I used to struggle with finding reliable and timely stock futures data, sifting through different websites and ending up with outdated information or confusing charts. Then I discovered Yahoo Finance, and it changed the game for me. This platform provides a user-friendly way to access real-time data, comprehensive charting tools, and market news that helps me make informed trading decisions. In this article, I’ll guide you through how to leverage Yahoo Finance stock futures and futures stocks to enhance your trading strategies and make well-informed decisions.

Toc

Understanding Yahoo Finance Stock Futures and Its Importance

Let’s start by breaking down what stock futures are. Stock futures are contracts that bind the buyer to purchase, or the seller to sell, an asset at a predetermined price on a specified future date. This mechanism serves two primary purposes: hedging against potential losses and speculative trading. By engaging with stock futures, traders can capitalize on anticipated price movements without needing to own the underlying assets.

What Are Stock Futures?

Futures contracts are agreements to buy or sell an asset at a future date for a price that is agreed upon today. This financial instrument is widely used in various markets, including commodities and equities. When it comes to trading stock futures, the allure lies in the leverage they offer. Traders can control a larger position with a smaller amount of capital, which can lead to higher potential returns. However, this also increases risk, making it essential for traders to understand the nuances of the contracts they are trading.

Why Trade Stock Futures?

Trading stock futures comes with several advantages. The potential for high returns through leverage is enticing, especially in volatile markets. Additionally, futures contracts offer flexibility, allowing traders to profit whether the market is rising or falling. They also serve as a useful tool for hedging against losses in other investments, thereby providing a layer of protection in uncertain times.

Yahoo Finance’s Role

This is where Yahoo Finance steps in as a vital resource. It provides real-time data on a wide array of stock futures and futures stocks, comprehensive charting tools, and essential market news. These features are invaluable for traders who seek to make informed decisions. While Yahoo Finance stock futures may have some limitations—such as occasional data delays during high-volume trading periods—the benefits of using this platform often outweigh the downsides.

Accessing stock futures data on Yahoo Finance is quite straightforward. The platform is designed to cater to both novice and experienced traders, allowing easy navigation through its features.

Finding Stock Futures Quotes

To locate specific futures contracts, start by utilizing the search bar at the top of the Yahoo Finance homepage. Input the stock or futures symbol you’re interested in, and the platform will guide you to relevant data. This feature streamlines the process, helping you stay informed about significant market movements.

Understanding the Data

Once you’ve found the futures contract you’re interested in, Yahoo Finance provides crucial data points that can inform your trading decisions. Key metrics include the current price, volume, open interest, and specific contract specifications. For instance, open interest can give you insights into market sentiment, while volume indicates the level of trading activity and liquidity. Understanding these metrics is vital for making informed decisions.

Using Charting Tools

Yahoo Finance’s charting tools are particularly useful for analyzing price movements over time. Traders can customize charts to reflect various time frames and technical indicators. This flexibility allows you to identify trends and patterns that can guide your trading decisions. For instance, a trader might notice a bullish trend emerging from a chart and decide to enter a long position based on that analysis.

1. https://viralblogspost.com/mmoga-roofing-companies-that-finance

2. https://viralblogspost.com/mmoga-best-small-business-financing

4. https://viralblogspost.com/online-degree-in-finance

5. https://viralblogspost.com/mmoga-online-masters-in-finance

Integrating with Other Tools

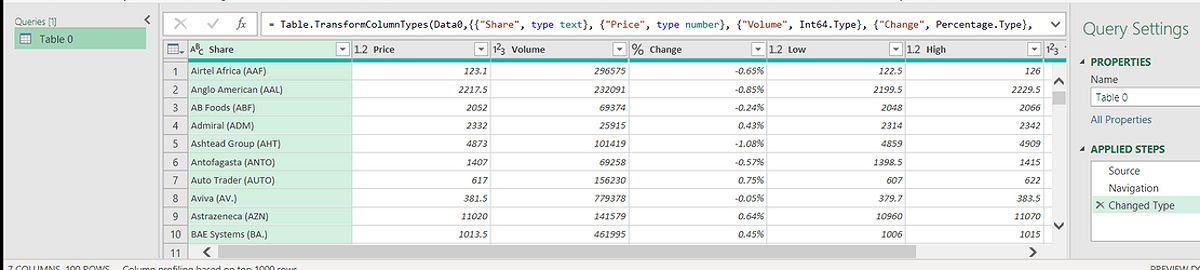

Furthermore, Yahoo Finance allows you to export data to other platforms or spreadsheets for deeper analysis. For example, you might export data to Excel to create custom dashboards tailored to your trading strategy. This integration can enhance your analytical capabilities and streamline your trading process.

