Finding affordable car insurance in Arizona can feel like navigating a desert road—hot, dusty, and confusing. With so many options and factors to consider, it’s easy to feel overwhelmed. But understanding your needs and knowing how to shop for the best rates can make the process much smoother. This guide will equip you with the knowledge and tools to get the cheapest auto insurance quotes Arizona has to offer, helping you save money and drive with peace of mind.

Toc

Understanding Minimum Auto Insurance Quotes Arizona

Before diving into the process of obtaining car insurance, it’s essential to grasp the state’s minimum coverage requirements. Arizona law mandates that all drivers maintain a minimum level of liability coverage, which includes:

- Bodily Injury Liability: This covers injuries you may cause to others in an accident, with minimum limits set at $25,000 per person and $50,000 per accident.

- Property Damage Liability: This covers damage you cause to someone else’s property, such as their vehicle or a fence, with a minimum required limit of $15,000 per accident.

While these minimums might seem sufficient, they can quickly fall short in the event of a serious accident. Medical bills and vehicle repairs can add up, potentially leaving you responsible for the excess costs. Therefore, many drivers opt for additional coverage options to better protect themselves:

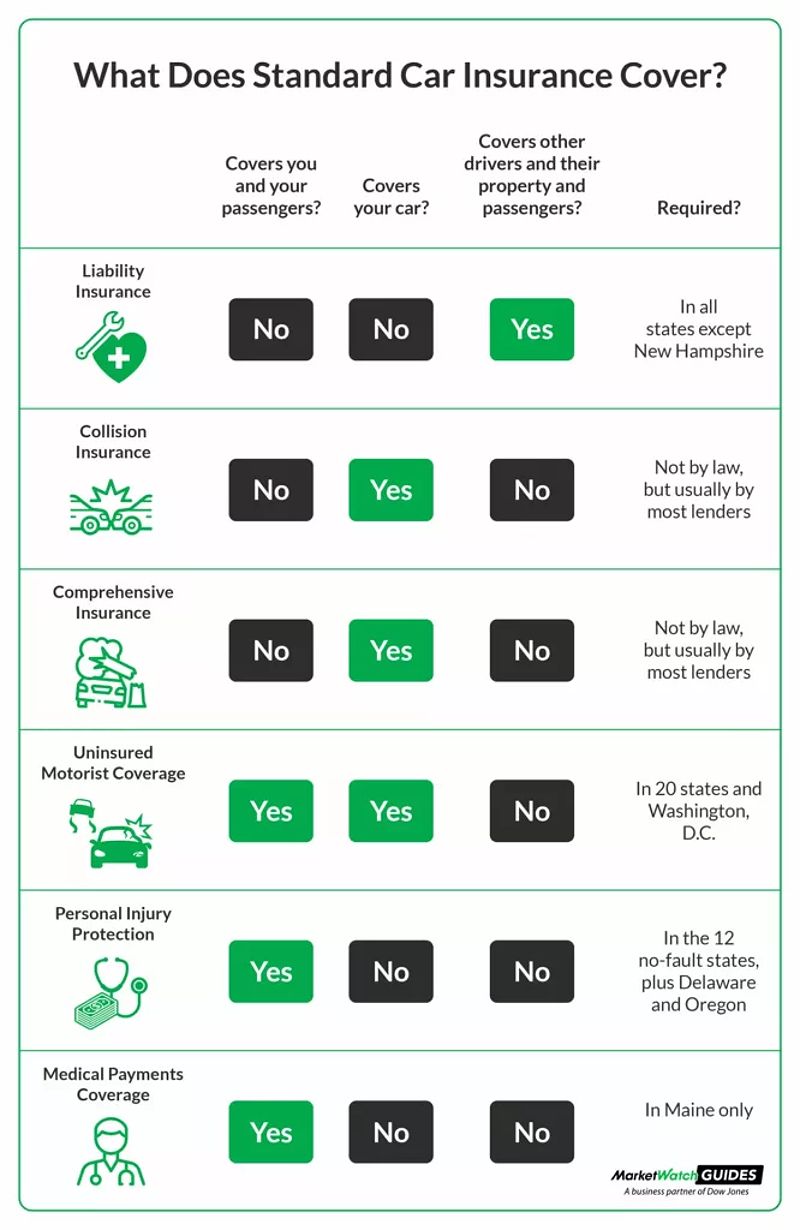

- Collision Coverage: This insurance pays for damage to your vehicle resulting from a collision, regardless of fault.

- Comprehensive Coverage: This protects against damages not related to a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This is crucial for protecting yourself financially if you’re involved in an accident with a driver who lacks adequate insurance.

- Medical Payments Coverage (MedPay): This covers medical expenses for you and your passengers after an accident, regardless of fault.

- Personal Injury Protection (PIP): PIP goes a step further, covering medical expenses, lost wages, and other costs related to an accident.

Understanding these coverage options allows you to make informed decisions when obtaining “auto insurance quotes Arizona,” ensuring you have the protection you need.

How to Get the Cheapest Auto Insurance Quotes in Arizona

Finding the best auto insurance quotes in Arizona requires a bit of strategy. Here’s a step-by-step guide to help you navigate the process:

1- Compare Quotes from Multiple Providers

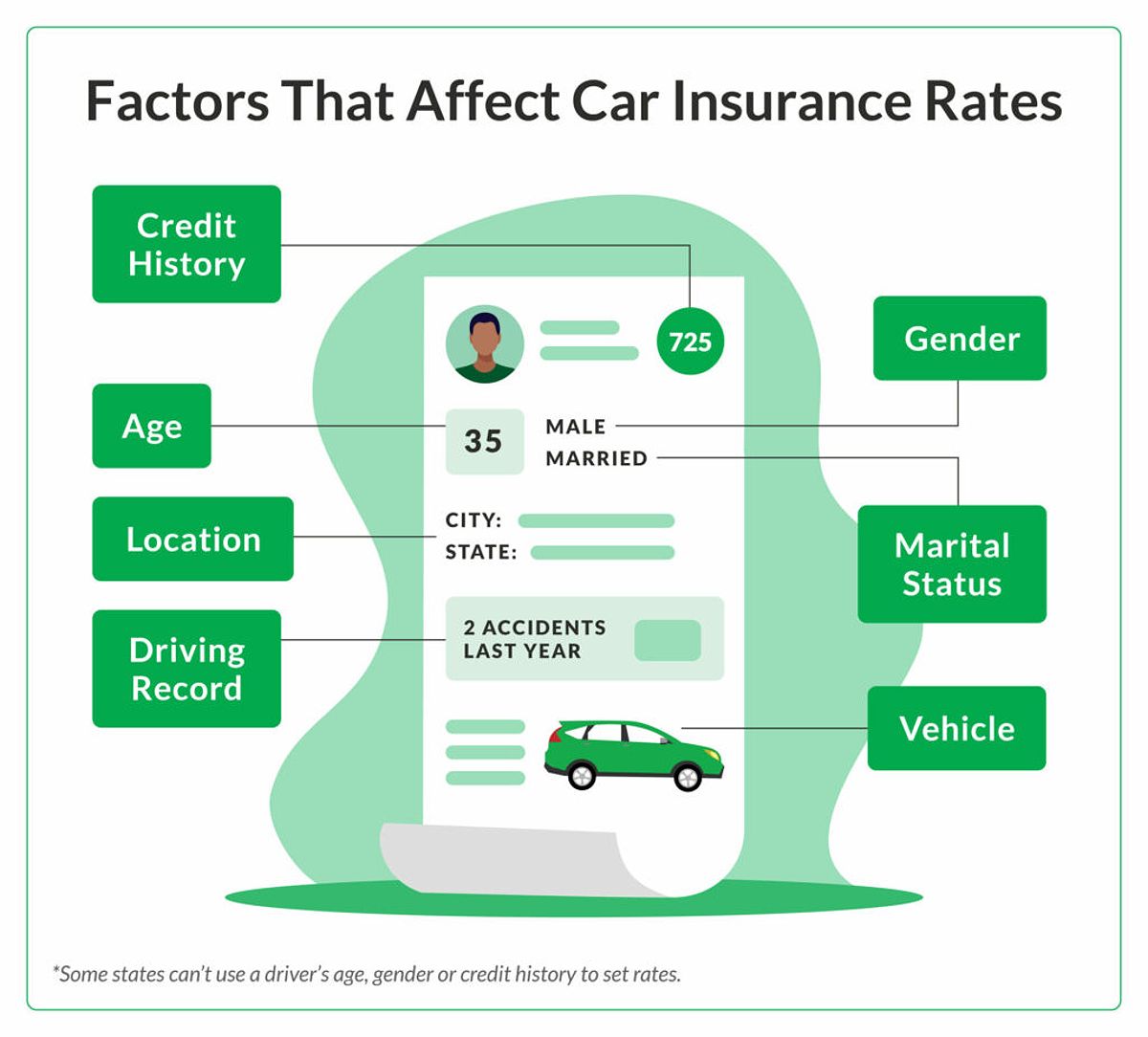

One of the best ways to secure affordable car insurance is to compare quotes from various providers. Don’t just go with the first quote you receive; instead, aim to gather at least three to five quotes to get a better sense of the market. Rates can vary widely based on factors like:

- Your driving history

- The type of vehicle you drive

- Your age and gender

- Your credit score

Using online comparison tools can streamline this process, allowing you to input your information and receive multiple quotes simultaneously. Just remember to keep your personal details consistent across quotes for accurate comparisons.

2- Consider Discounts and Bundling Options

Insurance providers often offer a variety of discounts that can significantly reduce your premiums. Some common discounts available in Arizona include:

- Multi-Car Discount: Save money by insuring multiple vehicles under the same policy.

- Multi-Policy Discount: Bundle your auto insurance with other types of insurance, like homeowners or renters insurance, for a discount.

- Good Student Discount: Young drivers who maintain a certain GPA may qualify for this discount.

- Safe Driver Discount: Drivers with a clean driving record, free from accidents and violations, often receive reduced rates.

- Defensive Driving Course Discount: Completing an approved defensive driving course can lead to lower premiums.

- Military and Veteran Discounts: Many insurers offer special rates for active military personnel and veterans.

- Loyalty Discounts: Long-term customers may receive discounts for staying with the same provider.

Be proactive in asking about available discounts during the quoting process. You might be surprised at how much you can save by simply mentioning your qualifications.

![]()

1. https://viralblogspost.com/archive/2333/

2. https://viralblogspost.com/archive/3462/

3. https://viralblogspost.com/archive/2277/

3- Shop Around Regularly

Insurance rates are not set in stone; they can fluctuate based on various factors, including your driving record and the insurance market. To ensure you continue to receive the best auto insurance quotes in Arizona, make it a habit to review your options at least once a year or every six months. This practice allows you to take advantage of any new discounts or changes in your situation that could affect your rates.

4- Understand Your Coverage Needs

When seeking out auto insurance quotes, it’s vital to understand your specific coverage needs. Consider factors such as:

- Vehicle Value: If you own an older car, you may not need comprehensive or collision coverage. Conversely, newer vehicles often require full coverage to protect your investment.

- Driving Habits: If you frequently drive long distances or in high-traffic areas, you may want to consider additional coverage for peace of mind.

- Financial Situation: Assess your ability to pay higher deductibles versus higher premiums. Choosing a higher deductible can lower your monthly payments but requires you to have funds available in case of an accident.

