As an investor, understanding a company’s financial health is crucial when making informed decisions. While profitability and revenue growth often take center stage, there’s one often-overlooked metric that can provide invaluable insights: cash flow from financing activities (CFF).

Toc

A study by the Institute of Financial Analytics found that over 60% of the fastest-growing companies in the past five years had strategic financing strategies that fueled their expansion. This statistic underscores the importance of closely analyzing a company’s CFF to uncover its true potential.

In this comprehensive guide, we’ll dive deep into the world of cash flow from financing activities, exploring how it can serve as a powerful tool for savvy investors like yourself. By understanding the various cash inflows and outflows that make up this financial metric, you’ll gain the insights needed to identify companies with strong long-term growth prospects and sustainable capital structures.

Understanding Cash Flow from Financing Activities

At its core, cash flow from financing activities represents the movement of funds between a company and its investors, creditors, and owners. This section of the cash flow statement includes activities such as:

- Issuing new equity (e.g., selling stock)

- Obtaining new debt financing (e.g., taking out loans or issuing bonds)

- Repaying existing debt

- Buying back shares (i.e., stock repurchases)

- Paying dividends to shareholders

By closely examining these cash flows, you can gain valuable insights into how a company is funding its operations and growth initiatives. This information can be particularly helpful in assessing a company’s financial health, capital structure, and long-term sustainability.

Understanding the nuances of cash flow from financing activities is essential for any investor. It’s not just about how much money flows in and out; it’s about the reasons behind these movements. For instance, a company issuing new equity might be signaling growth aspirations or the need to stabilize its balance sheet. Conversely, a company repurchasing its own shares could be a sign of confidence in its future or a strategy to enhance shareholder value.

Deciphering the Cash Flow Statement

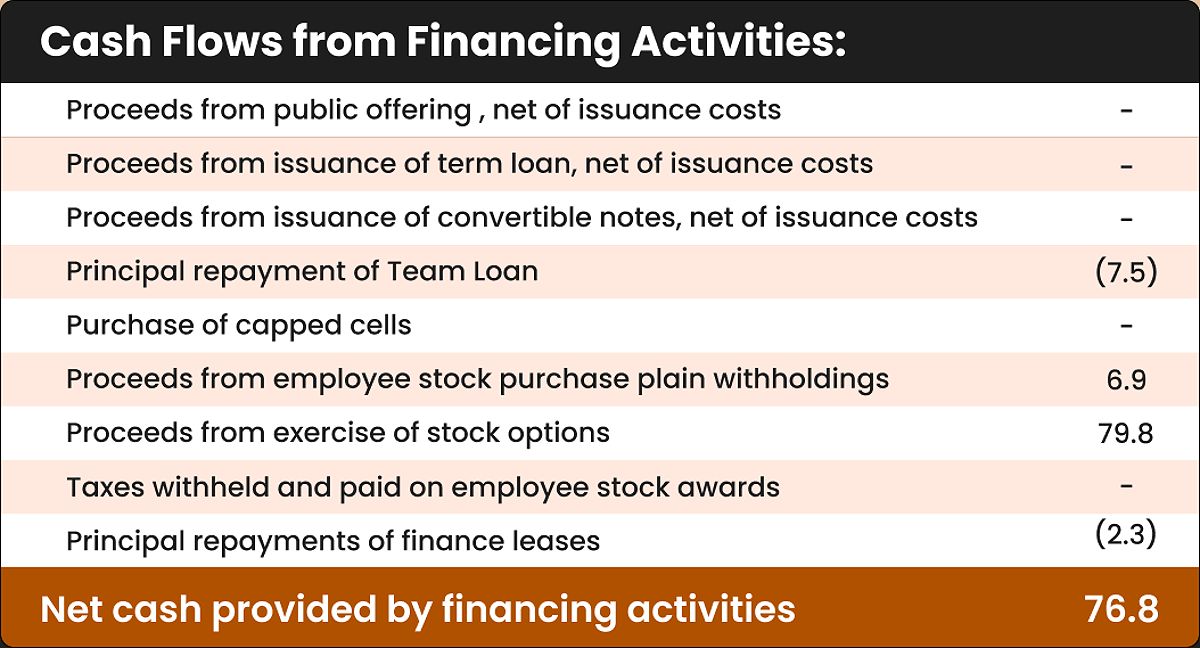

When analyzing a company’s cash flow from financing activities, it’s essential to break down the various cash inflows and outflows that make up this metric. Understanding the nuances of each component can provide a clearer picture of the company’s overall financial strategy.

