As someone who has navigated the often-confusing world of car insurance, I know firsthand the importance of having the right customer service number at your fingertips. Whether you’re a new Progressive insurance customer or have been with them for years, being able to quickly and easily reach their support team can make all the difference when you need help.

Toc

- 1. The Progressive Insurance Customer Service Number: Your Trusted Lifeline

- 2. Exploring Progressive’s Multichannel Support Options

- 3. Related articles 01:

- 4. What to Expect from Progressive’s Customer Service

- 5. Weighing the Pros and Cons of Progressive’s Customer Service

- 6. Comparing Progressive’s Customer Service to the Competition

- 7. Tips for a Smooth Customer Service Experience with Progressive

- 8. Related articles 02:

- 9. FAQ

- 10. Conclusion

In this comprehensive guide, I’ll share the essential Progressive insurance customer service number and walk you through the various channels available to get the assistance you need. From filing a claim to managing your policy, I’ll equip you with the knowledge to have a smooth and efficient experience every time you reach out.

The Progressive Insurance Customer Service Number: Your Trusted Lifeline

The primary Progressive insurance customer service number is 1-800-PROGRESSIVE (1-800-776-4737). This number is available 24/7 and can be used for a wide range of inquiries, including:

- Obtaining a quote for new or updated coverage

- Reporting an accident or filing a claim

- Making changes to your existing policy

- Addressing general customer service questions

According to Progressive’s own data, the average wait time for phone calls is around 5 minutes. While this can vary depending on the time of day and call volume, it’s a relatively quick response time compared to many other insurance providers.

When you call this number, you’ll be greeted by an automated system that will guide you through the available options. If you prefer to speak directly with a representative, you can navigate through the prompts to reach the appropriate department. This streamlined approach is designed to get you the help you need as efficiently as possible.

Exploring Progressive’s Multichannel Support Options

While the phone number is the primary way to reach Progressive’s customer service, the company also offers several other channels for assistance. This diverse approach ensures that you can engage with them in the manner that best suits your preferences and needs.

The Progressive Website: Your Online Helpdesk

The Progressive website (progressive.com) has a dedicated “Contact Us” section where you can find a range of options for getting in touch, including email and online forms. The website also provides a wealth of self-service resources, such as FAQs and policy management tools. If you prefer to handle your inquiries digitally, you can easily find answers to common questions without needing to wait for a representative.

The Progressive Mobile App: Convenience at Your Fingertips

The Progressive mobile app (available for iOS and Android) allows you to manage your policy, file claims, and contact customer service directly from your smartphone. The app’s customer service features include the ability to chat with a representative or request a call-back. This convenient tool makes it easy to access your insurance information and get assistance while on the go, ensuring that you can stay on top of your policy no matter where life takes you.

Progressive’s Social Media Presence: Connecting for Support

In addition to their phone and digital channels, Progressive maintains active social media pages on platforms like Facebook, Twitter, and Instagram. While these channels may not be suitable for sharing sensitive information, they can be helpful for general inquiries and providing feedback to the company. Engaging with Progressive on social media can also keep you informed about promotions, policy updates, and other important announcements.

When choosing the best way to contact Progressive, consider your specific needs and preferences. The phone line offers immediate assistance, but the website and app may be more convenient for simple tasks or routine policy management. Ultimately, having multiple options at your disposal can help ensure you get the support you need, exactly when you need it.

1. https://viralblogspost.com/mmoga-auto-insurance-quotes-texas

2. https://viralblogspost.com/mmoga-seven-corners-travel-insurance

3. https://viralblogspost.com/car-insurance-quotes-ohio

4. https://viralblogspost.com/why-life-insurance-rates-are-the-lowest-theyve-been-in-20-years

5. https://viralblogspost.com/errors-and-omissions-insurance-quote

What to Expect from Progressive’s Customer Service

As you navigate the world of car insurance, it’s important to have a clear understanding of what to expect when it comes to customer service. After all, the quality of support can make all the difference in how you experience your relationship with your insurance provider.

When it comes to Progressive, the company aims to provide a responsive and helpful experience. Their representatives are generally knowledgeable and eager to assist customers, though the quality of the interaction can sometimes vary depending on the individual agent.

In terms of response times, Progressive’s phone support is available 24/7, with the aforementioned average wait time of around 5 minutes. For email inquiries and social media messages, the company typically responds within 1-2 business days. This level of responsiveness is critical for customers who need timely assistance, especially when dealing with claims or urgent policy changes.

Customer feedback on Progressive’s customer service is mixed, with some praising the company’s efficiency and professionalism, while others have reported longer wait times or difficulty resolving complex issues. However, the overall satisfaction ratings for Progressive’s customer service tend to be on par with or slightly above the industry average. This balance suggests that while there may be room for improvement, many customers find value in the support they receive.

