Did you know that the average Ohio driver could save hundreds of dollars on their car insurance by simply comparing quotes? Navigating the world of car insurance can be daunting, especially in Ohio, where numerous providers and coverage options exist. This comprehensive guide will help you understand the local requirements, compare options, and find ways to lower your premiums, ensuring you get the best car insurance quotes Ohio has to offer while staying within your budget.

Toc

Understanding Ohio Car Insurance Requirements

Minimum Coverage Requirements

When it comes to car insurance in Ohio, understanding the minimum coverage requirements is crucial. Ohio law mandates that drivers carry liability insurance, typically expressed in the format of 25/50/25. This means that your policy must provide at least $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage.

But what does this really mean? Bodily injury liability covers medical expenses for others if you’re at fault in an accident, while property damage liability helps pay for repairs to another person’s vehicle or property. Many drivers, however, find that these minimum limits can be inadequate. For instance, if you cause an accident that results in $30,000 worth of damages, your insurance would only cover $25,000, leaving you responsible for the remaining $5,000. This reality often drives drivers to seek higher coverage limits to safeguard their finances.

Additional Coverage Options

Beyond the mandated minimum liability coverage, Ohio drivers can explore various additional coverage options that can enhance their financial protection. Collision coverage is one such option, which pays for damage to your vehicle resulting from a collision, regardless of who is at fault. Comprehensive coverage, on the other hand, protects against non-collision incidents, such as theft, vandalism, or natural disasters.

Furthermore, uninsured/underinsured motorist coverage is essential, especially in a state where many drivers may lack adequate insurance. This coverage protects you in the event of an accident with a driver who either has no insurance or insufficient coverage to pay for your damages.

It’s worth noting that while the average cost of minimum coverage in Ohio might hover around $511 annually, full coverage can average approximately $1,660 per year. This significant price difference underscores the financial implications of your coverage choices.

How to Find the Cheapest Car Insurance Quotes in Ohio

Shop Around and Compare Quotes

One of the most effective strategies for securing the best car insurance quotes in Ohio is simply to shop around. Obtaining quotes from multiple insurance providers allows you to compare coverage options and premiums effectively. Online quote tools make this process easy, and you can also reach out to local agents directly.

Don’t settle for the first quote that comes your way; aim to gather at least three different quotes. This approach not only gives you a clearer picture of the market but also helps you identify the best deal for your unique needs. Many drivers find that by taking the time to compare auto insurance quotes in Ohio, they can save hundreds of dollars annually.

Take Advantage of Discounts

Another excellent way to lower your car insurance premiums is by capitalizing on available discounts. Insurance companies often provide various discounts to attract and retain customers. Here are some common discounts you might encounter:

- Multi-policy discounts for bundling home and auto insurance.

- Good student discounts for young drivers maintaining a certain GPA.

- Safe driver discounts for those with clean driving records.

- Defensive driving discounts for completing approved driving courses.

- Vehicle safety feature discounts for cars equipped with advanced safety technologies.

When seeking quotes, be sure to ask about the specific discounts each provider offers. Many drivers overlook potential savings simply because they fail to inquire. For example, if you have a young driver in the family who maintains good grades, this could significantly reduce your overall premium. Additionally, vehicles with safety features like anti-lock brakes or airbags may also qualify for discounts.

2. https://viralblogspost.com/selective-insurance-agent-login

3. https://viralblogspost.com/amica-life-insurance-company

4. https://viralblogspost.com/the-3-car-insurance-companies-that-give-you-the-option-of-no-down-payment

5. https://viralblogspost.com/the-basics-of-insurance-understanding-the-different-types

Consider Usage-Based Insurance (UBI) Programs

Usage-based insurance (UBI) programs have emerged as a cost-effective option for safe drivers. These programs monitor your driving habits, including speed, braking, and mileage, to determine your premium. If your driving behavior demonstrates safety and responsibility, you may qualify for substantial discounts.

However, it’s essential to weigh the pros and cons of UBI programs. While they can lead to lower premiums for responsible drivers, those with less favorable driving habits might see their costs increase. Before enrolling, consider your driving patterns and whether this type of coverage aligns with your needs. Some drivers have reported savings of up to 30% on their premiums by participating in UBI programs, making them a viable option for many.

