Running a small business is a whirlwind of activity. You’re juggling customers, managing inventory, and keeping an eye on the bottom line. But what if there was a way to simplify your financial management and gain deeper insights into your business performance? The Beyond Finance log in process is the key to unlocking a platform designed to help small business owners gain clarity and control over their financial activities.

Toc

- 1. Beyond Finance: Your Financial Management Partner

- 2. Navigating the Beyond Finance Log In Process

- 3. Unlocking the Power of Beyond Finance

- 4. Beyond Finance: A Valuable Tool for Small Business Growth

- 5. The Role of Customer Support and Resources

- 6. Related articles 02:

- 7. FAQ

- 8. Conclusion

- 9. Related articles 01:

Beyond Finance is a powerful online platform tailored specifically for small business owners like you. It offers a range of features, from tracking expenses and income to generating financial reports and creating budgets. This article will guide you through the process of logging into Beyond Finance, highlighting its key benefits and how it can help you make smarter financial decisions. We’ll explore the benefits of using Beyond Finance and walk you through the simple steps to log in to your account at www.beyondfinance.com.

Beyond Finance: Your Financial Management Partner

Imagine having a financial ally at your side, ready to help you tackle the challenges of managing your business finances. That’s exactly what Beyond Finance offers. This comprehensive financial management solution is designed to make your life easier by integrating essential features that streamline your financial processes.

Key Features of Beyond Finance

-

Expense Tracking: Keep a close eye on where your money is going. Beyond Finance allows you to categorize your expenditures, scan receipts automatically, and monitor expenses in real-time. This not only helps you maintain an organized financial overview but also empowers you to identify spending patterns and control costs effectively.

