When buying a house, it’s crucial to prioritize safeguarding your most valuable asset. Home insurance provides peace of mind, protecting your finances from unexpected calamities. Explore homeowners insurance and the best home insurance providers in 2023 to ensure the safety of your property and investments.

Toc

- 1. What does homeowners insurance cover?

- 2. What does homeowners insurance not cover?

- 3. Do you really need homeowners insurance?

- 4. How to pick the best homeowners insurance company

- 5. What kind of coverage do you need?

- 6. How coverage limits work

- 7. How much coverage do you need?

- 8. How deductibles work

- 9. What does homeowners insurance usually cost?

- 10. Related articles 01:

- 11. How to get cheaper homeowners insurance

- 12. How we picked the best companies

- 13. Best Choice: Lemonade

- 14. Best for customizable coverage: Allstate

- 15. Best for new homeowners: Hippo

- 16. Related articles 02:

- 17. Best for in-person support: State Farm

- 18. Best for discounts: Progressive

- 19. Best for guaranteed replacement cost coverage: ERIE Insurance

- 20. Best for customer satisfaction: Amica

- 21. Best for military families: USAA

- 22. Summary

What does homeowners insurance cover?

Home insurance offers protection against unforeseen accidents, whether caused by natural disasters or third parties.

Most homeowners’ insurance policies safeguard your property from common weather events and hazards such as fire, smoke, snow, freezing, lightning, windstorms, tornadoes, hurricanes, and falling objects like trees or power lines. Additionally, these policies typically cover theft, vandalism, and damage caused by other vehicles.

