Disability insurance is a critical safeguard for working professionals. It provides financial protection in the event that a medical condition impairs one’s ability to earn an income. This comprehensive guide aims to demystify disability insurance, addressing its importance, the types available, how to obtain coverage, and much more.

Mục lục

![]()

Introduction of disability insurance

What is Disability Insurance?

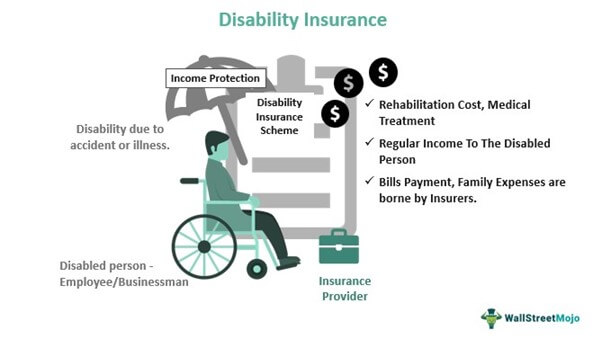

Disability insurance acts as an income replacement if you become unable to work due to injury or illness. It provides financial support until you are able to return to work or reach retirement age.

Why is Disability Insurance Important?

Disability insurance is essential because it protects your income, which is crucial for maintaining a comfortable standard of living. Without this protection, a sudden disability can cause significant financial strain, impacting not only your own well-being but also that of your loved ones.

Why Working Professionals Need It

For many professionals, the ability to work is directly tied to their financial security. Disability insurance ensures that even when you can’t work, you can still meet your financial obligations. It is especially important for those who have high earning potential, as it can help maintain their standard of living and cover ongoing expenses such as mortgage payments, car loans, and other bills.

Importance of Understanding Disability Insurance

Navigating disability insurance policies can be a challenging task due to their complexity. However, gaining a clear understanding of these policies can significantly empower individuals to make well-informed decisions regarding their financial future and security. By comprehensively grasping the intricacies of disability insurance, individuals can better protect themselves and their loved ones from unforeseen circumstances that may impact their financial well-being.

Types of Disability Insurance

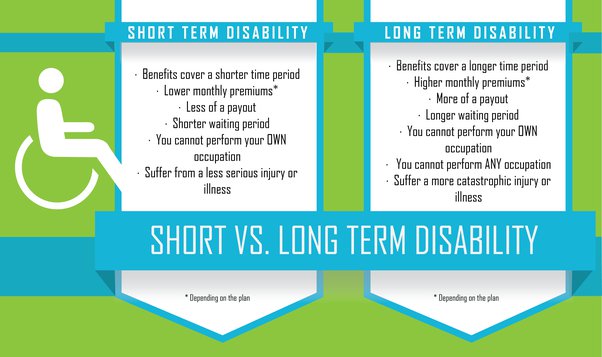

Short-Term vs. Long-Term Disability Insurance

Short-term policies, which usually span a few months, are designed to provide immediate coverage for individuals. On the other hand, long-term policies offer extended protection that can last until retirement age, ensuring comprehensive benefits tailored to long-term financial security.

Differences and Benefits

Understanding the distinct features of short-term and long-term options is crucial when selecting the right policy that aligns perfectly with your unique needs. By delving into the specifics of each, you gain a comprehensive view that empowers you to make an informed decision tailored to your specific circumstances and goals.

Who Each Type is Best Suited for

Whether it’s the aftermath of a major surgery, managing a chronic health condition, or facing unexpected disabilities, there exists a diverse range of disability insurance options tailored to various situations and professions. By selecting the right type of disability insurance, individuals can secure financial protection and peace of mind in times of need.

Eligibility and Coverage

Who Should Consider Disability Insurance

Virtually anyone earning an income should consider disability insurance as a means of financial protection. Particularly, it’s crucial for sole earners in families, individuals with physically demanding jobs, and those without substantial savings. This insurance safeguards not only the policyholder’s financial stability but also provides peace of mind for their dependents.