-

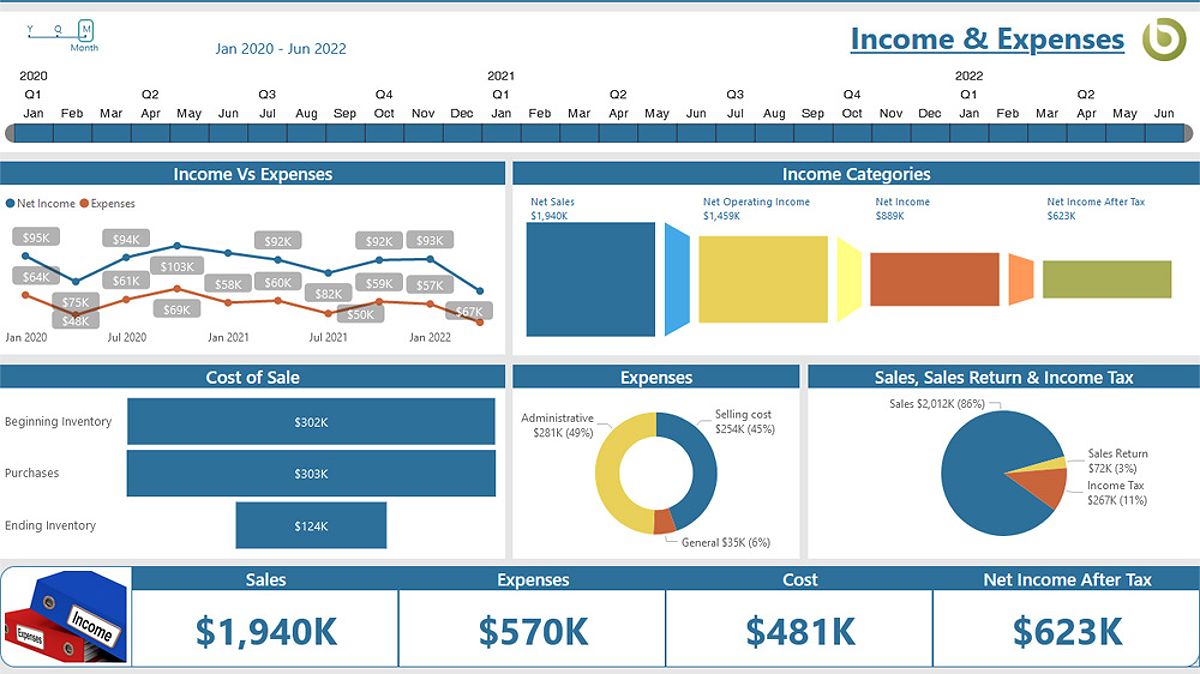

Income Management: Managing your revenue is just as crucial. With Beyond Finance, you can create and manage invoices, process payments seamlessly, and generate detailed sales reports. This holistic view of your income streams helps you make informed decisions that can positively impact your business growth.

-

Budgeting and Financial Insights: Beyond Finance also provides budgeting tools and insightful reports to help you set financial goals and track your progress. This feature encourages accountability, enabling you to make informed decisions about spending and investments.

For instance, consider a small bakery that struggled with managing its expenses. After implementing Beyond Finance, the owner could track ingredient costs, identify where savings could be made, and ultimately improve profit margins. This is the kind of transformation that effective financial management can bring.

Now that you’re excited about what Beyond Finance can do for you, let’s dive into the “beyond finance log in” process. Accessing your account is straightforward, and with just a few simple steps, you’ll be on your way to managing your finances like a pro.

Step-by-Step Instructions for Logging In

- Visit the Website: Open your preferred web browser and type in www.beyondfinance.com.

- Locate the Login Button: On the homepage, look for the ‘Log In’ button, typically found at the top right corner.

- Enter Your Credentials: Input your registered email address and password. If you signed up through a social media platform, you can use that option for quick access.

- Access Your Dashboard: After entering your credentials, click the ‘Log In’ button to access your financial dashboard.

Troubleshooting Common Login Issues

It’s not uncommon to run into a few bumps on the road while logging in. If you forget your password, don’t panic! There’s a handy ‘Forgot Password?’ link that will guide you through resetting it. Just follow the instructions in the email you receive to regain access.

If you find yourself locked out due to multiple unsuccessful attempts, customer support is available to assist you. To make your life easier, consider using a password manager. This tool not only simplifies the login process but also enhances security by generating strong, unique passwords for each account.

Customizing Your Beyond Finance Experience

Once you’re logged in, you can personalize your Beyond Finance experience. From setting up your dashboard to customizing your reports, the platform allows you to tailor the tools to fit your specific business needs. This means you can focus on what matters most to you—growing your business.

Unlocking the Power of Beyond Finance

Now that you’re logged in, let’s explore the treasure trove of features and functionalities that Beyond Finance offers to enhance your financial management practices.

