Did you know that the average driver could save hundreds of dollars a year just by shopping around for car insurance? It’s true! The competitive nature of the insurance market means that companies are always vying for your business, which gives you the power to negotiate and find a policy that fits your budget without sacrificing the coverage you need. This comprehensive guide will walk you through the steps to shop for car insurance effectively, helping you compare auto insurance quotes, understand different coverage options, and secure the best deal for your unique situation.

Toc

- 1. Gather Your Information: The Foundation for a Successful Shop for Car Insurance

- 2. Define Your Coverage Needs: Understanding Your Options

- 3. Choose Your Shopping Method: Online, Agent, or Broker?

- 4. Related articles 01:

- 5. Compare Quotes & Discounts: Finding the Best Deal

- 6. Negotiate & Finalize Your Policy: Securing the Best Value

- 7. Related articles 02:

- 8. FAQ

- 9. Conclusion

Gather Your Information: The Foundation for a Successful Shop for Car Insurance

Before you dive into the world of car insurance, it’s essential to gather accurate information to get precise quotes. This foundational step is crucial for ensuring that you receive tailored quotes that reflect your specific circumstances.

Start by compiling your personal details. This includes your full name, address, date of birth, and how long you’ve lived at your current residence. Insurers use this information to assess your risk profile and determine your premium. Next, focus on your vehicle. Collect details such as the make, model, year, and vehicle identification number (VIN). This data helps insurers evaluate the value of your car and the associated risks.

Your driving history is another vital piece of the puzzle. Be prepared to share information regarding any accidents, traffic violations, or claims you’ve made in the past few years. Insurance companies typically review your driving record over the last three to five years, so having this information readily available can streamline the process. If you boast a clean driving record, this could work to your advantage by lowering your premiums.

While gathering this information may seem tedious, it’s a necessary step in your journey to shop for auto insurance effectively. To simplify the task, consider creating a checklist to ensure you don’t overlook any critical details. Additionally, storing this information in a digital format can help you access it easily during your search.

Actionable Steps:

- Create a checklist of personal details, vehicle information, and driving history.

- Use online resources to access your driving records and locate your VIN.

Define Your Coverage Needs: Understanding Your Options

Once you have your information gathered, it’s time to define your coverage needs. Understanding the various types of car insurance coverage is essential as each serves a specific purpose and can significantly influence your premium.

