Imagine a banking environment where every interaction feels personalized, every service is tailored to individual needs, and every customer feels valued. This is not just a dream it’s the reality that a robust crm system banking industry can create. As we step into 2024, the global banking CRM market is on track to hit an impressive $39.2 billion, underscoring a seismic shift towards customer-centric strategies. This transformation is not merely a trend it’s a necessary evolution in an industry grappling with fierce competition from fintech solutions, cryptocurrencies, and borderless accounts. This article will explore how the right CRM software for the banking industry can empower banking professionals to enhance customer engagement, streamline operations, and drive sustainable growth.

Toc

The Power of CRM in the Banking Industry

What is CRM and Why is it Essential for Banks?

At its core, Customer Relationship Management (CRM) is a strategic approach that enables banks to manage and optimize their interactions with customers. But in the context of the banking industry, CRM transcends basic contact management; it embodies a comprehensive strategy for nurturing customer relationships.

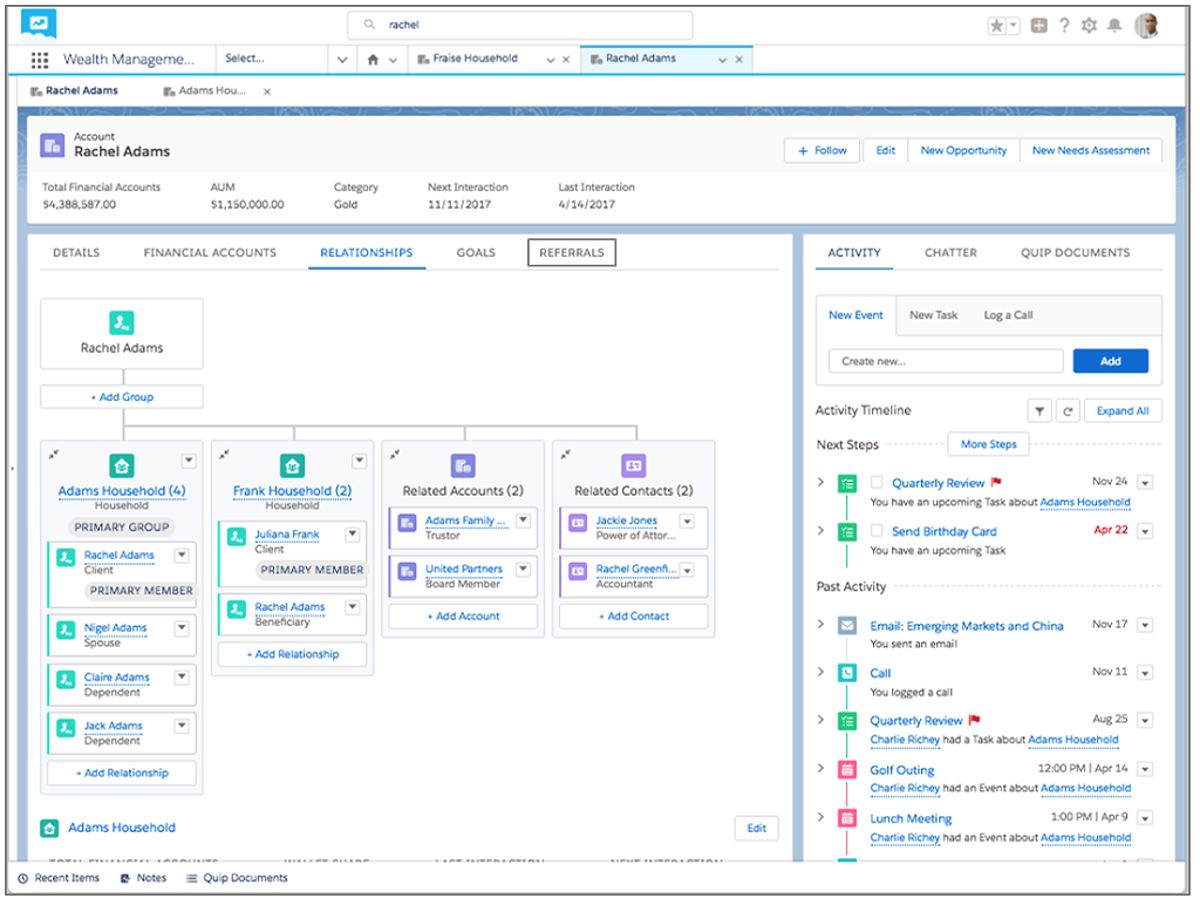

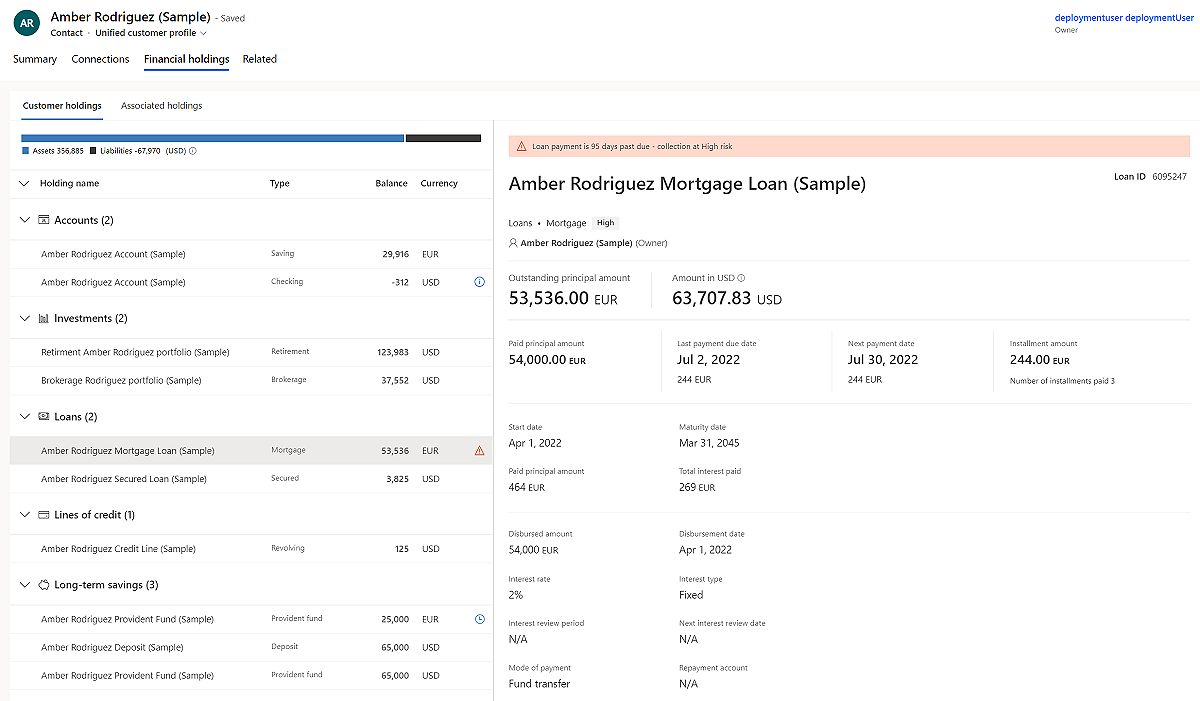

The advantages of implementing a CRM system in the banking industry are significant. By consolidating customer data, banks can enhance engagement and loyalty, streamline operational processes, and ultimately boost profitability. A well-implemented CRM system offers a 360-degree view of each customer, allowing banks to anticipate needs, personalize services, and provide a seamless experience. In today’s competitive financial landscape, these capabilities are not just beneficial; they’re essential.