Expense Tracking Made Easy

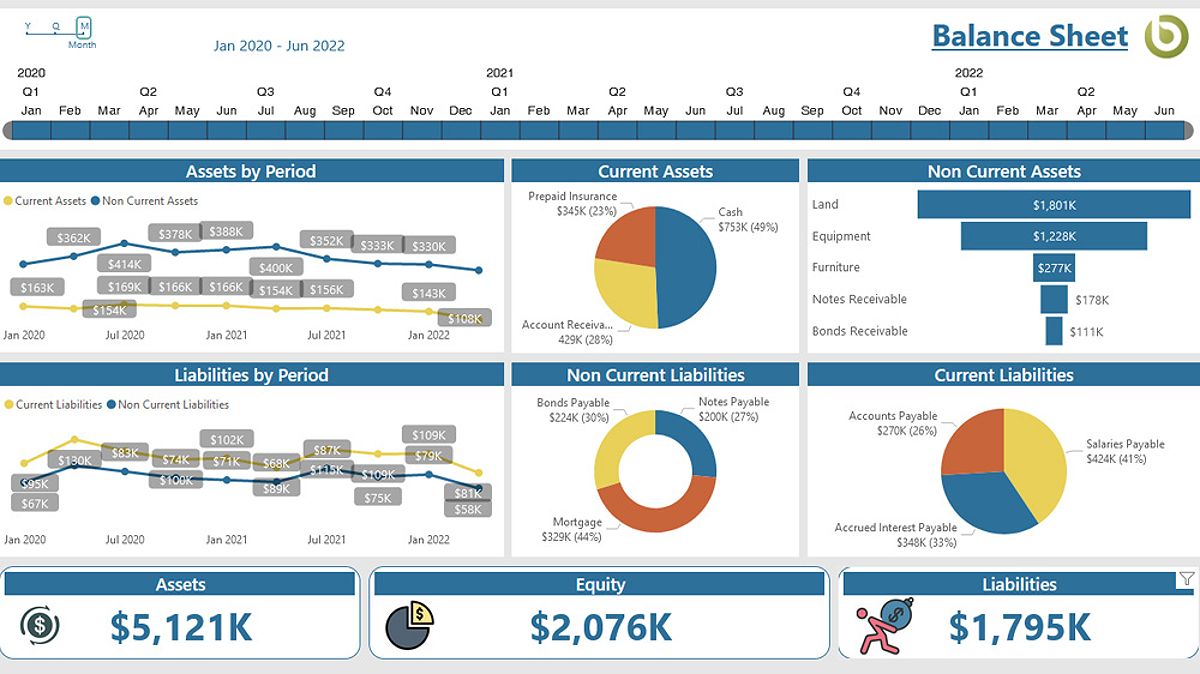

Gone are the days of sifting through stacks of receipts and spreadsheets. Beyond Finance simplifies expense tracking with features such as:

- Categorization of Expenses: Easily categorize your expenditures to understand where your money is going.

- Automated Receipt Scanning: Snap a photo of your receipts, and let the platform do the heavy lifting by entering the details for you.

- Integration with Bank Accounts: Link your bank accounts to monitor your expenses in real-time, giving you a clear picture of your financial health.

For example, if you notice an unexpected spike in office supply costs, you can investigate and find ways to reduce expenses, like bulk purchasing or negotiating better deals with suppliers.

Managing Income and Revenue

Tracking income is just as essential as monitoring expenses. Beyond Finance equips small business owners with tools to manage their revenue effectively:

- Invoice Creation and Management: Create professional invoices and keep track of payments with ease.

- Payment Processing Integration: Receive payments quickly through integrated payment processing systems.

- Sales Reports and Analysis: Access detailed sales reports that help you understand your revenue streams better.

This feature can be a game-changer for businesses. For instance, a local café might identify peak sales periods and adjust staffing or inventory accordingly, optimizing operations to maximize profits.

Budgeting and Financial Planning

Effective budgeting is the backbone of sustainable business growth. Beyond Finance facilitates this through:

- Customizable Budget Templates: Set financial goals and track your progress with personalized budget templates.

- Goal Setting and Tracking: Establish clear financial targets and monitor your performance against them.