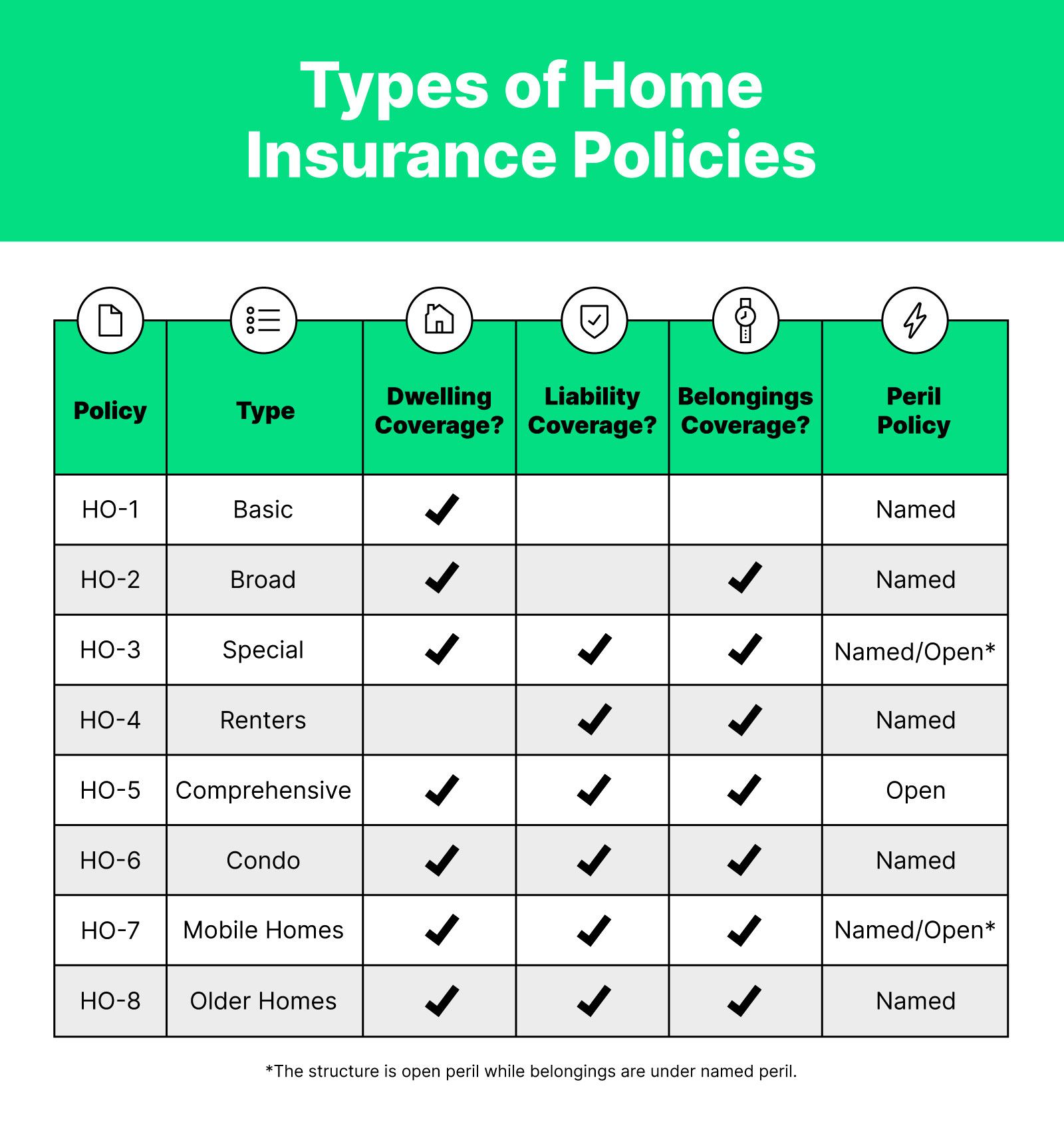

The HO-3 policy is a widely chosen type of coverage, safeguarding:

– Your home and structures on the property

– Your personal belongings

– Living expenses and medical costs

– Liability expenses in case of a lawsuit

In the event of damage due to a covered peril, your home insurance will assist with reimbursing some or all of the incurred expenses for repairs or replacements.

Coverage for personal belongings varies depending on the item and the cause of damage. While items like clothing damaged in a house fire are generally covered, more valuable possessions may not be automatically included.

Scheduled personal property coverage extends protection to valuable items such as jewelry, art, antiques, and collectibles. To file a claim for scheduled personal property, you would need to determine the value of the damaged or stolen items, often requiring an appraisal.

In situations where you are displaced or injured due to a covered disaster, your home insurance provider may cover living expenses and medical fees. Liability coverage can also assist in paying legal expenses arising from incidents on your property.

What does homeowners insurance not cover?

Home insurance typically excludes coverage for natural wear and tear or neglect-related issues. Instances like mold, rot, and insect damage fall under this category. For instance, termites can be deterred by appropriately maintaining your home’s foundation and replacing decaying wood, making termite damage generally ineligible for home insurance coverage.

Flood insurance and earthquake insurance are commonly omitted from homeowners’ policies. Flood coverage is usually not part of home insurance due to the high costs associated with floods and water damage, which are deemed more preventable than other mishaps.

Nonetheless, protection against floods is crucial, particularly for residents in flood-prone areas like low-lying or coastal cities. Obtaining an additional policy is advisable, and in high-risk zones, mortgage requirements may mandate flood insurance. While some homeowners’ insurance providers offer flood insurance as an optional supplement, many do not include it in their standard policies, necessitating a separate policy.

For flood insurance, consider acquiring coverage through The National Flood Insurance Program, overseen by the Federal Emergency Management Agency.

Do you really need homeowners insurance?

Homeowners insurance is a crucial necessity for homeowners, providing essential protection for your property and belongings. While not mandated by law, most mortgage lenders require this coverage. You have the flexibility to select your insurance provider and policy, but maintaining this coverage is typically mandatory until your mortgage is paid off. Additionally, your mortgage lender may request additional coverage like flood damage protection.

Renters insurance versus home insurance?

Individuals residing in apartments typically have a renters insurance policy. If transitioning from renters insurance to home insurance, you may be contemplating the anticipated changes.

Renters insurance and home insurance encompass many similar areas of coverage, encompassing protection against natural disasters and theft. However, distinct disparities exist.

For instance, renters insurance generally provides limited liability coverage. Both forms of insurance protect against accidental damage to personal possessions, yet solely homeowners insurance includes coverage for structural damages to the property.

How to pick the best homeowners insurance company

The initial step in selecting the appropriate insurance policy involves researching to identify a home insurance provider that aligns with your preferences. This necessitates a consideration of your financial bottom line.

When contemplating your insurer preferences, reflect on key aspects. Factors like customizability, reputation, and value are among the essential priorities to focus on. Alternatively, you may prioritize bundling your home insurance with other insurances for convenience, or seek comprehensive coverage options for your unique property. Remember, there is no singular correct choice.

After utilizing your financial bottom line to eliminate insurance providers that do not meet your criteria, you can commence reviewing available offers. It is crucial to have a clear understanding of your insurance needs before proceeding with this step.

To ensure that a company can fulfill your insurance requirements, assess:

– The appraisal of your residence

– The extent of coverage necessary

– Your willingness regarding deductibles

Researching customer satisfaction is a crucial step. To gauge the expected service quality:

– Initiate support calls before committing

– Review online feedback and forums

– Seek insights from existing members

Although filing a home insurance claim can be daunting, excellent customer service can significantly impact the experience.