The Evolution of CRM in Banking

The landscape of CRM in the banking industry has undergone a radical transformation. Once characterized by manual, fragmented processes, the sector is now embracing automated, data-driven systems that harness the power of analytics and artificial intelligence. Modern CRM solutions now offer features such as omnichannel engagement and mobile-first experiences, enabling banks to meet the rising expectations of tech-savvy consumers.

This evolution is not merely a response to changing customer demands; it’s a proactive strategy for survival in an increasingly competitive marketplace. The shift from traditional methods to innovative, technology-driven solutions marks a critical juncture for banking professionals looking to thrive.

Key Features of a Powerful CRM System for Banks

Centralized Customer Data Management

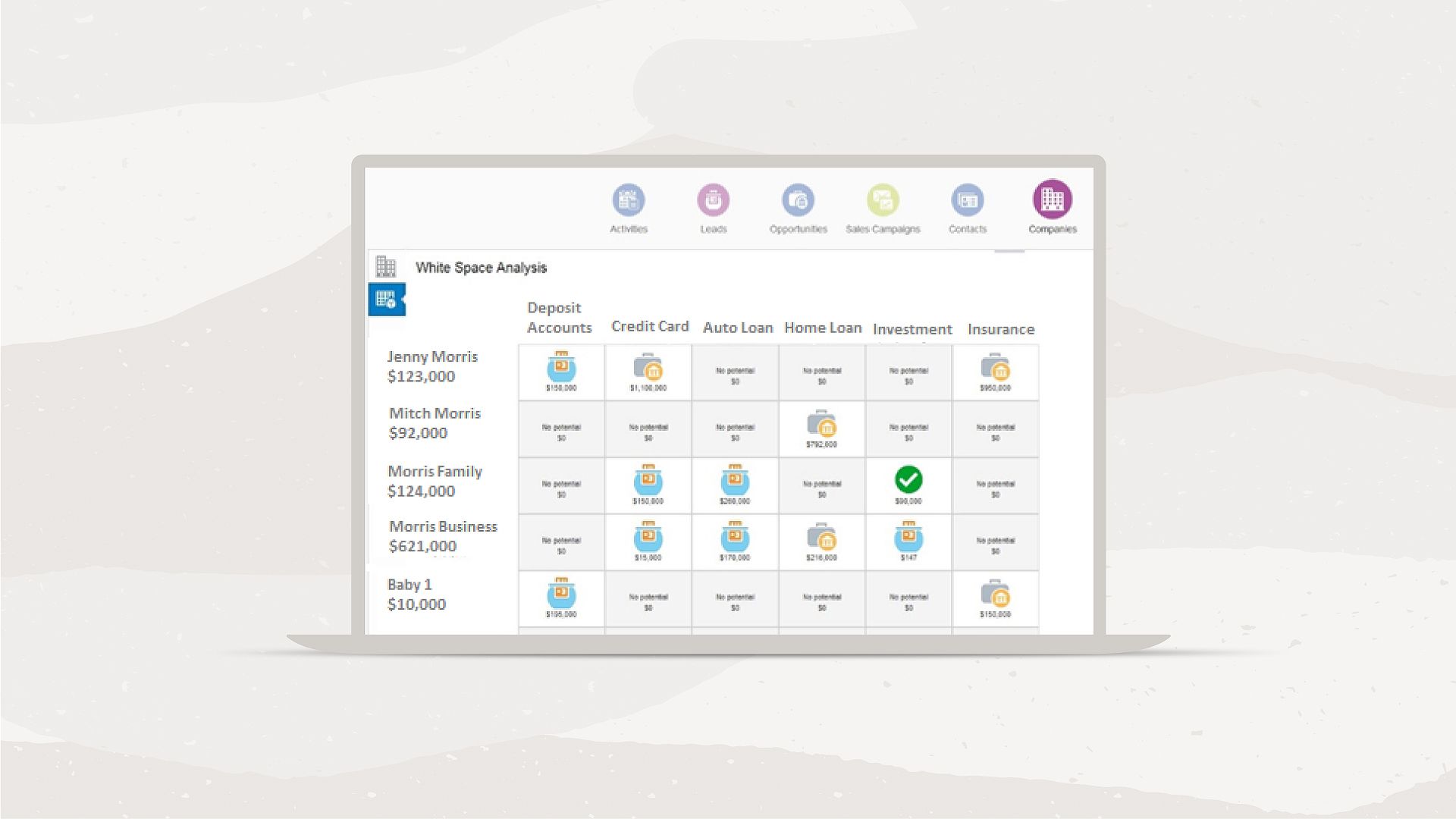

At the heart of any effective CRM system is the ability to consolidate customer data from multiple sources. This centralized approach provides a comprehensive view of each client, capturing their financial history, preferences, and interactions. With this wealth of information at their fingertips, relationship managers can engage in meaningful conversations, tailor financial products, and resolve issues more efficiently.

Moreover, a unified customer profile minimizes the risk of data silos, which can lead to inconsistent customer experiences. By employing CRM software for the banking industry, banks can not only enhance customer satisfaction but also build trust and loyalty, which are vital for long-term success.

