Running a business entails inherent risks and uncertainties. From property damages to legal liabilities, unexpected occurrences can pose threats to a business’s future. Commercial insurance offers vital protection, enabling businesses to navigate challenges and sustain growth. This guide will delve into the diverse array of commercial insurance options, underscore the significance of each coverage type, and outline strategies for tailoring insurance policies to align with unique business requirements.

Mục lục

Types of Commercial Insurance

Types of Commercial Insurance

Commercial insurance encompasses a range of policies, each designed to protect businesses from different risks and liabilities. Business owners should consider their specific operations, industry, and potential exposures when selecting the appropriate coverage.

- Commercial Property Insurance: Commercial property insurance safeguards business properties, physical structures, and assets against damages and losses caused by covered perils. It offers financial reimbursement for repairing or replacing damaged property, equipment, and inventory.

- General Liability Insurance: General liability insurance serves as a fundamental coverage for businesses, shielding them from third-party claims and lawsuits. It encompasses bodily injury, property damage, and advertising claims.

- Professional Liability Insurance: Also referred to as errors and omissions insurance, professional liability insurance shields businesses from claims of professional negligence or inadequate service. It is crucial for service-based businesses and professionals.

- Commercial Auto Insurance: Commercial auto insurance provides coverage for vehicles utilized for business purposes, safeguarding against accidents, damages, and liability arising from business-related vehicle use.

- Workers’ Compensation Insurance: Workers’ compensation insurance is typically mandated in most states, offering coverage for employees who experience work-related injuries or illnesses. It includes wage replacement and medical benefits while safeguarding businesses from lawsuits.

- Business Interruption Insurance: Business interruption insurance covers lost income and operating expenses when a business is temporarily unable to operate due to covered events, such as fire or natural disasters.

- Cyber Liability Insurance: In an increasingly digital landscape, cyber liability insurance is indispensable for businesses. It shields against cyber threats, data breaches, and cyber extortion, covering the costs of data recovery and legal expenses.

- Employment Practices Liability Insurance (EPLI): EPLI shields businesses from employee-related claims, encompassing discrimination, harassment, and wrongful termination lawsuits.

- Commercial Umbrella Insurance: Commercial umbrella insurance extends additional liability coverage beyond the limits of standard policies. It provides protection against high-value claims and lawsuits that surpass primary policy limits.

Factors Affecting Commercial Insurance Premiums

Numerous factors impact the pricing of commercial insurance premiums. Grasping these elements can empower businesses to effectively control their insurance expenses.

- Business Industry plays a crucial role in determining insurance premiums. The nature of operations and industry type can significantly impact costs. Certain industries are inherently riskier, leading to higher insurance expenses. For instance, industries with high liability risks may face increased premiums compared to low-risk sectors.

- Business Size is another factor influencing insurance premiums. Factors such as revenue, number of employees, and physical locations can impact coverage needs. Larger businesses typically have higher coverage requirements, resulting in increased premiums to cater to their size and scale of operations.

- Claims History is a key consideration for insurers. Businesses with a history of frequent or high-value claims may face elevated premiums due to the perceived higher risk associated with insuring them. On the contrary, businesses with a clean claims record may benefit from lower insurance costs.

- Risk Management Measures are evaluated by insurance providers to assess a business’s risk profile. Implementing robust safety measures and risk reduction strategies can lead to lower insurance premiums as insurers perceive reduced risk exposure.

- Location of the business also influences insurance costs. Businesses located in areas prone to natural disasters or high crime rates may face higher premiums due to the increased risk associated with such locations. Conversely, businesses in low-risk areas may enjoy more affordable insurance rates.

- Coverage Limits and Deductibles play a vital role in determining premiums. Opting for higher coverage limits and lower deductibles usually results in higher premiums. Businesses need to strike a balance between adequate coverage levels and manageable costs to ensure comprehensive protection without incurring excessive expenses.

- Business Experience is a factor considered by insurers when determining premiums. New businesses with limited operating history may face higher insurance costs as insurers perceive them to have a higher risk profile compared to well-established businesses with a proven track record of stability and reliability.

Customizing Commercial Insurance Policies

Every business is distinct, and insurance requirements can vary widely depending on the business’s nature. Tailoring commercial insurance policies guarantees that a business obtains the right coverage for its particular risks and operations.