Weighing the Pros and Cons of Progressive’s Customer Service

As you consider Progressive as your car insurance provider, it’s important to carefully evaluate the pros and cons of their customer service offerings. This will help you make an informed decision and set appropriate expectations for the level of support you can expect.

Pros:

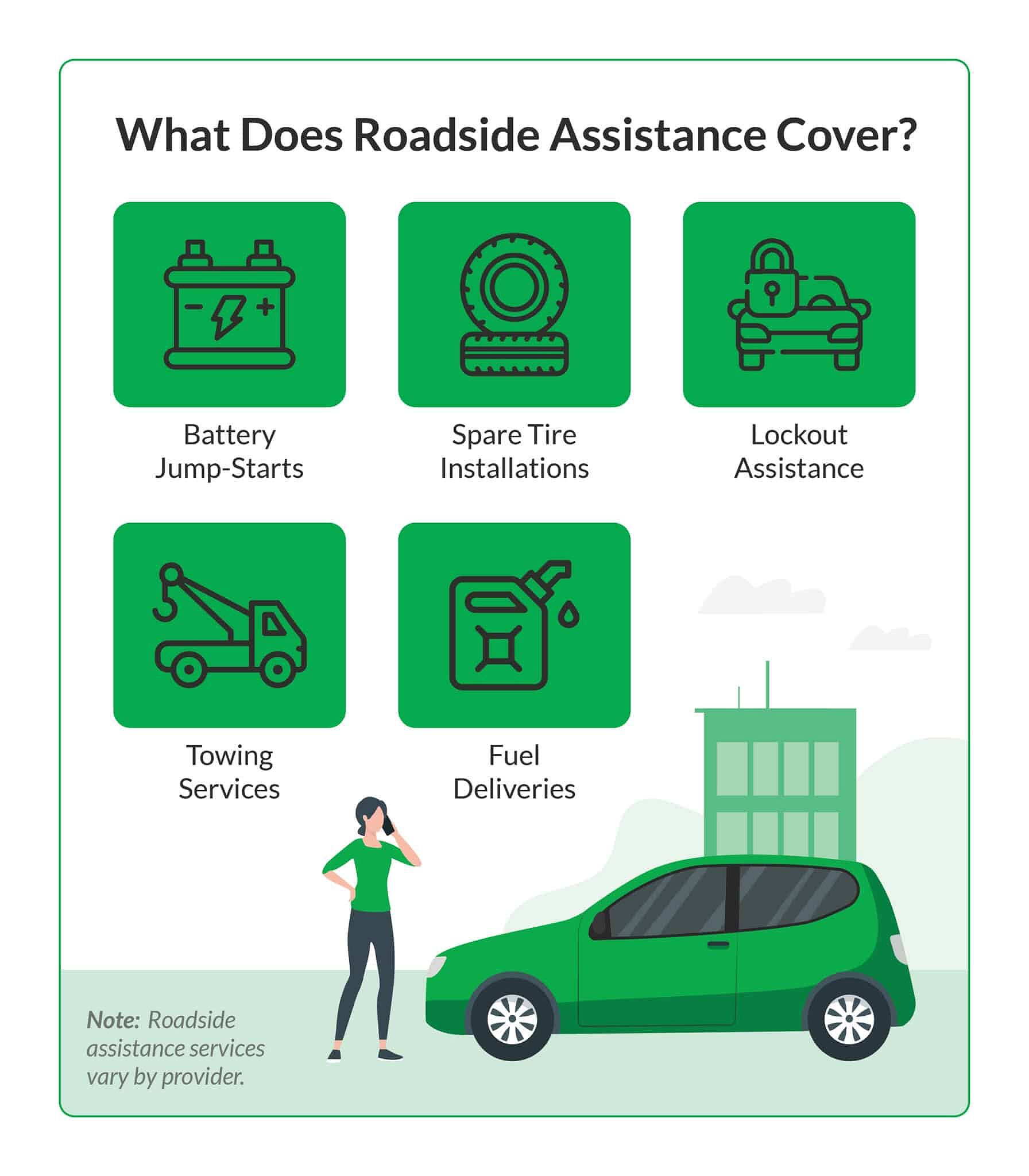

- Availability: Progressive’s customer service is available 24/7 via phone, with additional support channels like the website and mobile app.

- Multiple Channels: Customers can choose from a variety of contact options, including phone, website, app, and social media, allowing for flexibility based on personal preference.

- Knowledgeable Representatives: Progressive’s customer service agents are generally well-versed in the company’s policies and procedures, providing informed assistance to customers.

- Prompt Response Times: While not always immediate, Progressive’s response times for phone calls, emails, and social media inquiries are generally considered reasonable, helping to minimize frustration for customers.