Conduct a comparative analysis:

– Obtain rate quotes from various insurers

– Explore eligibility for discounts

While opting for the most economical home insurance may not be ideal, ensuring cost-effectiveness is prudent.

Upon selecting a provider, proceed with customizing your coverage and policy.

What kind of coverage do you need?

There are two primary types of home insurance coverage: actual cash value coverage and guaranteed replacement cost coverage.

Actual cash value coverage pays for repairing or replacing your belongings in the event of a covered loss based on their current value. The coverage amount for each item is determined by its depreciated value, meaning older items receive less coverage.

To calculate an item’s actual cash value, insurers deduct depreciation from the replacement cost.

On the other hand, replacement cost coverage pays for repairing or replacing items based on their current replacement cost. The coverage amount for each item is based on its replacement value, which is the cost to purchase a new item of the same kind.

Replacement cost coverage offers more comprehensive protection compared to actual cash value coverage. Opting for replacement cost ensures your home insurance can assist in repairing your home and replacing belongings with equivalent substitutes.

To determine replacement cost, you must estimate the replacement expenses of your items, which are crucial for calculating your total coverage.

Guaranteed replacement cost coverage pays for repairing or replacing your belongings regardless of the cost. If the actual replacement cost exceeds the estimated value under replacement cost coverage, you are responsible for the difference. However, with guaranteed replacement cost coverage, your home insurance will cover the entire replacement cost.

While guaranteed replacement cost coverage provides enhanced protection, it is usually more costly than replacement cost coverage due to its comprehensive coverage.

How coverage limits work

Home insurance coverage limits are the maximum amount of money your insurer will pay out in the event of a covered claim. Your policy will list specific limits for different types of damage, such as natural disaster damage or theft. It’s important to understand these maximums so you know what to expect when filing a claim.

Most home insurance policies have separate limits for different forms of coverage. For example, you may have a policy with a $200,000 dwelling coverage limit and a $100,000 personal belongings limit. That means your insurer would reimburse up to $200,000 to repair or replace your home in the event of a covered claim and up to $100,000 to replace your personal belongings.

Unless you have guaranteed replacement cost coverage, you would be responsible for paying the difference for any excess costs.

Remember that home insurance coverage limits are per policy, not per incident. So, if you have a $250,000 policy and you make two separate claims for $200,000 each, your insurer will only pay out a total of $250,000. You would pay the remaining $150,000 yourself.

How much coverage do you need?

You should have enough homeowners insurance to completely cover the costs of rebuilding or repairing your home after a covered accident and replacing your damaged items.

Homeowners insurance policies commonly provide dwelling coverage, other structures coverage, personal property coverage, living expense coverage, and liability coverage. Here’s how to determine your coverage limits for each.

Dwelling coverage

Dwelling coverage protects your home itself. This extends to the structures of your house including the frame and foundation, roof, deck, heating and cooling systems, and fixtures.

In general, you want enough dwelling coverage in your home insurance policy to cover 100% of your home’s replacement costs.

Dwelling coverage is based on the costs to repair your home, not the value of your home. So instead of looking at home sale prices in your area to determine how much coverage you need, look at building and reconstruction costs. This will give you a more accurate representation of how much you can expect to spend and what coverage limit to choose.

Some home insurance policies have dwelling coverage limits that are guaranteed replacement cost. As mentioned, that means your insurer will pay whatever it costs to repair or replace your home even if the expenses exceed your policy limit.

For example, if you have a guaranteed replacement cost policy with a limit of $300,000 and your home is damaged by a fallen tree, your insurer will pay to rebuild your home even if the cost of repairs exceeds $300,000.

Not all home insurance policies offer guaranteed replacement cost dwelling coverage.

Other structures coverage

Other structures coverage provides separate coverage for structures other than your home that are on your property, such as fences, sheds, and detached garages. Your other structures coverage limit should be equal to between 10% and 20% of your dwelling coverage.

Personal property coverage

For most people, 50% to 70% of total dwelling coverage is enough to cover personal belongings.

When purchasing a home insurance policy, you should take inventory of your personal property so you have a good idea of how much your belongings are worth. And if you think you need more coverage for your belongings, consider an extended policy or add-on.

Living expense coverage

Finally, you need coverage for living expenses. Living expense coverage, also called loss of use coverage, would kick in if your house were to become temporarily unlivable. This ensures you’re not paying out of your own pocket for accommodations when you can’t live in your home.

For example, if a storm displaced your family and you had to stay in a hotel until roof repairs were finished, living expense coverage would help cover the hotel bill and any other expenses you have while you’re gone.

Standard living expense coverage is equal to between 20% and 30% of dwelling coverage.

