As a young driver in Pennsylvania, the excitement of hitting the road for the first time can quickly turn into a headache when it comes to finding affordable car insurance. Did you know that young drivers often face premiums that are significantly higher than those of their more experienced counterparts? Navigating the world of car insurance quotes in PA can feel overwhelming, but this guide will equip you with the knowledge you need to find the best car insurance quotes PA, understand the factors that influence your rates, and explore various coverage options that suit your lifestyle.

Toc

Understanding Car Insurance Quotes in PA

Minimum Coverage Requirements

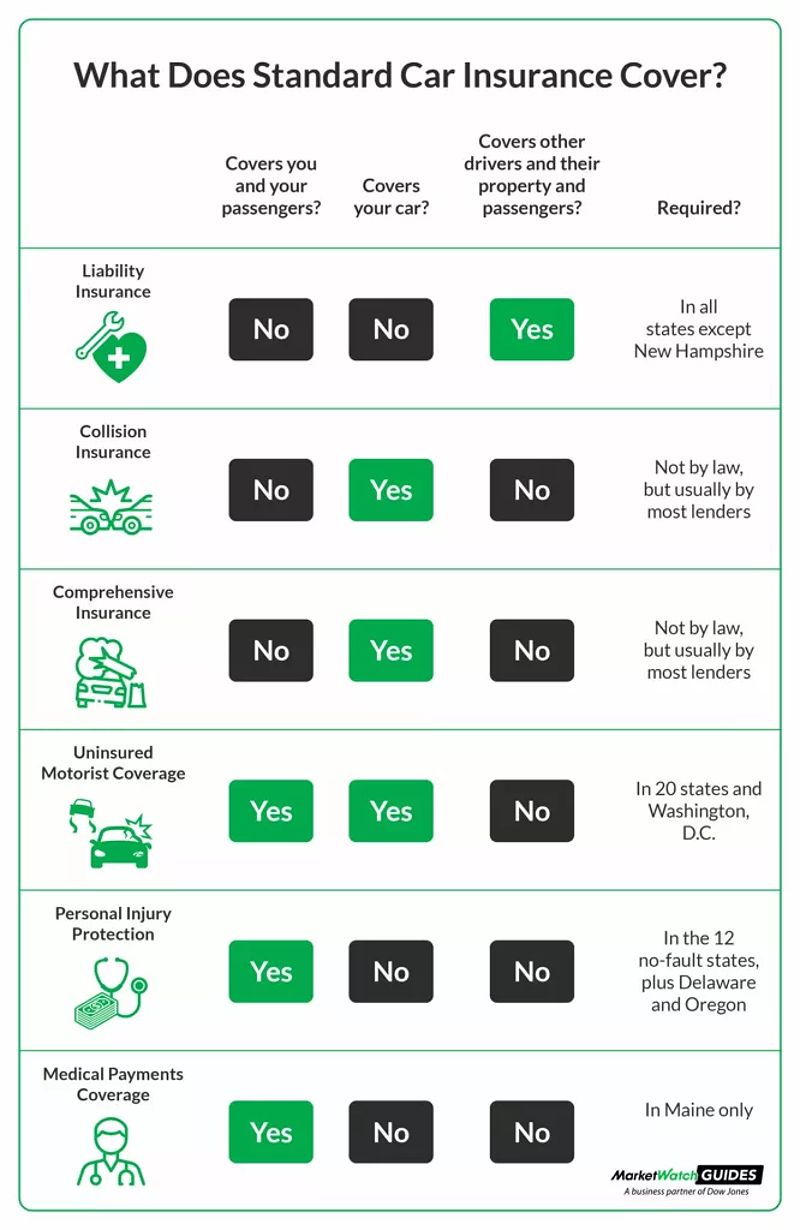

Let’s start by breaking down the essential minimum coverage requirements in Pennsylvania. All drivers are legally obligated to carry certain types of insurance to protect themselves and others on the road. In PA, the minimum requirements include bodily injury liability, property damage liability, and medical benefits coverage. Specifically, you must have at least $15,000 in bodily injury liability per person, $30,000 per accident, and $5,000 for property damage liability. Additionally, a minimum of $5,000 is required for medical benefits.