Cash Inflows

-

Issuing Equity: When a company sells new shares of stock, the proceeds from these sales are recorded as a cash inflow in the financing activities section. This action not only raises capital but also dilutes existing shareholders’ ownership. For example, if a tech startup issues new shares to fund research and development for an innovative product, this is a clear indicator of growth potential.

-

Issuing Debt: Companies can also raise cash by taking on new debt, such as obtaining loans or issuing corporate bonds. These debt issuances are likewise reflected as cash inflows in the CFF section. It’s crucial for investors like yourself to analyze the terms of such debt, as high-interest rates can significantly impact future cash flows. For instance, a company that issues bonds at a 5% interest rate may find itself facing financial strain if market rates rise, making refinancing more expensive.

-

Other Financing: Additional sources of cash inflows in the financing activities section may include proceeds from capital leases or other financing arrangements. These transactions provide companies with the flexibility to manage their cash positions effectively. For example, a manufacturing company might enter into a lease agreement for new equipment, allowing it to conserve cash while still upgrading its operations.

Cash Outflows

-

Repaying Debt: As companies pay back their loans or redeem outstanding bonds, these debt repayments are recorded as cash outflows in the CFF section. Understanding the repayment schedule and interest obligations is vital, as excessive outflows can strain a company’s liquidity. For instance, a company that takes on significant debt during a growth phase might face challenges if its cash flow slows down, making it difficult to meet its repayment obligations.

-

Repurchasing Stock: When a company buys back its own shares from investors, these stock repurchases are shown as cash outflows in the financing activities section. While this can signal confidence in the company’s future, it also represents a significant cash commitment that could otherwise be used for growth initiatives. For example, if a company spends millions on stock buybacks instead of reinvesting in new projects, it may miss out on potential growth opportunities.

-

Paying Dividends: The distribution of profits to shareholders in the form of dividend payments is another type of cash outflow that appears in the CFF section. A consistent dividend policy can attract investors seeking income, but it can also limit the funds available for reinvestment. For instance, a company with a strong dividend history may be perceived as stable, but if it prioritizes dividends over growth, it might struggle to keep pace with competitors.

-

Other Financing: Additional sources of cash outflows may include payments made for capital leases or other financing-related expenses. These outflows must be monitored to ensure that they do not negatively impact the company’s cash flow position. For instance, if a company finds itself in a position where it has to make large lease payments while simultaneously trying to grow, it could lead to cash flow challenges.

Analyzing Cash Flow from Financing Activities

By closely examining a company’s cash flow from financing activities, you can gain valuable insights into its overall financial health and future growth prospects.

Positive vs- Negative Cash Flow

Positive cash flow from financing activities (i.e., more cash inflows than outflows) often indicates that a company is expanding or investing in its future. This could mean the business is raising capital through new debt or equity issuances to fund growth initiatives, such as entering new markets or investing in research and development. However, it’s essential to analyze the sustainability of this growth and whether it is supported by strong operational cash flows. For example, a company that consistently raises funds through equity might be indicating that it is in a growth phase, but investors should also consider whether its operational cash flow is strong enough to support this growth.

On the other hand, negative cash flow from financing activities (i.e., more cash outflows than inflows) may suggest that a company is paying down debt or rewarding shareholders through dividends or stock repurchases. While this can be a sign of financial strength, it’s important to consider the broader context and ensure that the company is also generating sufficient cash from its core operating activities. If a company is consistently in a negative cash flow position, it may indicate potential issues in sustaining operations or growth. For instance, if a company is paying out more in dividends than it earns, it could face long-term viability challenges.