Any working professional stands to benefit, especially those without substantial emergency savings or those with dependents relying on their income. Additionally, individuals with physically demanding jobs or those prone to illness may find disability insurance particularly valuable.

Criteria for Eligibility

Insurers take various factors into account such as the level of risk associated with one’s occupation, detailed medical history, and income levels as part of the eligibility assessment process. Typically, occupations with higher levels of risk are often charged higher insurance premiums to mitigate potential liabilities.

Assessing Your Specific Needs

Before opting for either short-term or long-term disability insurance, it’s imperative to evaluate your unique circumstances and financial responsibilities. Factor in your current savings, lifestyle expenses, and the financial security of dependents. Additionally, consider the nature of your profession and any potential risks it entails. Ultimately, the goal is to ensure that the insurance coverage aligns with your needs, providing adequate financial support during periods of disability. Making an informed decision requires careful consideration of how a sudden loss of income would impact your life and those dependent on you.

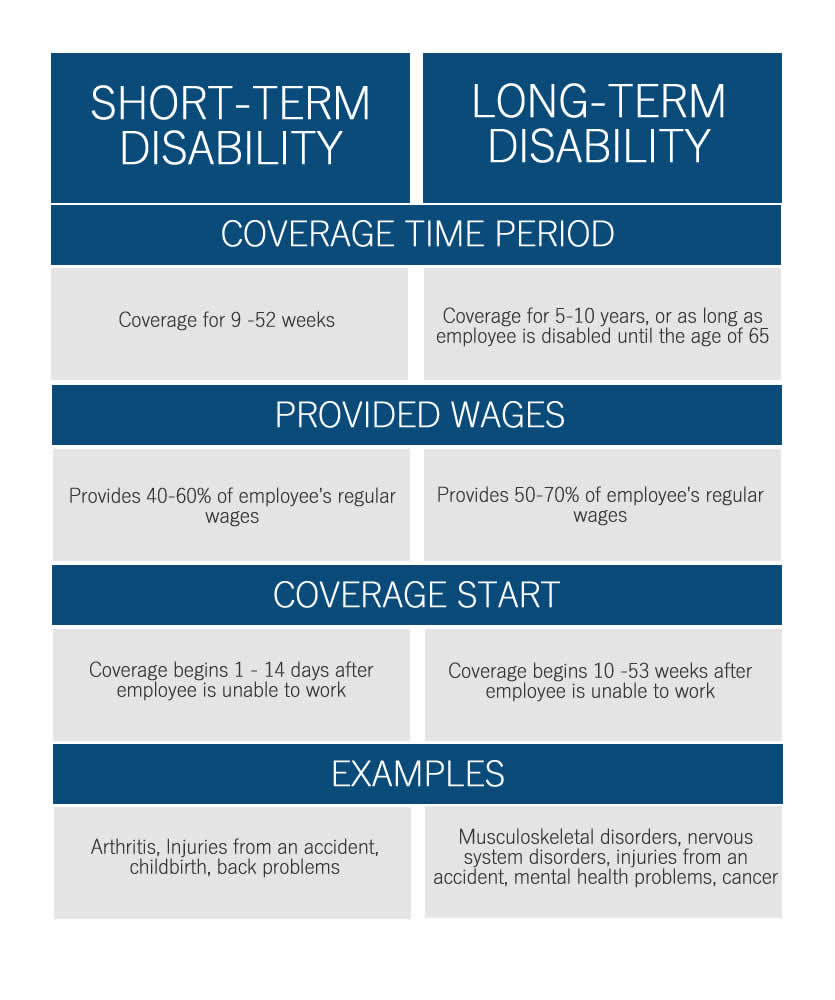

Range of Coverage Offered in Different Plans

Policies vary significantly when it comes to the percentage of salary covered in case of benefits, the maximum amount of benefit payouts allowed, and the duration of coverage provided. These factors play a crucial role in determining the level of financial protection and support individuals can receive during unforeseen circumstances.

