Navigating the world of car insurance can be daunting, especially for young drivers in Colorado. The excitement of getting your first car can quickly turn into confusion when faced with the task of finding affordable coverage. Did you know that the average annual cost for a 16-18-year-old in Colorado can reach an astonishing $8,453? That’s a hefty price tag for those just starting their driving journey! This guide aims to demystify the process of obtaining car insurance quotes in Colorado, focusing on the unique challenges young drivers face and providing practical tips to secure the best rates.

Toc

Understanding Colorado Car Insurance Requirements

Before diving into the world of car insurance quotes in Colorado, it’s essential to understand the state’s legal requirements. Every driver must carry minimum coverage to protect themselves and others on the road.

Minimum Liability Coverage

In Colorado, the law mandates that drivers maintain specific minimum liability coverage:

- Bodily Injury Liability (BIL): $25,000 per person and $50,000 per accident.

- Property Damage Liability (PDL): $15,000 per accident.

These coverages are designed to protect other drivers and their vehicles in the event of an accident where you are at fault. However, these minimums may not suffice in severe accidents, potentially leaving you liable for significant expenses. It’s prudent to consider higher limits or additional coverage options to safeguard your financial future.

Other Important Coverages

While Colorado’s minimum requirements are a starting point, there are several additional coverages that young drivers should consider for enhanced protection:

- Collision Coverage: This pays for damage to your vehicle resulting from a collision with another car or object.

- Comprehensive Coverage: This protects against non-collision incidents such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage steps in if you’re involved in an accident with a driver who lacks sufficient insurance.

- Medical Payments Coverage: This helps cover medical expenses for you and your passengers, regardless of fault.

Understanding these coverages can provide peace of mind while driving in the Centennial State.

Consequences of Driving Without Insurance

Driving without adequate insurance in Colorado can lead to severe penalties, including hefty fines, license suspension, and even legal repercussions. Staying compliant with the state’s insurance laws is not just a legal obligation; it’s a crucial step in protecting your financial well-being.

Average Car Insurance Costs for Young Drivers in Colorado

The costs associated with car insurance can vary widely, especially for young drivers. Factors such as age, driving history, vehicle type, and even your location can significantly influence your premiums.