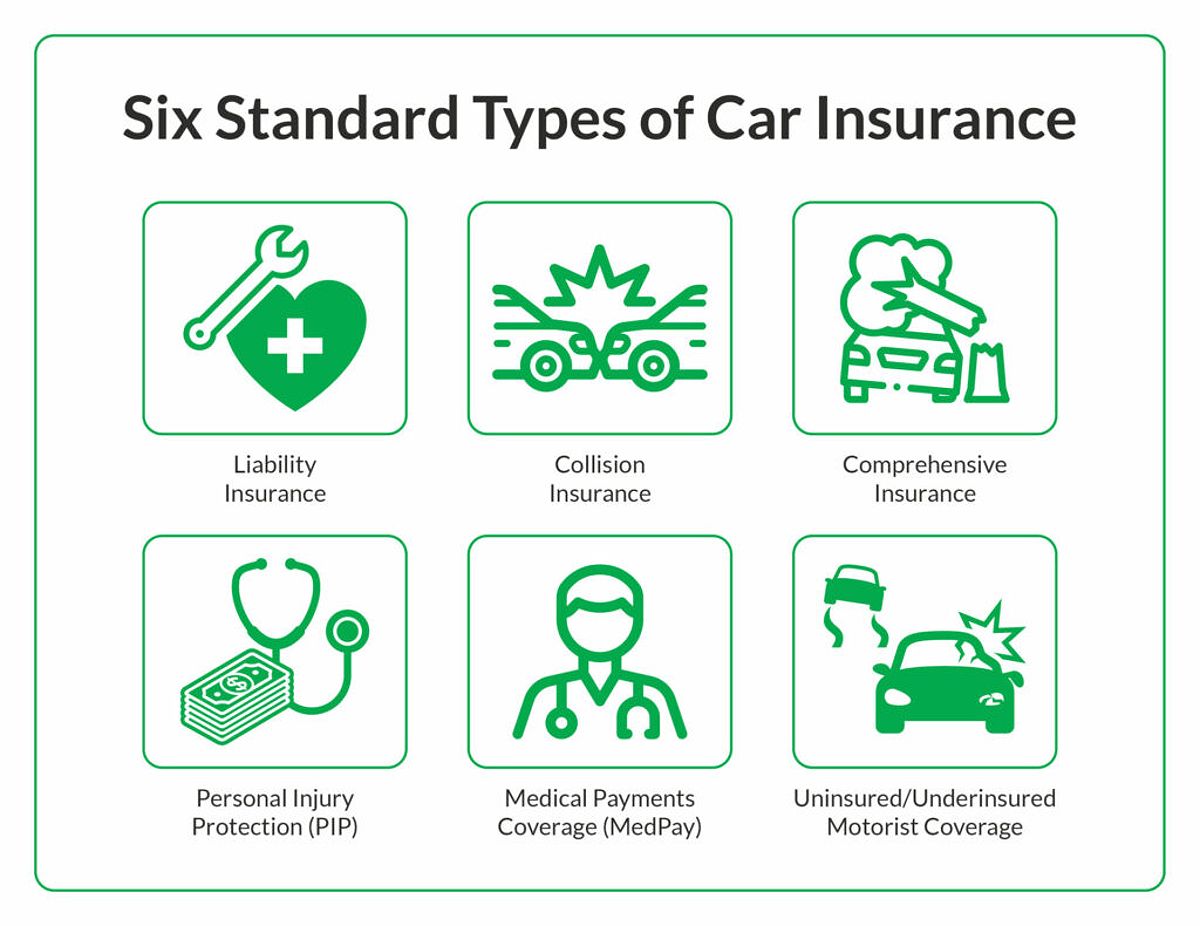

Liability insurance is typically mandatory in most states. It covers damages and injuries you may cause to others in an accident. This coverage is divided into two parts: bodily injury liability, which pays for the medical expenses of others, and property damage liability, which covers damages to someone else’s vehicle or property. If you frequently drive in high-traffic areas or own a newer vehicle, collision insurance may be beneficial as it helps pay for repairs to your vehicle, regardless of fault.

Comprehensive insurance is another option that covers non-collision-related damages, such as theft, vandalism, or natural disasters. This coverage is particularly important if you reside in an area prone to severe weather conditions or if you own a valuable car. Furthermore, consider uninsured or underinsured motorist coverage, which protects you if you find yourself in an accident with a driver who lacks adequate insurance. Given the rising number of underinsured drivers, this coverage is increasingly vital.

Medical payments coverage (MedPay) and personal injury protection (PIP) are also worth considering. These options cover medical expenses for you and your passengers following an accident, with PIP potentially covering lost wages and other related expenses. By grasping these coverage types, you empower yourself to make informed decisions about what suits your needs best. Assess your individual circumstances, such as whether you have a loan on your vehicle or live in an area prone to natural disasters, to determine the appropriate level of coverage for you.

Actionable Steps:

- Create a table summarizing different coverage types, their benefits, and potential costs.

- Assess your individual coverage needs based on personal circumstances and risk factors.

Choose Your Shopping Method: Online, Agent, or Broker?

With a clear understanding of your coverage needs, it’s time to choose how you want to shop for auto insurance. Various methods are available, each with its advantages and disadvantages.

1. https://viralblogspost.com/mmoga-auto-insurance-quotes-texas

2. https://viralblogspost.com/the-3-car-insurance-companies-that-give-you-the-option-of-no-down-payment

3. https://viralblogspost.com/car-insurance-quotes-va

5. https://viralblogspost.com/selective-insurance-agent-login

You can start by using online comparison tools, which allow you to quickly compare multiple quotes from different providers. This method is convenient and time-saving, but it may not provide a comprehensive view of all available options. Online tools can give you a snapshot of potential rates, but specific discounts or unique policy features might be missed.

Alternatively, visiting insurance company websites allows you to get quotes directly from the source. While this method provides detailed information about specific policies, it may require more effort and time to compare different companies. Pay close attention to the coverage options and additional features included in the policy, as these can significantly impact your decision.

If you prefer a more personalized approach, consider working with an independent insurance agent or broker. These professionals can help you navigate the complexities of insurance policies and provide access to a broader range of options. They can also offer valuable insights based on your specific needs and circumstances. However, be mindful that agents may have incentives to recommend certain companies or products, so doing your research remains essential.