Applying for Disability Insurance

The application process for disability insurance involves a series of steps, starting with a comprehensive evaluation of your health and financial status. Applicants are required to undergo a medical examination and provide detailed financial information, including income verification. It’s essential to be transparent and truthful during this process, as any discrepancies can lead to denial of coverage or complications in the future claims process. Additionally, consulting with an insurance advisor can provide valuable insights into the types of coverage available and help tailor a policy that best suits your needs and budget. Remember, the earlier you apply for disability insurance, the better your chances are for obtaining favorable terms, as age and health conditions play a significant role in determining premiums and coverage eligibility.

How Disability Insurance Works

Disability insurance serves as a financial safeguard, offering income replacement if one becomes unable to work due to a disability. The coverage typically pays out a percentage of the insured’s salary, up to a pre-defined cap, for a specified duration. The specifics, such as coverage amount, benefit period, and eligibility, vary by plan. To initiate a claim, the insured must provide proof of disability, often certified by a medical professional. Upon approval, there’s usually a waiting period before benefits commence. This insurance is crucial for financial stability during challenging times, but it’s important to understand the terms and choose a policy that aligns with individual needs and circumstances.

Step-by-Step Guide from Application to Benefits

From the initial stage of comparing quotes to the crucial steps involved in filing a claim, this comprehensive section offers detailed guidance to help you navigate the insurance process with clarity and simplicity. Whether you’re seeking the best coverage options or understanding policy terms, each step is explained thoroughly to ensure you make informed decisions tailored to your needs.