Factors Affecting Your Rates

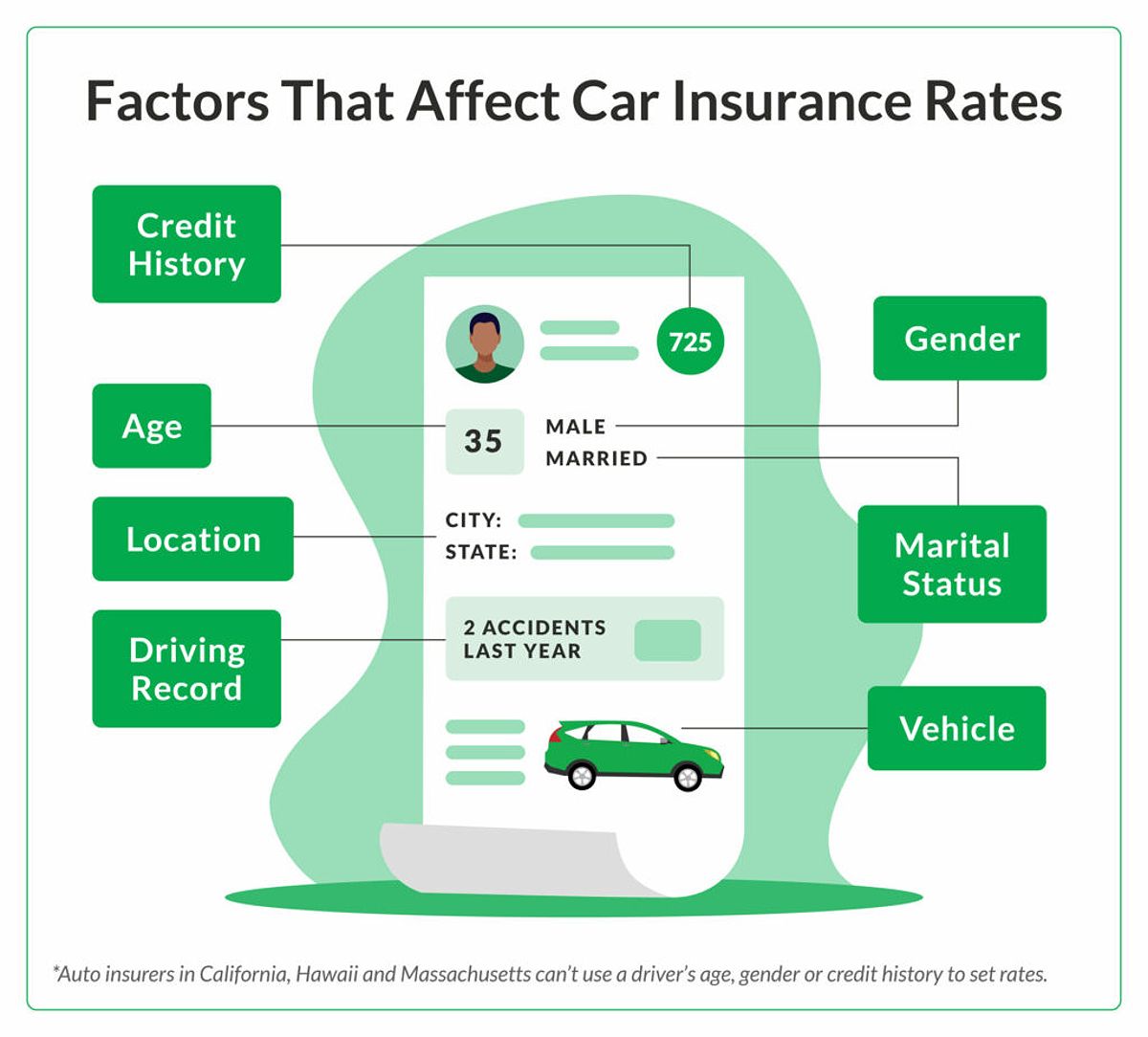

Several key elements can impact the cost of your car insurance quotes in Colorado:

- Age: Younger drivers typically pay more due to their limited experience. However, rates often decrease as drivers reach their mid-20s.

- Driving History: Accidents, traffic violations, and claims history can all lead to increased premiums.

- Vehicle Type: The make, model, and safety features of your car can affect your rates. Generally, vehicles with high safety ratings may qualify for lower premiums.

- Credit Score: Many insurers use credit-based insurance scores to determine rates. A higher credit score can lead to lower premiums.

- Location: Insurance rates can differ significantly based on your geographic area due to factors like population density and local accident rates.

Average Rates for Young Drivers

Based on recent research, here are the estimated average annual car insurance costs for young drivers in Colorado:

- Ages 16-18: Approximately $8,453

- Ages 19-21: Around $2,533

- Ages 22-25: About $2,087

These figures represent full-coverage policies for unmarried drivers with clean driving records. Your actual rates may differ based on your unique circumstances, so it’s essential to shop around for the best car insurance quote in Colorado.

Tips for Getting Cheaper Car Insurance Quotes

Finding affordable car insurance quotes in Colorado doesn’t have to be a stressful process. Here are some practical strategies to help you secure lower premiums:

Shop Around and Compare Quotes

One of the most effective ways to save on car insurance is to gather quotes from multiple providers. Each insurance company has different pricing structures and discounts, so comparing them side-by-side can lead to significant savings. Use online platforms to streamline this process and make informed decisions.

1. https://viralblogspost.com/archive/3357/

2. https://viralblogspost.com/archive/3515/

3. https://viralblogspost.com/archive/2333/

Consider Discounts

Many insurance companies offer various discounts that can help lower your premiums:

- Good Student Discount: If you maintain a high GPA, you may qualify for this discount.

- Safe Driver Discount: Maintaining a clean driving record can earn you additional savings.

- Defensive Driving Course Discount: Completing an approved defensive driving course can lead to lower rates.

Always inquire about available discounts when obtaining car insurance quotes in Colorado; you might be pleasantly surprised by how much you can save.

Improve Your Driving Record

Your driving history plays a crucial role in determining your insurance rates. By prioritizing safe driving and avoiding accidents or traffic violations, you can gradually secure lower premiums. Consider taking a defensive driving course to enhance your skills and potentially lower your rates.

Choose a Higher Deductible

Opting for a higher deductible can result in lower monthly premiums. However, ensure you have the financial means to cover this amount in case of an accident. This strategy can be particularly effective for young drivers who may not need to file frequent claims.

Bundle Your Policies

If you have other insurance policies, such as renters or homeowners insurance, consider bundling them with your car insurance. Many providers offer discounts for customers who consolidate their policies, making it a smart way to save money.

