Whoa! I woke up one morning and checked my wallet—just routine—then my stomach dropped. My first instinct said “Uh-oh”, but my brain kicked in and started untangling what happened. Initially I thought it was a weird UI glitch, but then realized some token approval had gone sideways and the gas fees were eating the recovery plan. Seriously? Yeah. This is the kind of day that makes you rethink how you interact with smart contracts, how you simulate transactions, and how you keep track of assets across chains.

Toc

Okay, so check this out—risk assessment in DeFi isn’t a single checklist. It’s more like a mindset. On one hand you want frictionless UX and fast trades; on the other hand those clicks can expose you to infinite approvals, malicious contracts, or subtle reentrancy hooks that only reveal themselves under load. My instinct said “reduce permissions”, but the analysis showed that sometimes coarse-grained permissions are necessary for certain dApps to work. Hmm… that tension is everywhere.

Here’s what bugs me about common wallet setups: they push convenience as the default and security as the optional add-on. That’s backwards. You should be able to simulate a transaction, see potential token flows, and inspect contract calls without having to be a solidity whisperer. I’m biased, but I think user-friendly simulation is the single most underbuilt feature in many wallets.

Start with the right questions

Ask small but smart questions first. What permissions am I granting? Which contracts are involved? Could any of these calls indirectly approve tokens or move funds I didn’t expect? These are quick mental checks. They save you from long recovery headaches later. On paper it sounds obvious. In practice, people skip them, often because the dApp copy is persuasive or because of time pressure—human nature, right?

Transaction simulation solves a lot of this. A good simulator gives you a dry run of state changes, shows token transfers, and identifies risky patterns like approving an entire token supply to a contract. When that dry run is clear, you can decide to split approvals, set spend limits, or use a relay that vets the contract logic. Initially I thought simulation was purely a developer tool, but actually everyday users benefit massively from it.

Now here’s the technical nuance. Simulators that only replay the visible call stack miss off-chain components and oracle behaviors that could flip outcomes. So, simulation needs to be context-aware: oracles, price slippage thresholds, and approval allowances, all matter. This gets tricky fast, though, because you need reliable node access and a way to sensibly model off-chain feeds without overfitting to rare edge cases.

1. https://viralblogspost.com/pin-ap-kazino-ofitsial-nyi-sait-zerkalo-i-vkhod-igrat-onlain-2025

2. https://viralblogspost.com/mostbet-kazino-dar-toch-ikiston-sharkh-i-purra-bonuskh-o

3. https://viralblogspost.com/leading-online-gambling-establishments-that-accept-mastercard-deposits

4. https://viralblogspost.com/free-gambling-enterprise-slots-an-interesting-means-to-play-and-win

5. https://viralblogspost.com/la-fiabilite-des-plateformes-de-paris-sportifs-en-ligne-etude-de-betfrost

One approach I’ve used is layered checks: quick heuristic scans for obvious red flags, then a deeper simulated execution that models price slippage and reentrancy windows. It sounds heavy, but with the right tooling it’s fast. And it prevents a lot of dumb mistakes—like accepting a token swap with zero minimum received set, which can be catastrophic during a sandwich attack.

Smart contract interaction: read before you sign

Read what you sign. I know it’s boring. But contracts are just code, and code has intent. Some intents are benign; some are not. Tools that decode function selectors into human terms help—things like “increaseApproval” vs “approve” vs “transferFrom” matter. Also, look at the contract’s verified source when possible. If it’s unverified, treat it like a stranger’s sketchy handshake. You’re not being paranoid. You’re being practical.

When interacting, think about permission granularity. Approve only what you need. Use approvals that expire or use spender allowances where possible. If you must approve the whole amount, consider creating a small, disposable vault and funding it only when needed. These are trade-offs—some dApps won’t function without broader approvals—but they reduce blast radius. My instinct says smaller blast radius is always better.

Something felt off about one yield aggregator I used once; I ignored it initially and paid for that mistake. Actually, wait—let me rephrase that. I had a gut feeling and rationalized it away because the APR was shiny. That’s human. On one hand shiny APRs are tempting; on the other hand contracts with obfuscated logic and anonymous deployers are high risk even if returns look great. The math rarely justifies the trust deficit.

Portfolio tracking that tells the story

Tracking balances across chains and liquidity pools is not glamorous, but it’s necessary. Your portfolio isn’t just numbers; it’s exposure vectors. A single token wrapped into multiple vaults creates correlated risk you might not notice until a TVL migration occurs. Good trackers surface not just dollar values, but linkages: where assets are bridged, which pools hold them, and any open approvals tied to those assets.

One practical rule: classify positions by trust level. Label smart contracts as high/medium/low trust based on audits, verified source, and community signal. You’re building a mental map. It helps when a sudden market event happens and you need to triage which positions to unwind first. This approach is surprisingly calming—anxiety goes down when you can prioritize action instead of flailing.

And yes, automation helps. Alerts on abnormal token flows, large approvals, or sudden contract code changes let you act fast. But automation is a double-edged sword; poorly configured alerts become noise and you start ignoring them. Balance is key—use alerts for high-severity signals and periodic audits for everything else.

