, if you’re involved in a serious accident and your liability coverage is insufficient, you could be held personally responsible for the damages. This could lead to financial ruin, especially if there are injuries involved. It’s crucial to evaluate your financial situation and consider how much coverage you truly need based on your lifestyle and driving habits.

Tips for Young Drivers to Save on Car Insurance

1. https://viralblogspost.com/why-life-insurance-rates-are-the-lowest-theyve-been-in-20-years

You can take proactive steps to lower your insurance costs while ensuring you stay protected on the road.

Maintain a Clean Driving Record

First and foremost, keep your driving record squeaky clean. Safe driving not only reduces the likelihood of accidents but also helps you avoid traffic violations that can hike your rates. A single speeding ticket or accident could dramatically increase your premiums, so make it a priority to follow traffic laws and drive responsibly. Plus, many insurers offer accident forgiveness programs for drivers with clean records, so you won’t see a rate increase after a minor mishap.

Consider using a smartphone app that tracks your driving habits. Many insurance companies offer programs where you can receive feedback on your driving style and potentially earn discounts based on safe driving behaviors. This can serve as an incentive to stay cautious on the road.

Consider a Less Expensive Vehicle

The type of vehicle you drive can also impact your insurance rates. Generally, older and less expensive cars tend to have lower premiums compared to flashy new models. If you’re in the market for a car, think about choosing one that balances affordability with safety features. Vehicles equipped with advanced safety technologies often qualify for discounts as well. For example, sedans typically cost less to insure than sports cars or luxury vehicles.

When selecting a car, do your research on which models are considered safer and more affordable to insure. Websites like the Insurance Institute for Highway Safety (IIHS) provide ratings that can help you make an informed decision. A car with good safety ratings may not only protect you better in an accident but could also save you money on your insurance premiums.

Take a Defensive Driving Course

Lastly, consider enrolling in a defensive driving course. Not only will this enhance your driving skills, but it can also lead to discounts on your insurance premiums. Insurance providers recognize the value of drivers who are educated in safe driving practices, making these courses a worthy investment. Plus, you’ll feel more confident behind the wheel, which is always a bonus.

Many defensive driving courses can be completed online at your own pace, making them convenient to fit into your schedule. After completing a course, be sure to notify your insurance company, as they may require proof of completion to apply any potential discounts.

