Facing a work injury or extended illness without income protection can lead to financial strain. Learn why disability insurance is crucial for safeguarding your finances in times of need.

Toc

- 1. What is disability insurance?

- 2. Is it worth it to buy disability insurance

- 3. Why is disability insurance so important

- 4. Related articles 01:

- 4.1. Disability insurance replaces your income if you get seriously ill

- 4.2. Disability insurance replaces income if you are severely injured

- 4.3. Disability insurance could provide enough income to cover bills while recovering

- 4.4. Disability insurance may kick in if you can still work but not in the same capacity

- 4.5. Disability insurance covers short-term and long-term needs

- 5. Related articles 02:

- 6. Where to get disability insurance

- 7. Summary

What is disability insurance?

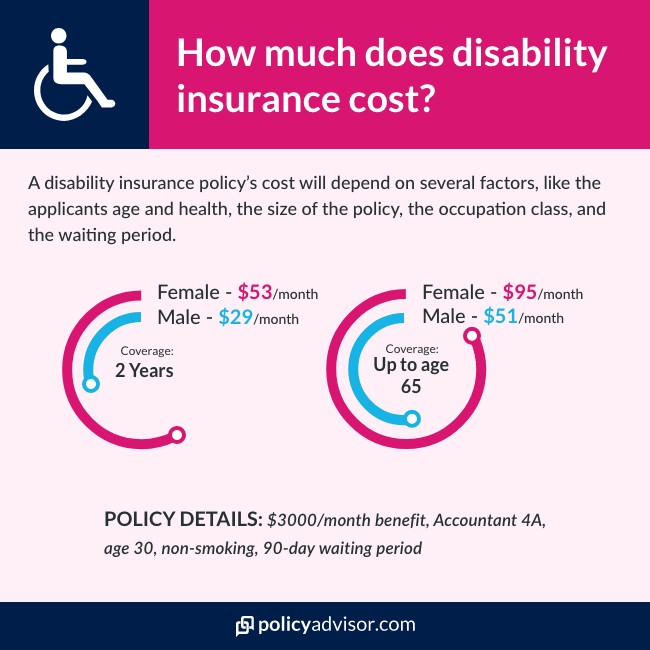

Disability insurance provides a safety net by offering a monthly benefit in case of disability. It is advisable for individuals to consider acquiring both short-term and long-term disability insurance. The waiting period for long-term disability coverage to become effective can be as long as six months, making short-term disability coverage crucial for immediate protection.

Short-term disability insurance, true to its name, provides faster coverage compared to long-term plans. According to the nonprofit Council for Disability Awareness, the most common reasons for short-term disability claims include pregnancy, musculoskeletal disorders, digestive disorders, mental health issues, and injuries. On the other hand, long-term disability claims commonly arise from musculoskeletal disorders, cancer, pregnancy, mental health issues, and injuries.

It is worth noting that disability is a significant contributor to bankruptcy cases. While Social Security Disability Insurance (SSDI) and Workers’ Compensation may offer some support to individuals with disabilities, the benefits may not suffice to cover all financial needs during a period of inability to work. Therefore, having disability insurance serves as a crucial fallback plan to ensure financial stability while recuperating from a disability and unable to work.

Read more: Disability Insurance – Everything You Need To Know

Is it worth it to buy disability insurance

Not everyone needs disability insurance. In fact, I recently spoke to an insurance broker who said I could probably avoid buying it because, as a freelance writer, there is little chance I could become so disabled that I could not work at all. Even if I broke my arm, I could use voice dictation to type out my articles. However, disability insurance is a necessity for other people – especially those who work manual labor jobs. If you work in an injury-prone profession, you should definitely invest in disability insurance.

Disability insurance is like life insurance. If your family doesn’t rely on your income, then you probably don’t need to buy it. Clint Haynes CFP® of NextGen Wealth said he recommends disability insurance to about half of his clients, depending on their careers and their personal situations. He goes on to say: “If you’re the breadwinner, you better have some disability insurance.”

It’s crucial to consider the impact of unexpected events on your ability to earn an income. While some professions may have a lower risk of disability, unforeseen circumstances can still arise. Understanding your specific needs and financial responsibilities can guide you in determining whether disability insurance is a prudent investment for safeguarding your financial stability in the face of unforeseen challenges.

Why is disability insurance so important

![]()

1. https://viralblogspost.com/archive/3633/

2. https://viralblogspost.com/archive/3462/

3. https://viralblogspost.com/archive/3445/

Disability insurance replaces your income if you get seriously ill

Some of the most common disability insurance claims are often linked to serious health conditions such as cancer, musculoskeletal disorders, and depression. While nobody wishes to encounter these challenging situations, they are unfortunately prevalent in today’s world.

Sadly, one of these conditions has personally impacted my family recently. Currently, my father is receiving disability insurance benefits due to his battle with prostate cancer. The news of his stage four diagnosis came as a shock to all of us, as we never anticipated such a health crisis. The financial support from the insurance has been a crucial lifeline for my family during this unexpected and difficult time. It serves as a reminder of the importance of being prepared for unforeseen health issues that can arise without warning.

