Debt consolidation is a popular option for individuals who are struggling with multiple debts and high interest rates. This process involves combining all of your debts into one single loan, making it easier to manage and potentially saving you money in the long run. If you’re considering online debt consolidation, this guide will provide you with all the necessary information to make an informed decision. From understanding the types of debt consolidation loans available to finding a reputable online lender, we’ve got you covered.

Toc

- 1. Introduction of Online Debt Consolidation

- 2. Benefits of Online Debt Consolidation

- 3. Related articles 01:

- 4. Getting Started with Online Debt Consolidation

- 5. Tips for Success with Online Debt Consolidation

- 6. Related articles 02:

- 7. Case Studies: Success Stories with Online Debt Consolidation

- 8. Conclusion

Introduction of Online Debt Consolidation

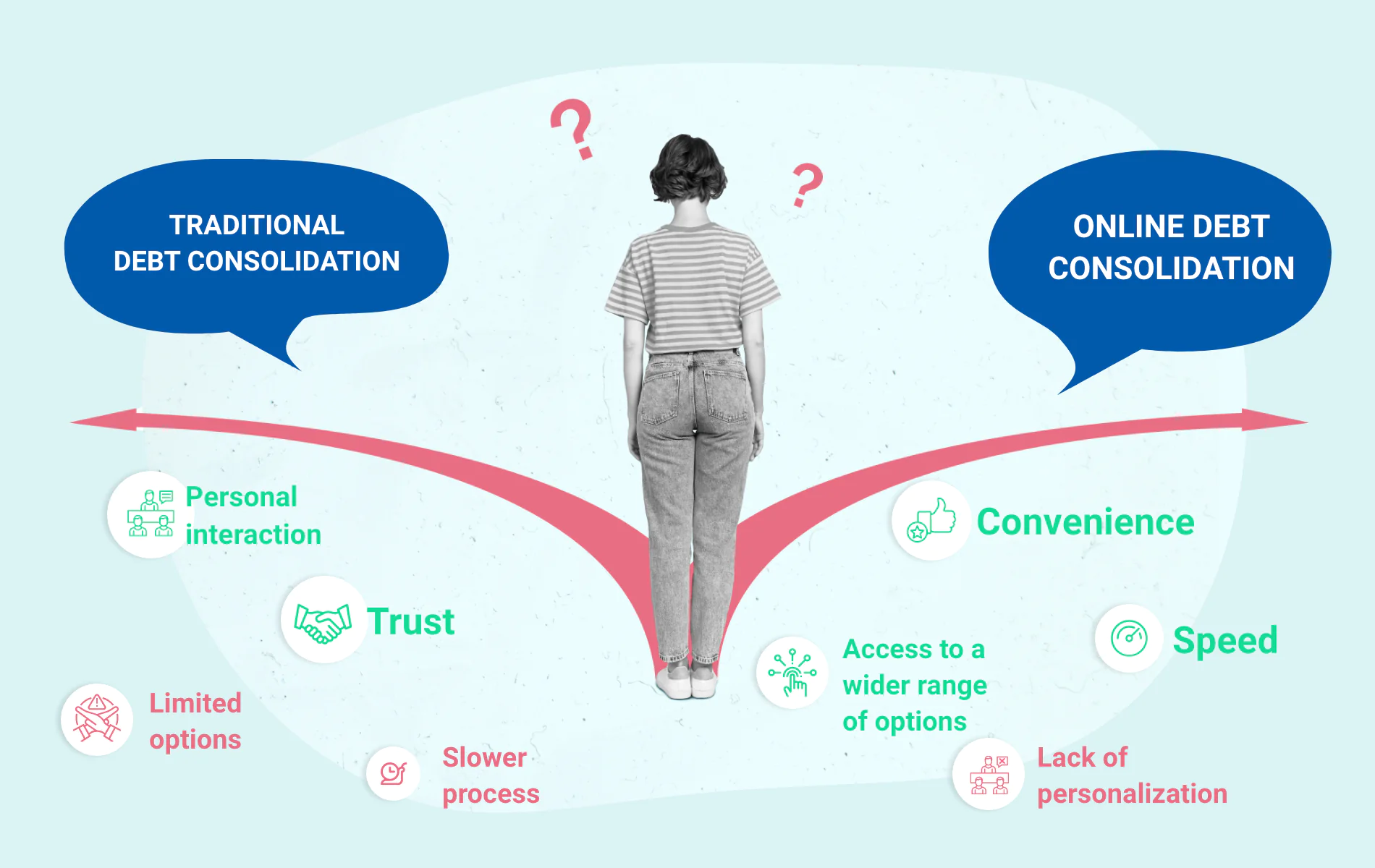

Debt consolidation is the process of combining multiple debts into one single loan. This can be done through various means, such as taking out a personal loan or using a debt consolidation company. While traditional debt consolidation methods may involve going to a physical location, the rise of online lending has made it easier and more convenient for individuals to consolidate their debts from the comfort of their own home.

