Imagine you’re a freelance graphic designer, nurturing your creative business, yet facing the daunting task of securing a mortgage. The landscape of mortgage financing for self-employed individuals can often feel like a labyrinth of paperwork and lender skepticism. However, with the right guidance and understanding, self-employed borrowers can confidently navigate this journey toward homeownership. This guide aims to empower real estate agents and mortgage brokers with essential knowledge and strategies to assist their self-employed clients in achieving their dreams of home financing.

Toc

Understanding the Unique Challenges of Self-Employed Borrowers

Self-employed individuals, whether they are entrepreneurs, freelancers, or small business owners, encounter distinct challenges when pursuing a mortgage. The hurdles they face often stem from the unpredictable nature of their income, which can be more complex to verify compared to traditional W-2 employees.

Income Verification

One of the most significant challenges for self-employed borrowers is income verification. Lenders typically seek a steady and predictable income stream to assess a borrower’s ability to manage monthly mortgage payments. For those who are self-employed, demonstrating consistent income can be difficult, especially if their earnings fluctuate due to seasonal trends or client contracts. Gathering and organizing the necessary documentation can feel overwhelming, yet it is crucial for securing a favorable loan.

Fluctuating Income

Self-employed individuals often experience variations in their income, which can impact their loan approval and interest rates. Unlike traditional employees who receive a regular paycheck, self-employed borrowers may have months of robust income followed by leaner times. This inconsistency can lead lenders to view them as higher risk, complicating the mortgage approval process.

Higher Debt-to-Income Ratios

Additionally, self-employed borrowers may struggle with higher debt-to-income ratios (DTI) due to business-related expenses and tax deductions. While these financial strategies can benefit their businesses, they can also obscure the true picture of their ability to afford a mortgage. This is where real estate agents and mortgage brokers can step in, helping clients present their financial situations in a more favorable light.

Addressing Misconceptions

Moreover, self-employed borrowers often face misconceptions regarding their financial stability. Many lenders may perceive self-employment as a risky endeavor, resulting in heightened scrutiny of applications. Both borrowers and their advisors should be prepared to address these misconceptions during the mortgage application process, providing clarity on the self-employed lifestyle where income can be substantial yet variable.

Essential Documentation and Verification Processes

When it comes to mortgage financing for self-employed individuals, the documentation and verification process can be more comprehensive than for traditional employees. Lenders generally require at least two years of personal and business tax returns, along with detailed profit and loss statements, to gain a thorough understanding of the applicant’s financial landscape.

Tax Returns

Providing recent tax returns—both personal and business—is paramount. Lenders typically ask for two to three years of tax documents to evaluate income trends and ensure the applicant can maintain payments over time.

Bank Statements

In addition to tax returns, lenders often request bank statements for both personal and business accounts. These documents help assess the consistency and reliability of the borrower’s cash flow, which is crucial for understanding their financial stability.

Profit and Loss Statements

Detailed profit and loss statements for the past two to three years are also essential. These statements provide a clear picture of income and expenses, allowing lenders to evaluate the borrower’s financial health accurately.

Credit Report

Credit scores play a pivotal role in the mortgage approval process. Self-employed borrowers should prioritize maintaining a strong credit history. Regularly checking credit reports for errors and addressing discrepancies can significantly enhance their creditworthiness, helping to offset perceived risks associated with their employment status.

1. https://viralblogspost.com/mmoga-bachelors-degree-in-finance

2. https://viralblogspost.com/mmoga-best-small-business-financing

3. https://viralblogspost.com/mmoga-beyond-finance-log-in

4. https://viralblogspost.com/mmoga-roofing-companies-that-finance

5. https://viralblogspost.com/bill-consolidation-debt-your-path-to-financial-freedom

Additional Documentation

Self-employed borrowers may need to provide additional documentation that traditional employees might not be required to submit. This can include business licenses, contracts with clients, and letters from accountants or financial advisors verifying income. Compiling a comprehensive documentation package can strengthen the borrower’s case when presenting to lenders.