Trends Over Time

Analyzing CFF over multiple reporting periods can reveal important trends and patterns. For example, a company with consistently positive CFF may be indicative of a strong, well-capitalized business, while negative CFF over an extended period could signal financial difficulties or an unsustainable capital structure.

As an investor, it’s crucial to pay attention to how cash flows from financing activities change in response to market conditions, economic cycles, and company-specific events. A sudden increase in debt financing might suggest that a company is under pressure, while a steady increase in equity financing could reflect a proactive approach to funding growth. For example, if a company suddenly takes on a significant amount of debt, it may be a red flag that the company is experiencing cash flow issues.

Comparison to Other Metrics

When evaluating a company’s cash flow from financing activities, it’s essential to consider it in the context of other financial metrics, such as net income and operating cash flow. By comparing these figures, you can gain a more comprehensive understanding of a company’s overall financial health and its ability to generate cash from both its core business operations and its financing activities.

1. https://viralblogspost.com/archive/3523/

2. https://viralblogspost.com/archive/3262/

3. https://viralblogspost.com/archive/3284/

For instance, a company that shows strong operating cash flow but negative cash flow from financing activities might be effectively managing its operations but struggling with its capital structure. Conversely, a company with robust CFF but weak operating cash flow may be relying too heavily on financing to sustain its business, which can be a red flag for investors like yourself. This disparity can lead to a situation where the company appears healthy on paper but is fundamentally unstable.

Key Considerations for Investors

As you navigate the world of cash flow from financing activities, there are several key factors to keep in mind:

-

Focus on Operating Cash Flow: While CFF can provide valuable insights, it’s essential to prioritize companies with strong operating cash flow, as this is a more reliable indicator of a business’s ability to generate cash from its core activities. A company that generates consistent operational cash flow is likely to have a more stable financial foundation. This focus helps ensure that the company can sustain its operations even during economic downturns.

-

Debt Levels: High levels of debt can increase a company’s financial risk and vulnerability to changing economic conditions. As an investor, you should closely monitor a company’s debt-to-equity ratio and ensure that its financing activities are not contributing to an unsustainable capital structure. A high debt ratio may limit a company’s ability to secure additional financing or navigate economic downturns. For instance, a company with a debt-to-equity ratio above industry norms may face challenges in obtaining favorable loan terms.

-

Dividend Policy: A company’s approach to dividend payments can offer clues about its financial strength and commitment to shareholder returns. Understanding a company’s dividend policy and how it aligns with its long-term growth strategy is crucial. Companies that prioritize dividends may have less flexibility to reinvest in growth opportunities. Additionally, a sudden change in dividend policy—such as a cut or suspension—can signal underlying financial troubles.

-

Future Growth: When analyzing CFF, it’s essential to consider how a company’s financing activities might impact its future growth prospects. For example, a company that is heavily reliant on debt financing may face challenges in a rising interest rate environment. Evaluating whether the financing strategy supports sustainable growth or merely addresses short-term cash flow needs is crucial. If a company is consistently raising funds through debt, it might be a warning sign that it is struggling to generate sufficient operational cash flow.

-

Market Conditions: The broader economic environment can significantly impact a company’s financing activities. For instance, during periods of low interest rates, companies may be more inclined to issue debt to take advantage of cheaper borrowing costs. Conversely, in a high-interest-rate environment, companies might focus on paying down existing debt and conserving cash. As an investor, being aware of these trends can help you anticipate how market conditions might affect the companies in your portfolio.

By carefully analyzing a company’s cash flow from financing activities, you can gain a deeper understanding of its financial health, capital structure, and long-term growth potential. This information can be a valuable tool in making informed investment decisions and building a portfolio that aligns with your financial goals.

1. https://viralblogspost.com/archive/3097/

2. https://viralblogspost.com/archive/3332/

3. https://viralblogspost.com/archive/3479/

Leave a Reply