Tips for Lowering Your Car Insurance Premiums

Maintain a Clean Driving Record

One of the most significant factors influencing your car insurance premium is your driving record. Insurance companies typically penalize drivers with accidents or traffic violations by increasing their rates. For instance, a single speeding ticket could lead to a premium increase of 20% or more.

To keep your premiums low, prioritize safe driving practices. Avoid distractions, obey speed limits, and adhere to traffic laws. The longer you maintain a clean driving record, the better your chances of receiving lower rates. Many insurance providers also offer accident forgiveness programs, which can prevent your first accident from affecting your premium, but these benefits often require a history of safe driving.

Increase Your Deductible

Another effective strategy for reducing your car insurance costs is to increase your deductible. A higher deductible means you’ll pay more out of pocket in the event of a claim, but it also lowers your premium. This approach can be particularly beneficial if you have a financial cushion to cover potential expenses.

Before increasing your deductible, evaluate your financial situation to ensure you can comfortably afford the higher amount if you need to file a claim. If you’re confident in your ability to manage this risk, raising your deductible could lead to significant savings. For example, increasing your deductible from $500 to $1,000 could reduce your premium by 10% to 20%, depending on your insurer.

Bundle Your Policies

Bundling your car insurance with other types of coverage, such as homeowners or renters insurance, can also yield savings. Many insurance companies offer discounts for customers who consolidate multiple policies. This not only simplifies your insurance management but can also lower your overall premiums.

Contact your current insurer to inquire about bundling options and potential savings. If you have existing policies with different companies, consider comparing the bundled rates against standalone policies to determine the best financial move. For instance, if your home insurance costs $800 annually and your auto insurance costs $1,200, bundling them might result in a combined rate of $1,900 instead of $2,000, providing a $100 discount.