While opting for the bare minimum might seem appealing for your wallet, it’s crucial to consider the risks involved. Minimum coverage may leave you exposed to significant financial strain if you are involved in a serious accident. For instance, if you cause an accident that results in substantial injuries to others, your minimum coverage might not be enough to cover all medical expenses and damages, potentially leaving you responsible for paying the balance out of pocket.

Thus, young drivers, who statistically have a higher likelihood of accidents, should weigh their options carefully. It’s worth asking yourself whether higher coverage limits would provide you with better protection, especially in a state where the unexpected can happen on the road.

Full Coverage Insurance

Now, let’s talk about full coverage insurance. This option is particularly beneficial for young drivers who want a more robust safety net. Full coverage typically encompasses both collision and comprehensive coverage. Collision coverage pays for repairs or replacement of your vehicle in the event of an accident, regardless of fault. On the other hand, comprehensive coverage protects against damages that occur from non-collision events, such as theft, vandalism, or natural disasters.

Although full coverage insurance comes with higher premiums, the peace of mind it provides can be invaluable. Imagine the relief of knowing that you’re protected against costly repairs or the total loss of your vehicle. Moreover, if you’re financing your car, many lenders require full coverage insurance to safeguard their investment. If you’re in the market for a vehicle, understanding the implications of full coverage is essential.