Sales and Marketing Automation

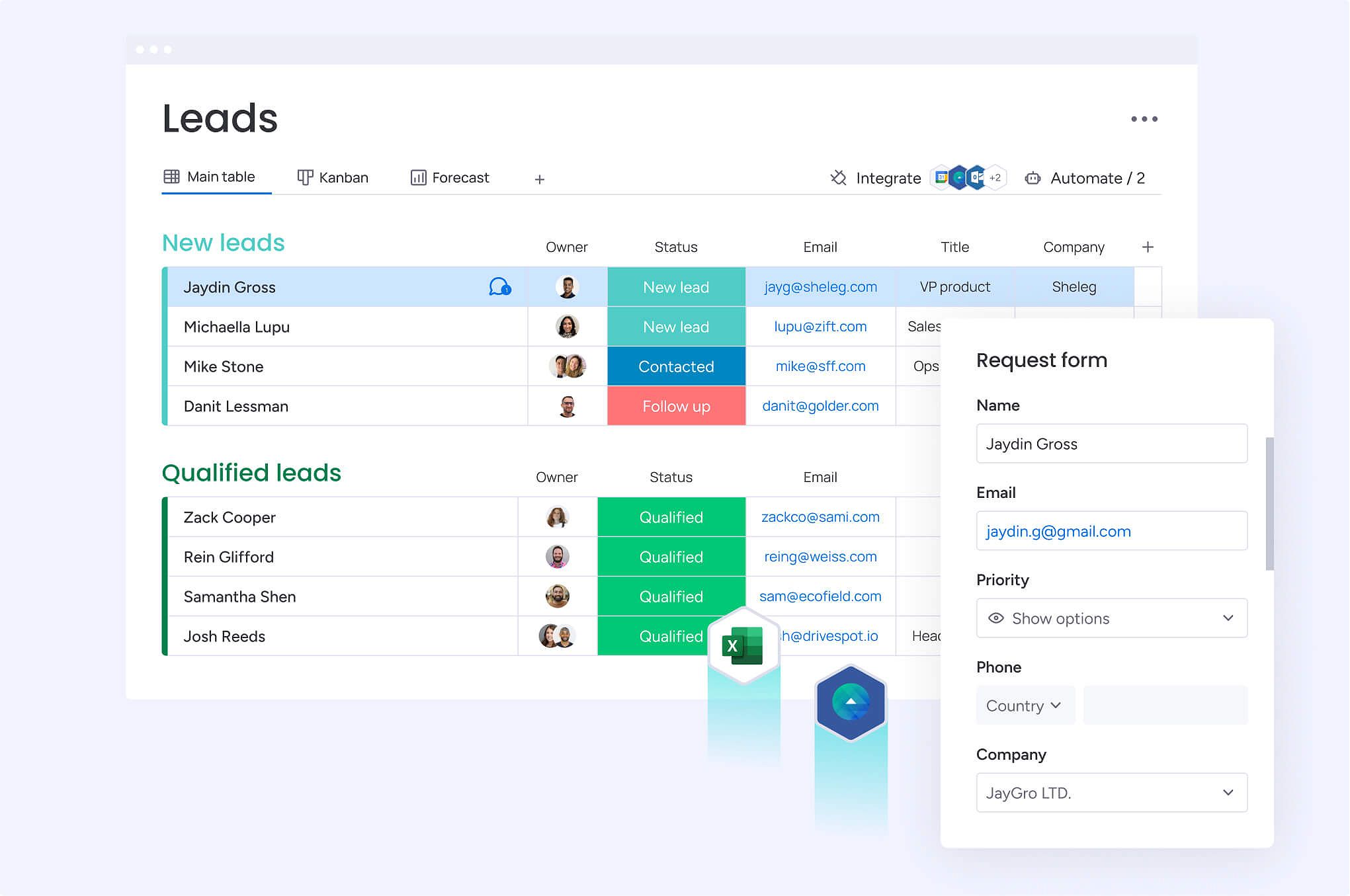

In an environment where every second counts, CRM systems in the banking industry automate a variety of sales and marketing processes. From lead generation and nurturing to targeted outreach and cross-selling, these systems streamline efforts and identify promising opportunities.

1. https://viralblogspost.com/third-party-logistics-industry

3. https://viralblogspost.com/the-timeless-allure-of-the-cartier-love-necklace

4. https://viralblogspost.com/samsung-heavy-industries-co

5. https://viralblogspost.com/global-industrial-distribution-inc

Features like campaign management and lead scoring empower relationship managers to engage customers effectively, while marketing automation tools enable banks to execute targeted campaigns based on customer behavior. By analyzing data, banks can segment their audience and deliver personalized messages that resonate deeply with clients. The precision of this approach not only enhances engagement but also significantly boosts conversion rates.

Customer Service and Support

Exceptional customer service is non-negotiable in the banking sector. CRM systems play a crucial role in delivering that level of service. With features like case management, ticketing systems, and knowledge bases, banks can provide quick and efficient support to clients.

Centralizing customer interactions and maintaining a comprehensive history allows banks to resolve issues swiftly and personalize the service experience. Furthermore, incorporating self-service options through CRM can empower customers to find answers independently, enhancing their overall experience. This capability not only increases customer satisfaction but also alleviates the burden on customer service representatives.

Choosing the Right CRM System for Your Bank

When it comes to selecting a CRM system for your bank, a thoughtful approach is crucial. Here are several factors to consider:

Factors to Consider

- Budget and Pricing Models: Assess the vendor’s pricing structure to ensure it aligns with your bank’s financial strategy. Some vendors offer tiered pricing based on features, while others may have flat-rate models.

- User-friendliness and Ease of Implementation: Opt for a platform that is intuitive and minimizes the learning curve for staff. A user-friendly interface can significantly enhance adoption rates.

- Integration with Existing Systems: Ensure seamless integration with core banking software and other applications. This reduces redundancy and enhances data accuracy.

- Scalability and Future Growth Potential: Choose a solution that can accommodate your bank’s growth and evolving needs. As your customer base expands, your CRM should scale without sacrificing performance.

- Data Security and Compliance: Prioritize vendors with robust security measures and a track record of compliance with industry regulations. Protecting customer data is paramount in the banking sector.

- Vendor Reputation and Experience in the Banking Industry: Select a provider with a strong understanding of the banking sector and a proven track record of successful implementations. Industry expertise can significantly impact the effectiveness of the solution.

