Remember the excitement of finally buying your first home? It was a dream come true, but the whole insurance process felt like a maze. You had no idea what kind of coverage you needed or how to compare quotes effectively. After weeks of research and frustration, you found a way to navigate the system. This guide is here to share your experience and provide a roadmap for first-time homebuyers to confidently secure auto and home insurance quotes.

Toc

- 1. Understanding Homeowners Insurance for First-Time Buyers

- 2. Navigating Auto Insurance Quotes for New Homeowners

- 3. The Benefits of Bundling Auto and Home Insurance

- 4. Getting Started with Your Auto and Home Insurance Quotes

- 5. Frequently Asked Questions

- 6. Related articles 02:

- 7. Conclusion

- 8. Related articles 01:

Understanding auto and home insurance quotes is essential for safeguarding your investment and ensuring peace of mind. In this guide, we’ll explore the critical aspects of auto and home insurance quotes tailored specifically for first-time homebuyers, helping you make informed decisions to find the best coverage at competitive prices.

Understanding Homeowners Insurance for First-Time Buyers

As a new homeowner, one of the first things you’ll need to consider is homeowners insurance. This type of insurance is not just a formality; it’s a crucial element in protecting your investment.

What is Homeowners Insurance?

Homeowners insurance serves as a safety net for your home and belongings. It typically covers a range of potential risks, including damage from fire, theft, and natural disasters. Additionally, homeowners insurance provides liability coverage, which can protect you if someone is injured on your property or if you accidentally damage someone else’s property.

In many cases, mortgage lenders require homeowners insurance as a condition of financing, making it not just a good idea, but a necessity.

Essential Coverages for First-Time Homebuyers

Navigating the different types of coverage can be overwhelming, but understanding these essential coverages is vital for first-time buyers.

- Dwelling Coverage: This protects the physical structure of your home. If a fire or storm causes damage, dwelling coverage ensures you can repair or rebuild.

- Personal Property Coverage: This covers the belongings inside your home, such as furniture, electronics, and clothing. If these items are damaged or stolen, personal property coverage helps you recover their value.

- Liability Coverage: This is particularly important for new homeowners. It protects you from potential lawsuits if someone is injured on your property. For instance, if a guest slips and falls, liability coverage can help cover their medical expenses and legal fees.

- Additional Living Expenses Coverage: If your home becomes uninhabitable due to a covered event, this coverage helps pay for temporary housing and related expenses.

Understanding these coverage types can provide peace of mind and help you protect your investment effectively.

Factors Affecting Your Home Insurance Quote

Several factors influence your homeowners insurance premium, and being aware of them can help you make informed decisions.

- Location: The geographical area where your home is located plays a significant role in your premium. Homes in regions prone to natural disasters, like hurricanes or floods, typically face higher rates. Additionally, crime rates in your neighborhood can influence your premium; higher crime areas may lead to increased rates due to the risk of theft.

- Home Value: The higher the value of your home, the more it will cost to insure. If your home is valued at $300,000, your insurance policy will reflect that value, potentially leading to higher premiums.

- Deductible: Your deductible is the amount you agree to pay out of pocket before your insurance kicks in. A higher deductible often results in lower premiums, but it means you’ll pay more in case of a claim.

- Coverage Limits: The amount of coverage you choose also impacts your premium. Ensure you have sufficient coverage to protect your home and belongings adequately.

- Age and Condition of Home: Older homes may incur higher premiums due to potential maintenance issues or outdated materials.

- Credit Score: In some regions, your credit score can affect your insurance rates. Insurers often view homeowners with higher credit scores as less risky, which can lead to lower premiums.

Understanding these factors can empower you to make adjustments that may lower your premiums while still providing the necessary coverage.

As a first-time homeowner, it’s essential to consider how your insurance needs might change, particularly regarding auto insurance.

The Impact of Homeownership on Auto Insurance

Becoming a homeowner can affect your auto insurance rates in several ways. Insurers often view homeowners as more financially responsible, which can lead to lower premiums compared to renters.

Your driving habits also come into play. Factors such as your commute distance, driving history, and vehicle usage will influence your auto insurance quote. Furthermore, the location of your new home can impact your auto insurance rates. For instance, if your home is situated in an area with high traffic congestion or elevated crime rates, your premiums may be higher due to the increased risk of accidents or vehicle theft.

Key Considerations for First-Time Homebuyers

When seeking auto insurance quotes as a new homeowner, there are several important factors to keep in mind.

- Coverage Options: Understanding the various types of auto insurance coverage is crucial. Key options include liability coverage, which covers damages you cause to others; collision coverage, which pays for damages to your vehicle after an accident; comprehensive coverage, which protects against non-collision-related incidents (like theft or natural disasters); and uninsured/underinsured motorist coverage.

