Professional liability insurance is crucial for consultants to safeguard against claims arising from negligence, errors, or omissions in their professional services. This guide examines the importance, features, and best practices for obtaining professional liability insurance for consultants, ensuring your consulting business is protected.

Toc

- 1. Understanding Professional Liability Insurance for Consultants

- 2. Key Features of Professional Liability Insurance for Consultants

- 3. Finding the Right Professional Liability Insurance for Your Consulting Business

- 4. Protecting Your Consulting Business: Best Practices

- 5. Bundling Insurance Policies for Consultants

- 6. Navigating the Insurance Landscape for Consultants

- 7. FAQ

- 8. Related articles 02:

- 9. Conclusion

- 10. Related articles 01:

Understanding Professional Liability Insurance for Consultants

What is Professional Liability Insurance?

Professional liability insurance, also known as errors and omissions (E&O) insurance, is designed to protect consultants from claims related to negligence, errors, or omissions in their professional services. This type of insurance covers the legal costs and damages that may arise if a client alleges that your advice or services led to financial harm.

Why is Professional Liability Insurance Crucial for Consultants?

As a solopreneur, you face unique challenges, particularly when it comes to financial stability. The potential repercussions of lawsuits can be devastating for those running their own consulting business. You may lack the financial backing of larger organizations, making you more vulnerable to the fallout from a lawsuit. And if your business faces a claim, your personal assets could also be at risk, further complicating your financial situation.

By securing professional liability insurance, you create a safety net that allows you to focus on delivering quality services without the constant fear of legal repercussions. This coverage not only protects your business but also enhances your credibility with clients, showcasing your commitment to professionalism and accountability.

Distinguishing Professional Liability Insurance from General Liability Insurance

It’s important to understand the difference between professional liability insurance and general liability insurance. While general liability insurance protects against bodily injury or property damage claims, professional liability insurance focuses on the specific risks associated with providing professional services. This distinction is vital for consultants who primarily deal with intangible advice rather than physical products or services.