Liability coverage

Liability coverage helps out with expenses related to being sued and damage or harm to others that takes place on your property.

For example, if a person visiting your home were to injure themselves in your home and you were legally responsible for their medical bills, your liability coverage would help pay. This coverage also extends to property damage or injuries you yourself (or a pet or family member) may cause.

Liability coverage minimums usually start at $100,000. For a lot of people, this is more than enough.

How deductibles work

Home insurance deductibles are the amount of money you have to pay out of pocket before your insurance policy kicks in.

For example, if you have a $500 deductible and you experience a covered loss that costs $1,000, you will have to pay the first $500 and your insurer will pay the remaining $500. After you’ve reached your deductible for the year, your insurer will pay for any covered losses up to your policy limit.

When you take out any insurance policy, you’re hoping you never need to use it. But if you do, you want to make sure you can come up with the money you’re responsible for paying when you’re responsible for paying it. This is why choosing your deductible carefully is so important.

The right deductible for you depends on a few factors:

- How much you can afford to pay out of pocket

- The types of coverage you have

- Your claims history

If you have a history of making small claims, you may want to choose a higher deductible to keep your premiums low as high deductible policies can be much cheaper. But if you live in a high-risk area or know your home is older, you may save more over time by paying a higher premium for a lower deductible.

What does homeowners insurance usually cost?

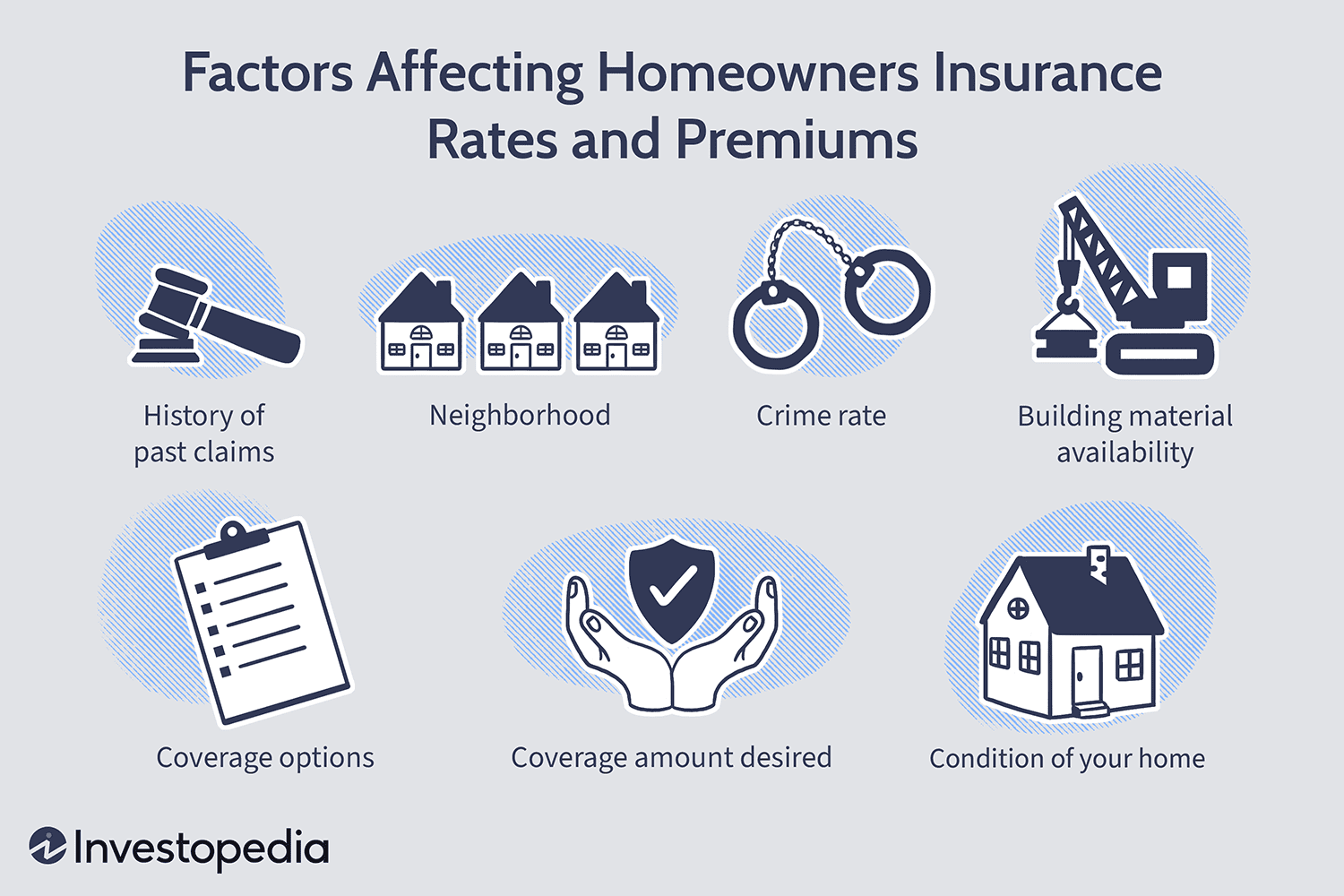

The average price of homeowners insurance depends a lot on where you are and how houses are valued in your area.