Utilizing Yahoo Finance Data for Informed Trading

Accessing data is only the first step; the real challenge lies in effectively analyzing and interpreting that information to make informed trading decisions. Here are several strategies that traders can employ using Yahoo Finance’s stock futures and futures stocks data.

Technical Analysis

One popular approach is technical analysis, where traders study price charts and apply various indicators to identify potential trading signals. Tools like moving averages, the Relative Strength Index (RSI), and Fibonacci retracements can provide valuable insights. For instance, if you observe a bullish crossover on a moving average, it could signal a good time to enter a long position.

Fundamental Analysis

In addition to technical analysis, fundamental analysis plays a crucial role in trading decisions. This method involves evaluating the financial health of the underlying stocks and broader market conditions. By analyzing Yahoo Finance’s financial news and data, you can assess the performance and future prospects of the stocks behind your futures contracts. This insight can guide your decisions based on market trends and economic indicators.

Market Sentiment

Understanding market sentiment is another critical aspect of trading. Traders can gauge sentiment by monitoring news events, earnings reports, and other market developments. Yahoo Finance provides timely updates on these topics, allowing you to react quickly to shifts in sentiment and adjust your trading strategies accordingly.

Risk Management

Effective risk management is essential in trading. Yahoo Finance’s data can assist you in setting stop-loss orders and managing position sizes effectively. By analyzing market volatility and price movements, you can make informed decisions about how much capital to risk on each trade. Establishing clear risk management rules can help protect your capital and minimize potential losses.

Case Studies and Real-World Examples

Consider the case of a trader who uses Yahoo Finance to analyze a stock futures contract. They notice a significant increase in volume alongside a bullish chart pattern. By leveraging this information, the trader decides to enter a long position, anticipating a price increase. After a few days, the price rises, allowing the trader to exit with a profit. This example illustrates how utilizing Yahoo Finance stock futures and futures stocks data can lead to successful trading outcomes.

Alternatives to Yahoo Finance for Stock Futures Data

While Yahoo Finance is a robust option, it’s essential to recognize that it is not the only platform available for traders seeking stock futures data.

Paid Platforms

For those willing to invest in their trading tools, paid platforms such as Interactive Brokers, TradingView, and Bloomberg Terminal offer advanced features and real-time data tailored to professional traders. These platforms typically include sophisticated charting capabilities, in-depth analysis tools, and access to exclusive market insights. However, the costs associated with these services can be a barrier for casual traders.

Free Alternatives

If you prefer free alternatives, platforms like Finviz, StockCharts, and Google Finance can provide useful data. While they may not offer the same level of detail or real-time updates as Yahoo Finance, they can still serve as valuable resources for traders. It’s important to evaluate your specific needs when choosing a data source.

API Access

For the tech-savvy, utilizing APIs to access stock futures data directly from exchanges or data providers can be a game-changer. This approach allows for greater customization and integration with proprietary trading systems, although it may require a higher level of technical expertise.

1. https://viralblogspost.com/the-ultimate-guide-to-online-debt-consolidation

2. https://viralblogspost.com/mmoga-master-of-science-in-finance

3. https://viralblogspost.com/mmoga-wells-fargo-financing-home

4. https://viralblogspost.com/local-roofing-companies-that-finance

5. https://viralblogspost.com/mortgage-financing-for-self-employed

FAQ

-

Is Yahoo Finance’s stock futures data real-time?

While Yahoo Finance aims to provide real-time data, occasional delays may occur, especially during high-volume trading sessions.

-

Can I use Yahoo Finance to trade stock futures directly?

No, Yahoo Finance does not offer brokerage services. You’ll need to use a separate brokerage account to execute trades.

-

What are the limitations of using Yahoo Finance for stock futures trading?

Yahoo Finance’s charting tools are limited compared to paid platforms, and data delays can impact real-time trading decisions.

-

How can I improve my trading strategies using Yahoo Finance?

By utilizing technical and fundamental analysis, staying updated on market news, and managing risk effectively, traders can enhance their trading strategies with the data provided by Yahoo Finance.

Conclusion

In summary, Yahoo Finance stock futures and futures stocks serve as an invaluable resource for traders looking to access real-time data and insights into the futures market. By understanding the fundamentals of stock futures and leveraging the tools available on Yahoo Finance, you can make informed decisions that enhance your trading strategies. While alternatives exist, Yahoo Finance remains a strong contender for those seeking a user-friendly and accessible option for tracking stock futures data. Dive into Yahoo Finance today and empower your trading journey with the wealth of information it offers!

Leave a Reply