Factors Affecting Car Insurance Quotes for Young Drivers

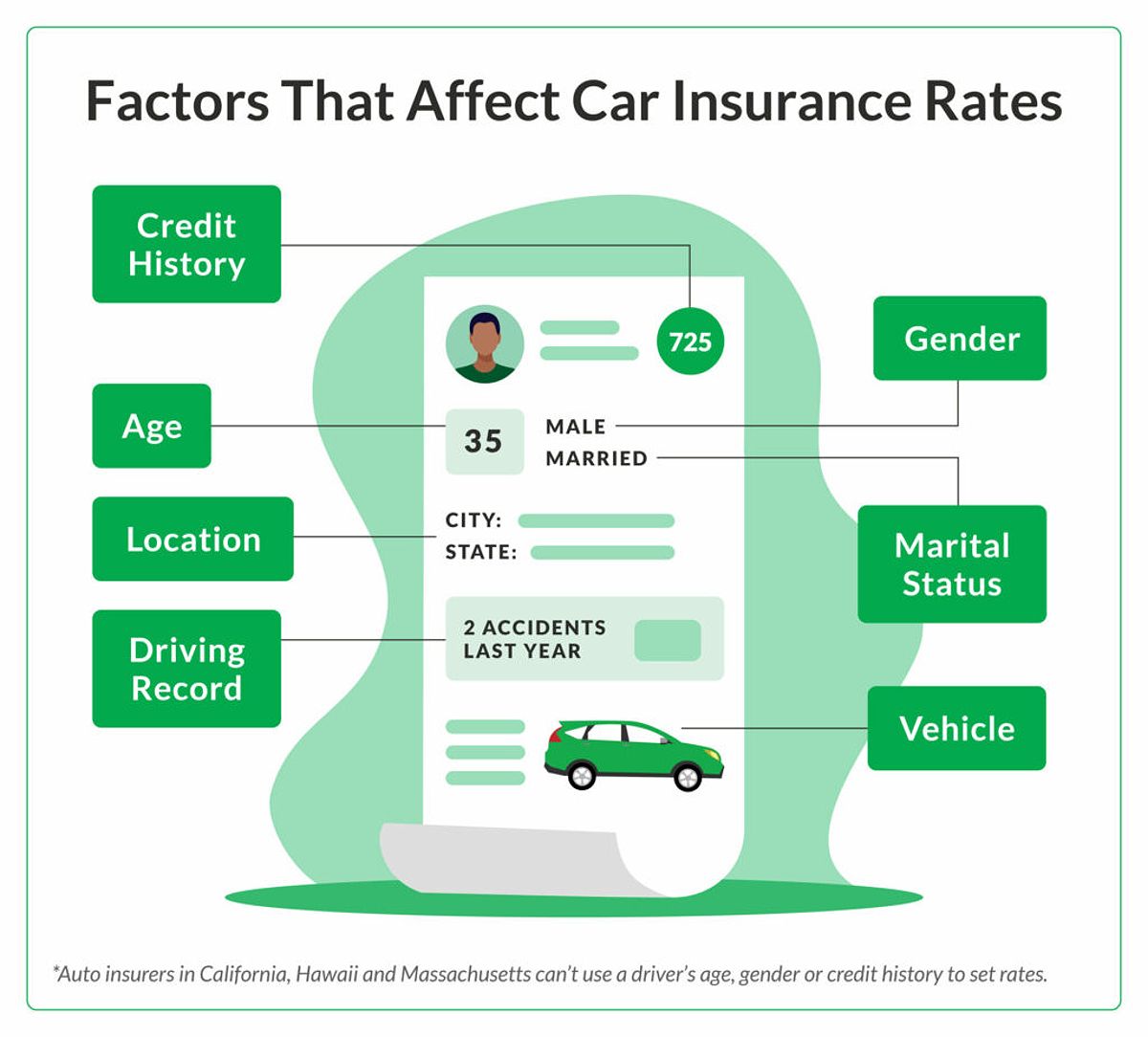

When it comes to car insurance quotes in PA, several factors play a critical role in determining your premium. Insurance companies evaluate risk based on various criteria, including your age, driving history, credit score, and the type of vehicle you drive. Young drivers, particularly those under 25, often face higher premiums due to their increased likelihood of being involved in accidents.

Maintaining a clean driving record is paramount for securing lower rates. A history free from accidents and traffic violations can significantly impact your premium. Additionally, your credit score is another key factor; drivers with better credit scores generally receive more favorable quotes. Insurance companies often perceive individuals with poor credit as higher risk, leading to increased premiums.

Lastly, the make and model of your vehicle can also influence your insurance costs. Cars with high safety ratings and low theft rates typically attract lower premiums, while sports cars or vehicles with high repair costs may lead to higher insurance rates. Therefore, selecting a car with solid safety features and a reputation for reliability can help keep your insurance costs in check.

