In a country where financial inclusion remains a challenge, Ujjivan Small Finance Bank has emerged as a beacon of hope. With a mission to serve the underserved, this dynamic institution is revolutionizing the banking landscape, bringing essential services to communities that have traditionally been overlooked.

Toc

A Vision for Financial Inclusion

Ujjivan Small Finance Bank has its roots firmly planted in the principles of empowerment and accessibility. Established in 2017 and backed by the expertise of Ujjivan Financial Services Limited, the bank is dedicated to bridging the gap between the financially privileged and the underserved.

Its commitment to financial inclusion is evident in the fact that over 60% of its customers hail from marginalized communities. By tailoring its offerings to the unique needs of these populations, Ujjivan Small Finance Bank is not only uplifting individuals but also contributing to the broader economic growth of the nation.

From its headquarters in Bengaluru, the bank has steadily expanded its reach, establishing a robust network of branches across both urban and rural areas. This strategic expansion ensures that everyone, regardless of their location or financial background, can access the essential banking services they deserve.

A Comprehensive Range of Financial Products and Services

Ujjivan Small Finance Bank understands that one size does not fit all when it comes to banking. That’s why they’ve curated a diverse portfolio of financial products and services to cater to the varied needs of their customers.

Savings Accounts for Every Need

Whether you’re looking for a basic savings account or a premium option with added benefits, Ujjivan has got you covered. Their savings accounts boast attractive interest rates and minimal maintenance fees, making them an appealing choice for both individuals and families. And with a simple online account opening process, getting started with Ujjivan has never been easier.

Home Loans for Your Dream Home

Owning a home is a cherished dream for many, and Ujjivan Small Finance Bank is here to make that dream a reality. Their home loan offerings feature competitive interest rates and flexible repayment options, empowering you to access the financing you need to secure your dream abode. Whether you’re a first-time buyer or looking to upgrade, Ujjivan’s home loans cater to your unique requirements.

Secure Savings with Fixed Deposits

For those seeking a reliable way to grow their savings, Ujjivan’s fixed deposit schemes are a smart choice. With attractive interest rates and flexible maturity periods, these fixed deposits provide a secure avenue for you to save for your future goals, be it a family vacation, your child’s education, or your retirement.

Beyond Traditional Banking

Ujjivan Small Finance Bank’s financial offerings extend beyond the realm of traditional banking. They also provide personal loans, business loans, insurance products, and wealth management services, ensuring that their customers can find comprehensive solutions under one roof.

1. https://viralblogspost.com/mmoga-masters-in-finance-vs-mba

2. https://viralblogspost.com/mmoga-newtek-small-business-finance

3. https://viralblogspost.com/local-roofing-companies-that-finance

Digital Banking: Convenience at Your Fingertips

In today’s fast-paced world, convenience is key, and Ujjivan Small Finance Bank understands that. Their commitment to digital banking solutions ensures that managing your finances has never been easier.

Internet Banking for Seamless Management

Ujjivan’s internet banking platform is a true game-changer. With just a few clicks, you can transfer funds, pay bills, and access your account statements – all from the comfort of your own home. The intuitive interface makes banking a breeze, even for the less tech-savvy among us.

Mobile Banking: Your Bank in Your Pocket

The Ujjivan Mobile Banking app puts the power of banking right in your hands. Check your balances, transfer funds, and view mini-statements with just a few taps. The user-friendly design ensures that you can navigate the app with ease, whether you’re a seasoned digital native or a tech-curious newcomer.