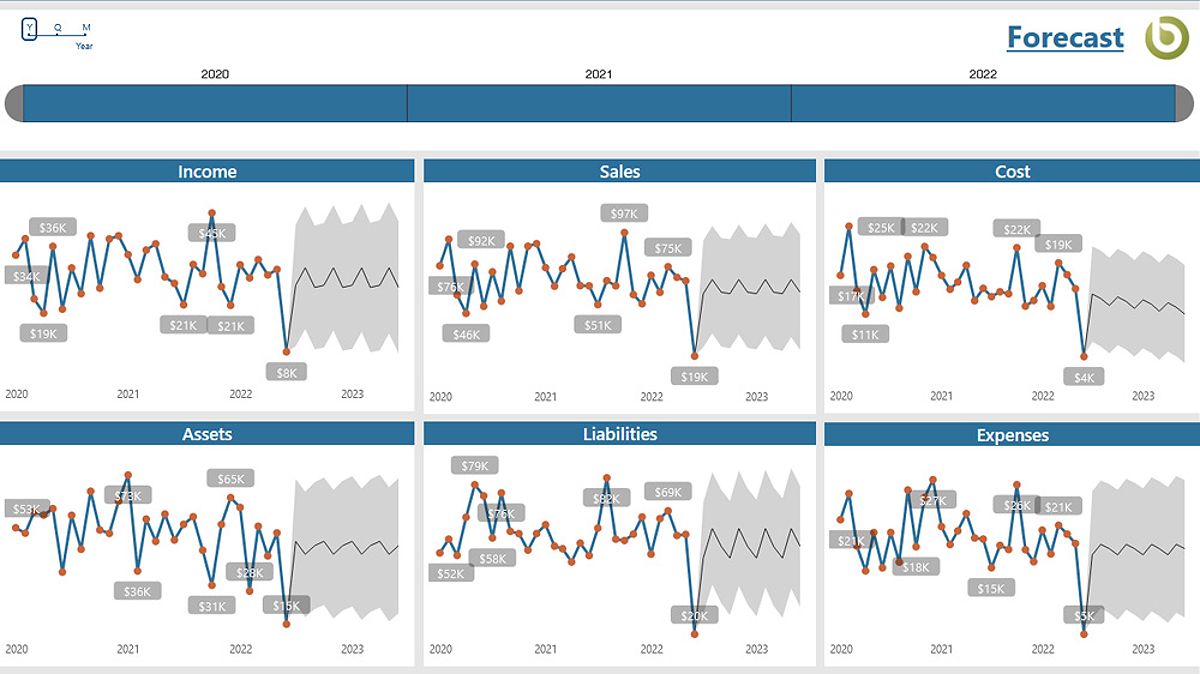

- Financial Forecasting Tools: Gain insights into potential future financial scenarios to help you prepare for upcoming challenges.

By utilizing these features, small business owners can manage cash flow more effectively. For example, if you anticipate increased sales during a holiday season, you can adjust your budget to accommodate marketing efforts and inventory needs.