Regardless of the method you choose, it’s crucial to shop for car insurance quotes from multiple sources. This ensures you find the best coverage at the most competitive rates. Taking the time to compare and contrast will help you make an informed decision.

Actionable Steps:

- Research and select a few reputable online comparison tools.

- Make a list of insurance companies that align with your needs and preferences.

Compare Quotes & Discounts: Finding the Best Deal

After gathering your information and deciding on a shopping method, the next step is to compare quotes from various insurance providers. This is where you can truly see how different companies stack up against each other.

When comparing auto insurance quotes, pay close attention to the coverage levels and any additional features included in each policy. A lower premium might seem appealing, but it could come with reduced coverage or higher deductibles. It’s essential to evaluate the total cost of ownership, which encompasses premiums, deductibles, and out-of-pocket expenses in the event of a claim.

Many insurance companies offer discounts that can significantly lower your premiums. Common discounts include those for multi-car policies, safe driving records, and bundling your auto insurance with other types of coverage, such as homeowners or renters insurance. Don’t hesitate to ask each provider about specific discounts that may apply to your situation, like good student discounts or those for completing a defensive driving course.

Some companies also offer usage-based insurance programs that track your driving habits through telematics. If you demonstrate safe driving behavior, you could earn additional discounts on your premiums. By actively seeking out these discounts, you can enhance your chances of saving money while securing the coverage you need.

To facilitate your comparison process, create a table or spreadsheet to organize the quotes you receive. Include key details such as coverage limits, premiums, deductibles, and available discounts. This visual representation can help you make an informed decision and identify which policy offers the best overall value.

Actionable Steps:

- Create a comparison table to track quotes and coverage details from different providers.

- Inquire about available discounts and eligibility requirements with each insurance company.

Negotiate & Finalize Your Policy: Securing the Best Value

After comparing quotes and identifying the best options, the final step is to negotiate and finalize your policy. This is where you can apply your research and knowledge to secure the best value for your coverage.

Start by discussing your findings with the insurance provider. If you’ve identified a lower quote from another company for similar coverage, don’t hesitate to bring it up during negotiations. Many insurers are willing to match or beat competitor prices to retain your business, especially if you have a good driving record and a history of being a loyal customer.

Understanding the terms and conditions of your policy is crucial at this stage. Be sure to read through the fine print and ask questions about any aspects you don’t understand. This diligence will help you avoid potential pitfalls and ensure that you’re fully aware of your coverage limits and responsibilities. For example, clarify how claims are processed, what is required for roadside assistance, and any exclusions that may apply.

1. https://viralblogspost.com/selective-insurance-agent-login

3. https://viralblogspost.com/mmoga-auto-insurance-quotes-florida

4. https://viralblogspost.com/mmoga-progressive-insurance-customer-service-number

5. https://viralblogspost.com/general-liability-insurance-online

Once you’ve negotiated a satisfactory agreement, you can proceed to purchase your policy. Ensure that there is no lapse in coverage by coordinating the start date of your new policy with the cancellation of your old one. You may also want to set up automatic payments to avoid any missed payments that could lead to coverage lapses.

Actionable Steps:

- Prepare a list of questions to ask insurance companies during negotiations.

- Review the policy details thoroughly before signing to ensure you understand all terms.

FAQ

What factors influence car insurance rates?

Driving history, age, vehicle type, location, and coverage levels are significant factors that impact insurance rates.

How often should I shop for car insurance?

It’s advisable to shop for car insurance at least once a year or when your policy is up for renewal to ensure you’re getting the best rates.

What are the advantages of bundling my auto and home insurance?

Bundling can lead to significant discounts and simplifies managing multiple policies with a single insurer.

How can I determine the right coverage amount for my needs?

Consider your financial situation, the value of your vehicle, your driving habits, and any state requirements when determining the right coverage amount.

Conclusion

Shopping for car insurance doesn’t have to be a daunting task. By gathering essential information, understanding your coverage needs, comparing quotes, and negotiating effectively, you can find the best car insurance policy for your situation. Remember to utilize the various methods available for shopping and take advantage of discounts to secure the most favorable terms. With this guide, you are better equipped to shop for car insurance and find the right policy for your needs. Start your search for the best car insurance rates today! Use the information in this guide to compare quotes, find discounts, and secure the coverage you need at a price you can afford.

Leave a Reply