Disability insurance replaces income if you are severely injured

Many professions come with a heightened risk of injury, especially those involving manual labor. For individuals engaged in tasks requiring physical exertion, the body plays a crucial role in their capacity to generate income. Industries such as construction, factory work, and other manual jobs carry inherent risks of workplace injuries. While it is expected that your employer’s insurance will cover a portion of your medical expenses in case of an injury, these benefits might not always be sufficient to address all the financial implications.

Furthermore, unforeseen accidents can occur that are completely out of one’s control. Whether it’s slipping on an icy sidewalk, being involved in a car accident that was not your fault, or experiencing a fall from a ladder, unexpected incidents can swiftly sideline individuals from their daily activities. It’s important to acknowledge that accidents happen unintentionally, hence the term “accident.” By being aware of potential risks and taking necessary precautions, individuals can better safeguard themselves against the unexpected.

Disability insurance could provide enough income to cover bills while recovering

Hopefully, if you find yourself in a situation where disability insurance becomes necessary, it’s reassuring if it’s not a permanent disability. Typically, disability insurance covers approximately 60% of your regular income. For instance, if your monthly income is $4,000, the insurance would provide $2,400 monthly. While this amount may be significantly less than your usual earnings, it can still be a crucial lifeline when combined with emergency savings.

According to the Social Security Administration, statistics indicate that around 25% of individuals who are 20 years old today will experience a disability before they turn 67. This percentage highlights the importance of considering disability insurance as a vital aspect of financial planning.

Read more: Emergency Funds: Everything You Need To Know

Disability insurance may kick in if you can still work but not in the same capacity

Disability insurance typically includes provisions for “any occupation” or “own occupation,” which dictate the level of disability required to qualify for benefits. Under “any occupation” coverage, usually the more cost-effective option, benefits only kick in if you are unable to perform any job. This could mean having to seek alternative employment, potentially in a lower-paying role, if you are physically capable of working.

On the other hand, “own occupation” coverage ensures that your insurance will provide benefits if you are disabled and unable to carry out your specific job, regardless of your ability to work in a different role. This type of coverage is advantageous since it recognizes that you are likely most skilled and have the highest earning potential in your current job.

Disability insurance serves as a complement to Social Security Disability Insurance (SSDI), which is a form of disability insurance that all US taxpayers have by default. However, meeting the qualifications for and receiving SSDI benefits can be challenging.

Even if you do qualify for SSDI, the benefit amount may not suffice to cover all your monthly expenses. For instance, the non-blind disability benefit for 2020 stands at $1,260 per month, according to the Social Security Administration.

Having your private disability insurance in addition to SSDI could significantly enhance your financial protection. The combination of both insurance plans could potentially replace over 60% of your regular income, providing a more comprehensive safety net in case of disability.

Disability insurance covers short-term and long-term needs

1. https://viralblogspost.com/archive/2389/

2. https://viralblogspost.com/archive/3286/

3. https://viralblogspost.com/archive/2333/

The two primary types of disability insurance commonly encountered are short-term and long-term. The nomenclature effectively conveys their operational nature.

Short-term disability coverage typically applies for a duration of three to six months, after which a long-term disability policy becomes necessary.

Long-term disability insurance generally features a waiting period of three to six months before benefits commence. The duration of the benefit period significantly influences the policy cost. These durations commonly span two, five, or ten years, or until retirement.

Disability insurance protects your household from a complete loss of income

If you think going down to 60% of your income sounds tough, imagine it dropping to $0. Unless you have significant savings or a spouse with a paycheck that can carry the household’s needs, a disability could be dire. Those with disabilities may have to give up their home and move in with relatives. It could lead to relying on others completely to get by.

With disability insurance, things are not necessarily easy. If disabled, however, getting disability insurance benefits is a lot better than not having the option.

Where to get disability insurance

When it comes to disability insurance, many individuals rely on the coverage provided by their employer, which is indeed a valuable benefit. However, it is crucial to recognize that this coverage may not always prove to be sufficient in certain situations. For instance, making a career transition to a job that does not offer disability insurance or venturing into entrepreneurship could potentially leave you vulnerable and unprotected. This highlights the importance of securing personal disability insurance to safeguard your financial well-being in such scenarios.

Exploring disability insurance options can be a daunting task, but a strategic starting point is utilizing an insurance marketplace such as Policygenius. By leveraging this platform, you can delve into a diverse array of options by obtaining quotes from various insurers. This comprehensive approach empowers you to make a well-informed decision, ensuring that the policy you ultimately choose aligns with your specific financial requirements and provides the necessary coverage tailored to your needs.

Summary

Insurance plays an indispensable role in shielding individuals from unexpected events that could potentially disrupt their lives. Life insurance acts as a sturdy pillar of protection for your loved ones in the unfortunate event of your passing, providing a crucial safety net for their financial well-being. Conversely, disability insurance serves as a vital shield during times when you might encounter challenges with working due to injury or disability, ensuring that you have a safety cushion when you need it most.

While disability insurance holds particular importance for individuals with occupations prone to higher risks of injury, it is a wise consideration for anyone reliant on their regular income to safeguard against unforeseen circumstances. By delving into the intricacies of these insurance options, understanding their nuanced benefits, and evaluating how they align with your needs, individuals can empower themselves to make well-informed decisions that protect their financial stability in the face of uncertainties.