Cheapest Car Insurance Companies for Young Drivers in Utah

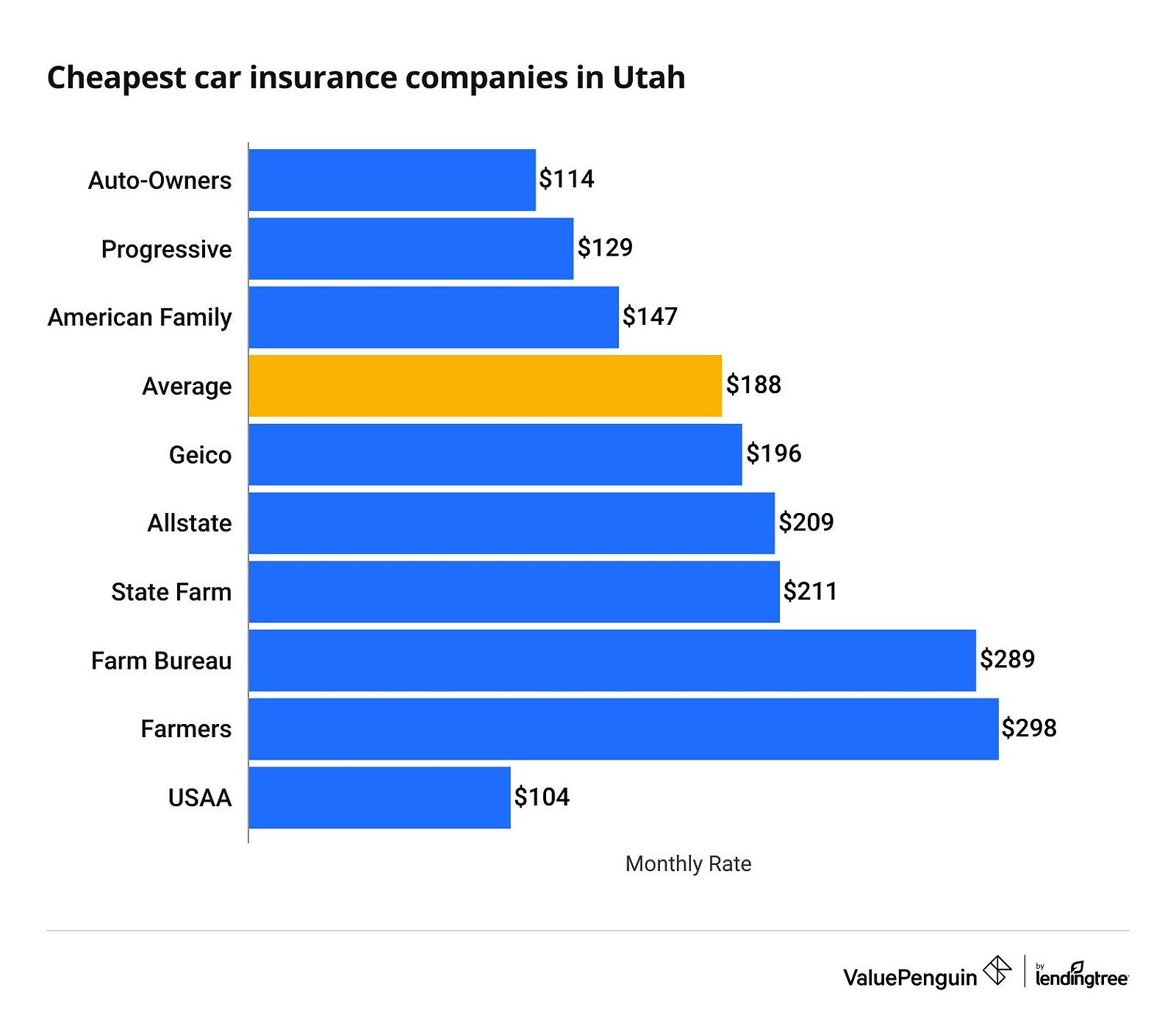

When searching for cheap auto insurance in Utah, some providers stand out for their competitive rates and favorable terms for young drivers.

Nationwide Insurance

Nationwide is known for offering reasonable rates for young drivers. They provide specific discounts tailored to this demographic, including incentives for safe driving and bundling options that can further lower your premiums. Plus, their customer service reputation is solid, making it a reliable choice for newcomers navigating the insurance landscape. Nationwide often emphasizes its commitment to customer satisfaction, which is crucial when you’re unsure about your coverage needs.

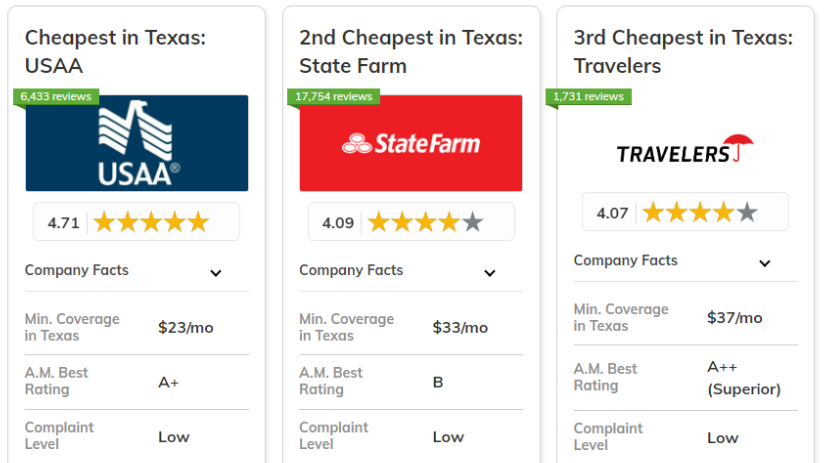

Geico

Geico often ranks among the most affordable options for young drivers. With a wide range of coverage options and numerous discounts available, it’s a popular choice for budget-conscious individuals. Their user-friendly online platform allows young drivers to manage their policies easily and access resources to help them understand their coverage. Geico’s advertising may be catchy, but their customer service and claims process are equally important, especially when you need assistance.