- Deductibles: Choosing the right deductible is essential. A higher deductible usually results in a lower premium, but it also means you’ll pay more out of pocket in the event of a claim. Striking the right balance between affordability and risk tolerance is key.

- Discounts: Many insurers offer discounts that can lower your premiums. These may include good driver discounts, multi-car discounts, and discounts for having safety features in your vehicle.

- Comparison Shopping: It’s vital to get quotes from multiple insurance companies. This allows you to compare prices and coverage options, ensuring you find the best deal that meets your needs.

By taking the time to understand these factors, you can make informed decisions about your auto insurance that align with your new homeowner status.

The Benefits of Bundling Auto and Home Insurance

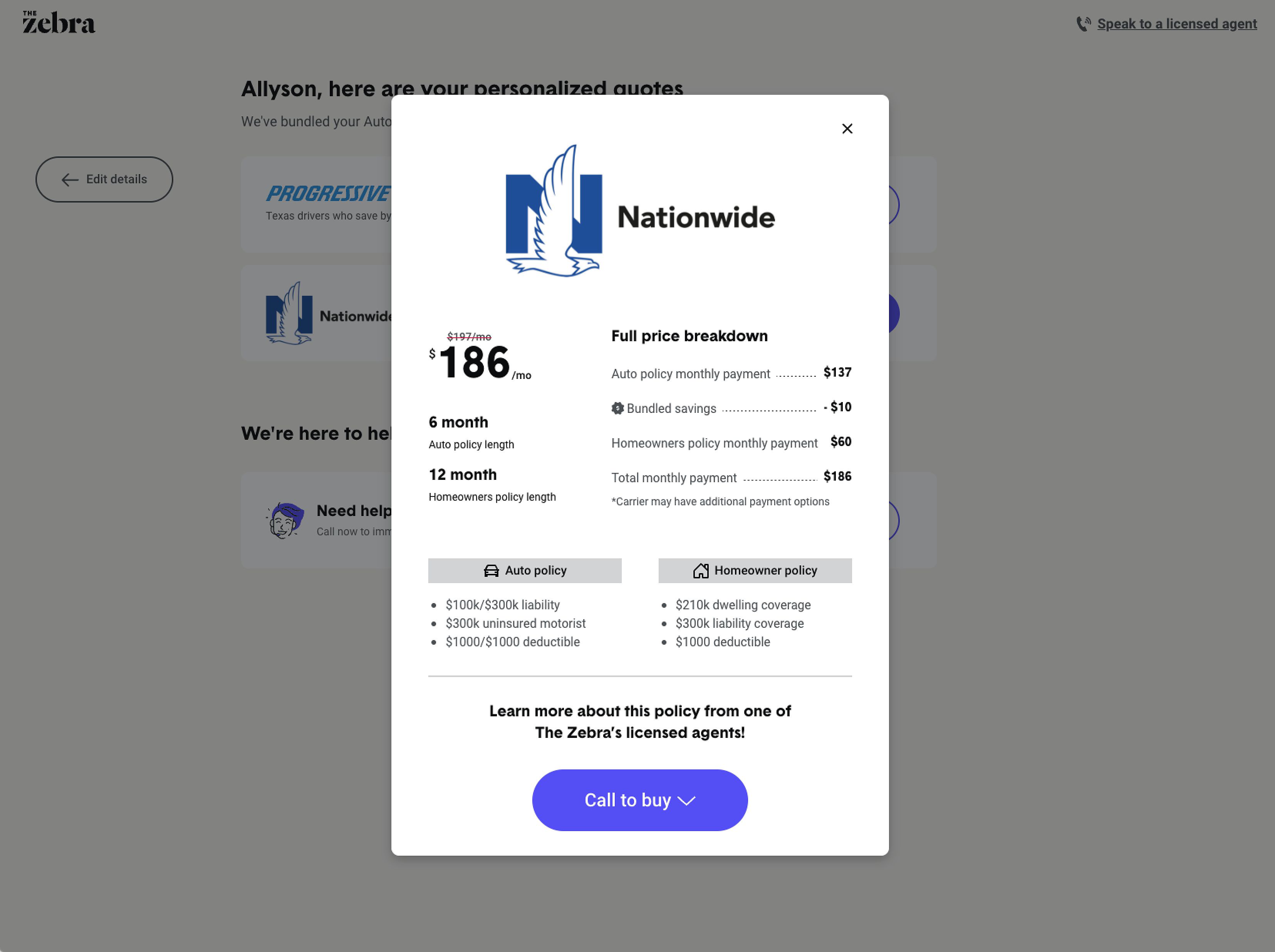

One effective strategy for managing insurance costs is bundling your auto and home insurance policies with the same provider.