2. https://viralblogspost.com/commercial-property-insurance-guild-to-protecting-your-investment

3. https://viralblogspost.com/car-insurance-quotes-va

4. https://viralblogspost.com/errors-and-omissions-insurance-quote

5. https://viralblogspost.com/why-life-insurance-rates-are-the-lowest-theyve-been-in-20-years

The national average rate for home insurance in 2023 is $158 per month, according to Policygenius. This comes out to just shy of $1,900 per year. With that said, home insurance premiums vary greatly from state to state. Take a look at the examples below.

The top three most expensive states for home insurance are:

- Oklahoma: $4,230 annually

- Nebraska: $3,741 annually

- Kansas: $3,094 annually

The top three cheapest states for home insurance are:

- Hawaii: $486 annually

- Vermont: $900 annually

- New Jersey: $904

But insurance premiums vary a lot by home too.

Insurance rates are determined by a variety of factors that can affect how much it would cost to cover damage to your home. This means everything from when your house was built and how large it is, where it’s located in relation to hazards and first responders, and local crime rates can influence the price of your policy.

Almost every home insurance company will give you a free quote if you answer a few questions about your insurance needs. This doesn’t cost you anything and has no impact on your credit score. You can also talk with an insurance agent if you have questions about what kind of policy is right for you.

How to get cheaper homeowners insurance

There are so many different ways to save on homeowners insurance. These include comparison shopping, bundling, updating your security, choosing a higher deductible, improving your credit score, and taking advantage of other discounts.

Comparison shopping

One of the best ways to cut your home insurance premium is to compare prices from different providers. You can shop around by getting quotes from multiple insurers or using a home insurance comparison tool. When comparing rates, be sure to try out a few coverage limits and deductibles.

Policygenius is a platform that lets you easily compare rates and quotes from different homeowners insurance companies. After filling out one application with some personal information and details about your home — which takes less than three minutes to complete — Policygenius compiles a list of policies from top providers.

Next, Policygenius sends you an email from a licensed expert within 24 hours to talk next steps and personalized quotes within 48 hours. When you’re ready, you can fill out an application through the Policygenius site.

Policygenius even gives you the option to search automatically for home and auto bundles.

Bundling

Another way to save on all your insurance, not just your home insurance, is to bundle. Many insurance companies offer multi-policy or bundling discounts. This can be a great way to save money since you’re paying for different types of insurance anyway. Home insurance companies may knock up to 35% off your premium when you bundle.

Home and auto bundles are really common, but you can also bundle your home insurance with your motorcycle insurance, boat insurance, life insurance, and more.

Just make sure to compare bundling rates between companies too. Bundle prices are always lower from the same company, but they might not be cheaper than what another insurance provider can offer.

Updating your security

Keeping your home updated and safe can also bring your insurance rates down. Insurance companies want to see that you’re doing as much as you can to prevent disasters since this makes you a lot less likely to file expensive claims.

Making your home more disaster-resistant can help to lower your premium. This can include things like installing:

- Storm shutters

- Smoke detectors

- Fire sprinklers

- Reinforced roofing

Home security systems that can help prevent break-ins and theft, such as alarms and cameras, may also reduce your rates, but this depends on the company.

If you’re unsure of what security updates to make, you can talk with your insurer. They may suggest steps you can take to make your home safer and more resistant to disasters and tell you how much you can save by doing so.

Choosing a higher deductible

You can also save by increasing your deductible, which is the amount you would pay out of pocket before your insurance kicks in. You’ll pay more of your own money for a high deductible plan when you do file a claim, but you’ll save a lot when you don’t.

You can also choose higher deductibles just for specific types of damage. For example, if you live in an area that doesn’t get intense storms, you might be able to choose a higher deductible for this type of coverage. By doing this, you can save on your premium while still being protected in the event of other types of damage you are at a greater risk of experiencing.

Just don’t take on a higher deductible than you can afford.

To enhance your credit profile, consider the following:

To potentially reduce homeowners insurance costs, focus on improving your creditworthiness. Securing homeowners insurance is akin to applying for credit, where lenders evaluate your credit history to determine your interest rates. Similarly, insurance providers analyze your credit information to determine your premium rates.