Key Features of Professional Liability Insurance for Consultants

Coverage Limits and Deductibles

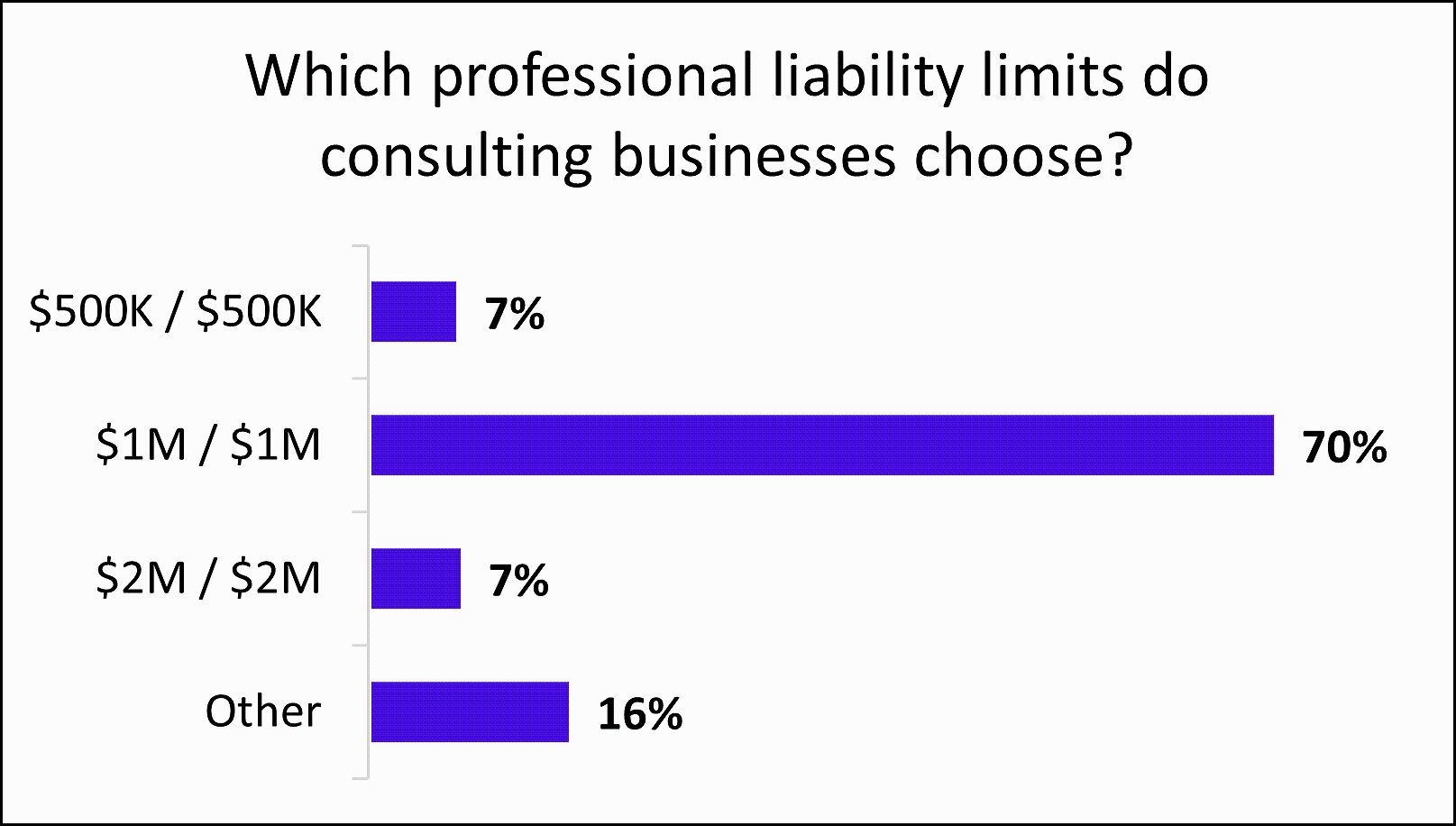

When it comes to professional liability insurance, coverage limits and deductibles are crucial factors to consider. Coverage limits indicate the maximum amount your insurer will pay for a claim, with both per-occurrence limits and aggregate limits. The per-occurrence limit is the maximum amount covered for a single claim, while the aggregate limit refers to the total amount covered during the policy period, usually one year.

Selecting appropriate limits is crucial; insufficient coverage can leave you exposed to significant financial risks. Deductibles are the amounts you must pay out of pocket before your insurance coverage kicks in. Typically, a higher deductible results in lower premium costs, but ensure you can comfortably afford the deductible in case of a claim.

Common Exclusions in Policies

While professional liability insurance provides essential coverage, it’s important to be aware of common exclusions. Policies may not cover claims arising from intentional misconduct, criminal activity, or issues related to previous employment. Understanding these exclusions helps ensure that you select a policy that aligns with your business needs and potential risks.

Defense Costs Coverage

Another critical feature of professional liability insurance is that it typically covers legal defense costs, even if the claim is ultimately found to be unfounded. This aspect can significantly alleviate the financial strain associated with legal proceedings.

Finding the Right Professional Liability Insurance for Your Consulting Business

Factors to Consider

When selecting professional liability insurance, there are several factors to consider:

- Industry Specificity: Different consulting niches carry varying risks. It’s essential to choose a policy tailored to your specific industry.

- Business Revenue: Your annual revenue can influence your premium costs. Generally, higher revenue correlates with higher premiums, as it indicates greater potential exposure to claims.

- Claims History: Your past claims can impact your insurance rates. A history of claims may lead to higher premiums, while a clean record can help you secure more favorable rates.

- Coverage Limits and Deductibles: Assess your business needs to determine the appropriate levels of coverage and deductibles. It’s crucial to find a balance that provides adequate protection without straining your budget.

