Starting a business is exciting, but it also comes with its fair share of anxieties. One of the biggest concerns for many entrepreneurs is the cost of insurance. It’s easy to feel overwhelmed by the complex policies and seemingly high premiums. But what if I told you that finding cheap insurance for business is not just a pipe dream? This comprehensive guide will share the insider tips and strategies I’ve learned to help you secure the protection your business needs without breaking the bank. As a fellow small business owner, I understand the delicate balance between managing costs and ensuring your enterprise is safeguarded against unexpected risks.

Toc

Uncovering the Essential Coverage for Your Business

When it comes to business insurance, there’s no one-size-fits-all solution. Each industry and enterprise faces unique challenges, from customer injuries to property damage and employee accidents. While it may be tempting to think “it won’t happen to me,” the reality is that a single lawsuit or disaster can jeopardize your hard-earned livelihood.

That’s where business insurance comes into play. General liability coverage shields your company from the costs associated with third-party bodily injuries or property damage. Property insurance safeguards your physical assets, while workers’ compensation ensures you can care for your employees if they’re hurt on the job. Professional liability (or “errors and omissions”) insurance, on the other hand, protects you from claims of negligence or mistakes in your professional services.

Neglecting to have the right insurance in place can leave your small business vulnerable. Without coverage, you’d be responsible for paying out of pocket for legal fees, settlements, repairs, and other expenses — which could quickly deplete your resources and jeopardize your operations.

Strategies for Finding Cheap Insurance for Business

Now that you understand the importance of business insurance, let’s dive into the steps you can take to secure affordable coverage for your small enterprise.

Shop Around and Compare Quotes

One of the most effective ways to find cheap insurance for your business is to compare quotes from multiple providers. This allows you to identify the best rates and coverage options that fit your unique needs and budget.

You can start your search by using online insurance platforms that provide quotes from a range of top-rated carriers. These tools make it easy to input your business details and quickly receive personalized estimates. Alternatively, you can reach out to insurance companies directly or work with a broker, who can assist you in navigating the market and negotiating the best deals.

When comparing quotes, be sure to consider factors like coverage limits, deductibles, and any available discounts. Remember that the cheapest option may not always be the best — you’ll want to balance affordability with the level of protection your business requires.

Bundle Policies for Maximum Savings

Many insurance providers offer discounts when you bundle multiple policies together, such as general liability and commercial property insurance. This can result in significant savings compared to purchasing each policy separately.

One popular bundled option is a Business Owner’s Policy (BOP), which combines general liability and property coverage into a single, discounted package. By taking advantage of these bundling opportunities, you can get comprehensive protection for your small business at a lower overall cost.

1. https://viralblogspost.com/archive/3286/

2. https://viralblogspost.com/archive/3633/

3. https://viralblogspost.com/archive/2277/

Choose Cost-Saving Coverage Options

In addition to bundling, there are other ways to customize your business insurance policies to maximize savings:

- Increase Deductibles: Higher deductibles typically translate to lower premiums, though you’ll need to ensure the deductible amount is still manageable for your business.

- Reduce Policy Limits: Opting for lower coverage limits can result in cheaper premiums, but be cautious not to sacrifice too much protection.

- Opt for Actual Cash Value Coverage: Insuring your business property for its actual cash value (depreciated worth) rather than replacement cost can help lower your commercial property insurance premiums.

By carefully evaluating your coverage needs and selecting the right combination of options, you can find a balance between affordability and the level of protection your business requires.

Managing Risks to Reduce Insurance Costs

Your business’s risk profile is a significant factor in determining your insurance premiums. By implementing effective risk management strategies, you can demonstrate to insurers that your company is a lower-risk investment, resulting in potential premium reductions.

Invest in Safety and Prevention

Start by conducting a thorough risk assessment of your business operations. Identify potential hazards, such as slip-and-fall accidents, property damage, or employee injuries, and develop a plan to mitigate these risks. This may involve investing in safety equipment and systems (e.g., fire suppression, security alarms, personal protective gear), establishing clear safety protocols, and regularly inspecting your premises.

By taking a proactive approach to risk management, you can prove to insurers that your business is committed to safety and reducing the likelihood of claims, which may lead to lower premiums.

Maintain a Clean Claims History

Your business’s claims history is another critical factor that insurers consider when setting your insurance rates. Avoid filing unnecessary claims, as this can signal to providers that your company is a higher-risk investment. Focus on implementing robust risk management practices to minimize the occurrence of incidents that could result in claims.