Common Misconceptions and Clarifications

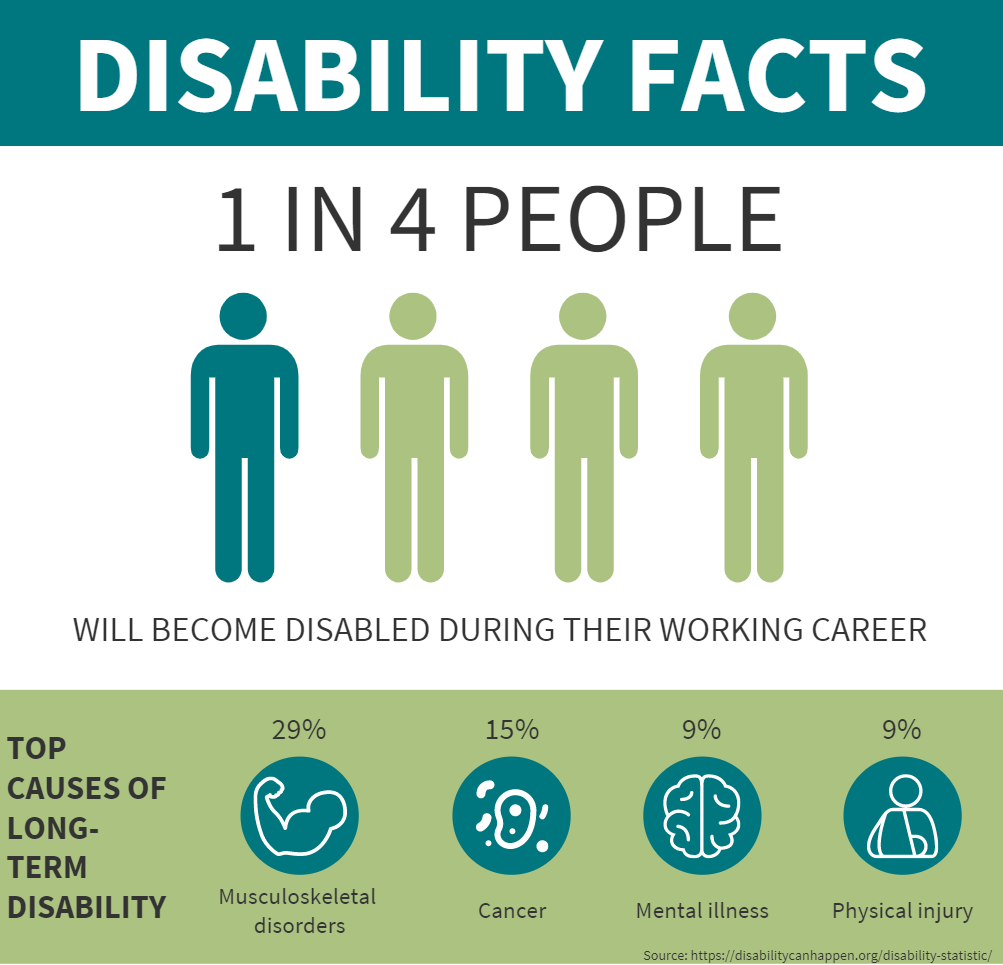

We aim to clarify prevalent misconceptions, one being the common misunderstanding that workers’ compensation serves as a replacement for disability insurance, whereas they each serve distinct purposes. Furthermore, many individuals are under the impression that only those in high-risk professions need disability coverage, when in reality, anyone can experience a disabling condition at any point in their life. It’s essential to understand the importance of disability insurance for financial protection and peace of mind.

Understanding Key Terms and Concepts

To make an informed decision regarding disability coverage, it’s important to have a clear understanding of key terms and concepts. Some crucial ones to familiarize yourself with include:

- Elimination period: This is the waiting period after a disability occurs before benefits are received. It’s important to understand the duration of this period as it can affect when you receive payments.

- Benefit amount: This refers to the monthly payment amount received during a disability. Understanding this amount is crucial in determining how much coverage you need and what premium you can afford.

- Own occupation: This term defines the ability to perform your current job duties in light of a disabling condition. Policies with this definition tend to offer more comprehensive coverage but may come at a higher cost.

Tips for Filing a Successful Claim

Discover best practices for a smooth claims process and how to avoid common pitfalls that could delay your benefits. Some helpful tips to keep in mind include:

- Have a thorough understanding of your policy: Be sure to review your policy and understand the terms and conditions before filing a claim. This will help you avoid any surprises or misunderstandings during the process.

- Keep detailed records: Maintain accurate and organized records of all medical documentation, including doctor’s notes, test results, and treatment plans. This will help support your claim and provide evidence of your disability.

- Follow up with your insurance provider: Make sure to stay in communication with your insurance provider throughout the claims process. Regularly follow up on the status of your claim and address any additional information or documents they may need.

