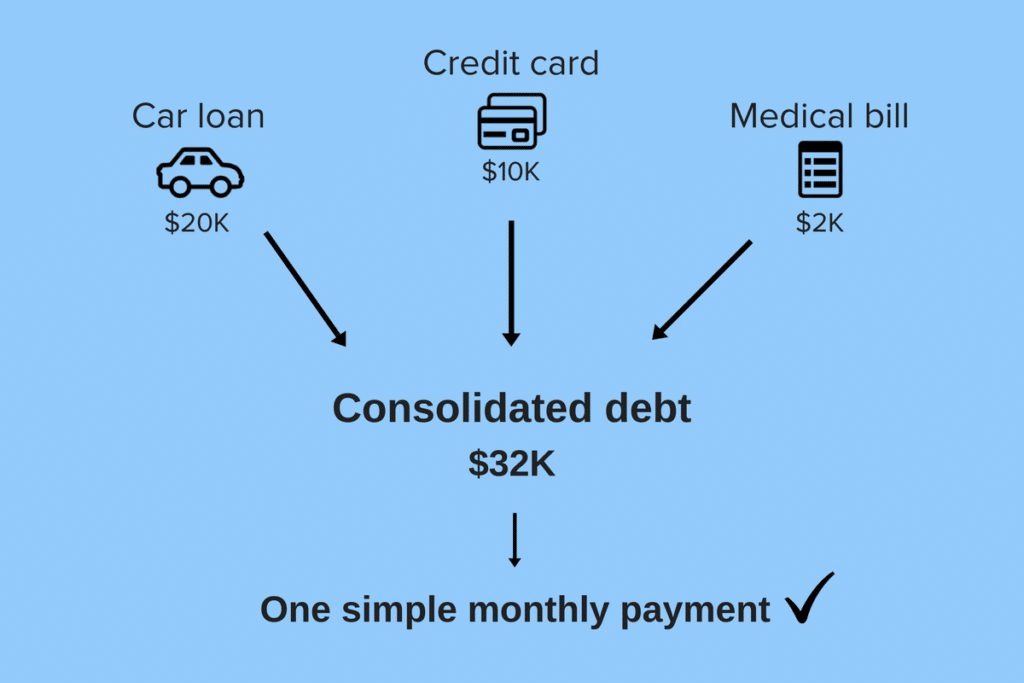

Bill Consolidation Debt is a process that involves combining multiple outstanding debts into one single loan. This is often done through a financial institution or a debt consolidation company. The main purpose of this type of debt consolidation is to make it easier for individuals to pay off their debts, usually at a lower interest rate and with lower monthly payments.

Toc

Introduction of Bill Consolidation Debt

Debt is a common burden that many people face in their daily lives. Whether it’s from credit card bills, medical expenses, or student loans, the weight of debt can be overwhelming and have a negative impact on one’s financial well-being. In such situations, bill consolidation debt can provide individuals with a way to regain control over their finances and ultimately achieve financial freedom.

The concept of bill consolidation debt involves taking out a new loan to pay off multiple existing debts. By consolidating these debts into one loan, individuals are left with only one monthly payment to make instead of juggling multiple payments at different interest rates. This not only simplifies the repayment process but also often results in lower interest rates and monthly payments, making it more manageable for individuals to pay off their debts.

Understanding Bill Consolidation Debt

Are you feeling financially overwhelmed by multiple debts? Bill consolidation debt might be the solution you need. This financial strategy combines various debts into a single, manageable monthly payment, potentially reducing your overall monthly expenses and helping you regain control over your finances. In this article, we’ll delve into the benefits of bill consolidation debt, who can benefit from it, how it works, and the steps you need to take for successful debt consolidation.

Benefits of Bill Consolidation Debt

One of the main benefits of bill consolidation debt is that it can help individuals save money. By consolidating multiple high-interest debts into one lower interest loan, individuals can potentially save thousands of dollars in interest over time. In addition, with a single monthly payment and a set repayment plan, individuals are less likely to miss payments or incur late fees, which can also lead to savings.

Another advantage of bill consolidation debt is that it can improve an individual’s credit score. With multiple debts paid off through consolidation, there are fewer accounts with outstanding balances on one’s credit report. This can positively impact one’s credit score and demonstrate responsible financial management to potential lenders.

Furthermore, bill consolidation debt can help individuals avoid bankruptcy. By consolidating their debts, individuals can avoid the negative consequences of filing for bankruptcy, which can have long-lasting effects on one’s credit score and financial reputation.