Beyond Finance: A Valuable Tool for Small Business Growth

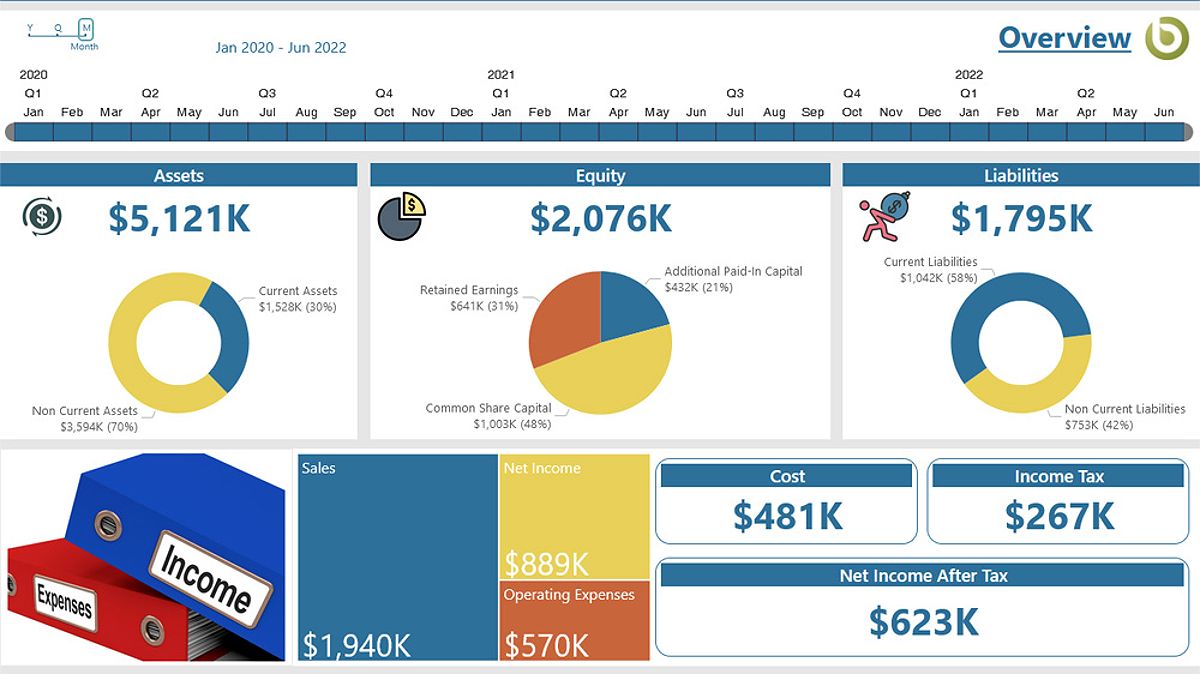

Beyond Finance is not just about managing your finances; it’s about driving your business growth. With the insights and data provided by this platform, small business owners can make strategic decisions that propel their businesses forward.

Data-Driven Decision Making

Having access to real-time data and analytics is crucial in today’s competitive landscape. Beyond Finance empowers you to identify new revenue opportunities and allocate resources effectively.

Take the example of a small boutique that utilized Beyond Finance to analyze customer purchase patterns. By tailoring their marketing strategies to target specific demographics, they saw a significant increase in sales. This ability to make data-driven decisions is what sets successful businesses apart.

Emphasizing the Importance of Financial Data

The significance of leveraging financial data to inform business decisions cannot be overstated. Beyond Finance helps you utilize your financial data to identify trends, evaluate performance, and make necessary adjustments. This proactive approach fosters sustainable growth and agility in a changing market.

Moreover, financial data can serve as a benchmark for evaluating your performance. By comparing your current financial standing with past data or industry standards, you can gauge your success and pinpoint areas for improvement.

The Role of Customer Support and Resources

Another advantage of Beyond Finance is its robust customer support and educational resources. Small business owners can access a wealth of information, including tutorials, FAQs, and customer service representatives ready to assist with any questions or concerns.

1. https://viralblogspost.com/archive/3557/

2. https://viralblogspost.com/archive/3523/

3. https://viralblogspost.com/archive/3319/

Accessing Help and Support

If you encounter challenges while navigating the platform, Beyond Finance provides various support options. From live chat to email support, help is readily available to ensure that you can resolve issues quickly. This means less downtime and more focus on your business operations.

Additionally, the platform may offer webinars and training sessions that delve deeper into specific features. These resources can enhance your understanding and help you maximize the potential of Beyond Finance.

FAQ

What if I forget my password for Beyond Finance?

You can easily reset your password by clicking on the ‘Forgot Password?’ link on the login page. Just follow the instructions in the email you receive to create a new password.

How secure is my financial data on Beyond Finance?

Beyond Finance employs industry-standard security measures, including encryption and two-factor authentication, to protect your data from unauthorized access.

Can I access Beyond Finance from my mobile device?

Yes, Beyond Finance is designed to be accessible from various devices, including smartphones and tablets, allowing you to manage your finances on the go.

What resources are available for learning how to use Beyond Finance?

Beyond Finance offers a variety of resources, including tutorials, webinars, and customer support, to help users effectively utilize the platform and maximize its features.

Conclusion

The “beyond finance log in” process opens the door to a powerful financial management tool tailored for small business owners. With features that streamline expense tracking, income management, and budgeting, Beyond Finance equips you with the tools necessary to make informed financial decisions. By leveraging this platform, you can gain control over your finances and set the stage for sustainable growth.

So, are you ready to unlock financial clarity for your small business? Visit www.beyondfinance.com today to create an account and start leveraging the power of Beyond Finance. Embrace the opportunity to simplify your financial management and focus on what you do best—growing your business and serving your customers.

1. https://viralblogspost.com/archive/3098/

2. https://viralblogspost.com/archive/3284/

3. https://viralblogspost.com/archive/3368/

Leave a Reply