A favorable credit score can result in cost savings on home insurance. Insurers commonly utilize credit scores to evaluate risk levels. Individuals with higher credit scores are typically perceived as lower risks, leading to reduced premiums. Essentially, individuals with excellent credit ratings are often less costly to insure compared to those with poor credit histories.

Exploring Additional Discounts:

Homeowners insurance companies frequently offer various discounts to policyholders. Three primary discount categories include:

1. Loyalty Discount: Additional savings for policy renewals and continued membership.

2. Claim-Free Discount: The longer you maintain a claims-free record, the lower your premiums may be.

3. Switch Discount: Many insurers offer price reductions for switching from another insurance provider.

Discovering the specific discounts available through a particular insurer is generally straightforward and a worthwhile investment of your time.

How we picked the best companies

To identify the leading homeowners insurance companies, we conducted a comprehensive assessment ranging from policies to user experiences. Specifically, we evaluated the following criteria for each company:

– Value and cost

– Customizability

– Policy options

– Claims process

– Coverage limits

– Customer service

– Sign-up process

– Regional availability

– Home insurance discounts

While no single company can meet all your requirements, our top home insurance providers come remarkably close. It is implied that all the homeowners insurance firms listed are reputable and reliable. Our endorsement is based on their provision of comprehensive policies, coverage, and assistance.

Best Choice: Lemonade

Advantages

– Cost-effective policies

– Streamlined claims process

– Policy updates or cancellations available anytime

Disadvantages

– Limited availability in all states

– Limited additional coverage options

Details

Lemonade diverges from traditional homeowners insurance companies. As a certified Public Benefit Corporation and B-Corp, Lemonade emphasizes social impact by supporting nonprofits such as the ACLU, American Red Cross, and The Trevor Project through contributions from policyholders.

To achieve this, Lemonade deducts a fixed fee from your insurance premiums to cover your claims. Additionally, the company donates unclaimed funds annually to a charity of your choice during policy signup through the Giveback initiative. This strategy minimizes fraud risks and allocates up to 40% of unclaimed premiums to charitable endeavors.

Lemonade stands out as one of the most budget-friendly homeowners insurance providers. Basic coverage for homeowners insurance starts at $25 per month or $300 per year. Policy adjustments or enhancements can be easily made at any time, and claims can be filed conveniently through the mobile application.

Lemonade provides standard coverage for personal property against weather-related incidents and theft, liability coverage for potential lawsuits, and accidental injury coverage for on-property incidents. The entire process is conducted online, eliminating the need to interact with an insurance agent unless desired.

The majority of mortgage lenders accept Lemonade, enabling insurance payments from escrow accounts or credit cards. Transitioning from a different insurance provider is facilitated by Lemonade, assisting in terminating previous coverage and transferring to their services.

Moreover, Lemonade extends its insurance offerings to include renters, auto, pet, and term life insurance. Customers can benefit from a multi-policy discount when securing more than one type of insurance from Lemonade.

Best for customizable coverage: Allstate

Pros:

– Extensive coverage options available

– Diverse range of discounts offered

– Nationwide coverage across all 50 states

Cons:

– Base prices are relatively higher compared to competitors

– Sign-up process may be more intricate

Details

Ranked as the second-largest provider of homeowner’s insurance by market share and premiums, Allstate serves over 10.5 million policyholders, as reported by the Insurance Information Institute. It stands out as the top choice for homeowners seeking a tailored insurance policy.

In addition to fundamental property and liability coverage, Allstate provides a wide array of additional coverage options, including:

– Water backup coverage for drain or pump system incidents

– Identity theft restoration coverage for related expenses

– Yard and garden protection for landscaping assets

– Green improvement reimbursement for energy-efficient replacements

– Scheduled personal property coverage for high-value items

Choosing Allstate means collaborating closely with an insurance agent to customize your policy, with the flexibility of phone consultations or in-person meetings at a local office.

The Allstate website is a comprehensive resource that simplifies the intricacies of homeowners insurance, offering detailed insights into the selection process.

Allstate’s pricing starts at approximately $82 per month or $980 annually, with various potential discounts available. Eligible discounts include savings through autopay enrollment, bundling home and auto policies, or qualifying as a new homeowner.

Furthermore, Allstate extends its insurance offerings to renters, condo owners, as well as life, motorcycle, and auto insurance policies.