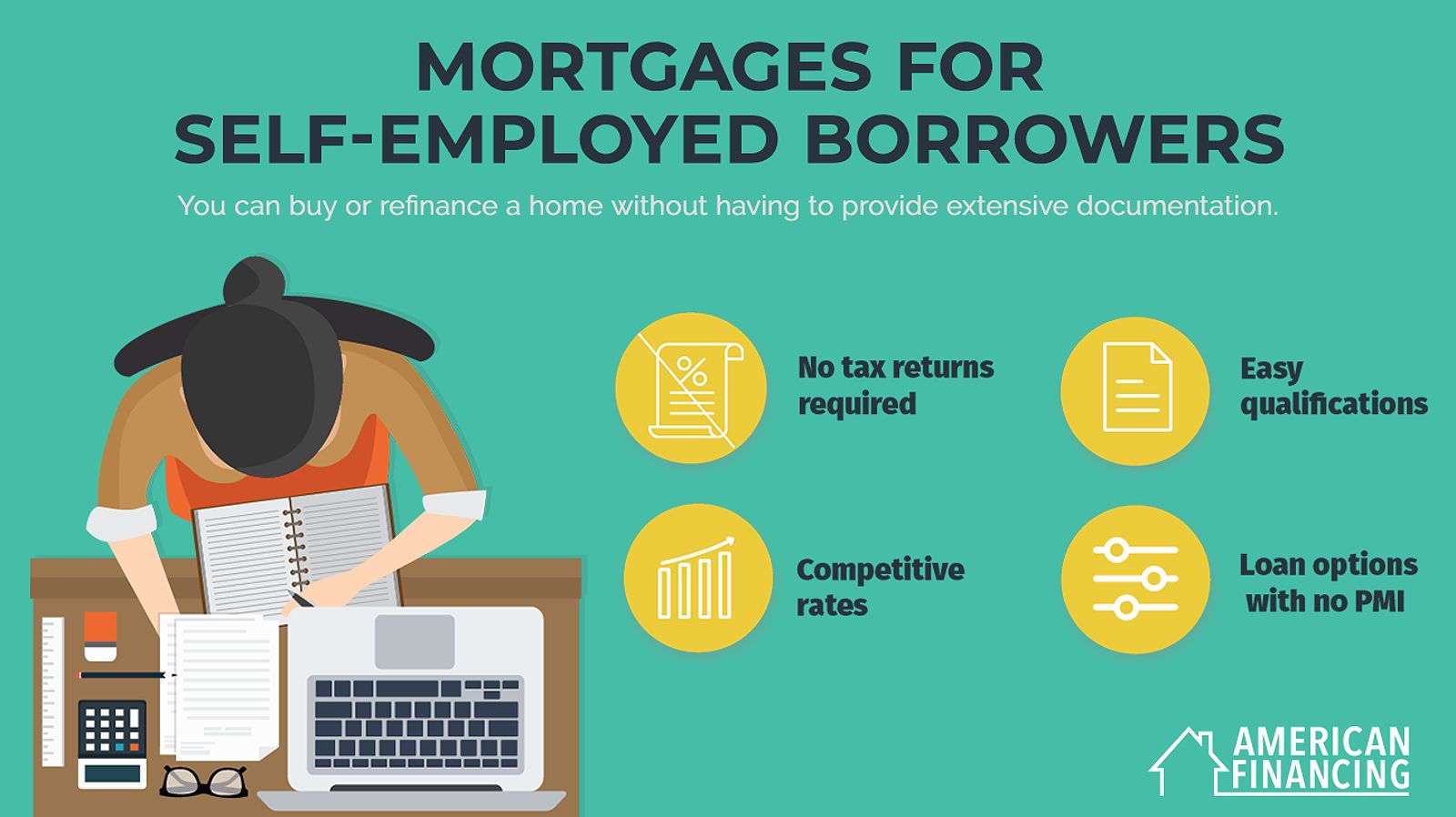

Self-employed borrowers have a variety of mortgage options available to them, each with its unique requirements and benefits. Understanding these options can help real estate agents and mortgage brokers guide their clients toward the most suitable loan programs.

Conventional Loans

Conventional loans are a popular choice for self-employed borrowers, as they often come with more flexible income verification requirements compared to other loan types. Lenders may consider a self-employed borrower’s gross income rather than just their taxable income, which can help mitigate the impact of business deductions. However, it’s essential to note that conventional loans typically require a higher credit score and a more substantial down payment.