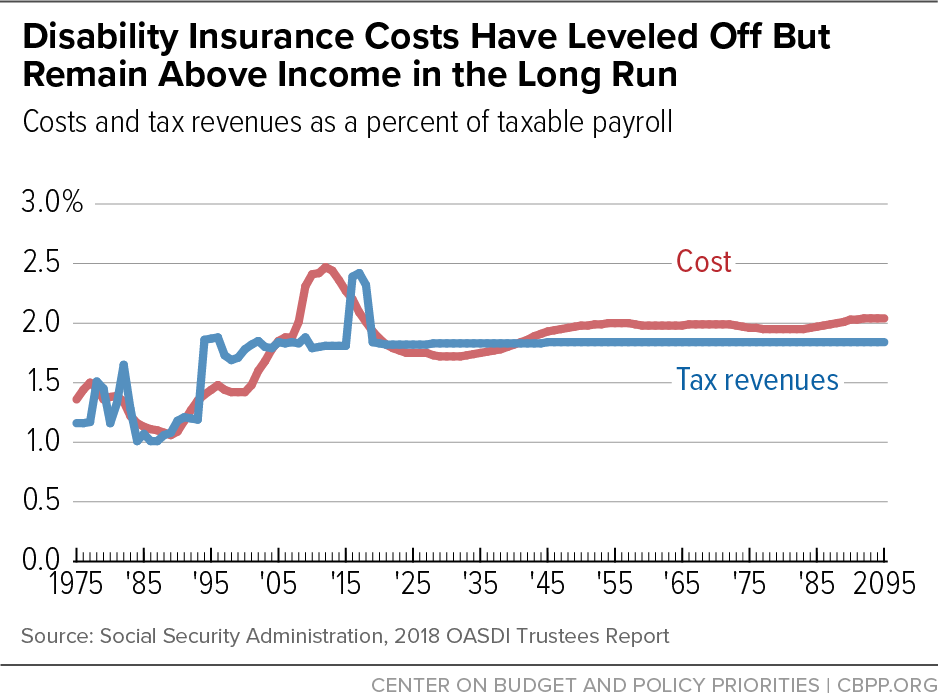

Understanding the Cost of Disability Insurance

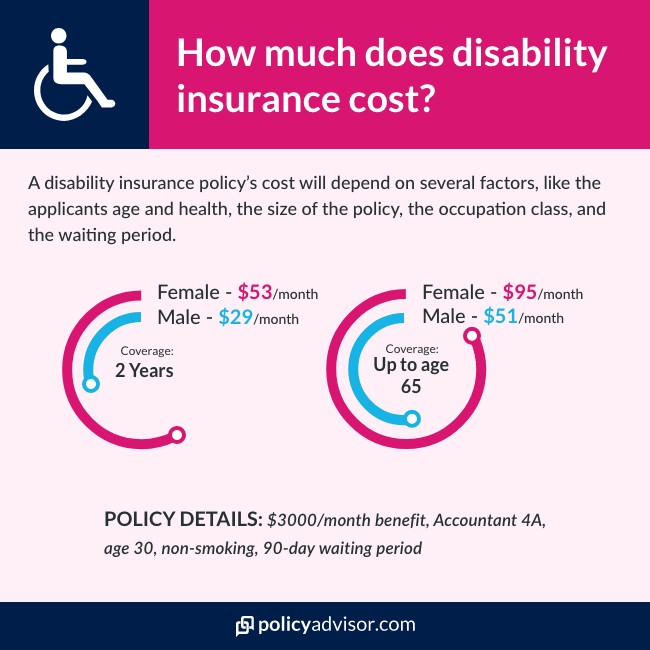

Factors Influencing the Cost of Disability Insurance

Age, health, job risk level, and the comprehensiveness of the policy all affect premiums. Insurance companies use these factors to determine the likelihood of a claim being filed and adjust premiums accordingly.

- Age: Generally, the younger you are when purchasing a policy, the lower your premiums will be. This is because younger individuals are typically healthier and less likely to file a claim.

- Health: Your current health status plays a significant role in determining your premium. Pre-existing conditions or a history of health issues may result in higher premiums.

- Job risk level: The nature of your occupation can impact the cost of disability insurance. Jobs with higher levels of physical risk or those that require specialized skills may have higher premiums.

- Policy comprehensiveness: The more comprehensive the policy, the higher the premium will be. This is because it offers greater coverage and protection in the event of a disability.

What to Consider When Choosing a Plan

Balancing cost with the necessity of adequate coverage is a delicate art—know what’s most important to consider. Here are a few key factors to keep in mind when selecting a disability insurance plan:

- Coverage amount: Consider how much coverage you would need in the event of a disability. This can include lost income, medical expenses, and other associated costs.

- Waiting period: The waiting period is the time between when you become disabled and when your benefits kick in. A longer waiting period typically results in lower premiums, but it also means you may have to cover expenses out of pocket for a longer period of time.

- Length of coverage: Some policies offer coverage until retirement age, while others only provide coverage for a set number of years. Consider your personal situation and how long you would need coverage for.

- Exclusions: It’s important to carefully review the exclusions listed in a policy. In some cases, pre-existing conditions or certain occupations may not be covered. Make sure you understand what is and isn’t covered before choosing a plan.

- Renewability: Some policies offer guaranteed renewable options, meaning your coverage cannot be cancelled as long as you pay your premiums on time. This can provide peace of mind for long-term disability coverage.

- Optional riders: Some policies may offer additional riders that can be added to your plan for an extra cost. These may include options such as cost-of-living adjustments or future purchase options, which can provide added flexibility and protection in the event of a disability.