By determining your coverage needs, you can tailor your search for auto insurance quotes in Arizona to find policies that align with your lifestyle and financial situation.

Top Car Insurance Companies in Arizona

When searching for affordable car insurance, several companies stand out for their competitive rates and customer service:

Geico

Geico is widely recognized for its affordability and extensive coverage options. The company offers a user-friendly online experience, allowing you to get quotes quickly and manage your policy easily. Geico also has a strong reputation for customer service and claims handling. However, its discount offerings may be more limited compared to some competitors.

State Farm

As one of the largest insurers in the country, State Farm provides a broad range of coverage options and discounts. The company has a vast network of agents, making it easy for customers to get personalized service. State Farm is known for high customer satisfaction ratings, although its rates can sometimes be higher than those of other providers.

Travelers

Travelers is another reputable option, known for its competitive rates and comprehensive coverage options. The company offers various discounts, including those for safe driving and bundling policies. However, some customers report lower satisfaction with the claims process, so it’s essential to weigh the pros and cons before committing.

Auto-Owners

Auto-Owners is praised for its affordability and excellent customer service. The company has a strong financial standing and provides a wide range of coverage options. However, it’s important to note that Auto-Owners operates in only 26 states, which may limit its availability for some customers.

Progressive

Progressive is known for its innovative features and competitive pricing. The company offers a variety of online tools, including the “Name Your Price” tool, which allows customers to find coverage that fits their budget. While Progressive has a solid reputation, some customers report average satisfaction with its customer service.

1. https://viralblogspost.com/archive/2263/

2. https://viralblogspost.com/archive/3515/

3. https://viralblogspost.com/archive/3286/

Tips for Saving on Auto Insurance Quotes in Arizona

In addition to comparing quotes and taking advantage of discounts, consider these additional strategies to lower your auto insurance quotes in Arizona:

- Maintain a Clean Driving Record: A history free from accidents and violations can lead to lower premiums. Defensive driving and safe driving habits are essential.

- Opt for Higher Deductibles: While this means you’ll pay more out of pocket in the event of a claim, choosing a higher deductible can significantly lower your monthly premiums.

- Shop for Discounts: Regularly inquire about new discounts, as insurers often change their offerings. This can include discounts for safe driving, low mileage, or new safety features in your vehicle.

- Bundle Your Insurance Policies: Combining auto insurance with other types of insurance can yield significant savings. Many companies offer discounts for bundled policies.

- Improve Your Credit Score: Your credit score can impact your insurance rates. By maintaining good credit habits, you can potentially lower your premiums over time.

Frequently Asked Questions

Q: What are the minimum car insurance requirements in Arizona?

A: Arizona requires drivers to carry at least $25,000 per person and $50,000 per accident in bodily injury liability coverage, along with $15,000 per accident in property damage liability coverage.

Q: How can I get the cheapest car insurance quotes in Arizona?

A: To obtain the cheapest auto insurance quotes in Arizona, compare rates from multiple providers, consider available discounts, and regularly review your options to ensure you’re getting the best deal.

Q: What are some of the top car insurance companies in Arizona?

A: Some of the leading car insurance companies in Arizona include Geico, State Farm, Travelers, Auto-Owners, and Progressive. Each has unique strengths and weaknesses, so it’s important to compare them based on your needs.

Q: How can I save money on my auto insurance in Arizona?

A: You can save money on your auto insurance quotes in Arizona by maintaining a clean driving record, opting for a higher deductible, bundling your insurance policies, and regularly shopping for discounts.

Conclusion

Navigating the world of auto insurance can be challenging, but understanding your options and knowing how to shop for the best rates can significantly ease the process. By familiarizing yourself with Arizona’s insurance requirements, comparing quotes from various providers, and leveraging available discounts, you can find the best auto insurance quotes in Arizona tailored to your needs. Don’t let high rates deter you from securing the coverage you need; take control of your insurance costs and drive with confidence.

Leave a Reply