Understanding Car Insurance Quotes in Ohio

Factors Influencing Your Premiums

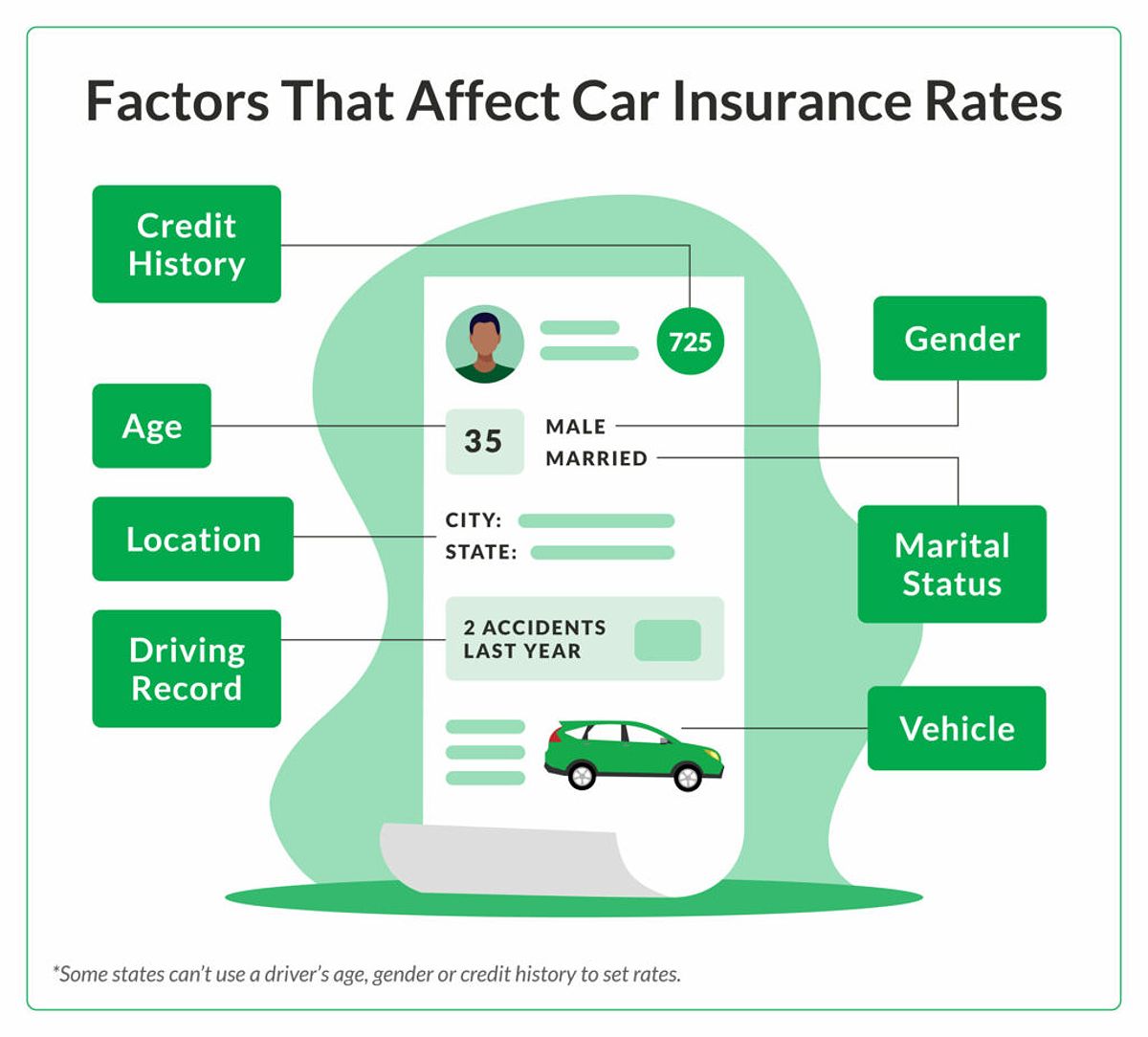

When you request car insurance quotes in Ohio, several factors will influence your premiums. These include:

- Your age and gender: Younger drivers and males typically face higher rates due to statistical risk factors.

- Your driving history: A clean record can significantly reduce your premiums, while accidents or violations can increase them.

- Your credit score: In Ohio, insurers may use your credit score as a factor in determining your rates, with better scores leading to lower premiums.

- The type of vehicle you drive: Cars with higher safety ratings or lower theft rates often cost less to insure.

Understanding these factors can help you make informed decisions when shopping for car insurance quotes in Ohio. For example, if you’re considering purchasing a new vehicle, researching its insurance costs beforehand can help you choose a more budget-friendly option.

The Importance of Comparing Quotes

When searching for the best car insurance quotes in Ohio, comparing options is essential. Each insurance company has its criteria for determining premiums, meaning rates can vary widely even for the same coverage. For instance, one insurer might quote you $1,200 annually for full coverage, while another might offer the same coverage for $1,000.

By comparing quotes, you can identify the best value for your specific needs. Utilize online tools that allow you to input your information once and receive multiple quotes from different insurers. This approach saves time and provides a clearer picture of the market.

1. https://viralblogspost.com/cheap-workers-comp-insurance

2. https://viralblogspost.com/why-life-insurance-rates-are-the-lowest-theyve-been-in-20-years

4. https://viralblogspost.com/mmoga-progressive-insurance-customer-service-number

5. https://viralblogspost.com/mmoga-seven-corners-travel-insurance

FAQ

How often should I shop for car insurance quotes?

It’s advisable to shop for new car insurance quotes at least once a year or whenever significant life changes occur, such as moving or changes in your driving record.

What are common mistakes when obtaining car insurance quotes?

Common mistakes include failing to compare quotes from multiple companies, overlooking available discounts, and not fully understanding the coverage options.

Can I obtain car insurance quotes online?

Yes, many insurance providers offer online tools for obtaining quotes, allowing you to compare options conveniently.

What additional coverage options should I consider?

In addition to minimum liability coverage, consider collision, comprehensive, and uninsured/underinsured motorist coverage to ensure you’re adequately protected.

Conclusion

Finding the best car insurance quotes in Ohio can save you hundreds of dollars each year. By understanding Ohio’s insurance requirements, shopping around for quotes, taking advantage of discounts, and following these tips, you can secure the best deal on car insurance that fits your budget.

Get started today by requesting free car insurance quotes from multiple companies in Ohio. You could be surprised at how much you can save!

Leave a Reply