Comparison Shopping and Negotiation

To find the best policy for your consulting business, it’s advisable to compare quotes from multiple insurance providers. This process allows you to evaluate different coverage options and premiums, ensuring you find a plan that suits your needs. Additionally, don’t hesitate to negotiate terms with insurers; many are willing to adjust premiums or coverage limits based on your specific circumstances.

Protecting Your Consulting Business: Best Practices

Securing professional liability insurance is just one step in safeguarding your consulting business. Here are additional proactive measures you can take to minimize risks:

Clear Contracts and Documentation

Establishing thorough contracts with your clients is paramount. These contracts should clearly outline the scope of your services, responsibilities, and limitations of liability. Well-defined agreements can help manage client expectations and reduce the likelihood of disputes. Meticulous documentation of all client interactions, decisions, and advice is equally important. Keeping detailed records can provide vital evidence in case of a claim, demonstrating your professionalism and diligence.

Ongoing Professional Development

Continuous learning and professional development are crucial for staying updated on industry best practices. By investing in your skills and knowledge, you can minimize errors and enhance the quality of your services, ultimately reducing the risk of claims.

Effective Client Communication

Maintaining clear and consistent communication with clients can prevent misunderstandings and manage expectations. Regular updates and open dialogues foster trust and can help mitigate potential disputes before they escalate.

Bundling Insurance Policies for Consultants

As a solopreneur, you may consider bundling different types of insurance policies to potentially save on premiums and streamline your coverage. For example, you could explore the option of combining your general liability and professional liability insurance into a single policy. This approach can provide comprehensive protection for your consulting business while potentially offering cost savings.

When exploring bundled insurance options, be sure to carefully review the terms and conditions to ensure that the coverage aligns with your specific business needs. Consult with a trusted insurance broker or provider to discuss the available bundling options and determine the most suitable solution for your consulting practice.

The world of insurance can be complex, and it’s important to have a solid understanding of the options available to you as a consultant. In addition to professional liability insurance, there are other types of coverage that may be beneficial for your consulting business, such as:

- General Liability Insurance: This coverage protects against claims related to bodily injury, property damage, or personal and advertising injury.

- Business Owner’s Policy (BOP): A BOP typically combines general liability and property insurance, providing a comprehensive package for small businesses.

- Workers’ Compensation Insurance: If you have employees, this coverage is often required by law to protect your team in the event of work-related injuries or illnesses.

- Cyber Liability Insurance: As consultants, you may handle sensitive client data, and this insurance can help cover the costs associated with data breaches or cyber incidents.

Consulting with an experienced insurance broker can be invaluable in navigating the complexities of the insurance landscape and ensuring that your consulting business is protected on all fronts.

FAQ

Is professional liability insurance mandatory for consultants?

1. https://viralblogspost.com/archive/3515/

2. https://viralblogspost.com/archive/3462/

3. https://viralblogspost.com/archive/2339/

While not legally required in most cases, it is highly recommended to protect your business and build client trust.