- Assessing Business Risks: It is crucial for businesses to proactively conduct a thorough risk assessment to meticulously pinpoint potential exposures that could impact their operations. This in-depth evaluation plays a pivotal role in assisting business owners in precisely determining the specific types and levels of coverage required to safeguard their ventures effectively.

- Industry-Specific Coverage: It is noteworthy that various industries come with their own set of unique insurance requirements and distinct risks that demand specialized attention. Therefore, it is highly recommended for businesses operating in such industries to diligently seek out and acquire industry-specific coverage tailored to address their specific needs and potential vulnerabilities.

- Bundling Coverage: An effective cost-saving strategy that businesses can leverage is bundling different types of coverage from the same insurer. By bundling policies, companies may benefit from policy discounts and potentially reduce overall insurance costs while ensuring comprehensive protection across various aspects of their operations.

- Coverage Reviews: As businesses progress and evolve, it is imperative for them to regularly reassess their insurance policies and coverage limits. Conducting periodic reviews enables organizations to align their insurance coverage with their current growth trajectory and evolving risk landscape, ensuring that they remain adequately protected against potential threats and liabilities.

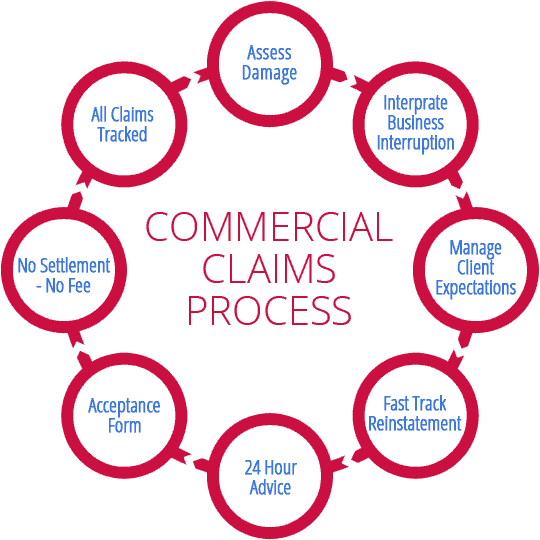

Claims Process and Handling Disputes of commercial insurance

The claims process can be complex, but efficient navigation is crucial to ensure prompt resolution and financial compensation for covered losses. Businesses should follow these steps during the claims process:

- Prompt Reporting: It is crucial to report any incident promptly to the insurance provider immediately after it occurs. This ensures that the claims process can begin without delays, leading to a quicker resolution.

- Documenting Evidence: Gathering and meticulously documenting all relevant evidence is essential for a successful insurance claim. This includes taking photos, collecting witness statements, and noting any additional pertinent information that can support your case effectively.

- Contacting the Insurer: Upon reporting the incident, it is important to reach out to the insurer’s claims department promptly. Providing all necessary information and documentation from the start can streamline the claims process and help avoid any unnecessary delays.

- Cooperation: Full cooperation with the insurance company throughout the investigation and assessment of the claim is key. Being transparent and responsive can facilitate a smoother claims process, leading to a quicker resolution.

- Handling Disputes: In cases where there are disputes concerning the claim, businesses are advised to maintain open communication with their insurance agent or broker. Working collaboratively to address and resolve any issues that may arise can help ensure a fair and amicable outcome for all parties involved.

Conclusion

Commercial insurance is a vital tool in safeguarding the future of a business. From protecting physical assets to providing liability coverage, insurance offers financial security and peace of mind to business owners. By understanding the different types of commercial insurance, assessing specific risks, and customizing coverage to match their needs, businesses can take proactive steps towards ensuring their continued success and protection against uncertainties. Regular policy reviews and effective claims management further reinforce the importance of commercial insurance in securing the future of businesses, no matter the challenges they may face. In today’s ever-changing and unpredictable market, it is essential for businesses to invest in comprehensive commercial insurance to mitigate risks and prepare for any potential obstacles. By doing so, they can continue to grow and thrive while having the support of a reliable insurance partner to resolve any issues amicably. So don’t wait until it’s too late – make sure your business is adequately protected with the right commercial insurance coverage today.