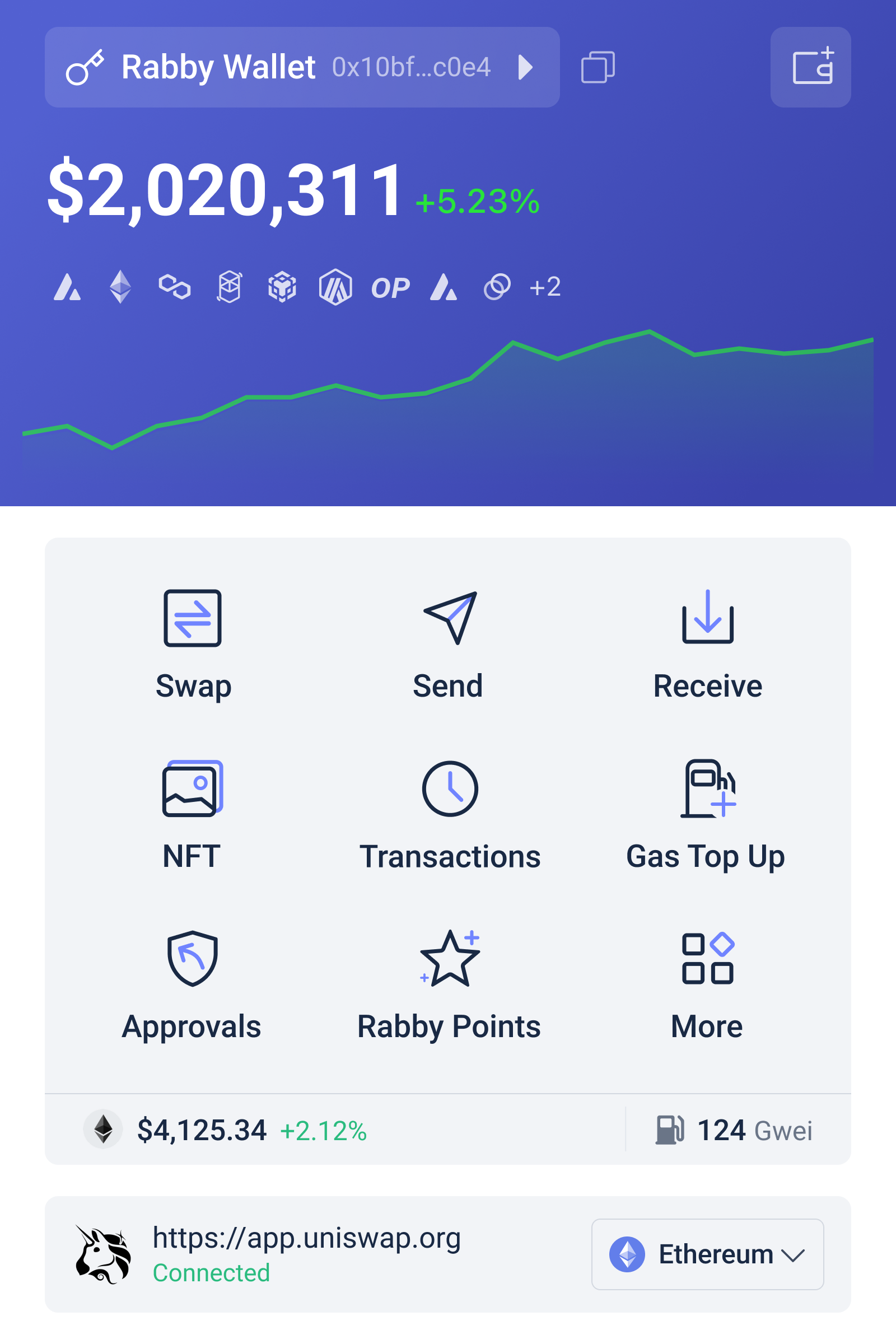

Check this out—trusted tooling that integrates simulation, permission management, and portfolio tracking is a game changer. I’ve been using a few options, but one that stands out for me mixes clear transaction simulation with permission controls and a clean portfolio dashboard. If you want something that nails that sweet spot between UX and security, consider trying rabby wallet. It streamlines approvals, shows simulated outcomes, and aggregates positions without drowning you in data.

2. https://viralblogspost.com/top-online-casinoer-uden-rofus-i-danmark-guide

3. https://viralblogspost.com/soar-score-wins-aviator-guide

4. https://viralblogspost.com/3806-2

5. https://viralblogspost.com/discover-the-excitement-of-free-gambling-establishment-gamings

Practical checklist before you hit confirm

Short checklist—easy to remember:

- Confirm the exact function and recipient.

- Simulate the transaction for state changes.

- Check the required approvals and minimize allowances.

- Validate the contract source and recent activity.

- Consider splitting large transactions to reduce risk.

Yeah, it’s a few extra clicks. But those clicks save messy recoveries. Don’t assume you can fix it later. Recoveries are expensive and sometimes impossible. Very very important note: set up multisigs for shared funds and use timelocks when possible. These small structural controls shift outcomes dramatically.

FAQ

How reliable are transaction simulators?

Simulators are solid for catching visible state changes and typical reentrancy or approval issues, but they can miss off-chain oracles and flash-loan edge cases unless specifically modeled. Treat simulation as a major filter, not a guarantee. If you’re dealing with large sums, combine simulation with on-chain audits and manual review.

Should I always minimize token approvals?

Minimizing approvals reduces risk but can break UX for some dApps. A pragmatic tactic is to approve small amounts initially, then increase allowances if necessary, or use a dedicated vault contract for repeated interactions. It adds friction but lowers the blast radius.

What’s the most common rookie mistake?

Blindly trusting flashy APYs and granting unlimited approvals. People see big returns and their caution evaporates. Slow down. Read the contract, simulate the flow, and treat approvals like handing someone a credit card with very high limits. Don’t be that person.

Leave a Reply