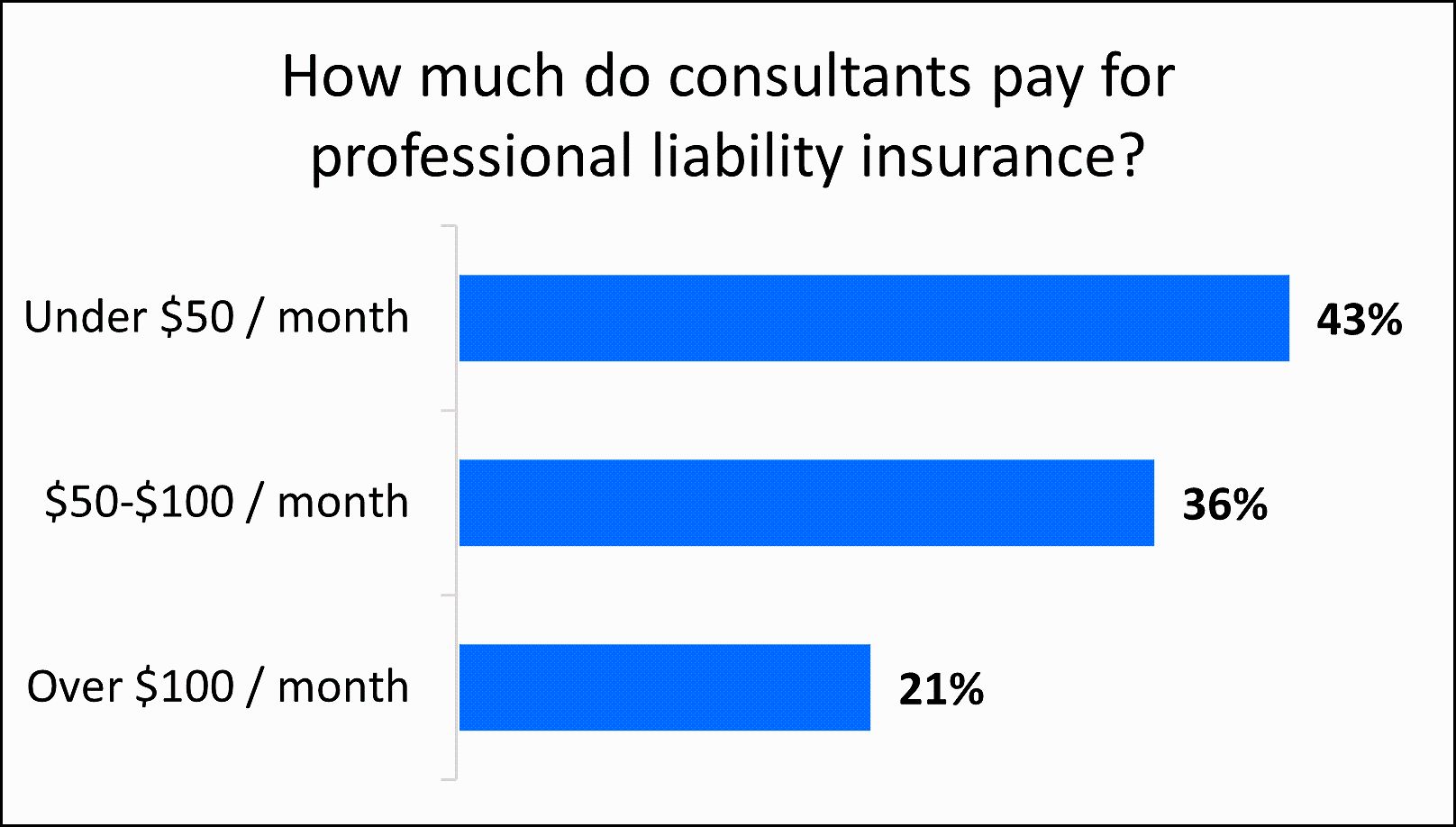

How much does professional liability insurance for consultants cost?

Premiums vary based on factors such as industry, revenue, and claims history. Comparing quotes from multiple providers is crucial to find the best rates.

What are some common exclusions in professional liability policies?

Common exclusions may include intentional acts, criminal activity, and claims arising from previous employment.

How can I find a reputable insurance provider?

Seek recommendations from other consultants, research online reviews, and consider working with a trusted insurance broker.

Conclusion

Protecting your consulting business with professional liability insurance is a crucial step for solopreneurs. By understanding the benefits, key features, and factors to consider, you can secure the right coverage to safeguard your business and provide peace of mind. Remember to also take proactive measures, such as maintaining clear contracts, ongoing professional development, and effective client communication. With the right approach, you can focus on delivering exceptional consulting services while minimizing the risks associated with your profession. Additionally, exploring the option of bundling different insurance policies can help you optimize your coverage and potentially save on costs. Take the necessary steps to protect your consulting business and ensure its long-term success.

1. https://viralblogspost.com/archive/2764/

2. https://viralblogspost.com/archive/2260/

3. https://viralblogspost.com/archive/3574/

Leave a Reply