Cons:

- Potential Wait Times: While the average wait time is around 5 minutes, callers may experience longer wait times during peak hours or when call volume is high, which can be frustrating for those needing immediate assistance.

- Limited Online Functionality: The website and mobile app may not be suitable for handling more complex inquiries or policy changes, which can necessitate a phone call.

- Varying Customer Experiences: As with any large insurance provider, the quality of the customer service experience can sometimes vary depending on the individual agent and the specific issue being addressed. Some customers may find certain representatives more helpful than others.

By weighing these pros and cons, you can get a clearer picture of what to expect when it comes to Progressive’s customer service, helping you determine if their offering aligns with your needs and preferences.

Comparing Progressive’s Customer Service to the Competition

When evaluating Progressive as a car insurance provider, it’s important to consider how their customer service stacks up against other major players in the industry. By understanding the strengths and weaknesses of Progressive’s support channels relative to the competition, you can make a more informed decision about the right coverage for your needs.

In terms of phone support, Progressive, Geico, and USAA all offer 24/7 availability, while State Farm’s customer service is generally limited to business hours. When it comes to average wait times, Progressive and Geico tend to have shorter wait times than State Farm and USAA, making them more appealing options for customers seeking quick assistance.

Customer satisfaction ratings can also be an important consideration. According to the latest J.D. Power U.S. Auto Insurance Study, Progressive scored slightly above the industry average, while Geico and USAA were among the top-ranked providers for customer service. This suggests that while Progressive is competitive, some customers may prefer the service offered by these other companies.

Ultimately, the best customer service experience will depend on your individual needs and preferences. It’s recommended to research and compare the offerings of multiple insurers to find the right fit for your car insurance coverage. Customer reviews and feedback can be invaluable in assessing which provider aligns best with your expectations.

Tips for a Smooth Customer Service Experience with Progressive

To ensure a positive customer service experience with Progressive, consider implementing the following strategies:

1. https://viralblogspost.com/selective-insurance-agent-login

2. https://viralblogspost.com/shop-for-car-insurance

4. https://viralblogspost.com/the-basics-of-insurance-understanding-the-different-types

5. https://viralblogspost.com/errors-and-omissions-insurance-quote

- Gather Your Information: Before contacting Progressive, have your policy number, driver’s license, and any other relevant details ready to provide to the customer service representative. Being prepared can help expedite the process and make the interaction more efficient.

- Choose the Right Channel: Use the phone for urgent matters or complex inquiries, the website for general information and policy management, and the mobile app for quick updates or simple requests. Selecting the appropriate channel can save you time and ensure your concerns are addressed effectively.

- Be Patient and Polite: Remember that the customer service representatives are there to help you, so approach the interaction with a positive and understanding attitude. Politeness can go a long way in fostering a productive conversation.

- Document Your Interactions: Keep a record of any phone calls, emails, or chat transcripts for future reference, in case you need to follow up on a request or issue. Documentation can help ensure continuity in your communication with Progressive.

- Follow Up if Necessary: If you don’t receive a timely response to your inquiry or if your issue remains unresolved, don’t hesitate to follow up. Persistence can often lead to quicker resolutions.

By following these tips, you can help ensure a smooth and efficient customer service experience with Progressive, no matter how you choose to get in touch.

FAQ

Q: What is the best way to contact Progressive customer service?

A: The best way to contact Progressive customer service depends on your specific needs and preferences. You can call the main number at 1-800-PROGRESSIVE (1-800-776-4737), use the website, the mobile app, or reach out through their social media channels.

Q: What are Progressive’s customer service hours?

A: Progressive’s customer service is available 24/7 by phone. You can also access their website and mobile app at any time to manage your policy or file a claim.

Q: How long does it typically take to reach a Progressive customer service representative?

A: According to Progressive’s customer service metrics, the average wait time for phone calls is around 5 minutes. However, wait times can vary depending on the time of day and the volume of calls.

Q: What if I have a complaint about Progressive customer service?

A: If you have a complaint about Progressive’s customer service, you can escalate the issue to a supervisor or file a formal complaint with the company. You can also contact your state’s insurance commissioner if you’re not satisfied with the resolution.

Conclusion

Knowing the Progressive insurance customer service number is essential for managing your policy, filing claims, and getting answers to your questions. While phone support is available 24/7, Progressive also offers a variety of other customer service channels, including their website, mobile app, and social media. This multi-channel approach ensures that you can reach out in a way that best suits your needs.

Before making a decision about car insurance, it’s crucial to research and compare customer service experiences across different providers. Use the information in this article to evaluate Progressive’s customer service and see if it aligns with your expectations. With the right coverage and support, you can drive with confidence, no matter where the road takes you. Ensuring that you have access to effective customer service can significantly enhance your overall experience with your insurance provider, making it easier to navigate the complexities of car insurance when the need arises.

Leave a Reply