Types of Bill Consolidation Loans

There are several types of bill consolidation loans, including:

- Personal Loans: Unsecured loans that can be used to consolidate various types of debts.

- Home Equity Loans: Secured loans that use your home as collateral, often offering lower interest rates.

- Balance Transfer Credit Cards: Credit cards with low or 0% introductory interest rates that can be used to pay off existing credit card debts.

The Process of Bill Consolidation Debt

The first step in the process of bill consolidation debt is to evaluate one’s current financial situation. Then…

Step 1: Assess Your Financial Situation

Before proceeding with bill consolidation debt, take a comprehensive look at your financial situation. Gather all relevant information regarding your outstanding debts, including the amounts owed, interest rates, and monthly payment obligations. This will help you determine if bill consolidation is the right strategy for you and identify which debts can be consolidated.

Step 2: Choose a Debt Consolidation Method

There are various methods to consolidate debt, such as a debt consolidation loan, a balance transfer credit card, or a home equity loan. Research the options available and choose the one that best suits your financial situation. Each method has its pros and cons, so it’s important to understand the terms and conditions associated with each.

Step 3: Apply for a Debt Consolidation Loan

If you decide to take out a debt consolidation loan, you’ll need to apply through a financial institution. This process typically involves providing detailed financial information, such as your income, employment history, and credit score. The lender will review your application and, if approved, will issue a loan that covers your existing debts.

1. https://viralblogspost.com/mmoga-online-masters-in-finance

2. https://viralblogspost.com/mmoga-beyond-finance-log-in

3. https://viralblogspost.com/mmoga-best-small-business-financing

4. https://viralblogspost.com/mmoga-finance-and-accounting-outsourcing-companies

5. https://viralblogspost.com/mortgage-financing-for-self-employed

Step 4: Use the Loan to Pay Off Debts

Once you receive the loan, use the funds to pay off your existing debts in full. This step is crucial, as it ensures that you are left with only one loan to focus on. Be diligent in making sure all previous debts are paid off to avoid any further financial complications.

Step 5: Repay the Debt Consolidation Loan

Now that your debts are consolidated, focus on repaying the new loan. Set up a manageable repayment plan that aligns with your budget, and make regular, on-time payments. This will help you stay on track and avoid falling back into debt.

Step 6: Monitor Your Credit and Financial Health

Throughout the debt consolidation process, keep an eye on your credit report and financial health. Regularly checking your credit score and monitoring your financial progress will help you stay informed and make any necessary adjustments to your repayment plan.

Bill consolidation debt can be a powerful tool for managing and overcoming debt. By following these steps, you can simplify your financial obligations, save money, and work towards achieving financial stability and freedom.

Factors to Consider Before Opting for Bill Consolidation Debt

Top factors to consider before opting for bill consolidation debt include:

- The total amount of debts to be consolidated

- The interest rates and monthly payments on existing debts

- Your credit score and income level

- The terms and conditions of the debt consolidation method you choose

- Any potential fees or penalties associated with consolidating your debts

Before deciding on bill consolidation debt, it’s important to carefully consider these factors and make an informed decision that is best for your individual financial situation.

Who Can Benefit from Bill Consolidation Debt?

Financially Overwhelmed Individuals: If you’re feeling overwhelmed by multiple debts and struggling to keep up with payments, bill consolidation debt can provide much-needed relief. By simplifying and reducing your monthly payments, you can regain control over your finances.

Those Looking to Improve Their Credit Scores: Individuals with poor or average credit scores can benefit from bill consolidation debt by making timely payments on their consolidated loan. Over time, this can lead to an improved credit score and better financial opportunities.

Individuals Seeking a Clear Path to Debt Freedom: If you’re looking for a structured and clear path to becoming debt-free, bill consolidation debt can help. With a single monthly payment and a set repayment plan, you can work towards financial freedom with confidence.

Case Studies: Real-Life Examples of Bill Consolidation Debt

To further understand the benefits and effectiveness of bill consolidation debt, here are two real-life case studies:

Case Study 1: John’s Credit Card Debts

John had accumulated a significant amount of credit card debt with various high-interest rates. He was struggling to make minimum payments each month and felt overwhelmed by his financial obligations. After researching his options, John decided to apply for a debt consolidation loan. With the loan, he paid off all of his credit card debts in full and was left with one manageable monthly payment at a lower interest rate. This allowed him to pay off his debts more quickly and improve his credit score.