Types of CRM Solutions

Banks have several options when it comes to CRM solutions, including on-premise, cloud-based, and specialized banking CRM platforms. On-premise systems offer greater control and customization but may require significant IT resources. Cloud-based solutions provide flexibility and scalability, while specialized platforms are tailored to the unique needs of the financial sector, often integrating seamlessly with core banking systems.

The choice of CRM type should align with your bank’s operational requirements and long-term strategy. In today’s hybrid work environments, cloud-based solutions can facilitate remote access and collaboration, making them increasingly appealing.

Tips for Successful CRM Implementation

Implementing a CRM system is not just about technology; it’s about people and processes. Here are some practical tips for a successful rollout:

1. https://viralblogspost.com/industrial-psychology-masters-programs

2. https://viralblogspost.com/classic-industries-promo-code

3. https://viralblogspost.com/process-in-bpo-industry

4. https://viralblogspost.com/project-management-software-for-construction-industry

5. https://viralblogspost.com/scheduling-software-construction-industry

- Define Clear Goals and Objectives: Identify the key challenges your bank faces and how a CRM system can address them. Establish measurable goals to guide the implementation process.

- Get Buy-in from All Stakeholders: Ensure that all departments—from sales and marketing to customer service and operations—are on board with the CRM implementation. This collaborative approach fosters ownership and accountability.

- Train Staff Properly: Comprehensive training is essential for employees to leverage the CRM system effectively. Ongoing training can help staff adapt to updates and new features.

- Start with a Pilot Project: Launching a pilot program allows you to test the CRM system, refine processes, and address challenges before a full-scale rollout. This approach can help identify potential pitfalls and optimize workflows.

- Monitor and Evaluate Performance: Continuously track the performance of your CRM system, and be prepared to make adjustments as needed. Regular evaluations can ensure that the system meets your bank’s evolving needs.

The Future of CRM in Banking

The Rise of AI and Machine Learning

As the banking industry continues to evolve, emerging technologies like AI and machine learning are transforming CRM systems. These advancements enable banks to personalize customer experiences and automate tasks with greater accuracy and efficiency.

AI-powered chatbots and virtual assistants are enhancing customer service by providing 24/7 support and instant responses to queries. Meanwhile, machine learning algorithms can analyze vast amounts of data to identify customer patterns and predict future behavior, allowing banks to proactively address customer needs.

The Importance of Data Security and Privacy

In the age of heightened data privacy concerns, the role of data security and compliance in CRM systems has become paramount. Banks must implement robust security measures and ensure compliance with industry regulations, such as GDPR, to maintain customer trust and safeguard sensitive information.

By prioritizing data security and privacy, banks can demonstrate their commitment to protecting customer data, which is essential in building long-term relationships and fostering a positive brand reputation.

The Integration of CRM with Fintech Solutions

As the financial landscape continues to evolve, banks are increasingly integrating their CRM systems with cutting-edge fintech solutions. This integration allows banks to offer innovative financial products and services, enhancing the overall customer experience.

By leveraging the power of CRM and seamlessly integrating it with fintech technologies, banks can stay ahead of the competition and cater to the ever-changing needs of their customers. This synergy between traditional banking and fintech innovations is poised to shape the future of the industry.

Conclusion

In the rapidly evolving banking landscape, a well-implemented CRM system is not just a tool; it’s a strategic asset that drives customer engagement, streamlines operations, and fosters sustainable growth. By leveraging centralized data management, sales and marketing automation, customer service optimization, and data-driven insights, banks can deliver a personalized experience that builds loyalty and trust.

For banking professionals, embracing the transformative potential of CRM systems is crucial to staying ahead of the competition and meeting the demands of today’s tech-savvy consumers. By carefully selecting the right CRM solution and implementing it with a strategic, customer-centric approach, banks can unlock a world of opportunities and secure their position as leaders in the financial services industry. The future is here, and it begins with the right CRM system in the banking industry.

Leave a Reply