FHA Loans

The Federal Housing Administration (FHA) offers loans with more lenient credit score and down payment requirements, making them an attractive option for self-employed individuals. FHA loans often have a lower minimum credit score requirement of 500, which can benefit those with shorter credit histories or lower scores. However, borrowers should be aware that FHA loans require mortgage insurance premiums, which can increase the overall cost of the loan.

VA Loans

For self-employed borrowers who are current or former military members, VA loans can provide an excellent financing solution. These loans offer no down payment requirements and often have more flexible income verification processes. The VA guarantees a portion of the loan, making lenders more willing to work with self-employed borrowers.

Bank Statement Loans

An alternative to traditional mortgage programs, bank statement loans focus on analyzing the applicant’s business bank statements rather than relying solely on tax returns. This approach can be particularly beneficial for self-employed borrowers with inconsistent or irregular income. While bank statement loans may come with higher interest rates and stricter requirements, they can offer a viable pathway to homeownership for those who may not qualify for conventional loans.

When assisting self-employed clients through the mortgage process, it’s crucial to carefully evaluate their unique financial situations and explore the pros and cons of each loan option. Each loan type has its strengths and limitations, and understanding these nuances can help clients make informed decisions.

Strategies for Enhancing Mortgage Eligibility

Self-employed borrowers can take proactive steps to improve their chances of securing a favorable mortgage. Here are some actionable strategies to consider:

Improving Credit Score

One of the most effective strategies is to focus on improving credit scores. Self-employed borrowers can demonstrate their creditworthiness by paying bills on time, reducing credit utilization, and disputing any errors on their credit reports. Regularly monitoring credit scores can help borrowers stay informed about their financial standing.

Saving for a Larger Down Payment

Saving for a larger down payment can significantly enhance a self-employed borrower’s eligibility. A higher down payment reduces the loan-to-value ratio, which translates to lower risk for the lender and potentially better loan terms for the borrower. Additionally, a substantial down payment can help mitigate concerns about income volatility.

Managing Debt-to-Income Ratio

Managing the debt-to-income ratio is crucial for self-employed borrowers. They can work on reducing their overall debt burden by consolidating high-interest accounts or strategically paying off debts. Keeping personal and business finances separate can also help present a clearer financial picture to lenders.

Building a Strong Self-Employment History

Establishing a solid self-employment history can be advantageous. Lenders prefer to see a consistent track record of self-employment, typically spanning at least two years. By maintaining stable income and demonstrating business growth, self-employed borrowers can build a compelling case for mortgage approval. Consulting with a financial advisor to strategize on business growth and income stability can further enhance their position.

1. https://viralblogspost.com/local-roofing-companies-that-finance

2. https://viralblogspost.com/the-ultimate-guide-to-online-debt-consolidation

3. https://viralblogspost.com/business-and-finance-degree

4. https://viralblogspost.com/yahoo-finance-stock-futures

5. https://viralblogspost.com/mmoga-newtek-small-business-finance

FAQ

What is the minimum credit score required for a mortgage as a self-employed individual?

The minimum credit score requirement can vary depending on the loan type and lender, but generally, a credit score of 620 or higher is recommended for conventional loans.

How long does it take to get pre-approved for a mortgage as a self-employed borrower?

The pre-approval process can take anywhere from a few days to a few weeks, depending on the lender and the complexity of the self-employed borrower’s financial situation.

What documentation do I need to provide as a self-employed borrower?

Self-employed borrowers typically need to provide personal and business tax returns, profit and loss statements, bank statements, and potentially additional documents such as business licenses or contracts.

Can I qualify for a mortgage if I’ve only been self-employed for a short time?

While most lenders prefer at least two years of self-employment history, some may consider alternative documentation or allow a co-signer to strengthen your application.

Conclusion

Navigating the mortgage landscape as a self-employed borrower can indeed be daunting, but with the right knowledge and strategies, it is a journey that can lead to successful outcomes. By understanding the unique challenges faced by self-employed individuals, real estate agents and mortgage brokers can better serve their clients and help them unlock the door to homeownership.

By guiding self-employed borrowers through the documentation and verification process, exploring the various mortgage options available, and implementing effective strategies to enhance their eligibility, real estate professionals can play a crucial role in empowering these borrowers to achieve their homeownership dreams. While the path to home financing for self-employed individuals may require extra effort and preparation, it can ultimately lead to a fulfilling and rewarding experience.

Leave a Reply