Best for new homeowners: Hippo

Pros:

– Streamlined claims process

– Proactive support

Cons:

– Limited availability in select states

Details

Acquiring a homeowners insurance policy for the first time differs significantly from subsequent policies. We recommend Hippo to novice policyholders. Founded in 2015, Hippo is a recently established home insurance provider, serving over 200,000 U.S. households. Their policies offer generous coverage limits at competitive rates, with a seamless digital experience from enrollment to claims processing.

Hippo Home Care and Smart Home Tech exemplify Hippo’s commitment to accident prevention for homeowners. Hippo Home Care, an app bundled with every policy, furnishes a personalized home health profile to identify areas for enhanced safety through maintenance and updates.

By integrating leak sensors, motion detectors, cameras, and smart smoke alarms via Ring, SimpliSafe, and Notion, Smart Home Tech enhances home security. Opting for a smart home kit not only qualifies you for policy and system discounts but also fortifies your home against potential risks.

Our selection of Hippo as the premier homeowners insurance for new homeowners is based on its emphasis on preventative measures and educational resources. Hippo stands out for its tech-centric approach, providing enhanced coverage for digital devices and appliances compared to traditional insurers.

With a user-friendly signup process, Hippo offers swift quotes in under a minute. Starting at approximately $900 annually or $75 per month, Hippo’s homeowners insurance provides a balance of affordability and comprehensive protection. However, availability is limited to specific states.

1. https://viralblogspost.com/car-insurance-quotes-va

2. https://viralblogspost.com/commercial-property-insurance-guild-to-protecting-your-investment

3. https://viralblogspost.com/why-life-insurance-rates-are-the-lowest-theyve-been-in-20-years

4. https://viralblogspost.com/selective-insurance-agent-login

5. https://viralblogspost.com/small-business-insurance-online

Best for in-person support: State Farm

Pros:

– Available in all 50 states

– Access to local agents

– Numerous extended coverage options

Cons:

– Complex or slow claims processing

Details

State Farm stands out as one of the premier home insurance companies and the largest insurance provider nationwide. Holding a JD Power rating of 834, State Farm secures the third position in customer satisfaction for homeowners insurance.

For those who prefer a personalized touch in managing insurance affairs, State Farm emerges as a top contender. The vast network of over 19,000 dedicated State Farm agents throughout the U.S. ensures convenient access within your community. Should you wish to discuss your policy and insurance requirements face-to-face, these local offices are readily available.

Recognized for its exceptional one-on-one support, State Farm offers replacement cost coverage for both dwelling and property, along with provisions for living expenses, liability, and medical costs. The option to increase your replacement dwelling limit by up to 20% above the estimated replacement cost comes at an additional premium.

Moreover, supplementary coverage for risks such as earthquakes, cyberattacks, and expenses related to energy-efficient replacements can be included. Noteworthy is the absence of dog breed restrictions for liability coverage eligibility, setting State Farm apart from its competitors.

Starting at approximately $83 per month or $1,000 annually, State Farm’s insurance policies may not provide as many rate discounts as some rivals, yet savings opportunities exist through bundling, maintaining a claim-free record, and implementing security measures like roof repairs. State Farm’s home insurance services are accessible across all 50 states.

Best for discounts: Progressive

Pros:

– Available in all 50 states

– Offers a variety of discounts

Cons:

– Average customer service

– Limited options for extended coverage

Details

Progressive is a well-known insurance provider renowned for its diverse discount offerings. It may be a suitable choice for existing Progressive auto customers looking to consolidate their insurance policies for a multi-policy discount. According to Progressive, customers typically save around 5% when bundling their home and auto insurance.

Discounts are available for:

– Installing safety systems

– Paying the annual premium in full

– Opting for email communications

– Owning a new-build home

– Requesting an insurance quote at least ten days before policy commencement

– Transitioning from renters insurance to a new home policy

Similar to State Farm, Progressive has a network of local agents nationwide, including over 38,000 independent agents who can assist with home insurance queries and updates. For those preferring online assistance, customer support is available via phone, chat, email, or direct messaging.

Progressive provides a select range of coverage add-ons, such as protection against water back-ups from sump pumps or sewer systems, and personal injury coverage for non-physical or non-bodily injury-related lawsuits (e.g., false arrest, wrongful eviction, slander).

Policy prices start at approximately $70 per month or $815 annually without discounts, positioning Progressive as a competitively priced option. Eligibility for further rate reductions could make it one of the most cost-effective choices available.

Progressive’s homeowners insurance is accessible across all U.S. states and in Canada.

Best for guaranteed replacement cost coverage: ERIE Insurance

Pros:

– Affordable policies

– Variety of discounts available

Cons:

– Availability limited to select states

Details

ERIE Insurance is renowned as one of the premier homeowners insurance companies, offering guaranteed replacement cost coverage. This ensures full coverage for repairs and replacements, regardless of the costs involved. The base ErieSecure Home policy includes this comprehensive coverage.

