Protecting your loved ones’ financial future is a top priority, and choosing the right life insurance company is crucial. Amica Life Insurance Company, with over a century of experience, offers a range of options designed to meet diverse needs. This comprehensive review will delve into Amica’s offerings, including term and whole life insurance, its financial stability, customer service, and pricing, to help you determine if it’s the right fit for your needs.

Toc

- 1. Amica Life Insurance Company Overview

- 2. Types of Life Insurance Offered by Amica

- 3. Related articles 01:

- 4. Amica Life Insurance Costs and Pricing

- 5. Pros and Cons of Amica Life Insurance

- 6. Amica’s Customer Service and Claims Handling

- 7. Is Amica a Good Life Insurance Company?

- 8. FAQ

- 9. Related articles 02:

- 10. Conclusion

Amica Life Insurance Company Overview

Amica Life Insurance Company has a rich history that began with auto, fire, and theft insurance in 1907. Over the years, it has evolved into a respected provider of life insurance, driven by its mutual ownership structure, which prioritizes the interests of its policyholders. This means that as a policyholder, you are part of a community where the focus is on delivering exceptional service and financial stability.

Amica’s Financial Strength

Amica has an A+ (Superior) rating from A.M. Best, the leading credit rating agency for the insurance industry. This high rating indicates that Amica has the financial stability to meet its obligations to policyholders, providing peace of mind and assurance that your coverage will be there when your loved ones need it most.

Amica’s Focus on Customer Service

Amica has built a reputation for providing excellent customer service. The National Association of Insurance Commissioners (NAIC) consistently reports low complaint index scores for Amica, indicating that the company receives fewer complaints than the industry average. This reflects Amica’s commitment to resolving issues and ensuring a positive experience for its policyholders.

Types of Life Insurance Offered by Amica

Amica provides two primary types of life insurance: term life insurance and whole life insurance. Each type is designed to meet distinct needs and comes with its own set of features.

Amica Term Life Insurance

Term life insurance offers coverage for a specific period, typically ranging from 10 to 30 years. If the policyholder passes away during this term, the beneficiaries will receive the agreed-upon death benefit. Amica’s term life insurance policies provide coverage amounts from $100,000 to $1 million, allowing you to select a level of protection that aligns with your financial goals.

One of the standout features of Amica’s term life insurance is its affordability. The premiums tend to be lower than those of whole life policies, making it a viable option for many individuals. Additionally, Amica offers the flexibility to convert your term life policy into a whole life policy at the end of the term, catering to changing life circumstances.

However, it’s important to understand that term life insurance does not accumulate cash value. Once the term ends, coverage ceases unless you choose to convert it. This can be a significant downside for those looking for lifelong coverage.

Amica Whole Life Insurance

In contrast, whole life insurance provides coverage for your entire lifetime. This type of policy includes a cash value component that grows over time, allowing policyholders to build savings that can be accessed through loans or withdrawals. Amica’s whole life policies start from $25,000 and can exceed $1 million, providing substantial options for long-term financial planning.

The cash value component grows on a tax-deferred basis, which can be appealing for individuals looking to integrate life insurance into their broader financial strategy. While whole life insurance offers many advantages, it’s crucial to consider that premiums are generally higher than those for term life insurance, which may not be feasible for everyone.

Amica’s Life Insurance Riders

Riders are additional features that can be added to life insurance policies to enhance coverage. Amica offers a free terminal illness rider, which allows policyholders to access a portion of their death benefit if diagnosed with a terminal illness. This can provide significant financial relief during difficult times, helping cover medical expenses or make necessary arrangements for loved ones.

While this rider is valuable, it’s worth noting that Amica does not have an extensive selection of additional riders compared to some competitors. This limitation may affect those seeking more customized coverage options.

1. https://viralblogspost.com/archive/3396/

2. https://viralblogspost.com/archive/3462/

3. https://viralblogspost.com/archive/3578/

Amica Life Insurance Costs and Pricing

The cost of life insurance varies based on several factors, including age, health, coverage amount, and policy type. Understanding how Amica’s premiums stack up against its competitors can help you make an informed decision.

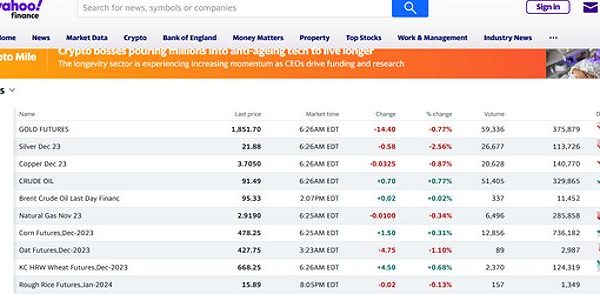

For example, consider a 35-year-old female in good health looking for a 20-year, $1 million life insurance policy. The monthly premiums from various providers are as follows:

- Amica: $60.70

- Fidelity Life: $52.63

- Transamerica: $55.31

In this scenario, Amica’s premiums are slightly higher than those of its competitors. However, it’s important to remember that individual circumstances will significantly impact the final premium quote. Factors such as health history, lifestyle choices, and the specific coverage amount will all play a role in determining your premium.

