This guide provides a comprehensive approach to using Yahoo Finance and Excel to analyze stock futures data. Learn how to access, import, and analyze stock futures data, enabling you to develop effective trading strategies using stock futures yahoo finance tools.

Toc

- 1. Accessing Stock Futures Data from Yahoo Finance

- 2. Importing Yahoo Finance Data into Excel

- 3. Related articles 01:

- 4. Analyzing Stock Futures Data in Excel

- 5. Automating Data Updates in Excel

- 6. Technical Analysis: Taking Your Insights on Stock Futures Yahoo Finance to the Next Level

- 7. Related articles 02:

- 8. Real-World Examples: Successful Stock Futures Traders Leverage Yahoo Finance and Excel

- 9. Tips and Best Practices

- 10. Conclusion

Accessing Stock Futures Data from Yahoo Finance

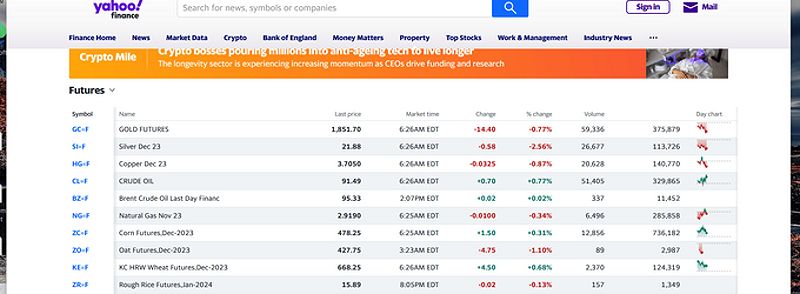

The first step in your stock futures analysis journey is to gather the necessary data. Yahoo Finance is a reliable source for comprehensive financial information, including real-time and historical data on stock futures.

Head over to the Yahoo Finance website and start by searching for the stock futures contracts you’re interested in. Once you’ve located them, you can access essential data points such as the opening price, highest and lowest prices, closing price, and trading volume.

While the Yahoo Finance website provides a user-friendly interface, manually downloading this data can be a tedious task, especially if you’re tracking multiple contracts. Imagine having to sift through countless spreadsheets and charts — not exactly the most efficient use of your time.

Utilizing the Yahoo Finance API

To streamline the data retrieval process, consider tapping into the power of the Yahoo Finance API. APIs, or Application Programming Interfaces, allow you to access data programmatically, automating the entire process.

If you’re familiar with Python, you can use the yfinance library to fetch stock futures data with just a few lines of code:

import yfinance as yf

# Fetch stock futures data for a specific ticker

data = yf.download('AAPL', start='2022-01-01', end='2024-01-01')

print(data)

By leveraging the API, you can seamlessly integrate the data into your workflow, ensuring you always have the latest information at your fingertips.

Exploring Alternative Data Sources

While Yahoo Finance is a valuable resource, it’s important to note that it has its limitations, such as restricted real-time updates and limited historical data availability. Consider exploring alternative sources like Google Finance, TradingView, or specialized financial data providers to complement your data needs and ensure you have a comprehensive view of the market.

Importing Yahoo Finance Data into Excel

With your data gathered, it’s time to bring it into Excel for analysis. Excel offers several powerful tools to make this process more efficient.

Importing Data from the Web

Excel’s “Get External Data” feature allows you to directly import data from web sources, including Yahoo Finance. Navigate to the Data tab, select “Get Data,” and choose “From Web.” Follow the prompts, and you’ll have the stock futures data in your Excel worksheet.

Remember to pay close attention to data formatting and cleaning. Ensuring your data is in a usable format can save you a lot of time and effort during the analysis phase.

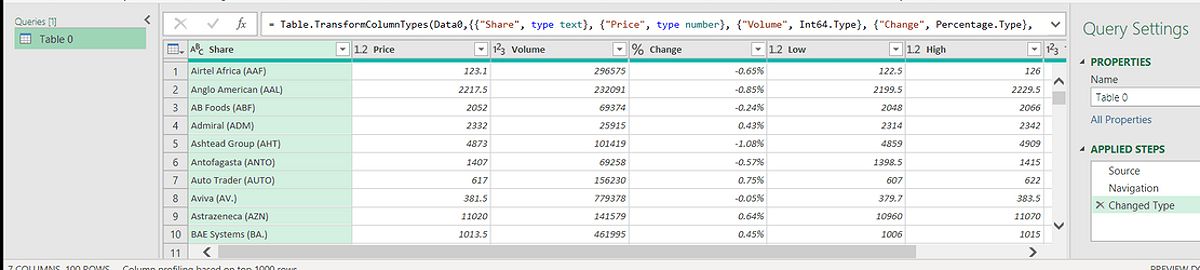

Leveraging Power Query (Get & Transform)

For a more advanced approach, consider using Power Query, a powerful tool within Excel for data importation and transformation. Power Query enables you to connect to Yahoo Finance, clean your data, and perform advanced transformations before importing it into your workbook.

1. https://viralblogspost.com/archive/3405/

2. https://viralblogspost.com/archive/3246/

3. https://viralblogspost.com/archive/3259/

To use Power Query, go to the Data tab, select “Get Data,” and then choose “From Other Sources.” This will allow you to pull in data from various sources and automate the data cleaning process, ensuring you have high-quality data to work with.