Finding the Best Car Insurance Quotes in PA for Young Drivers

Compare Quotes from Multiple Companies

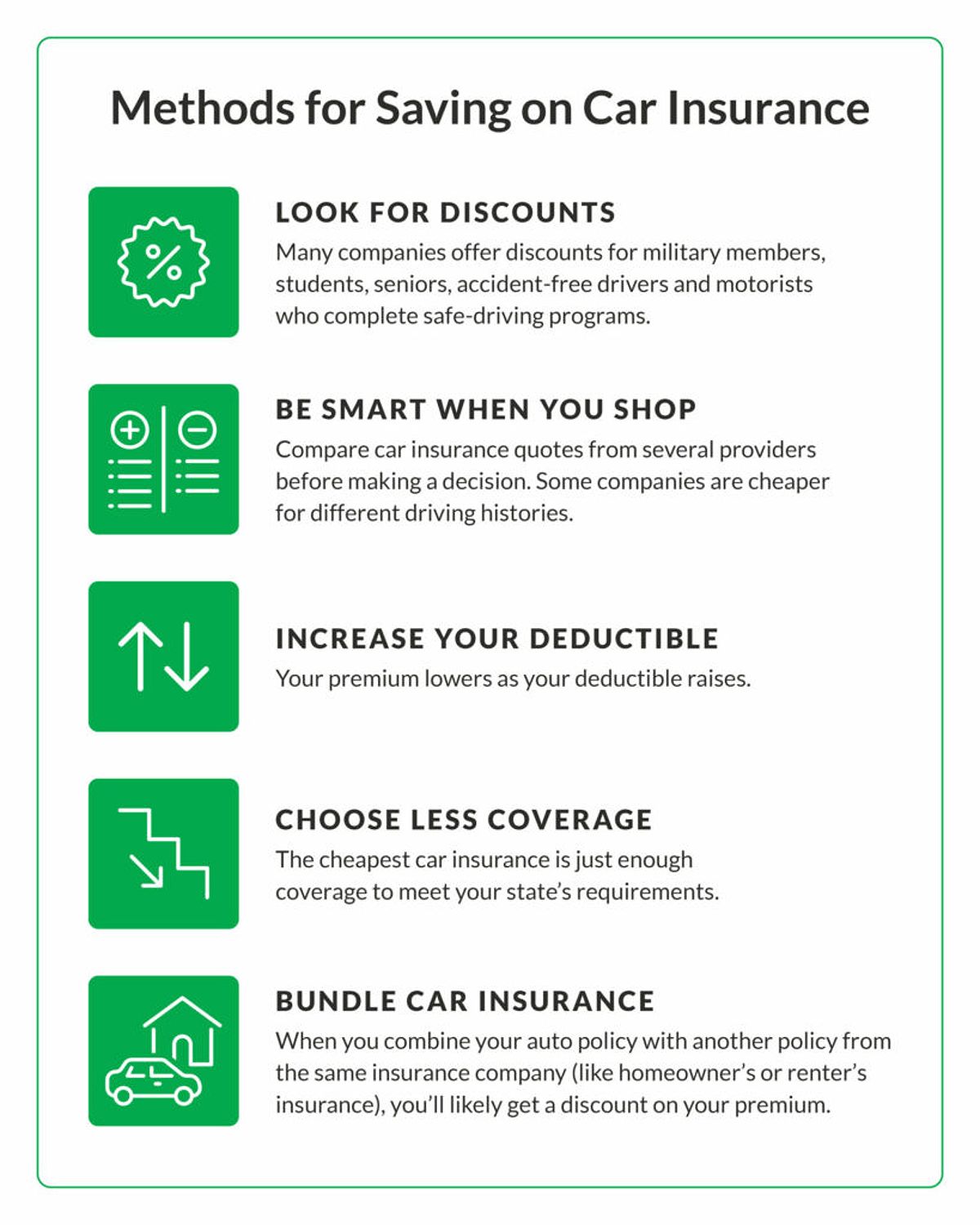

One of the most effective strategies for finding the best car insurance quotes in Pennsylvania is to compare rates from multiple insurance providers. Many young drivers make the common mistake of accepting the first quote they receive without exploring their options. By using online comparison tools or reaching out to insurance agents, you can gather quotes for the same coverage levels, ensuring a fair comparison.

1. https://viralblogspost.com/general-liability-insurance-online

3. https://viralblogspost.com/mmoga-car-insurance-quotes-houston

4. https://viralblogspost.com/why-life-insurance-rates-are-the-lowest-theyve-been-in-20-years

For example, let’s take Sarah, a recent college graduate who was shocked by the initial quote she received. By taking the time to compare quotes from three different insurance companies, she saved $200 per year. This simple step can lead to significant savings, making it a crucial part of your insurance shopping journey. Remember to review the coverage options and limits provided by each insurer; the cheapest quote might not always offer the best protection.

Consider Discounts and Bundling Options

Another way to save on your car insurance is by taking advantage of discounts and bundling options. Many insurance companies offer a variety of discounts that can help lower your premium. Young drivers should inquire about potential discounts for good students, safe driving records, and bundling multiple insurance policies. For instance, bundling your car insurance with homeowners or renters insurance can lead to average savings of around 10% on your premiums.

Understanding available discounts and actively seeking them out can significantly reduce your overall insurance costs. When obtaining quotes, be sure to ask about any applicable discounts. Some insurers offer reductions for completing a driver’s education course or maintaining a GPA above a certain threshold.

Additionally, consider exploring usage-based insurance programs offered by some insurers. These programs track your driving habits, and if you demonstrate safe driving, you may qualify for additional discounts on your premium. If you’re a responsible driver, this could be a beneficial way to lower your costs.

Tips for Getting Lower Car Insurance Rates

As a young driver, there are several proactive steps you can take to lower your car insurance rates. First and foremost, maintaining a clean driving record is essential. Avoiding speeding tickets and other violations can help you qualify for lower premiums. Additionally, completing a defensive driving course not only enhances your skills but also demonstrates your commitment to safe driving, which many insurers reward with discounts.