Amica’s pricing is generally competitive and aligns with industry standards. The company also offers potential discounts that can help lower premiums, such as bundling policies, loyalty discounts for long-term customers, and claim-free discounts for those who have not filed any claims in a specified period.

Pros and Cons of Amica Life Insurance

Like any insurance provider, Amica Life Insurance Company has its advantages and disadvantages. Understanding these can help you determine if Amica is the right fit for your life insurance needs.

Advantages

- Comprehensive Coverage Options: Amica provides both term and whole life insurance policies, catering to a wide range of needs.

- Strong Financial Stability: With an A+ (Superior) rating from A.M. Best, Amica demonstrates its financial strength and ability to meet obligations to policyholders.

- Customer Service Reputation: Amica’s customer service is often praised, with above-average ratings based on the NAIC complaint index scores. This indicates a commitment to resolving issues and providing a positive experience for policyholders.

- Free Terminal Illness Rider: The inclusion of this rider at no additional cost can be a significant benefit for policyholders facing serious health challenges.

- Discount Opportunities: Amica offers several potential discounts that can make policies more affordable, especially for customers who bundle multiple insurance products.

Disadvantages

- Limited Rider Options: While the terminal illness rider is beneficial, Amica does not provide a broad selection of additional riders that some competitors offer, which may limit customization.

- No Universal Life Insurance: Amica does not offer universal life policies, which could be a drawback for individuals seeking more flexible permanent life insurance options.

- Medical Exam Requirements: Some applicants may be required to undergo medical exams to qualify for certain policies, which could be a barrier for those who prefer a more straightforward application process.

Amica’s Customer Service and Claims Handling

Amica’s customer service representatives can be reached by phone or through the company’s online portal. Amica’s claims handling process is designed to be efficient, with dedicated claims adjusters assigned to assess claims and facilitate timely payouts. Policyholders can file claims online or by phone, ensuring that assistance is readily available when needed.

However, it’s essential to consider that all customer service interactions must be conducted through Amica’s representatives, as the company does not work with independent insurance agents. This structure may limit options for consumers who prefer personalized service from independent agents who can compare multiple insurance providers.

Is Amica a Good Life Insurance Company?

Evaluating whether Amica Life Insurance Company is a good fit for your life insurance needs involves weighing its strengths and weaknesses. Amica offers a solid range of life insurance products, including term and whole life policies, backed by strong financial stability and a positive customer service reputation.

For individuals seeking straightforward life insurance solutions, Amica can be an excellent choice. The company’s competitive pricing, especially for Amica term life insurance, combined with its free terminal illness rider, enhances its appeal. However, those looking for more comprehensive customization options may find the limited rider offerings and absence of universal life insurance policies to be a drawback.

Ultimately, Amica is a reliable life insurance provider that is worth considering. As with any major financial decision, it is essential to compare Amica’s offerings with those of other insurers to ensure you find the best policy for your specific needs and preferences.

FAQ

Q1: What is the difference between term life insurance and whole life insurance?

Term life insurance provides coverage for a fixed period, typically 10 to 30 years, while whole life insurance provides coverage for your entire lifetime. Whole life insurance also includes a cash value component that can grow over time.

1. https://viralblogspost.com/archive/2294/

2. https://viralblogspost.com/archive/3562/

3. https://viralblogspost.com/archive/3462/

Q2: How can I get a life insurance quote from Amica?

You can get a free, personalized quote online through Amica’s website. Simply input your information, and you’ll receive an estimate of the premiums you might pay.

Q3: Does Amica offer discounts on life insurance?

Yes, Amica offers several potential discounts, including bundling discounts, loyalty discounts, and claim-free discounts.

Q4: What is Amica’s financial strength rating?

Amica has received an A+ (Superior) rating from A.M. Best, the leading credit rating agency for the insurance industry. This high rating indicates that Amica has the financial stability to meet its obligations to policyholders.

Q5: How can I contact Amica’s customer service?

You can reach Amica’s customer service representatives by phone or through their online portal.

Conclusion

Amica Life Insurance Company offers a range of life insurance options that are worth considering. With its strong financial stability, positive customer service reputation, and competitive pricing, Amica can be an attractive choice for those seeking reliable life insurance coverage.

While Amica’s limited rider selection and the potential requirement for medical exams may be drawbacks for some, the benefits of its term and whole life insurance policies make it a provider worth evaluating. If you’re in the market for life insurance, be sure to get a personalized quote from Amica and compare it with other insurers to find the best coverage for your needs. Taking the time to research your options can help you secure the financial protection your loved ones deserve.

Leave a Reply