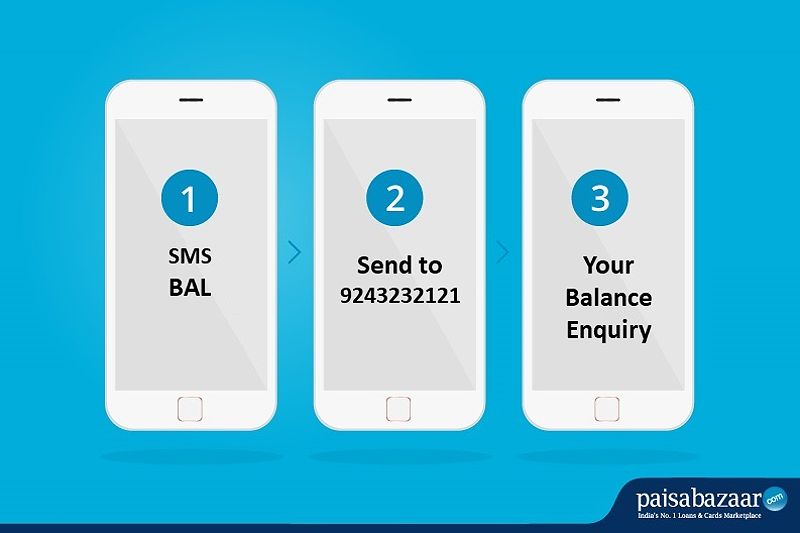

Missed Call and SMS Banking for Everyone

Not everyone is glued to their smartphones 24/7, and Ujjivan recognizes that. Their missed call and SMS banking services are a lifesaver for those without constant internet access. Simply give a missed call to a designated number, and you’ll receive your account balance via SMS. It’s a simple yet effective way to stay connected with your finances.

WhatsApp Banking: The Future of Banking

Ujjivan Small Finance Bank is at the forefront of innovation with its WhatsApp banking services. Yes, you read that right – you can now access various banking features right through your WhatsApp conversations. Whether you need to check your balance or request a mini-statement, a simple message can provide you with the information you need.

A Customer-Centric Approach

At the heart of Ujjivan Small Finance Bank’s operations is a deep commitment to customer satisfaction. They understand that banking is not just about transactions; it’s about building lasting relationships and earning the trust of their clients.

Dedicated Customer Support

Ujjivan’s comprehensive customer support network ensures that you’re never left alone. Whether you need assistance via phone, email, or online chat, their team of knowledgeable professionals is always ready to lend a helping hand. And with their extensive branch network across the country, personalized service is never more than a short trip away.

Building Trust through Service

The true testament to Ujjivan’s customer-centric approach lies in the overwhelmingly positive feedback from their existing clients. From praising the bank’s responsiveness to highlighting the ease of accessing various services, these testimonials reinforce Ujjivan’s reputation as a reliable and trustworthy financial institution.

Why Choose Ujjivan Small Finance Bank?

In a crowded banking landscape, Ujjivan Small Finance Bank stands out for several compelling reasons:

Commitment to Financial Inclusion

Ujjivan’s unwavering dedication to serving underserved communities is truly admirable. By providing essential financial services to those who have traditionally been overlooked, the bank is actively empowering individuals and uplifting communities across India.

Innovative Solutions

Ujjivan’s forward-thinking approach, particularly in the realm of digital banking, sets it apart from the competition. Their blend of traditional banking services and cutting-edge technology ensures that customers have access to the conveniences of modern banking, no matter their location or financial background.

1. https://viralblogspost.com/mortgage-financing-for-self-employed

2. https://viralblogspost.com/mmoga-financing-for-dental-implants

3. https://viralblogspost.com/the-ultimate-guide-to-online-debt-consolidation

4. https://viralblogspost.com/mmoga-finance-and-accounting-outsourcing-companies

5. https://viralblogspost.com/how-a-personal-loan-can-help-you-pay-off-credit-card-debt

Competitive Products and Services

With a diverse range of financial products and services, Ujjivan Small Finance Bank offers customers a compelling value proposition. From attractive interest rates on savings accounts to flexible repayment terms on loans, the bank remains a formidable player in the financial sector.

Frequently Asked Questions

Q: What are the eligibility criteria for opening an account with Ujjivan Small Finance Bank?

A: The basic eligibility criteria for opening an account with Ujjivan Small Finance Bank typically include factors such as age, residency, and minimum income requirements. However, it’s best to check with the bank directly or visit their website for the most up-to-date and comprehensive information.

Q: How secure are Ujjivan’s digital banking services?

A: Ujjivan Small Finance Bank takes the security of its digital banking services very seriously. The bank employs advanced security measures, including encryption, multi-factor authentication, and robust fraud detection systems, to protect customer data and transactions. You can rest assured that your financial information is in safe hands when using Ujjivan’s digital banking solutions.

Q: What are the benefits of using Ujjivan’s WhatsApp banking service?

A: Ujjivan’s WhatsApp banking service offers unparalleled convenience and accessibility. With just a few taps on your smartphone, you can access a range of banking features, such as checking your account balance, requesting mini-statements, and even making simple inquiries. This innovative service is particularly useful for those who prefer the familiarity of WhatsApp or may not have constant access to the internet.

So, if you’re looking for a banking partner that combines accessibility, innovation, and a genuine commitment to customer satisfaction, Ujjivan Small Finance Bank is the answer you’ve been searching for. Take the first step towards a more empowered financial future by exploring their offerings today.

Leave a Reply