What is Bundling?

Bundling refers to purchasing both your auto and home insurance from the same company. This approach often results in significant discounts compared to buying separate policies. Not only can bundling save you money, but it also simplifies your insurance management, allowing you to streamline payments and reduce the hassle of dealing with multiple insurers.

Why Bundle for First-Time Homebuyers?

For first-time homebuyers, bundling can offer specific advantages:

- Cost Savings: Bundling can lead to savings of 10% to 20% on your premiums, providing you with more budget flexibility as you settle into your new home.

- Convenience: Managing both policies with a single provider simplifies your life. You’ll have one point of contact for questions and claims, which can enhance your customer service experience.

- Enhanced Customer Service: Dealing with one insurer can make it easier to address any concerns or questions that arise, ensuring you receive consistent support.

Tips for Finding the Best Bundled Rates

To find the best bundled auto and home insurance rates, consider the following tips:

- Compare Quotes: Obtain quotes from multiple insurers for both bundled and unbundled policies. This will help you understand the best rates available.

- Consider Discounts: Inquire about various discounts, including those for good driving records, home safety features, and bundling multiple policies.

- Review Coverage: Ensure that the bundled policy offers sufficient coverage for both your auto and home insurance needs.

- Ask Questions: Don’t hesitate to reach out to insurance agents about their bundling options and any potential limitations that may apply.

By following these tips, you can maximize your savings while ensuring you have adequate coverage.

Getting Started with Your Auto and Home Insurance Quotes

Embarking on the journey to obtain auto and home insurance quotes may feel overwhelming, but breaking it down into manageable steps can simplify the process.

Gather Essential Information

Before you start obtaining quotes, it’s important to gather the necessary information that insurers will require. This includes:

- Personal Information: Be prepared to provide your name, address, date of birth, and social security number.

- Vehicle Information: For auto insurance, you’ll need details about your vehicle, including make, model, year, VIN, mileage, and how you use it.

- Home Information: For homeowners insurance, gather details about your home’s size, construction type, age, and any special features.

Compare Quotes from Multiple Insurers

Once you have all the necessary information, it’s time to start comparing quotes. Utilize online comparison tools or consult with insurance agents to gather different quotes. Be sure to evaluate both bundled and unbundled options to find the best rates and coverage.

When reviewing quotes, pay attention to the coverage limits, deductibles, and exclusions in each policy. This thorough examination will help ensure that you choose a policy that meets your needs without sacrificing necessary coverage.

Secure Your Policies

Once you’ve chosen the right policy, it’s time to complete the application process. Here are some steps to follow:

- Review Coverage: Thoroughly review the policy details, including coverage limits, deductibles, and any exclusions.

- Ask Questions: Clarify any uncertainties with the insurance agent. It’s important to understand what is and isn’t covered.

- Make Payment: Choose a payment method and schedule that works for you.

By following these steps, you can secure the auto and home insurance coverage you need to protect your new investment.

Frequently Asked Questions

What is the difference between renters insurance and homeowners insurance?

1. https://viralblogspost.com/archive/2389/

2. https://viralblogspost.com/archive/3430/

3. https://viralblogspost.com/archive/3595/

Homeowners insurance covers both the physical structure of your home and your personal belongings, while renters insurance only covers your personal belongings within a rented space.

How much homeowners insurance do I need?

The amount of homeowners insurance you need depends on the value of your home and possessions. Aim to have enough coverage to rebuild or replace your home and belongings.

What are some common discounts available for homeowners insurance?

Common discounts include those for good credit, home security systems, bundling policies, and claims-free history.

What should I do if I need to file a claim?

Contact your insurance provider immediately to report the claim and follow their instructions for the claims process.

How can I find a reputable insurance company?

Look for companies with strong financial ratings, positive customer reviews, and a history of fair claims handling. You can also consult with independent insurance agents who can help you find the best options for your needs.

Conclusion

Understanding auto and home insurance quotes is essential for first-time homebuyers looking to protect their new investment. By grasping the fundamentals of homeowners insurance, recognizing the factors that influence quotes, and exploring the benefits of bundling, you can make informed decisions that align with your needs. Take the time to compare quotes and ensure you have the right coverage in place, allowing you to focus on enjoying your new home with peace of mind.

As you embark on this journey, remember that securing the right insurance is not just about protecting your investment; it’s about creating a sense of security and peace of mind in your new chapter as a homeowner.

1. https://viralblogspost.com/archive/3637/

2. https://viralblogspost.com/archive/3506/

3. https://viralblogspost.com/archive/2588/

Leave a Reply