If you’re considering purchasing a new vehicle, opting for a model with high safety ratings and a lower market value can also lead to reduced insurance costs. Insurance companies often factor in the likelihood of a vehicle being involved in an accident or stolen when determining rates. Researching vehicles with favorable safety ratings and lower theft statistics can be beneficial.

Another useful tip is to regularly review your policy. As your circumstances change—whether you move to a new location, change jobs, or even improve your credit score—your insurance needs may also shift. Periodically reassessing your coverage and shopping around for new quotes can ensure you aren’t overpaying for your insurance.

Top Car Insurance Companies in PA for Young Drivers

Erie Insurance

When it comes to finding affordable car insurance quotes in PA, Erie Insurance is a strong contender. Known for its competitive rates, particularly for young drivers seeking minimum coverage, Erie has built a reputation for excellent customer service. They also offer a variety of discounts tailored to younger policyholders, making it an attractive option for those looking to save money.

In addition to their competitive rates, Erie Insurance is recognized for its straightforward claims process. Young drivers can feel confident knowing they will receive prompt assistance in the event of an accident. The availability of local agents adds a personal touch to the insurance experience, allowing for better communication and support.

The Hartford

Another excellent option for young drivers is The Hartford. This company stands out for its competitive rates and strong customer service reputation. Young drivers can benefit from some of the lowest full coverage rates available, making it an appealing choice for those looking to protect their vehicles comprehensively.

The Hartford is also known for offering a variety of coverage options and add-ons, allowing young drivers to tailor their policies to meet specific needs. This flexibility can be particularly advantageous for new drivers as they gain experience on the road.

USAA

For military families, USAA consistently ranks among the top car insurance providers in Pennsylvania. Known for its exceptional customer service and competitive rates, USAA is an excellent choice for eligible young drivers. However, it’s important to note that membership is limited to active and former military personnel and their families.

1. https://viralblogspost.com/car-insurance-quotes-va

2. https://viralblogspost.com/securing-your-future-with-long-term-care-insurance

3. https://viralblogspost.com/auto-insurance-quotes-arizona

4. https://viralblogspost.com/the-3-car-insurance-companies-that-give-you-the-option-of-no-down-payment

5. https://viralblogspost.com/8-best-homeowners-insurance-companies-of-2023

USAA is often praised for its commitment to serving military families, offering unique benefits such as rental car reimbursement and coverage for personal property while on deployment. Young drivers who qualify for USAA can enjoy peace of mind knowing they are supported by a company that understands their specific needs.

Frequently Asked Questions

How much does car insurance cost for young drivers in PA?

The cost of car insurance for young drivers in Pennsylvania varies widely based on factors such as age, driving record, and vehicle type. Generally, young drivers can expect to pay higher premiums than older, more experienced drivers.

What are the best car insurance discounts for young drivers in PA?

Many insurance companies offer discounts for good students, safe driving records, and those who bundle car insurance with other policies. It’s important to inquire about these discounts when obtaining quotes.

What should I do if I get a speeding ticket or have an accident?

If you receive a traffic violation or are involved in an accident, it’s crucial to report it to your insurance company promptly. While your rates may increase, being honest and transparent is essential for maintaining a good relationship with your insurer.

How can I lower my car insurance rates as a young driver?

To lower your car insurance rates, maintain a clean driving record, take a defensive driving course, and compare quotes from multiple insurance companies. Additionally, consider bundling your insurance policies and asking about available discounts.

Conclusion

Finding affordable car insurance quotes in Pennsylvania as a young driver can indeed be a challenge, but it’s a necessary step in protecting yourself and your finances. By understanding the minimum coverage requirements, exploring full coverage options, and considering the factors that impact rates, you can make informed decisions about your insurance needs.

Comparing quotes, leveraging discounts, and adopting safe driving habits are effective strategies for securing the best rates. Ultimately, your goal should be to find car insurance quotes in Pennsylvania that provide the necessary protection while fitting within your budget. Start your journey today by comparing car insurance quotes and take control of your financial future on the road!

Leave a Reply