Best Car Insurance Companies for Young Drivers in Colorado

When searching for car insurance quotes in Colorado, it’s essential to consider providers known for their competitive rates and excellent customer service. Here are some of the top companies to explore:

Top Companies for Young Drivers

- Geico: Renowned for its affordability and user-friendly online platform, Geico offers a wide range of discounts tailored for young drivers in Colorado.

- State Farm: With a strong presence in the state, State Farm is celebrated for its excellent customer service and various discounts, including those for good students and safe drivers.

- Progressive: Known for its innovative insurance solutions, Progressive offers usage-based insurance programs that can lead to substantial savings based on individual driving habits.

- USAA: While only available to military members, veterans, and their families, USAA consistently ranks among the best for competitive rates and outstanding customer service.

Each of these providers has unique offerings, so take the time to research and compare their policies to find the best fit for your needs.

Getting Car Insurance Quotes Online

In today’s digital age, obtaining car insurance quotes has never been easier. By leveraging online tools, young drivers in Colorado can quickly compare options from various providers.

Online Quote Tools

Most insurance companies provide user-friendly online quote tools where you can enter your personal and vehicle information to receive personalized estimates. These tools simplify the comparison process, enabling you to make informed decisions.

Gather Necessary Information

When requesting car insurance quotes online, it’s vital to have the following information ready:

- Personal details (name, age, address, etc.)

- Vehicle make, model, and year

- Driving history (accidents, tickets, etc.)

- Current insurance coverage (if applicable)

By having this information on hand, you can easily input it into the online quote tool and receive accurate estimates tailored to your specific situation.

Compare Coverage Options

When reviewing car insurance quotes, it’s essential to not only look at the price but also the coverage options. Cheaper rates may mean sacrificing important coverage, leaving you vulnerable in case of an accident. Consider factors such as liability limits, deductibles, and additional coverage options like roadside assistance or rental car reimbursement.

Utilize Discounts

Many insurance companies offer discounts for young drivers who have completed driver’s education courses or maintain good grades in school. Additionally, discounts may be available for bundling multiple policies with the same company or having certain safety features installed on your vehicle.

Having this information readily available will help streamline the quote process, ensuring you receive accurate estimates.

Review and Compare Quotes

Once you’ve gathered quotes from several providers, take the time to carefully review each policy’s details. Pay close attention to coverage limits, deductibles, and available discounts to determine which option offers the best value for your needs.

1. https://viralblogspost.com/archive/2389/

2. https://viralblogspost.com/archive/3556/

3. https://viralblogspost.com/archive/3462/

Finding the right car insurance as a young driver in Colorado may require some diligence, but the effort can lead to significant savings and peace of mind on the road.

FAQ

Q: What if I have a speeding ticket or an accident on my record?

A: A speeding ticket or accident can increase your car insurance rates. However, some companies specialize in insuring drivers with less-than-perfect records. Shop around and compare quotes to find the best rates that fit your situation.

Q: How do I know if I’m getting a good deal on car insurance?

A: To ensure you’re getting a good deal, compare quotes from multiple companies, consider available discounts, and review the coverage details carefully. Make sure the policy provides adequate protection for your needs and aligns with your budget.

Q: What types of coverage do I need for my car insurance?

A: The most common types of coverage include liability, collision, and comprehensive. Liability covers damages or injuries you cause to others, while collision and comprehensive cover damages to your own vehicle. It’s important to consider your specific needs and budget when selecting coverage options.

Q: Can I change my car insurance policy after purchasing it?

A: Yes, you can make changes to your policy at any time. If you want to add or remove coverage, or adjust your deductible, contact your insurance provider to discuss the options available. Keep in mind that making changes may affect your premium.

Q: What are some common mistakes young drivers make when getting car insurance?

A: Common mistakes include not shopping around for quotes, overlooking available discounts, and selecting the cheapest policy without considering coverage details. Taking the time to understand your options can help you avoid these pitfalls. Additionally, young drivers should also avoid risky driving behaviors and maintain a clean driving record to keep their insurance rates low.

Conclusion

In conclusion, finding the best rates for car insurance can be a daunting task, but it’s essential to ensure you’re getting adequate coverage at an affordable price. By comparing quotes from multiple companies and carefully reviewing your options, you can avoid common mistakes and make an informed decision. Remember to also consider available discounts and make sure the policy aligns with your needs and budget. Don’t settle for the first quote you receive – take the time to find the best rates that fit your situation. With proper research and consideration, you can feel confident in your car insurance coverage while also saving money. So remember, don’t rush into a decision when it comes to car insurance – take the necessary steps to find the best deal for you!

Leave a Reply