Defining Online Debt Consolidation

Debt consolidation is a financial strategy that involves combining multiple debts into a single payment, ideally at a lower interest rate. Online debt consolidation takes this traditional approach to the digital realm, providing an accessible and convenient way to manage debts through online platforms.

The Growing Trend of Managing Debts Online

In today’s digital age, managing finances online has become increasingly popular. From online banking to digital investment platforms, the internet has revolutionized how we handle money. Debt consolidation has followed suit, with online services offering a streamlined and efficient way to consolidate multiple debts.

How Online Debt Consolidation Works

Online debt consolidation involves taking out a new loan to pay off existing debts, such as credit cards, personal loans, and other liabilities. These services typically offer a user-friendly interface, enabling you to manage your debt repayment entirely online. You’ll make one monthly payment to the consolidation company, which then distributes the funds to your creditors.

Who Can Benefit from Online Debt Consolidation

Online debt consolidation can be a lifeline for anyone juggling multiple debts. This includes individuals with credit card debt, personal loans, student loans, and even small business owners. If you’re struggling to manage various due dates, interest rates, and terms, consolidating your debt online could provide significant relief.

Types of Online Debt Consolidation Loans

When it comes to online debt consolidation, there are a few different types of loans available. These include:

- Personal loan: This is a loan that you take out from a bank or online lender to pay off your existing debts. You then make one monthly payment towards the personal loan.

- Home equity loan: If you own a home and have built up equity, you may be able to use this as collateral for a debt consolidation loan.

- Balance transfer credit card: This involves transferring all of your high-interest credit card balances onto one low-interest card.

- Debt management plan (DMP): A DMP is an agreement between you and your creditors where you make one monthly payment to a credit counseling agency, who then distributes the funds to your creditors.

- Debt consolidation company: These companies specialize in debt consolidation and work with you to create a personalized plan to consolidate and pay off your debts.