It’s important to carefully consider these factors and weigh them against your budget when selecting a disability insurance plan. Remember, having some coverage is better than none at all, so even if you can’t afford a comprehensive plan, it’s still important to have some level of protection in place. Additionally, as your financial situation changes over time, it may be necessary to reassess and adjust your coverage accordingly.

Another important consideration when it comes to disability insurance is understanding the different types of disability coverage available. There are two main types of disability insurance: short-term and long-term. Short-term disability insurance typically covers a period of up to six months, while long-term disability insurance provides coverage for longer periods, usually until retirement age.

When deciding which type of coverage is right for you, it’s important to consider how much time you would need to recover from an illness or injury before being able to return to work. If you have a job that requires physical labor or involves a higher risk of injury, long-term disability insurance may be the better option. However, if you have a desk job with less risk of injury, short-term disability insurance may suffice.

It’s also important to note that there are different definitions of disability, which can impact your eligibility for benefits. Some policies may only cover disabilities that prevent you from performing your current job, while others may cover any disability that prevents you from working in your chosen profession. Understanding these definitions is crucial when selecting a disability insurance plan.

In addition to traditional disability insurance plans, there are also supplemental disability insurance options available. These can provide additional coverage on top of a primary policy, usually with higher benefit amounts. However, be sure to carefully review the terms and conditions of any supplemental plans as they may have different definitions and limitations.

Finally, it’s important to regularly review your disability coverage to ensure it still meets your needs. Life circumstances can change, such as a promotion or job change, which may affect the amount of coverage you need. It’s also important to review the terms and conditions of your policy, as they may change over time. By regularly reviewing your disability insurance, you can ensure that you are adequately protected in case of an unforeseen illness or injury.

Balancing Affordability with Adequate Coverage

Here we’ll explore how to find a middle ground that ensures solid coverage without breaking the bank. The first step is to determine your current financial situation and budget. This will help you find a disability insurance plan that fits within your means.

Next, consider the amount of coverage you may need in case of a disability. This can vary depending on factors such as income, expenses, and family needs. It’s important to strike a balance between having enough coverage for your specific situation and not over-insuring, which can lead to paying higher premiums.

One way to find affordable disability insurance is by looking for group plans through your employer or professional organization. These types of plans often have lower premiums due to the larger risk pool they cover. Additionally, some employers offer supplemental disability insurance as part of their benefits package, which can be a cost-effective option.

Another option is to consider a longer elimination period, which is the amount of time you must wait before receiving benefits. A longer elimination period can result in lower premiums, but also means you may have to rely on savings or other sources of income during that waiting period.

Overall, it’s important to carefully evaluate your financial situation and needs when selecting disability insurance. Finding a balance between affordability and adequate coverage is crucial in ensuring your protection in case of a disability. Remember to review and update your coverage as needed, especially as your financial situation changes over time. With proper planning and research, you can find a disability insurance plan that meets all of your needs without breaking the bank. So, it’s always better to be prepared for the unexpected with the right balance of disability insurance coverage. Additionally, seeking the advice of a financial advisor or insurance agent can also be helpful in finding the best plan for your specific needs and budget. They can provide personalized recommendations and help you understand the fine print of each policy. Ultimately, having disability insurance can provide peace of mind knowing that you have a safety net in case of unexpected events. Don’t delay in protecting your income and financial stability – start exploring disability insurance options today. Remember, it’s never too early to start thinking about the future and ensuring that you have the necessary safeguards in place. Keep yourself informed and educated about disability insurance, as well as other forms of insurance, to make the best decisions for your financial wellbeing.

This guide is designed to incorporate key SEO principles, targeting long-tail keywords like “what is disability insurance,” “types of disability insurance,” and “disability insurance for professionals.” Additionally, sections are structured to optimize for feature snippets, enhancing the article’s visibility on search engines and ensuring that readers can easily find the information they’re searching for. Protect your financial future with a clear understanding of disability insurance.