USAA

If you or a family member has served in the military, USAA is a fantastic option. They provide some of the most competitive rates in the market for eligible young drivers. Their policies offer excellent coverage at a fraction of the cost compared to other insurers, and their commitment to customer service is highly regarded. However, keep in mind that USAA is only available to military members and their families, so check eligibility before pursuing this option.

Auto-Owners Insurance

Auto-Owners Insurance is another contender that provides competitive rates for young drivers. Their focus on personalized service and customer satisfaction makes them a trustworthy choice for anyone navigating the complexities of auto insurance. Young drivers can benefit from straightforward policies and various coverage options tailored to their individual needs. Auto-Owners often receives high marks for its claims service, which is an essential factor to consider when choosing an insurer.

Understanding Utah Car Insurance Requirements

Before hitting the road, it’s crucial to know the minimum insurance requirements in Utah to ensure compliance and adequate protection.

1. https://viralblogspost.com/commercial-property-insurance-guild-to-protecting-your-investment

3. https://viralblogspost.com/car-insurance-quotes-va

4. https://viralblogspost.com/mmoga-progressive-insurance-customer-service-number

5. https://viralblogspost.com/how-to-buy-life-insurance-the-easy-way

Liability Coverage

In Utah, drivers must carry liability insurance with minimum limits of $25,000 per person for bodily injury and $65,000 per accident. Additionally, there’s a $15,000 limit for property damage. This coverage is designed to protect against damages caused to others in an accident, ensuring drivers can meet their financial responsibilities. Familiarizing yourself with these requirements can help you avoid fines and legal issues.

Personal Injury Protection (PIP)

Utah also mandates personal injury protection (PIP) coverage, which helps cover medical expenses and lost wages for the insured, regardless of fault. The minimum required PIP coverage in Utah is $3,000 per person. This coverage is especially important in a no-fault state like Utah, where it ensures drivers receive necessary medical care without the immediate need to determine fault after an accident. Having PIP can provide peace of mind, knowing that you’ll be covered for medical expenses in case of an accident.

Uninsured/Underinsured Motorist Coverage (UM/UIM)

Another essential component of Utah’s insurance requirements is uninsured and underinsured motorist coverage. This protects drivers in situations where they’re involved in an accident with someone who lacks sufficient insurance. While this coverage can be waived, it’s generally advisable to maintain it for added protection. Given that some drivers may not carry adequate insurance, having UM/UIM coverage can provide peace of mind and financial security. It’s a safety net that can protect you from the unexpected, ensuring that you’re not left to cover costs out of pocket due to another driver’s negligence.

FAQ

Q: What is the best way to find cheap car insurance in Utah?

A: The best way is to compare quotes from multiple insurance companies, explore available discounts, and consider your coverage options carefully. Don’t rush—take the time to do thorough research.

Q: What are some tips for young drivers to save money on car insurance?

A: Maintain a clean driving record, choose a less expensive vehicle, and consider taking a defensive driving course to qualify for discounts. Every little bit helps!

Q: What are the minimum car insurance requirements in Utah?

A: You must have liability coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage (UM/UIM). Familiarizing yourself with these requirements is essential for compliance.

Conclusion

Finding cheap auto insurance in Utah isn’t just a financial necessity for young drivers; it’s a critical step toward ensuring safe driving experiences. By understanding the factors that influence insurance rates and exploring various strategies, you can secure affordable coverage tailored to your needs.

Maintaining a clean driving record, shopping around for quotes, and taking advantage of available discounts are all effective ways to reduce your insurance costs while meeting state requirements. With the right approach, navigating the complexities of auto insurance can lead to finding the best car insurance in Utah that fits your budget and lifestyle. So, gear up, hit the road responsibly, and watch those rates drop as you gain more experience behind the wheel! Remember, being informed and proactive is your best bet for saving money on insurance while staying protected on the road.

Leave a Reply