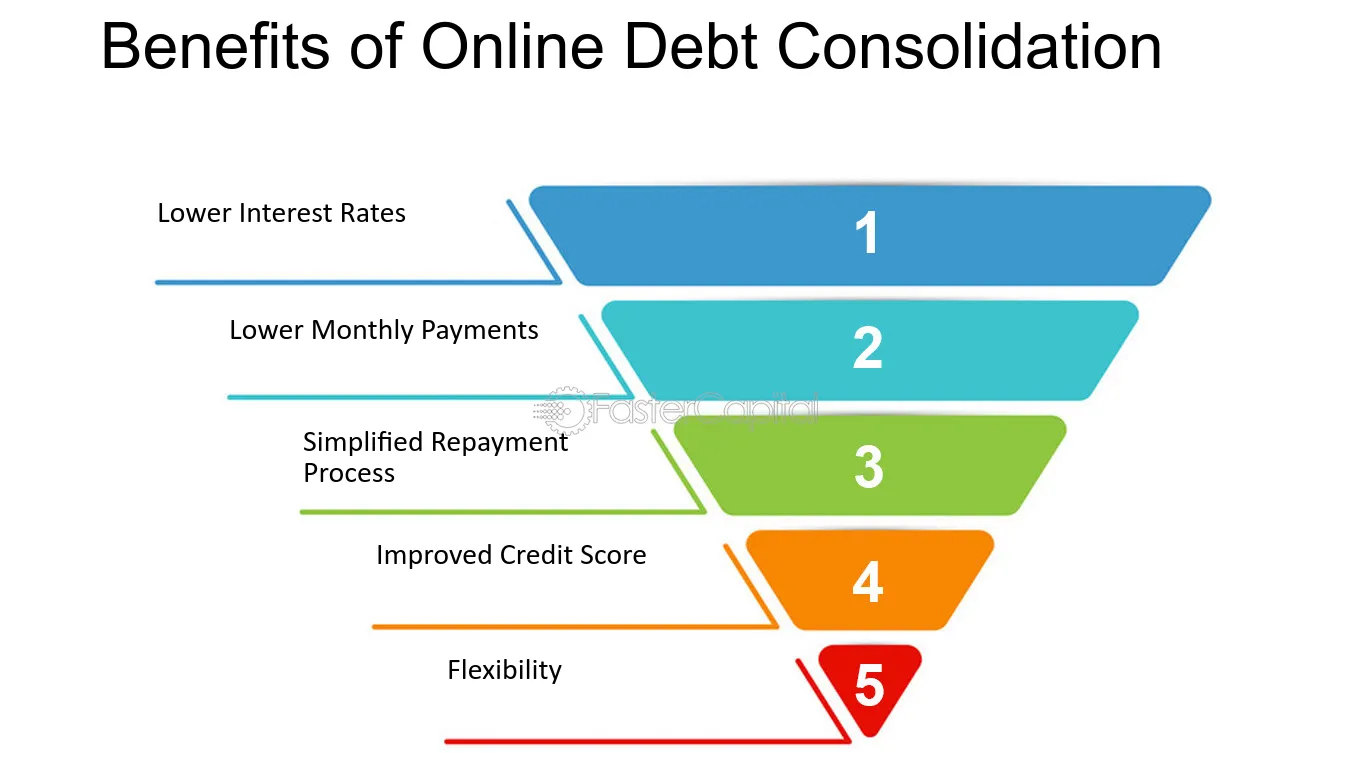

Benefits of Online Debt Consolidation

Consolidating your debts online can offer a range of benefits, including:

Simplify and Streamline Your Finances

One of the most appealing benefits of online debt consolidation is the simplification it offers. By merging multiple debts into one, you eliminate the hassle of keeping track of various payments and due dates. This consolidation can significantly reduce stress and make it easier to manage your finances effectively.

Lower Interest Rates and Financial Savings

Another major advantage is the potential for lower interest rates. Many online debt consolidation services offer competitive interest rates that can save you money over the life of the loan. This reduction in interest can lead to substantial financial savings, freeing up money for other needs or helping you pay off your debt faster.

Clear Path to Debt Freedom

Online debt consolidation provides a structured repayment plan, which creates a clear path to becoming debt-free. With consistent monthly payments, you’ll have a precise timeline for when your debts will be paid off. This structure can be incredibly motivating and help you stay on track.

1. https://viralblogspost.com/mmoga-newtek-small-business-finance

2. https://viralblogspost.com/mmoga-finance-and-accounting-outsourcing-companies

3. https://viralblogspost.com/mmoga-beyond-finance-log-in

4. https://viralblogspost.com/cash-flow-from-financing-activities

Convenience and Accessibility

Managing your debt online offers unparalleled convenience. You can access your account, make payments, and monitor your progress 24/7 from the comfort of your home. This accessibility ensures you can stay on top of your finances no matter where you are.

Positive Impact on Credit Scores

Consistently making on-time payments through a debt consolidation program can positively affect your credit score. As your consolidated debt decreases, your credit utilization rate improves, which can lead to a better credit score over time.

Getting Started with Online Debt Consolidation

If you’re interested in consolidating your debts online, here are a few steps to help get you started:

Assess Your Financial Situation

Before you begin the process, it’s crucial to have a clear understanding of your financial situation. List out all your current debts, including the outstanding balances, interest rates, and monthly payments. This overview will provide a comprehensive picture of your financial health and help you determine the best consolidation option for your needs.

Research and Compare Lenders

There are numerous online lenders and debt consolidation companies available, each with its own terms, rates, and requirements. Take the time to research and compare these options thoroughly. Look for lenders with positive customer reviews, transparent fee structures, and competitive interest rates. Using comparison tools and reading expert reviews can also help you make an informed decision.

Check Your Credit Score

Your credit score plays a significant role in determining the interest rates and terms you’ll qualify for with a debt consolidation loan. Obtain a copy of your credit report and review it for accuracy. If your score is less than ideal, consider taking steps to improve it before applying for a consolidation loan to secure better rates.

Gather Necessary Documentation

When applying for an online debt consolidation loan, you’ll need to provide certain documentation. This typically includes proof of income, identification, and details of your current debts. Having these documents ready can streamline the application process and expedite approval.

Apply for the Loan

Once you’ve identified the ideal lender, you can proceed with the online application process. Most online lenders have user-friendly platforms that guide you through each step. Fill out the necessary forms, submit your documentation, and await approval. In many cases, online applications are processed quickly, and you can receive a decision within a few days.

Review the Terms and Sign the Agreement

After receiving approval, carefully review the loan terms before signing any agreement. Ensure you understand the interest rate, repayment schedule, fees, and any other conditions associated with the loan. If everything looks good, sign the agreement to finalize the consolidation.