Moreover, ERIE Insurance provides exceptional extended replacement cost coverage, surpassing industry standards by offering up to 25% coverage over your dwelling. This higher coverage limit can provide a sense of security, especially during periods of inflation when repair costs may exceed expectations.

To qualify for guaranteed replacement cost coverage, promptly submit claims for home improvements exceeding $5,000 to ERIE within 90 days of payment.

We have highlighted ERIE as our preferred choice for guaranteed replacement coverage due to its generous coverage limits and overall value proposition

Policy premiums typically start around $58 per month or $700 annually with ERIE. However, these rates can be further reduced through multi-policy discounts, saving policyholders between 16% and 25% on their total insurance costs.

Please note that ERIE Insurance operates exclusively in 12 states, including:

– Illinois

– Indiana

– Kentucky

– Maryland

– New York

– North Carolina

– Ohio

– Pennsylvania

– Tennessee

– Virginia

– West Virginia

– Wisconsin

With a network of over 13,000 ERIE Insurance agents across these states, customers have access to dedicated assistance. It is important to acknowledge that guaranteed replacement cost coverage may not be available in all states.

Best for customer satisfaction: Amica

Pros:

– High customer satisfaction

– Variety of discounts available

Cons:

– Not available in all 50 states

– Higher base prices compared to other companies

Details

For individuals who prioritize customer service, Amica Mutual is a recommended option. Amica, also known as Amica Mutual, stands out as one of the top homeowners insurance companies overall, boasting an impressive JD Power rating of 854 out of 1,000. This customer satisfaction score places Amica significantly ahead of its competitors, with the closest runner-up scoring 840. In addition, Amica received an A+ rating from AM Best Company in 2022.

Similar to other home insurance providers, Amica emphasizes the importance of staying current with home repairs to prevent potential issues. Utilizing their home repair assistance program via Contractor Connection allows access to a network of over 2,000 vetted professionals capable of assisting with various home maintenance needs, including emergencies.

Engaging one of these recommended contractors can streamline the process. Amica’s agents collaborate with the contractor on pricing and facilitate the resolution of any arising concerns.

While the company’s policies align with industry standards, Amica distinguishes itself by offering support for flood insurance. Amica’s agents are equipped to assess your flood insurance requirements and guide you in selecting the most suitable plan.

Although flood insurance isn’t part of their standard home insurance coverage, Amica is prepared to assist in procuring a flood insurance policy from another provider.

Homeowners insurance plans with Amica Mutual typically start at approximately $85 per month or $1,020 annually. These rates rank towards the higher end of the average spectrum for similar policies, though eligibility for discounts may apply.

By combining your home and auto insurance policies (availability may vary based on location), savings of up to 20% can be realized. Further discounts are accessible for policy bundling, loyalty, maintaining a claims-free record, enrolling in AutoPay, and enhancing security measures.

In addition to homeowners insurance, Amica Mutual extends its services to life insurance, retirement insurance, marine insurance, umbrella insurance, and more.

Best for military families: USAA

Pros:

– Affordable policies

– Numerous extended coverage options

– Availability in all 50 states

Cons:

If you are affiliated with the military, USAA could serve as the ideal home insurance provider for your needs.

Details

In addition to providing basic replacement cost coverage for your home and property, USAA offers Home Sharing Coverage and Earthquake Coverage as supplementary options for eligible policyholders. Home Sharing Coverage safeguards short-term rental properties, while Earthquake Coverage assists in mitigating damages caused by earthquakes. USAA exclusively offers earthquake insurance to residents of Oregon and Washington presently.

Another advantage of selecting USAA as your home insurance provider is the potential for savings. The USAA Perks program features exclusive member deals and discounts across various categories, ranging from home security to car rentals to cruises.

A USAA home insurance policy typically commences at approximately $61 per month or $730 per year, positioning this provider as a more cost-effective option compared to others in the industry. Furthermore, by bundling your home and auto insurance, you could save up to 10% and benefit from a protective device credit and claims-free discount.

Regrettably, USAA home insurance eligibility is restricted. To secure a policy with USAA, you must have active, retired, or honorably discharged military status. Alternatively, you may qualify for membership through a family member.

USAA also extends a wide array of insurance products, including various types of vehicle insurance, umbrella insurance, pet insurance, landlord insurance, and mobile home insurance, among others. Rest assured, you can fulfill all your insurance needs with USAA.

Summary

Homeowners insurance can save money and protect your home from disasters. Choose wisely based on your needs. Check out the top 8 home insurance companies for 2024.