The Cheapest Industries for Business Insurance

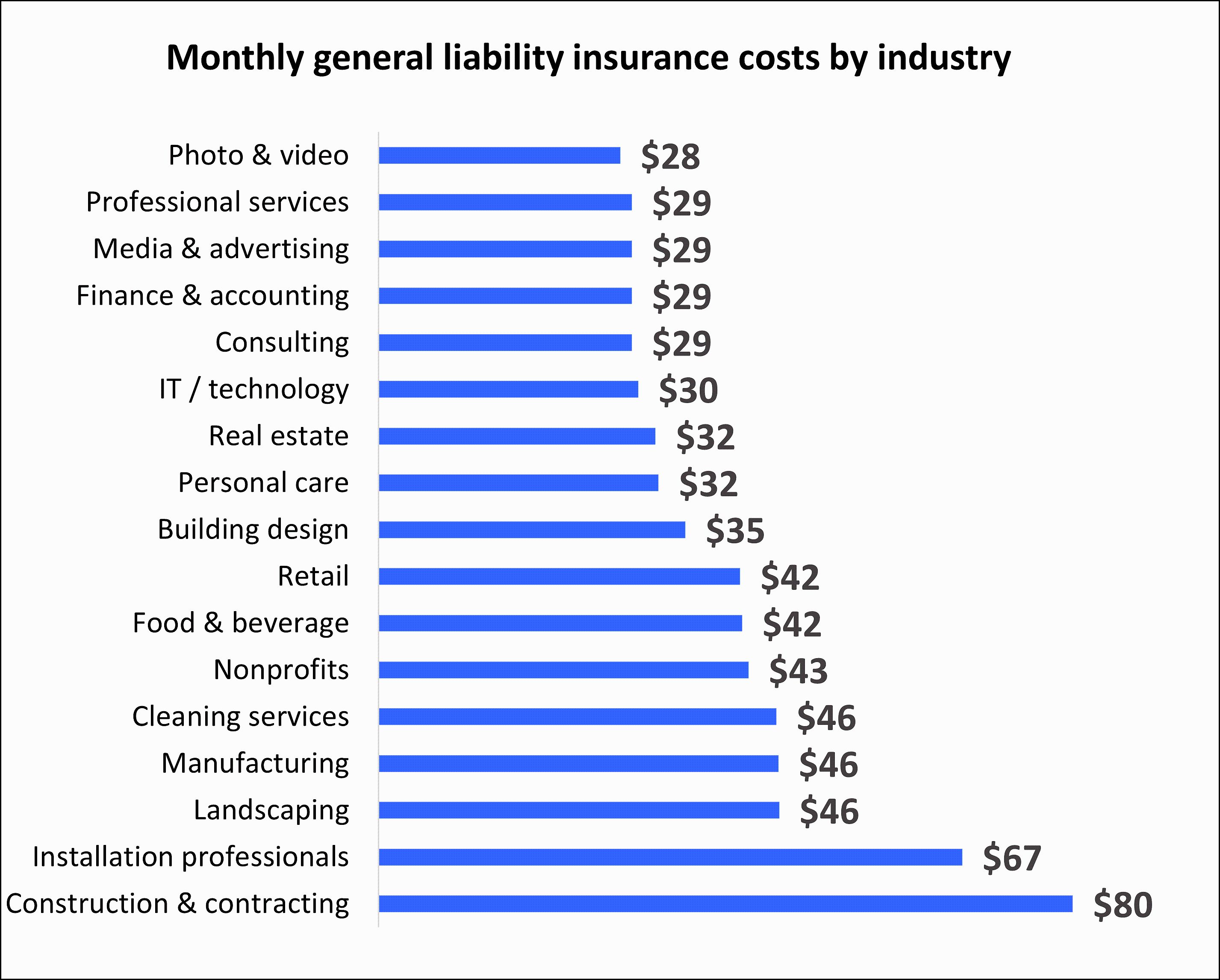

Not all industries pose the same level of risk, and this is reflected in the insurance premiums businesses in those sectors pay. Generally, industries with lower risks of accidents, injuries, or liability claims can expect to pay less for their business insurance coverage.

Professions that typically enjoy lower insurance costs include professional services (e.g., accounting, consulting, IT services), retail (especially online-based businesses), and creative industries (e.g., photography, graphic design). These types of businesses often have limited exposure to physical hazards and a lower likelihood of third-party claims, making them less risky investments for insurance providers.

In contrast, businesses in industries like construction, manufacturing, and transportation tend to face higher insurance premiums. These sectors are often characterized by increased physical risks, the potential for severe accidents, and a greater likelihood of liability claims, all of which drive up insurance costs.

FAQ (Optional)

Q: What is the cheapest type of business insurance?

A: General liability insurance is often the most affordable type of business insurance, especially when bundled with other policies in a Business Owner’s Policy (BOP).

1. https://viralblogspost.com/archive/2428/

2. https://viralblogspost.com/archive/2281/

3. https://viralblogspost.com/archive/3396/

Q: How can I get a free quote for business insurance?

A: Many online insurance platforms and providers offer free, no-obligation quotes. You can also work with an independent insurance broker, who can retrieve quotes from multiple carriers on your behalf.

Q: What is the best way to compare business insurance quotes?

A: When comparing quotes, consider factors such as coverage limits, deductibles, discounts, and the financial strength and reputation of the insurance companies. This will help you find the best balance of affordability and comprehensive protection for your business.

Q: How often should I review my business insurance policies?

A: It’s generally recommended to review your business insurance coverage on an annual basis. This allows you to ensure your policies still meet your evolving needs and that you’re getting the best rates available.

Conclusion

Protecting your small business with the right insurance coverage doesn’t have to come at a high cost. By leveraging strategies like shopping around, bundling policies, and managing your risks, you can find affordable insurance solutions that safeguard your enterprise without breaking the bank.

Remember, the key to securing cheap business insurance is to balance your coverage needs with your budget. Take the time to explore your options, compare quotes, and work with experienced insurance professionals to craft a comprehensive, cost-effective protection plan for your small business. With the right approach, you can enjoy the peace of mind that comes with knowing your company is prepared for whatever the future may hold.

So, don’t let the fear of high insurance premiums hold you back. Start your search for cheap business insurance today and take the first step towards securing the protection your business deserves. Your future self will thank you.

Leave a Reply