Analyzing Stock Futures Data in Excel

Now that your data is neatly organized in Excel, it’s time to dive into the analysis.

Basic Analysis Techniques

Excel is packed with powerful functions that can help you extract valuable insights from your stock futures data. Utilize functions like AVERAGE, STDEV, and CORREL to perform basic calculations, such as average prices, standard deviations, and correlations.

These metrics can provide a solid foundation for understanding the behavior and trends within the stock futures market.

Visualizing Data with Charts and Graphs

Data visualization is a powerful tool for identifying patterns and trends. Create line graphs, bar charts, and scatter plots to bring your stock futures data to life. These visual representations can help you quickly spot bullish or bearish trends, support and resistance levels, and other critical market signals.

Advanced Analysis with Excel Add-ins

To take your analysis to the next level, consider exploring Excel add-ins. These third-party tools can provide advanced charting capabilities, technical analysis features, and portfolio management functionalities. Some popular options include Power BI, StockSharp, and eSignal.

By incorporating these add-ins into your Excel workflow, you can unlock deeper insights and make more informed trading decisions.

Automating Data Updates in Excel

Keeping your data current is essential for effective analysis. Let’s explore methods for automating data updates in Excel, ensuring you always have the latest information at your fingertips.

Utilizing Excel’s Refresh Data Feature

Excel’s “Refresh Data” feature allows you to schedule regular data updates, ensuring that your spreadsheets always contain the most recent information. This can be a convenient option, but keep in mind that it may not provide real-time updates.

Creating VBA Macros

For a more advanced approach, consider creating VBA (Visual Basic for Applications) macros. By automating the process of retrieving stock futures data from Yahoo Finance and updating your spreadsheets, you can save time and ensure your analysis is always based on the most up-to-date information.

Imagine setting up a macro that pulls in the latest data every morning before the market opens. This level of automation can be a game-changer, allowing you to focus on the analysis and decision-making process rather than the tedious data collection tasks.

Technical Analysis: Taking Your Insights on Stock Futures Yahoo Finance to the Next Level

While the previous sections have covered the fundamentals of accessing, importing, and analyzing stock futures data in Excel, there’s another powerful tool at your disposal: technical analysis.

Technical analysis involves the study of historical price and volume data to identify patterns, trends, and potential trading opportunities. By incorporating technical analysis techniques into your Excel-based stock futures analysis, you can gain a deeper understanding of market dynamics and make more informed trading decisions.

1. https://viralblogspost.com/archive/3259/

2. https://viralblogspost.com/archive/3405/

3. https://viralblogspost.com/archive/3359/

Some popular technical indicators you can explore in Excel include moving averages, relative strength index (RSI), and Bollinger Bands. These indicators can help you identify support and resistance levels, overbought or oversold conditions, and potential entry and exit points for your trades.

To get started with technical analysis in Excel, you can use built-in functions or leverage Excel add-ins like Power BI, which offer advanced charting and technical analysis capabilities. Experiment with different indicators and visualizations to see which ones resonate best with your trading strategy.

Real-World Examples: Successful Stock Futures Traders Leverage Yahoo Finance and Excel

To further illustrate the power of using Yahoo Finance data and Excel for stock futures analysis, let’s look at a few real-world examples of successful traders who have leveraged this approach.

John, a seasoned trader, has been using Yahoo Finance and Excel to analyze the S&P 500 futures contract for years. By automating the data retrieval process and creating custom VBA macros, he is able to quickly identify market trends and potential trading opportunities. John’s attention to data quality and his use of advanced technical analysis have consistently helped him outperform the broader market.

Sarah, a young and ambitious trader, discovered the potential of Yahoo Finance and Excel while researching ways to enhance her trading strategy. She started by importing daily futures data, using Power Query to clean and format the information, and then creating interactive dashboards to visualize her findings. Sarah’s ability to quickly spot emerging patterns and make timely trading decisions has contributed to her growing success in the futures market.

These are just a few examples of how traders have harnessed the power of Yahoo Finance and Excel to their advantage. By following in their footsteps and implementing the strategies outlined in this guide, you too can unlock new opportunities and take your stock futures trading to new heights.

Tips and Best Practices

Data Quality and Validation

When it comes to stock futures analysis, data quality is paramount. Implement robust data validation measures to avoid errors and inconsistencies. Regularly check for outliers and clean your data to maintain its integrity. Remember, making decisions based on faulty information can have serious consequences.

Data Security and Privacy

In the world of finance, data security should be a top priority. Protect sensitive information stored in your Excel spreadsheets by implementing best practices such as password protection, file encryption, and secure data sharing.

Conclusion

By harnessing the power of Yahoo Finance data within Excel, you can unlock a wealth of opportunities in the stock futures market. From accessing and importing data to automating updates, performing advanced analysis, and incorporating technical analysis techniques, this guide has provided you with a comprehensive roadmap for leveraging this valuable resource.

So, what are you waiting for? Dive in, put these techniques into practice, and start transforming your trading strategies today. The world of stock futures is waiting for you — make it your own!

Leave a Reply