Repay Your Debts

Once your consolidation loan is approved and funded, use the funds to pay off your existing debts. Moving forward, you’ll make a single monthly payment to the consolidation lender, simplifying your debt management.

Monitor Your Progress

Keep a close eye on your repayment progress by regularly logging into your online account. Ensure that payments are being applied correctly and track your progress towards becoming debt-free. Celebrate milestones along the way to stay motivated.

Online debt consolidation can be a powerful tool to regain control of your finances and work towards a debt-free future. By taking the right steps and staying committed to your repayment plan, you can simplify your financial life and enjoy the benefits of reduced interest rates and streamlined payments.

Tips for Success with Online Debt Consolidation

1. https://viralblogspost.com/online-degree-in-finance

2. https://viralblogspost.com/mmoga-masters-degree-in-finance

3. https://viralblogspost.com/local-roofing-companies-that-finance

4. https://viralblogspost.com/bachelor-of-science-in-finance

5. https://viralblogspost.com/how-a-personal-loan-can-help-you-pay-off-credit-card-debt

Create a Budget and Stick to It

One of the key strategies for success with online debt consolidation is creating and maintaining a budget. Assess your income and expenses to develop a realistic budget that accommodates your monthly debt repayment. Allocate funds for essential expenses such as housing, utilities, groceries, and transportation, while also setting aside a portion for savings. By tracking your spending and adhering to your budget, you can avoid accumulating new debt and stay on course with your financial goals.

Avoid New Debt

While you’re working to pay off your consolidated debt, it’s crucial to refrain from taking on additional debt. Resist the temptation to use credit cards or take out new loans, as this can undermine your progress and lead to financial setbacks. Focus on living within your means and prioritizing debt repayment.

Seek Financial Education

Educating yourself about personal finance can greatly improve your ability to manage your money and achieve financial stability. Take advantage of free resources such as online courses, webinars, and financial blogs to enhance your knowledge. Understanding key concepts like budgeting, saving, investing, and credit management can empower you to make informed financial decisions and avoid common pitfalls.

Stay Informed About Your Loan

Throughout the repayment process, it’s important to stay informed about the terms and conditions of your consolidation loan. Keep track of any changes in interest rates or fees and be aware of your rights as a borrower. If you encounter any issues or have questions, promptly contact your lender for clarification and assistance.

Build an Emergency Fund

Building an emergency fund is an essential part of financial security. Aim to save at least three to six months’ worth of living expenses to cover unexpected events such as medical emergencies, car repairs, or job loss. Having an emergency fund can prevent you from relying on credit cards or loans during difficult times and help you stay on track with your debt repayment plan.

Top 5 Online Debt Consolidation Providers 2024

- Best Egg – With competitive interest rates and quick approval process, Best Egg is a top choice for online debt consolidation.

- SoFi – SoFi offers flexible repayment options and personalized customer service, making it a popular option for those looking to consolidate their debts.

- Payoff – This lender specializes in consolidating credit card debt and offers resources to help borrowers improve their financial habits.

- LendingClub – LendingClub connects borrowers with individual investors, providing competitive rates and transparent fees.

- LightStream – With its low-interest rates and no prepayment penalties, LightStream is a popular choice for those looking to consolidate high-interest loans or credit card debt.

Ultimately, the best online debt consolidation provider for you will depend on your individual financial situation and needs. Be sure to research and compare different lenders before making a decision, and don’t hesitate to seek guidance from a financial advisor or credit counselor.

Case Studies: Success Stories with Online Debt Consolidation

Rachel’s Journey to Financial Freedom

Rachel, a 35-year-old with multiple credit card debts, turned to an online debt consolidation service. By consolidating her debts, she was able to lower her overall interest rate, saving over $5,000 in interest payments over the life of her loan. She’s now on track to pay off her debts three years earlier than her original plan.

John’s Path to Financial Stability

John, a recent graduate with student loans and various personal debts, found online debt consolidation to be the solution he needed to manage his finances. By combining his debts into a single, more manageable monthly payment, he was able to stay on top of payments, boost his credit score, and start saving for his future.

Michelle’s Business Resurgence

A small business owner, Michelle, used an online debt consolidation service to combine her business and personal debts, which were impacting her credit score and the financial health of her business. The consolidation not only provided her with a lower interest rate but also allowed her to continue operating her business without the burden of multiple high-interest payments.

Conclusion

Online debt consolidation can be a lifeline for those struggling with multiple debts, but it’s important to approach it with a well-thought-out plan. This guide aimed to provide you with the steps and tips needed to make the most of your debt consolidation journey. By following these strategies, you can simplify your debt management and move closer to financial freedom.

Leave a Reply