Case Study 2: Sarah’s Student Loans

Sarah had multiple student loans with varying interest rates and monthly payments. She found it challenging to keep up with her repayments while also managing other expenses. After considering her options, Sarah chose to consolidate her student loans through a balance transfer credit card. The 0% introductory interest rate gave her some breathing room, allowing her to focus on paying off the loans without accumulating additional interest charges.

Case Study 3: Jane M.’s Success Story

Jane M., a single mother, was juggling multiple credit card debts and a personal loan, each with high monthly payments. After consolidating her debts into a single loan with a lower interest rate, she reduced her monthly payment by 30%, making it easier to manage her finances and save for her children’s education.

Case Study 4: John D.’s Journey

John D., a recent graduate, found himself with student loan debt, a car loan, and credit card debt. By opting for a debt consolidation plan, he was able to combine his debts into one loan with a lower interest rate, saving him over $200 a month. This not only made his monthly payments more manageable but also allowed him to pay off his debts faster.

Case Study 5: Sarah and David’s Transformation

Sarah and David, a couple struggling with credit card debt from their wedding and home renovation, were able to regain control of their finances by consolidating their debts. Not only did they reduce their monthly payments, but they also improved their credit scores by making timely payments. They are now on track to be debt-free in the next three years.

1. https://viralblogspost.com/local-roofing-companies-that-finance

2. https://viralblogspost.com/mmoga-best-small-business-financing

3. https://viralblogspost.com/mmoga-master-of-science-in-finance

4. https://viralblogspost.com/mmoga-masters-in-finance-vs-mba

5. https://viralblogspost.com/mmoga-bachelors-degree-in-finance

These case studies illustrate how bill consolidation debt can significantly impact the financial well-being of individuals, making it easier to manage and pay off debts, improve credit scores, and pave the way towards a debt-free future.

Financial Expert Insights

Jane Doe, Certified Financial Planner: “Bill consolidation debt can be an effective strategy for those struggling with multiple high-interest debts. By consolidating these debts into one manageable payment, individuals can reduce their overall interest costs and simplify their financial lives. However, it’s crucial to choose the right consolidation method and ensure that it aligns with your long-term financial goals.”

John Smith, Personal Finance Advisor: “It’s important to understand that while bill consolidation debt can provide immediate relief, it is not a cure-all solution for underlying financial issues. Individuals must also adopt disciplined spending habits and create a sustainable budget to avoid falling back into debt.”

Testimonials from People Who Have Used Bill Consolidation Debt

Emily R., 32, Teacher: “I was drowning in credit card debt with interest rates that were just too high. Opting for a bill consolidation loan helped me take control of my finances. The single monthly payment was much easier to manage, and I could finally see a path to becoming debt-free.”

Michael B., 45, Small Business Owner: “As a business owner, I had accumulated a significant amount of debt. Bill consolidation allowed me to lower my monthly payments and save on interest. It was a game-changer for my financial well-being and helped me focus on growing my business.”

Sophia L., 29, Healthcare Worker: “Consolidating my student loans and credit card debts into one loan was one of the best financial decisions I’ve made. It gave me peace of mind and made my financial situation much more manageable.”

Industry Recommendations

National Debt Relief: “For those considering bill consolidation, make sure to take the time to evaluate all available options and understand the terms associated with each. Consulting with a financial advisor can also provide personalized guidance and ensure that you choose the best solution for your unique financial situation.”

Financial Counseling Association of America: “Debt consolidation can be a beneficial tool, but it should be part of a larger financial strategy. Individuals should also seek to improve their financial literacy and develop strong money management skills to maintain long-term financial health.”

By integrating expert insights and real-life testimonials, you can better understand the potential benefits and considerations of bill consolidation debt. This balanced perspective can assist you in making a more informed and confident decision.

Conclusion

Bill consolidation debt provides a valuable solution for those feeling financially overwhelmed by multiple debts. By simplifying your payments, potentially reducing your monthly expenses, improving your credit score, and offering a clear path to debt freedom, bill consolidation debt can help you regain control over your finances and achieve financial peace of mind.

If you’re ready to take the first step towards financial recovery, consider bill consolidation debt as a viable option. Assess your current financial situation, choose the right consolidation method, and stay disciplined in your new repayment plan. With dedication and perseverance, you can pave the way to a debt-free future and enjoy the financial freedom you deserve.

Meta Description

Learn how bill consolidation debt can simplify your payments, lower your monthly expenses, and pave the way to financial freedom. Ideal for the financially overwhelmed, find out how it works and the benefits it offers to regain control over your finances.

Leave a Reply